You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The Indian equity markets opened the session on a subdued note and largely remained range-bound throughout the trading hours. Both headline indices reflected investor indecision as global cues offered limited direction and domestic triggers remained muted. The Sensex oscillated within a narrow band, while the Nifty 50 struggled to reclaim the 26,350 mark, signaling cautious sentiment among market participants.

This phase of consolidation comes after a period of strong upward momentum, prompting investors to pause and reassess valuations. Profit booking in select heavyweights, coupled with selective buying in energy and metal stocks, ensured that the indices avoided sharp cuts while also capping any meaningful upside.

The Sensex traded with mild fluctuations as gains in select large-cap stocks were offset by losses in others. Early optimism quickly faded as selling pressure emerged in IT counters, dragging the index lower before value buying stepped in.

Despite the flat trend, intraday volatility highlighted the underlying nervousness in the market. Traders remained cautious ahead of upcoming global economic data and domestic earnings announcements, choosing to stay light on fresh positions.

The Nifty 50’s inability to sustain above 26,350 emerged as a key talking point for the session. This level, seen as a near-term resistance, has become a battleground between bulls and bears. While downside was protected by support from banking and energy stocks, lack of broad-based participation restricted any sharp rebound.

The IT sector underperformed the broader market, weighed down by concerns over global demand, currency fluctuations, and cautious management commentary. Heavyweights in the space faced selling pressure, reflecting investor preference to book profits after recent rallies.

HCL Technologies declined notably, emerging as one of the top laggards on the benchmark indices. The stock’s weakness underscored broader worries about near-term revenue visibility and margin pressures within the IT pack.

In contrast, the energy sector provided much-needed support to the market. Rising crude-linked optimism and stable outlook for upstream companies boosted investor confidence.

ONGC surged during the session, benefiting from firm energy prices and expectations of improved realizations. The stock’s strength highlighted renewed interest in value-driven PSU plays, particularly those linked to commodities and infrastructure.

The decline in HCL Technologies weighed heavily on the IT index and, by extension, the benchmarks. Investors appeared cautious amid concerns over discretionary spending by global clients and potential margin compression.

While long-term fundamentals remain intact, short-term sentiment around IT stocks continues to be driven by global macroeconomic cues, particularly interest rate expectations in developed markets.

ONGC’s gains stood out in an otherwise muted market. The stock attracted buying interest from both institutional and retail investors, supported by expectations of steady production levels and favorable pricing dynamics.

The performance reinforced the narrative that energy and commodity-linked stocks may continue to act as defensive plays during periods of market consolidation.

Midcap stocks mirrored the cautious tone of the frontline indices. While select stocks witnessed buying on stock-specific news, overall breadth remained neutral to negative, indicating selective participation.

Investors appeared reluctant to chase midcap valuations at elevated levels, preferring to wait for clearer signals on earnings growth and macro stability.

The smallcap segment remained volatile, with sharp moves seen in individual names. However, lack of sustained buying interest suggested that risk appetite remains measured, particularly among short-term traders.

Asian equity markets offered a mixed picture, providing little directional guidance to Indian equities. Investors across the region remained cautious ahead of key economic data releases and central bank commentary.

This lack of clarity translated into subdued participation on Dalal Street, with traders preferring to stay on the sidelines.

Overnight cues from the US markets failed to spark enthusiasm among domestic investors. While global indices remained stable, absence of strong triggers kept Indian markets confined to a narrow range.

The overall market sentiment can best be described as cautiously optimistic. While investors are not in a rush to exit equities, they are equally hesitant to aggressively add positions at current levels.

This phase of consolidation is seen by many market watchers as healthy, allowing indices to digest recent gains and set the stage for the next directional move.

From a technical perspective, the Sensex continues to find support at lower levels, preventing a sharp correction. However, resistance near recent highs remains a hurdle, suggesting the possibility of continued sideways movement.

Traders are closely monitoring volume trends and momentum indicators for clues on the next breakout or breakdown.

For the Nifty 50, the 26,300–26,250 zone is emerging as an important support area. A decisive break below this range could invite further selling, while a sustained move above 26,350 may trigger fresh buying interest.

Foreign institutional investors appeared cautious, adopting a wait-and-watch strategy amid global uncertainties. While there was no aggressive selling, lack of strong inflows also capped upside.

Currency movements and global bond yields remain key factors influencing FII behavior in the near term.

Domestic institutional investors provided stability to the market, stepping in to absorb selling pressure in select sectors. Their presence helped prevent deeper cuts and maintained overall market balance.

Upcoming corporate earnings announcements are expected to play a crucial role in shaping near-term market direction. Stock-specific reactions could intensify, especially in sectors like IT, banking, and energy.

Investors will closely track global macroeconomic indicators, particularly inflation and growth data from major economies. These numbers could influence central bank outlooks and, in turn, market sentiment.

In a consolidating market, experts advise focusing on fundamentally strong stocks with reasonable valuations. Sectors offering earnings visibility and balance sheet strength are likely to outperform over the medium term.

With volatility expected to persist, maintaining disciplined risk management is crucial. Avoiding excessive leverage and chasing momentum can help investors navigate uncertain phases.

The session reflected a classic pause in an ongoing market journey. While the Sensex traded flat and the Nifty 50 slipped below 26,350, the absence of panic selling suggests underlying strength remains intact. Divergence between stocks like HCL Technologies and ONGC highlights the importance of stock selection in the current environment.

As markets await clearer cues, this consolidation phase could well be the calm before the next decisive move, making patience and prudence the key virtues for investors.

Disclaimer:

This article is for informational purposes only and does not constitute investment advice. Market investments are subject to risks, and readers are advised to conduct their own research or consult a qualified financial advisor before making any investment decisions.

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from

Lakshya Sen Wins, Malvika Bansod Loses at Malaysia Open 2026

Lakshya Sen advances to second round at Malaysia Open, while Malvika Bansod exits early after return

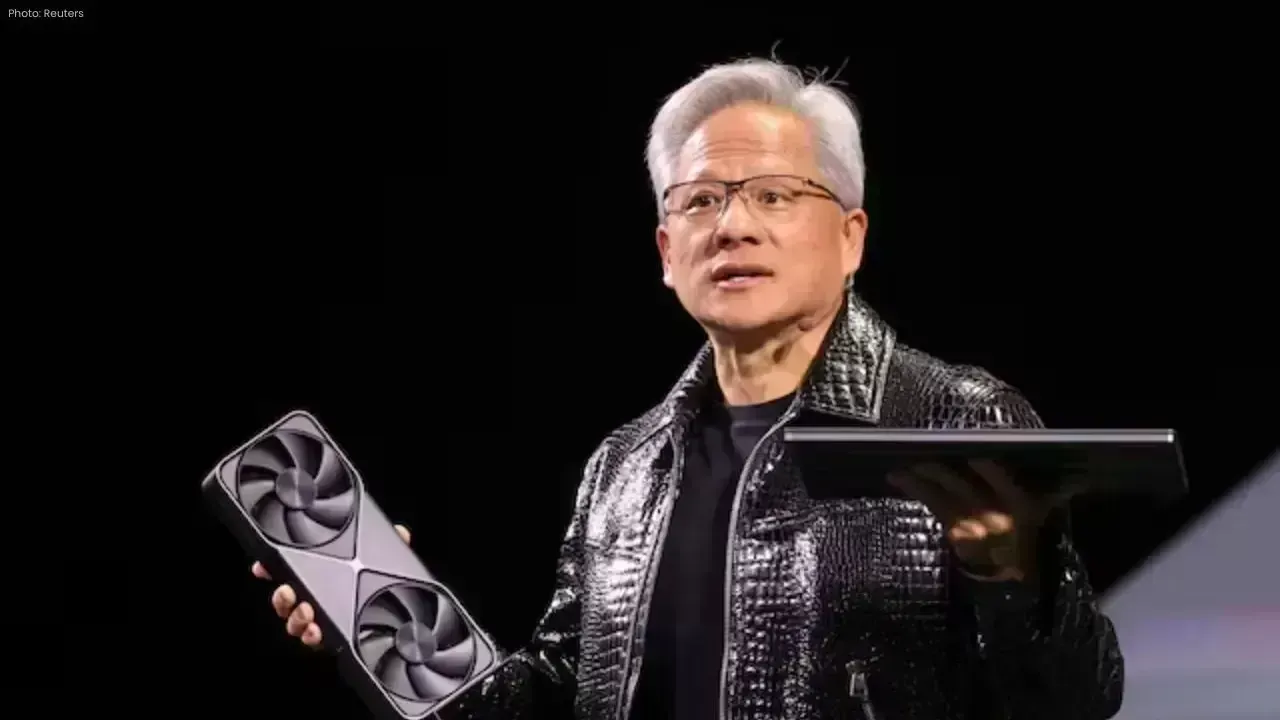

Nvidia's CEO Introduces Vera Rubin AI Chips Promising 5x Performance Gains

Nvidia has officially launched its Vera Rubin AI chips, aiming for faster chatbots, reduced costs, a

Avatar: Fire and Ash Surpasses $1 Billion Globally

James Cameron's latest installment, Avatar: Fire and Ash, has crossed $1.03 billion worldwide, showc

Canada Opens Skies to Middle East Airlines, Raising Competition Bar

Canada is expanding flight access for Saudi and UAE airlines, increasing competition and pressuring