You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The finance industry operates on instruments—structured tools that enable saving, investing, borrowing, lending, hedging, and transferring risk. Whether you plan to work in banking, investment management, corporate finance, fintech, insurance, or markets, financial instruments form the language of the profession.

Beginners often assume finance is only about stocks or the stock market. In reality, the ecosystem is far broader. Financial instruments are classified based on risk, return, liquidity, maturity, and purpose. Understanding them is the first step toward financial literacy and professional competence.

This article provides a complete, structured overview of financial instruments every beginner must know before entering the finance industry.

A financial instrument is a contract that represents a financial asset to one party and a financial liability or equity to another. These instruments allow money to move through the economy efficiently.

They are broadly used to:

Save money

Raise capital

Invest for growth

Manage risk

Facilitate trade

Financial instruments are generally grouped into:

Cash and cash-equivalent instruments

Debt instruments

Equity instruments

Derivative instruments

Hybrid instruments

Alternative investment instruments

Each category serves a specific function in the financial system.

Savings accounts are the most basic financial instruments. They allow individuals to store money securely while earning modest interest. In the finance industry, savings accounts represent low-risk, high-liquidity assets.

Key characteristics:

Very low risk

High liquidity

Low returns

Understanding savings accounts helps beginners grasp liquidity management and interest mechanics.

Fixed deposits involve locking money for a fixed period in exchange for higher interest than savings accounts. These instruments teach beginners about:

Time value of money

Interest compounding

Opportunity cost

They are widely used by banks to mobilize capital.

Treasury bills are short-term government-issued instruments with maturities under one year. They are considered risk-free because they are backed by the government.

In finance careers, treasury bills are critical benchmarks for:

Risk-free rates

Monetary policy analysis

Short-term liquidity management

Bonds are instruments where investors lend money to governments, corporations, or institutions in exchange for periodic interest and principal repayment.

Key bond types include:

Government bonds

Corporate bonds

Municipal bonds

Bonds teach beginners about:

Interest rates

Credit risk

Yield curves

Duration

Bonds form the backbone of fixed-income markets.

Debentures are unsecured debt instruments issued by corporations. Unlike bonds, they are not backed by collateral, making credit risk analysis crucial.

For finance professionals, debentures introduce:

Corporate credit evaluation

Default risk

Credit spreads

Commercial paper is a short-term unsecured debt instrument issued by large corporations to meet working capital needs.

It is essential for understanding:

Corporate treasury operations

Money markets

Short-term financing strategies

Equity shares represent ownership in a company. Shareholders benefit from capital appreciation and dividends.

Stocks are central to finance careers because they involve:

Valuation techniques

Market efficiency

Risk-return trade-offs

Corporate governance

Understanding stocks is mandatory for roles in investment banking, asset management, and trading.

Preference shares are hybrid instruments with features of both equity and debt. They provide fixed dividends but limited voting rights.

They help beginners understand:

Capital structure

Dividend prioritization

Risk layering

Mutual funds pool money from multiple investors and invest in diversified portfolios.

Types include:

Equity funds

Debt funds

Balanced funds

Index funds

Mutual funds teach:

Portfolio diversification

Risk profiling

Asset allocation

They are essential instruments in wealth management and retail finance.

ETFs are market-traded funds that track indices, sectors, or commodities.

For beginners, ETFs offer insights into:

Passive investing

Market efficiency

Low-cost portfolio construction

Futures are standardized contracts to buy or sell an asset at a predetermined price on a future date.

They are used for:

Hedging

Speculation

Price discovery

Futures introduce beginners to leverage and margin concepts.

Options give the right, but not the obligation, to buy or sell an asset at a specific price.

Key option types:

Call options

Put options

Options help learners understand:

Risk asymmetry

Volatility

Payoff structures

They are fundamental in trading, risk management, and structured products.

Swaps involve exchanging cash flows between two parties, commonly used for:

Interest rate management

Currency exposure control

Swaps are critical instruments in corporate finance and institutional banking.

Spot forex deals involve immediate currency exchange at prevailing rates.

They teach:

Exchange rate dynamics

Global trade flows

Macroeconomic linkages

Forwards allow parties to lock in future exchange rates, helping manage currency risk.

They are essential tools for:

Exporters

Importers

Multinational corporations

Convertible bonds can be converted into equity shares at a later stage.

They help beginners understand:

Risk mitigation

Capital flexibility

Investor incentives

Structured products combine multiple instruments to achieve customized risk-return profiles.

They are widely used in:

Private banking

Wealth management

Institutional investing

REITs allow investors to participate in real estate markets without direct ownership.

They introduce concepts like:

Rental yields

Asset-backed securities

Income-focused investing

Commodities such as gold, oil, and agricultural products are traded through spot and derivative markets.

They help explain:

Inflation hedging

Global demand cycles

Supply shocks

These instruments invest in private companies.

They are central to:

Startup financing

Growth capital

Long-term value creation

Understanding them is important for careers in corporate finance and entrepreneurship.

Cryptocurrencies represent decentralized digital assets.

They introduce:

Blockchain technology

Token economics

Regulatory challenges

Though volatile, they are increasingly relevant in modern finance.

Tokenization converts traditional assets into digital representations, improving liquidity and transparency.

This area is growing rapidly within fintech and institutional finance.

Every financial instrument exists on a risk-return spectrum. Beginners must understand:

Higher risk generally demands higher returns

Liquidity often trades off with yield

Time horizon affects suitability

Professionals evaluate instruments not in isolation, but within portfolios.

A logical learning order includes:

Savings accounts and deposits

Bonds and fixed income

Equity shares and mutual funds

ETFs and index investing

Derivatives and risk management tools

This progression builds foundational understanding before advancing to complex instruments.

Different finance roles focus on different instruments:

Bankers deal with deposits, loans, and bonds

Asset managers handle equities, funds, and derivatives

Corporate finance teams manage debt and equity issuance

Risk professionals focus on derivatives and hedging

Mastery of instruments determines career mobility and growth.

Financial instruments are the building blocks of the global financial system. For beginners entering the finance industry, understanding these tools is not optional—it is essential. Each instrument represents a solution to a financial problem, whether it is saving safely, raising capital, investing efficiently, or managing uncertainty.

A strong grasp of financial instruments builds confidence, sharpens analytical thinking, and opens doors across banking, markets, fintech, and investment careers. Finance rewards those who understand the tools of the trade deeply—and it all begins with mastering financial instruments.

Disclaimer: This article is for educational purposes only and does not constitute financial or investment advice. Readers should consult certified professionals before making financial decisions.

Landfill Collapse in Cebu Kills Four, Dozens Missing as Rescue Continues

A massive landfill collapse in Cebu City has left four dead and dozens missing as rescuers race agai

Netanyahu Says Israel Aims to End US Military Aid Within 10 Years

Israeli PM Benjamin Netanyahu says Israel plans to gradually stop relying on US military aid within

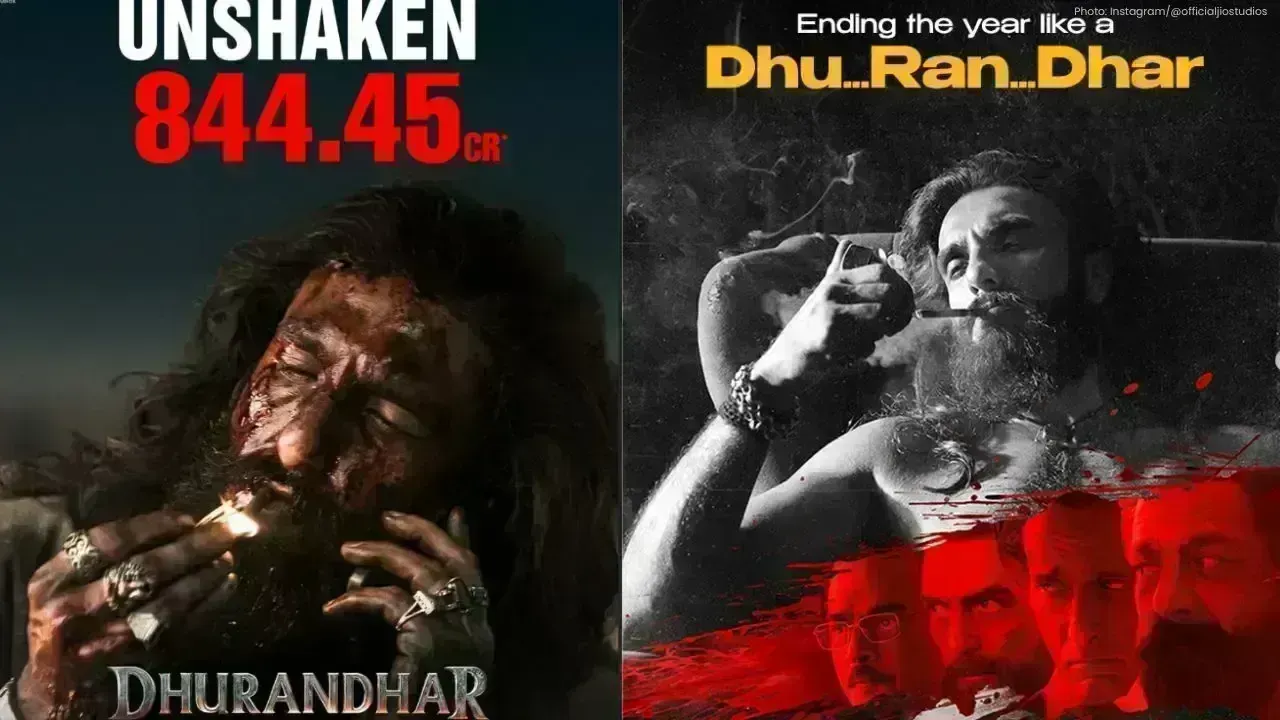

Dhurandhar’s Box Office Roars On: Ranveer Singh’s Spy Thriller Shatters Records

Ranveer Singh’s Dhurandhar earns ₹3.6 Cr on Day 36, totaling ₹844.45 Cr in India. The spy thriller s

FCC Clears SpaceX to Launch 7,500 More Starlink Satellites Worldwide

SpaceX gets FCC approval to add 7,500 new Starlink satellites and upgrade frequencies, boosting glob

Indonesia Blocks Elon Musk’s Grok AI Over Unsafe AI Content

Indonesia temporarily blocks Elon Musk’s Grok chatbot due to unsafe AI-generated images. The move ai

PV Sindhu’s Malaysia Open Run Ends with Semifinal Loss to Wang Zhiyi

PV Sindhu’s comeback at Malaysia Open ends in semifinals as China’s Wang Zhiyi wins 21-16, 21-15. Si