You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The domestic stock market opened on a guarded note and remained range bound through most of the trading hours. Investors chose to book partial profits after the strong rally seen in the previous weeks. Although the decline in headline indices was not deep, the participation was clearly selective, showing that traders are becoming choosy about valuations and near-term triggers. The technology segment attempted to support the market, yet pressure in pharmaceuticals and oil related companies created an opposite force. Market breadth oscillated between positive and negative territory, underlining the absence of a decisive trend.

The Sensex began the day slightly lower and soon extended the cut to around 120 points. The Nifty index also moved beneath 26,150, a level considered important by many analysts. Dealers pointed out that the fall was largely due to a few large caps rather than a widespread panic. Volumes in the cash segment were moderate, suggesting that long-term participants were not aggressive sellers. The rupee traded steady against the dollar, and bond yields showed little movement, giving no major macro shock to equities. Traders kept an eye on global commodity prices because energy stocks were already weak.

Most sector indices displayed mixed behavior. The auto pack cooled after hitting record highs, while banking majors traded flat. The IT space gained some traction on hopes of fresh order flows from overseas clients. Pharmaceutical companies corrected as concerns over margin sustainability resurfaced. Oil and gas counters faced selling because crude prices have stayed elevated, increasing input costs for refiners. Consumer oriented businesses showed resilience, with Titan leading the charge.

Titan shares jumped close to three percent, becoming the top contributor on the positive side. Market participants linked the rise to optimism about wedding demand and new product launches. The company has expanded its store network across metros and smaller cities, which is expected to lift revenue visibility. Short covering by traders who had bet on consolidation added further fuel. The move highlighted that quality consumer franchises continue to attract money even when indices dip. Brokers expect Titan to remain in focus during the entire earnings season.

Investors are waiting for quarterly results that will start arriving soon. After the long bull run, there is fear that any disappointment may trigger sharper corrections. Several companies have already issued muted business updates, pushing traders to reduce risk. Analysts believe that the market is pricing in healthy growth, leaving little room for error. Foreign funds have turned marginal sellers in the last few sessions, another reason for defensive positioning. Domestic institutions provided partial support, yet they were not able to change the tone completely.

International markets have shown volatility due to tariff discussions and policy uncertainty. Asian indices traded weak, and European futures pointed to a cautious start. Commodity prices, especially metals and energy, stayed firm, which usually hurts import heavy sectors in India. The United States dollar remained strong, keeping emerging market flows under check. Traders feel that domestic equities cannot ignore these signals for long. Therefore, the mild fall on Dalal Street should be read as an alignment with the broader world rather than an isolated event.

Foreign portfolio investors have enjoyed significant profits from Indian stocks over the year. Recently they opted to rebalance toward other markets where valuations appear cheaper. Selling by these funds was visible in Cipla and ONGC, two large weights in the indices. Market experts say that unless global yields soften, overseas money may stay on the sidelines. The steady rupee has prevented a bigger outflow, but the direction remains fragile. Many traders track daily foreign numbers to gauge the next leg.

Cipla shares slipped during the session and pulled the entire pharmaceutical index lower. Concerns about pricing pressure in the American generics market affected sentiment. The company has delivered strong growth earlier, prompting fears of a slowdown from high base. Some brokerages trimmed their near-term estimates, encouraging profit booking. Traders also worried about rising research expenses that may dent margins. The fall in Cipla erased a portion of the recent gains but long-term investors are still positive on the franchise.

Pharma businesses have benefited from currency movement and new approvals. However, raw material costs and compliance expenses have started to rise. Investors question whether the earlier margin expansion can continue. Several mid-cap pharma names corrected along with Cipla, showing that traders are unwilling to pay very high multiples. Analysts expect the upcoming results to clarify the picture. Until then, the sector may experience intermittent selling.

Pharmaceuticals are usually considered defensive, yet in the present market they have turned volatile. After a large rally, even safe sectors face valuation risk. The selling in Cipla proves that no pocket is immune. Dealers believe that rotation toward consumer and IT segments may continue. The day’s trade provided evidence of this shift.

Oil and Natural Gas Corporation encountered selling and became a major drag on benchmarks. Elevated crude prices squeeze the marketing margins and raise subsidy related worries. The company’s exploration spending has increased, and investors fear a delay in production ramp up. Traders booked profits ahead of results because the stock hadrisen sharply earlier. The weakness in ONGC spread to other public sector oil companies. This pressure alone accounted for a large part of the 120 point fall in the Sensex.

Crude oil plays an emotional as well as financial role in Indian markets. When prices rise, investors quickly turn cautious about fiscal balance and inflation. The day’s trade followed the same pattern, hitting ONGC and a few refiners. Although the government has maintained stable fuel prices, market participants remain worried about policy changes. Analysts advise keeping an eye on weekly crude inventory data. Any sudden spike could hurt equities further.

Public sector oil companies have enjoyed renewed interest due to dividend hopes. Yet high crude prices challenge this narrative. The fall in ONGC demonstrates that traders want clarity on subsidies and capital allocation. Many expect the government to address these issues soon. Until that happens, the pack may stay heavy.

Information technology shares provided some relief and prevented a deeper fall. Optimism about global digital spending helped large IT companies trade in the green. Dealers said that orders in cloud and artificial intelligence services are improving. The sector has not participated fully in the earlier rally, leaving room for catch up. Traders rotated part of their money from pharmaceuticals into IT names. This shift kept the market breadth from collapsing.

Technology companies depend heavily on export demand. Recent global data indicate a pickup in corporate technology budgets. Indian IT firms have launched new platforms and hired fresh talent to capture this opportunity. Analysts believe that the earnings season may bring positive surprises from this pocket. Therefore, traders used IT as a hedge against energy and pharma weakness. The day’s trade reflected this defensive strategy.

Compared to other sectors, technology valuations appear relatively comfortable. This is one reason for investor interest even on a weak day. Dealers feel that the next leg of the rally may require IT participation. Titan and technology together tried to balance ONGC and Cipla drags. The tug of war created a mild but manageable cut in indices.

Retail investors continued to participate through systematic investment plans. Selling from traders was more visible than from long-term holders. The advance decline ratio moved around one to one, showing equilibrium. Several mid-caps in consumer and specialty chemicals traded higher despite the Sensex fall. Dealers said that retail participants are using declines to add quality names. Their behavior provided a floor to the market.

After months of gains, valuations have become central to every discussion. Traders examine price to earnings ratios before taking positions. The fall in Cipla and ONGC occurred because these stocks were not cheap anymore. Titan managed to rise because growth visibility justified the multiple. The day proved that the market is entering a valuation driven phase. Investors may reward only those companies that deliver real numbers.

The mild decline encouraged conversations about risk management. Traders kept stop losses tight and avoided leverage. Options premiums stayed elevated due to fear of larger swings. Analysts advise maintaining balanced portfolios. The session served as a reminder that markets do not move in straight lines.

Experts believe that the fall of 120 points in the Sensex should not be seen as a trend reversal. The Nifty below 26,150 is a temporary pause rather than a breakdown. Upcoming earnings, global tariff news, and crude prices will decide direction. Titan and IT may continue to shine, while pharmaceuticals require margin clarity. Energy stocks depend on crude movement and policy stance. Dealers expect the market to stay volatile but opportunities will emerge in quality franchises.

Analysts recommend focusing on businesses with strong cash flow and consumer demand like Titan. In technology, selective large IT companies may provide hedge. Pharmaceuticals should be watched rather than chased. Energy counters require light exposure until crude softens. Retail investors may use systematic plans to navigate volatility. The day’s trade offered a template for this strategy.

The session ended with indices lower but sentiment was not broken. Titan’s three percent gain remained the headline, proving consumer strength. Drags from Cipla and ONGC explained most of the fall. Market breadth showed selective buying. Earnings expectations and global cues created caution. The mild cut may pave the way for healthier consolidation.

Disclaimer:

This article is meant for information purposes only and should not be treated as financial or investment advice. Market investments are subject to risk, and readers are encouraged to consult certified professionals before making trading decisions.

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as

Bangladesh Cricket to Work with ICC on T20 World Cup Security

Bangladesh Cricket Board will cooperate with ICC to resolve security concerns and ensure team partic

Flash Floods in Indonesia’s North Sulawesi Kill 16, Hundreds Displaced

Deadly flash floods triggered by heavy monsoon rains in North Sulawesi, Indonesia, killed 16 people,

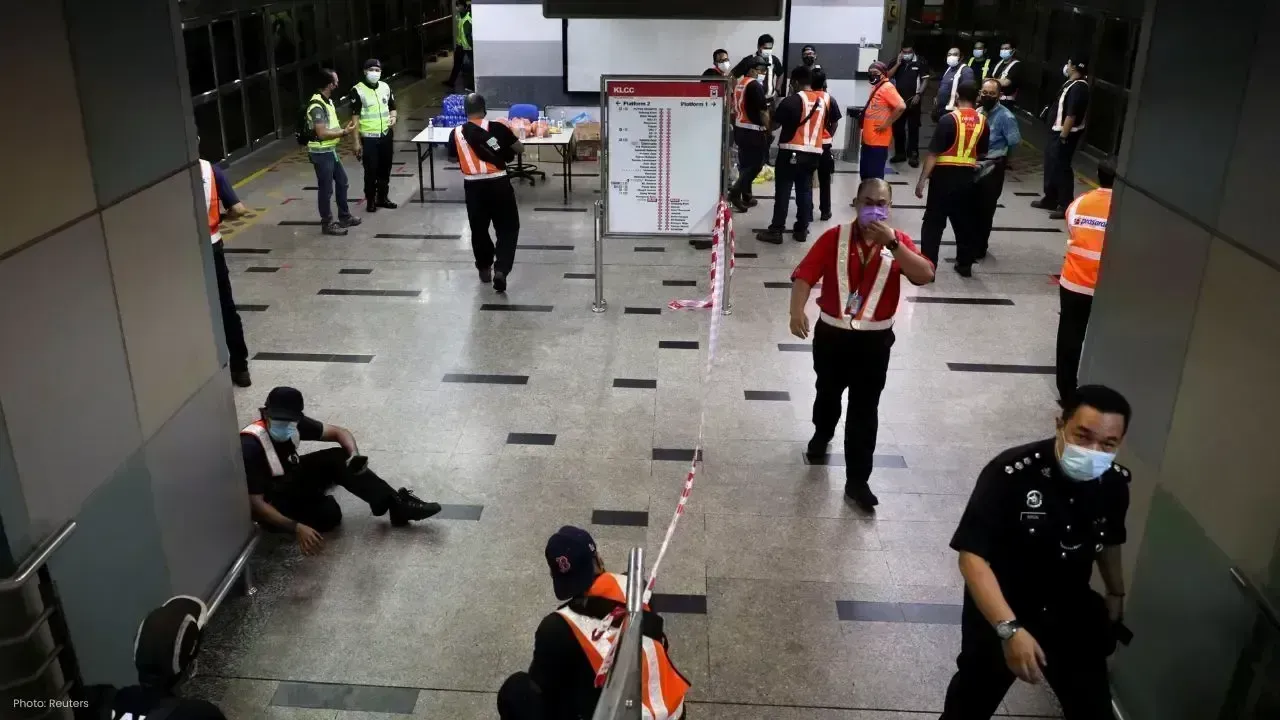

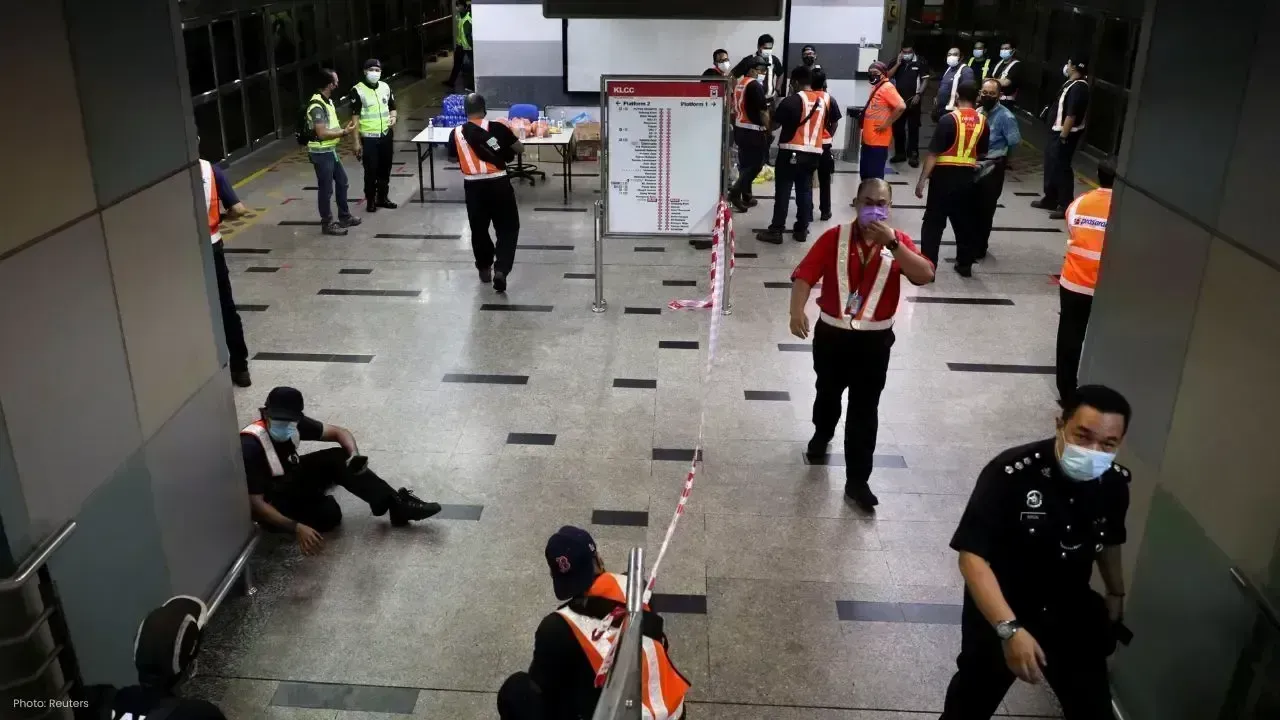

Prasarana Rail Reliability Soars as Service Breakdowns Fall in 2025

Prasarana records a major drop in rail service disruptions in 2025, while rising ridership signals r

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

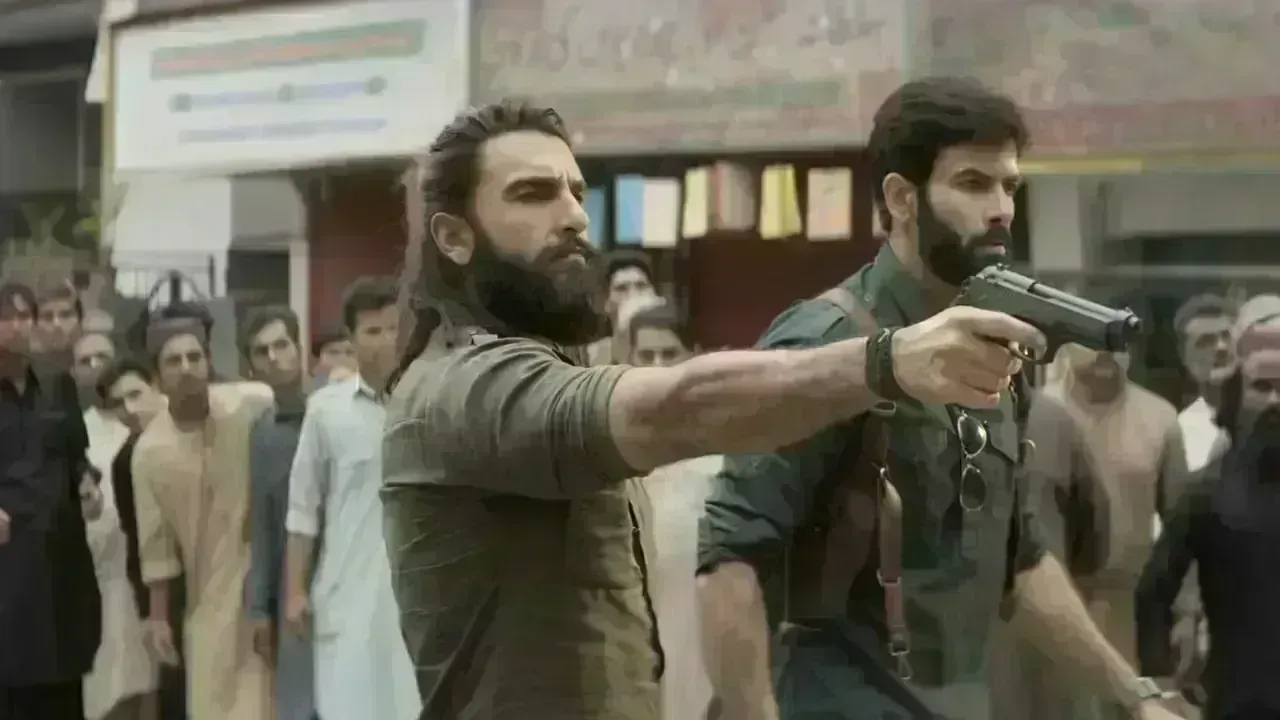

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from