Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Digital wallets are swiftly becoming a mainstream payment solution across the globe, with millions depending on them daily for transactions, bill payments, peer transfers, travel expenses, and identity verification. Their convenience and quick integration with smartphones have cemented their role in today's financial ecosystem.

However, recent financial breaches have unveiled significant weaknesses that many users had not anticipated. Despite claims of high security, these events demonstrate that hackers are finding novel pathways into mobile payment systems. The breaches affected various countries and service providers, indicating a worrying trend of vulnerabilities across digital wallet services.

Consumers generally consider digital wallets to be more secure than traditional cards, yet these recent incidents reveal that the protective measures surrounding these technologies may not be keeping pace with their rapid development. It's vital for users who rely on their smartphones for transactions to understand these newfound vulnerabilities.

The sudden rise in vulnerabilities can be attributed to multiple converging factors. The rapid growth of digital wallets has left many security protocols struggling to keep up.

With increasing reliance on mobile payment systems, hackers now target digital wallets as high-stakes environments ripe for exploitation.

Digital wallets have evolved from mere payment tools to interconnected systems that engage with banking applications, loyalty programs, travel IDs, and more, expanding potential vulnerabilities.

Hackers now focus on device-based vulnerabilities, moving beyond traditional server-side attacks.

Innovations like biometric logins and QR-based payments have rolled out swiftly, often without thorough security evaluations.

Emerging providers frequently lack robust security measures and compliance standards, compounding risks.

These intertwined factors are allowing vulnerabilities to become apparent at a scale that was previously unseen.

Analysis of recent security breaches has identified a range of vulnerabilities that are becoming increasingly common on a global scale. These weaknesses impact both personal devices and the wallet platforms themselves.

Digital wallet security heavily relies on smartphone protections. When attackers compromise a device, they can indirectly access the wallet.

Notable vulnerabilities include:

outdated operating systems

unpatched security flaws

malware-ridden applications

side-loaded apps

insufficient lock-screen measures

weak biometric settings

unsafe public Wi-Fi use

Incidents over the past month show that many attackers acquired wallet access through device compromises rather than the wallet providers themselves.

Many users impacted by recent breaches relied on:

short PINs

lack of biometric security

shared device access

auto-login settings

no screen lock

Wallets that depend solely on PINs are particularly vulnerable to device theft or remote hacks.

The most secure wallets implement multi-layered authentication, yet many users opt out of these for convenience, a choice that proved risky in recent breaches.

Near-field communication (NFC) is essential for tap-to-pay systems, yet recent breaches have demonstrated:

relay attacks in busy public areas

signal amplification through dishonest devices

NFC handshakes interception

unintentional payment triggers

Though most attacks require close physical proximity, crowded environments such as public transport and shopping centers make these risks more pronounced.

QR code payments are surging in popularity, which has also led to an increase in associated risks. Attackers are utilizing:

malicious QR stickers at checkouts

phishing-style fake QR codes

QR links directing to fraudulent apps

malware-laden auto-generated QR codes

Incidents involving QR manipulation reveal that many consumers trust QR payments without confirming their legitimacy.

Numerous wallets sync data with cloud accounts, where breaches can lead to:

accessing historical transaction data

modifying wallet settings

replicating accounts on fresh devices

restoring backups that include wallet info

This week's cluster of breaches revealed that compromised cloud accounts often result in direct risks to digital wallets.

Attackers are increasingly using methods such as:

SIM swap fraud

deceptive customer support calls

phishing messages mimicking wallet alerts

spoofed verification links

When an attacker gains control of a SIM or intercepts OTP messages, they can reset wallets and steal funds within moments.

The malware utilized in recent hacks showcased sophisticated capabilities:

capturing screen activities

logging keystrokes for PINs

intercepting transaction notifications

overlaying phony wallet interfaces

extracting stored credentials

This new malware wave specifically targets digital wallets rather than generic device hacks.

Digital wallet companies are under pressure to adapt to evolving threats, yet several obstacles hinder their progress.

Providers frequently introduce new features to remain competitive, often allowing security to lag behind innovation.

Providers must navigate diverse regulatory environments, risking varying security standards across regions.

Wallets operate on a multitude of devices, operating systems, and specifications, complicating uniform protection.

Even top security measures falter when users disable features like multi-factor authentication for convenience.

Many users don't realize that their wallet's security hinges on their device, not just the wallet itself.

While no digital system can be entirely secure, users can significantly mitigate risks with improved security practices.

Utilizing fingerprints, facial recognition, or iris scans enhances wallet security considerably.

Simple PINs are insufficient; longer, unique codes provide a stronger defense.

Many wallet breaches happen on outdated devices.

Using public networks raises interception risks.

Always scrutinize codes for signs of tampering.

NFC remains active until disabled, preventing relay attacks.

Real-time alerts help promptly identify suspicious activity.

Modified or malicious apps can put wallets at risk.

Legacy devices may still retain wallet access.

Organizations that rely on digital payments should bolster their protocols to secure both employees and clients.

Company devices must enforce biometrics, multi-factor authentication, and secure operating systems.

Many breaches start at integration points.

SIM swap and verification scams exploit human frailties.

Automated systems can swiftly recognize and halt fraudulent activities.

The recent breaches underscore the urgency of evolving security alongside convenience. As digital payments grow dominant, attackers are becoming ever more ingenious. The vulnerabilities uncovered highlight the critical need for improved authentication measures, conscientious device use, and enhanced awareness from both users and businesses.

Digital wallets represent significant financial advantages, yet their security relies on robust protective systems. Understanding the current challenges is crucial for ensuring the safety of our digital financial transactions.

This article offers general insights regarding trends in digital wallet security. Actual risks can differ by device, platform, and area. Users and businesses should consult with cybersecurity experts for customized security protocols.

Taijul Islam Shatters Bangladesh’s Test Wicket Record

Taijul Islam sets a new record for Bangladesh with 248 Test wickets, overtaking Shakib Al Hasan duri

Bavuma Achieves 1,000 Test Runs as South Africa's Captain

Temba Bavuma becomes the second-fastest South African captain to score 1,000 Test runs during the on

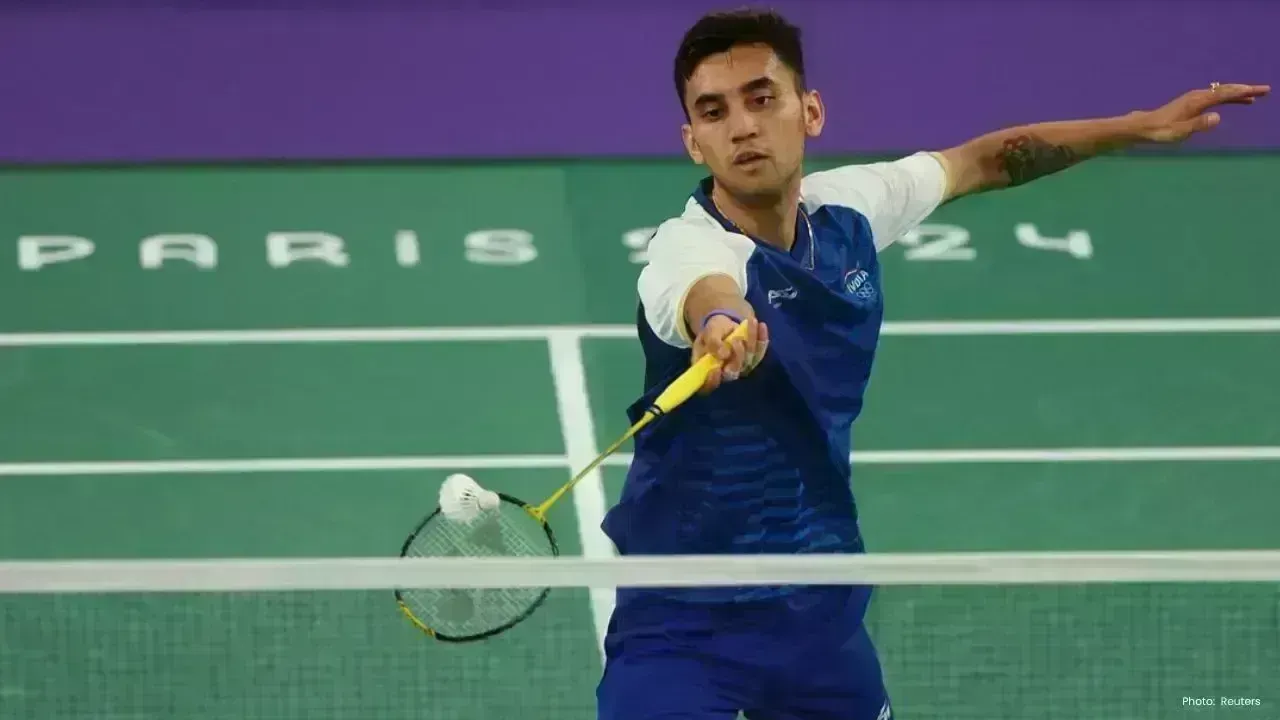

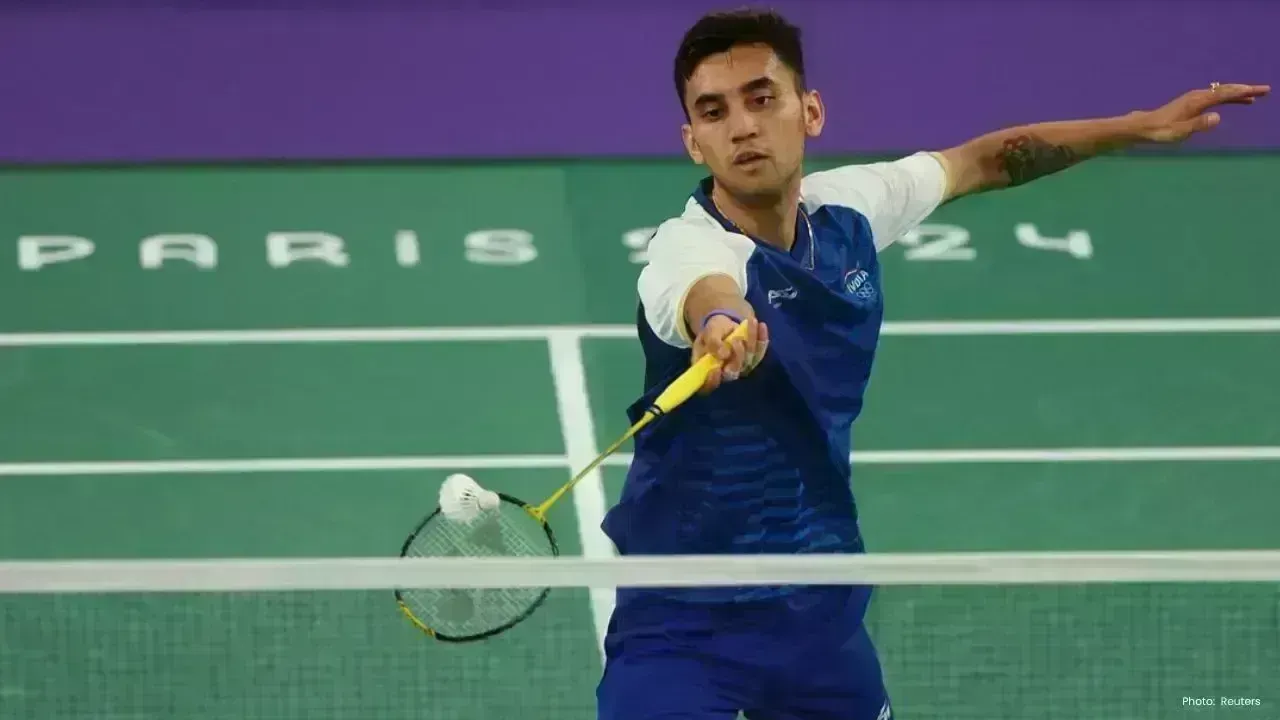

Lakshya Sen Triumphs Over Chou Tien Chen in Australian Open Semifinal

Lakshya Sen defeats world No. 6 Chou Tien Chen in a thrilling semifinal, advancing to the Australian

FIFA Enforces Six-Month Suspension on Panama's Manuel Arias Ahead of 2026 World Cup

FIFA bans Manuel Arias from all football activities for six months due to previous ethics violations

France to Compete Against Brazil and Colombia in Pre-World Cup Friendlies

France will face Brazil and Colombia in friendly matches in March 2026 as part of their World Cup pr

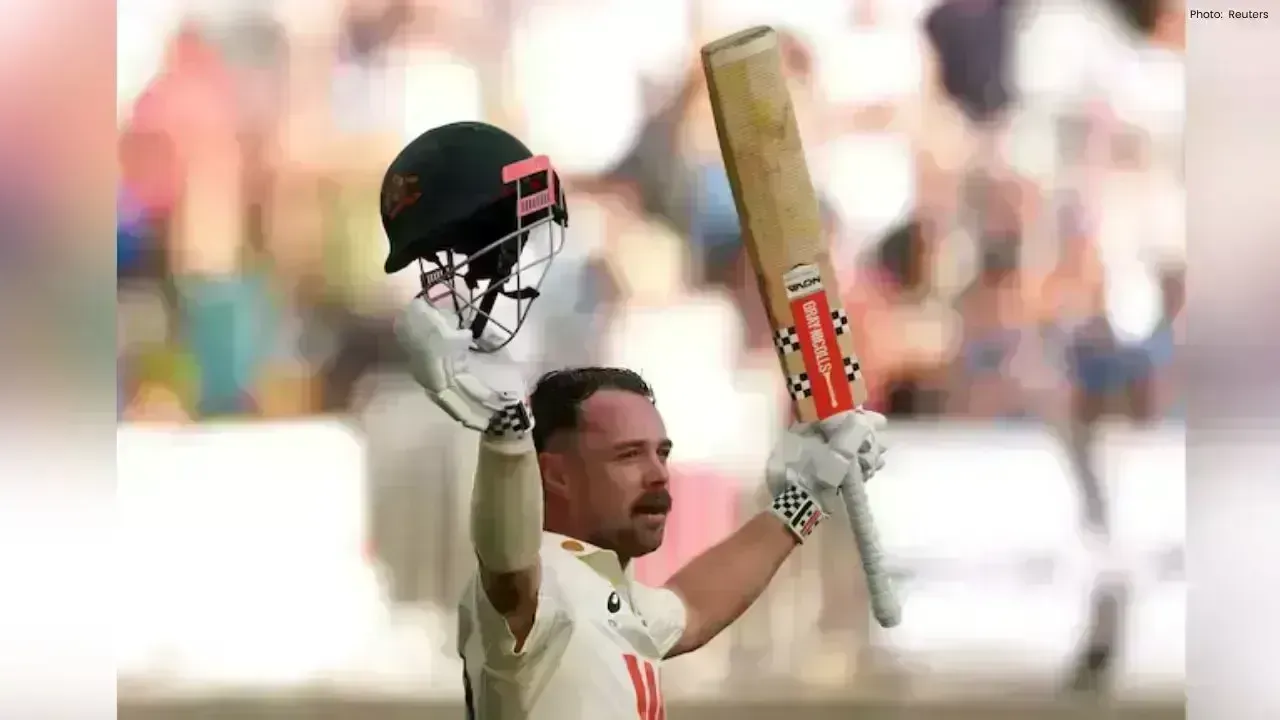

Travis Head's Century Leads Australia to Victory in First Ashes Test

Travis Head's explosive 123 drives Australia to an eight-wicket victory over England in the Ashes op