Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

As economic volatility, changing interest rates, and unpredictable markets prevail, investors are increasingly searching for secure short-term investments that offer reasonable returns while minimizing risks. Whether you’re saving for an important purchase, establishing an emergency fund, or looking to avoid lengthy commitments, experts suggest certain instruments that maintain a strong equilibrium between growth and safety this year. Below are the top recommended alternatives, along with their risks, benefits, and how to select what aligns with your financial objectives.

Experts typically classify safety in this realm by focusing on capital preservation, liquidity (the ability to access funds), and predictability of returns. For short-term investments, the priority is not maximizing profits but minimizing risks while ensuring availability when needed. The safest options usually provide steady income, assure creditworthiness, and exhibit low volatility.

One of the most straightforward and liquid methods to securely store cash is through high-yield savings accounts. These accounts, commonly offered by online banks, usually provide interest rates significantly higher than traditional savings accounts while ensuring easy access to your principal.

Benefits: Immediate liquidity, FDIC or local equivalent insurance, and low risk

Considerations: Rates may vary, and returns could fall short against long-term inflation

Fixed deposits are a favored choice for short-term investors seeking guaranteed returns. You deposit a specific amount for a set duration, and upon maturity, you reclaim your principal along with interest.

Benefits: Reliability, safety, and no market-related risks

Considerations: Funds may be immobilized until maturity, with penalties for early withdrawals

Government-issued treasury bills rank among the safest investments, as they are government-backed. These short-term securities typically have maturities ranging from three months to a year, making them suitable for investment horizons.

Benefits: Minimal default risk, good liquidity (dependent on market), and consistent returns

Considerations: Interest rates may be moderate, and market price fluctuations can occur

Short-term bond funds are comprised of bonds that usually mature within one to three years, including corporate, municipal, or government bonds.

Benefits: Higher yields compared to savings accounts or T-bills, relative stability, and professional management

Considerations: Not FDIC insured; credit risk relates to the underlying bonds; market shifts can impact fund NAV

Money market funds are mutual funds investing in low-risk, highly liquid instruments such as T-bills, commercial paper, and certificates of deposit.

Benefits: High liquidity, fairly stable net asset values, and portfolio diversification among secure assets

Considerations: Yield might be quite modest; some funds may have minimum investment requirements or fees

Short-duration certificates of deposit (CDs) function similarly to fixed deposits but typically offer various tenors such as 3, 6, or 12 months, available through banks and credit unions.

Benefits: Secure principal, fixed interest rates, and insurance in many regions

Considerations: Early withdrawal penalties; potential for missing out on better rates if they rise

For those favoring exchange-traded funds, ultra-short-term bond ETFs provide a blend of stability and accessibility. These ETFs invest in very short-duration bonds and can be traded like stocks.

Benefits: Intraday liquidity, diversified bond exposure, and low interest rate risk relative to long-term bonds

Considerations: Management fees, potential price volatility, and dependency on interest rate changes

In certain regions, P2P lending platforms present short-term low-risk lending chances. By selecting high-credit borrowers or collateralized loans, risks can be mitigated.

Benefits: Higher potential yields, flexible terms, and diversification across various loans

Considerations: Credit risk, platform reliability, and limited liquidity depending on loan conditions

If you're positioned in a higher tax bracket, short-term municipal bonds can yield tax-free income and carry relatively low risk based on the issuer.

Benefits: Tax benefits, consistent income, and typically lower risk than long-term municipal options

Considerations: Generally lower yields compared to corporate bond funds; credit risk is issuer-dependent

Start by considering: When will I need these funds? If you expect to access your money in the next 6–12 months, opt for highly liquid choices like high-yield savings or money market funds. If you can commit for a year, consider CDs or short-term bonds.

Typically, higher returns carry greater risks. For optimal safety, choose government-backed instruments or insured accounts. For slightly improved yields, look into bond funds or P2P lending avenues with thorough risk assessment.

If engaging in bond funds or municipal securities, understand how taxes will influence your net returns. Municipal bonds may prove more appealing for taxable accounts, while other options might better suit tax-advantaged accounts.

Experts frequently recommend a diversified short-term portfolio to enhance returns while mitigating risks. For instance, you could allocate your capital as follows:

30% in a high-yield savings account

30% in a short-term bond fund

20% in T-bills

20% in short-term CDs

This strategy helps maintain liquidity while generating consistent interest income.

Interest rates in 2026 could shift due to global economic factors. Monitor central bank actions closely. If rates are climbing, CDs and T-bills may present more value. Conversely, if rates decline, bond funds might perform better.

Short-term “secure” options aren’t designed for maximizing returns. Aiming for yield through aggressive investments introduces risk. Recognize the trade-off: safety ≠ high profits.

Numerous short-term products yield returns that barely surpass inflation. Sustained inflation could threaten your real purchasing power. Regularly reassess your asset allocation if your timeline stretches.

Even short-term bond funds or peer-to-peer loans carry credit risks. Opt for funds comprising high-quality bonds or P2P platforms with rigorous borrower evaluations.

Instruments like CDs and locked government securities might restrict early withdrawals. Ensure your allocation to these products isn’t required immediately.

Choosing trustworthy, established banks, bond funds, or P2P platforms can minimize the risk of default or fraud. Always evaluate the financial security and regulatory standing of the issuer.

Financial authorities agree that short-term instruments will play a vital role this year. With thoughtful planning, you can safeguard your capital, maintain liquidity, and harvest modest returns without excessive risk exposure. The safest approach involves a blend of multiple instruments, ongoing vigilance, and attention to broader economic trends.

The information presented in this article is for general educational purposes only and does not serve as professional financial advice. Investment results are dependent on individual circumstances, product specifications, and future economic conditions. Readers should seek counsel from licensed financial advisors or investment professionals prior to making any decisions or allocating resources.

Taijul Islam Shatters Bangladesh’s Test Wicket Record

Taijul Islam sets a new record for Bangladesh with 248 Test wickets, overtaking Shakib Al Hasan duri

Bavuma Achieves 1,000 Test Runs as South Africa's Captain

Temba Bavuma becomes the second-fastest South African captain to score 1,000 Test runs during the on

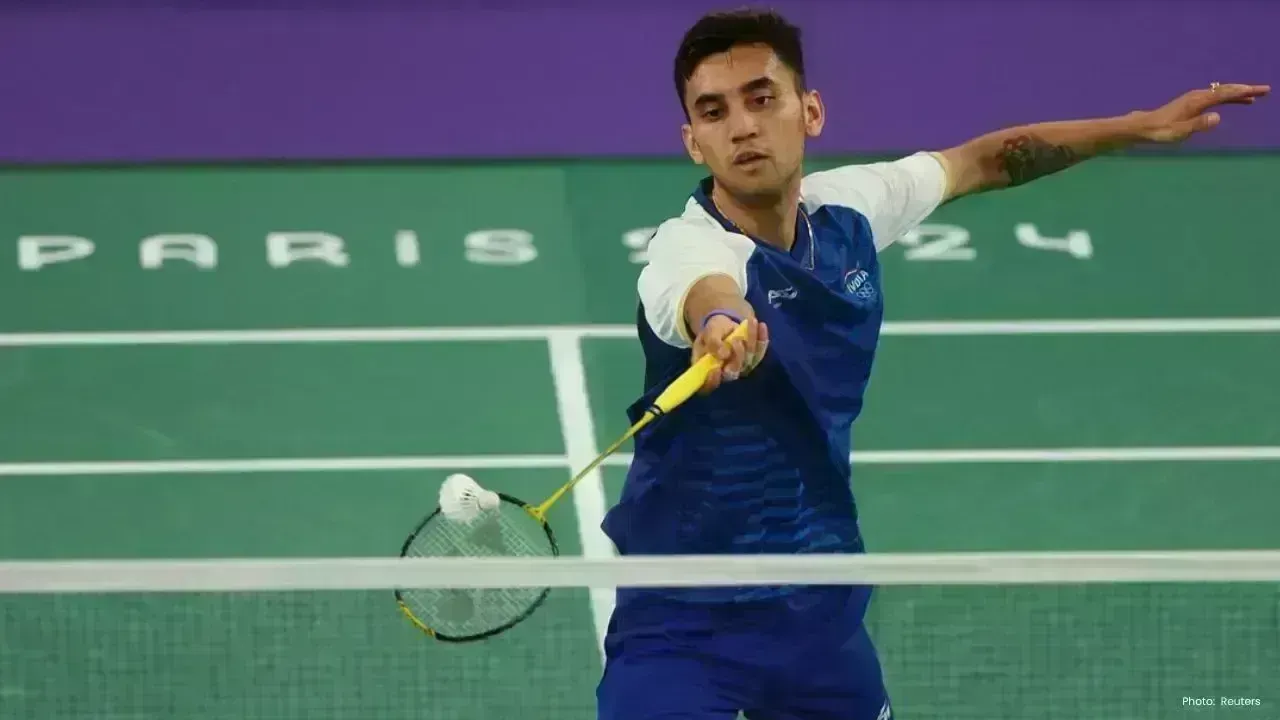

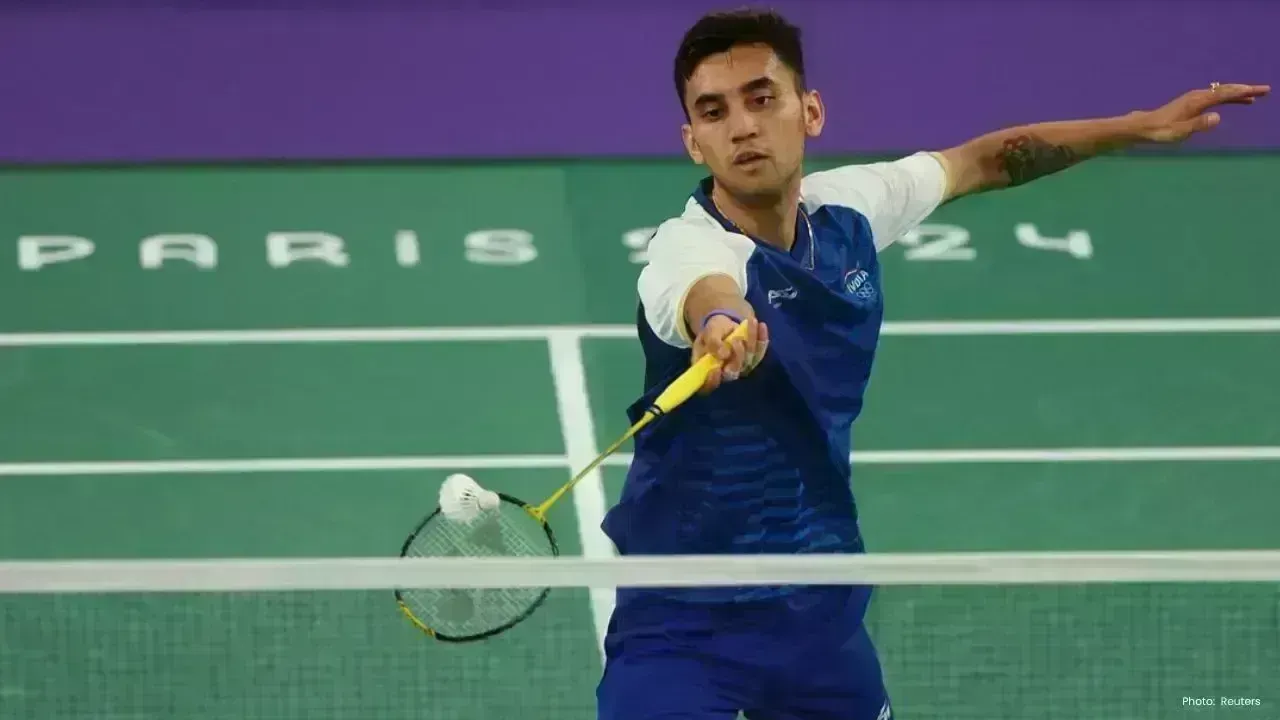

Lakshya Sen Triumphs Over Chou Tien Chen in Australian Open Semifinal

Lakshya Sen defeats world No. 6 Chou Tien Chen in a thrilling semifinal, advancing to the Australian

FIFA Enforces Six-Month Suspension on Panama's Manuel Arias Ahead of 2026 World Cup

FIFA bans Manuel Arias from all football activities for six months due to previous ethics violations

France to Compete Against Brazil and Colombia in Pre-World Cup Friendlies

France will face Brazil and Colombia in friendly matches in March 2026 as part of their World Cup pr

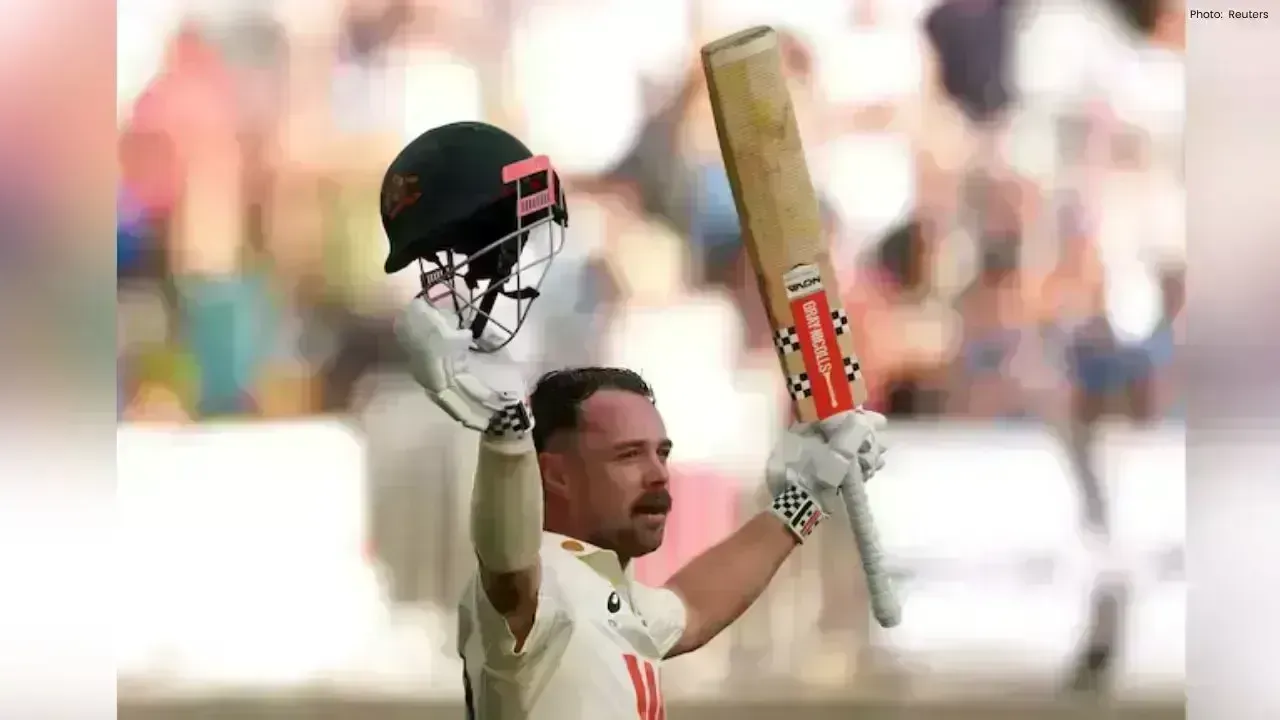

Travis Head's Century Leads Australia to Victory in First Ashes Test

Travis Head's explosive 123 drives Australia to an eight-wicket victory over England in the Ashes op