You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

As Indian markets open for trading on January 8, 2026, key stocks are under the spotlight due to recent corporate announcements, structural changes in share capital, and broader sector dynamics. Against a backdrop of mixed global cues and domestic economic data, equities linked to technology, financial services, infrastructure and capital goods are likely to see increased investor interest. Among the names drawing attention are Angel One Ltd, Eternal Limited — the parent company of Zomato and Blinkit — Infosys, Housing and Urban Development Corporation Limited (HUDCO), and A-1 Ltd, which is executing a significant stock split. These developments are expected to shape intraday and short-term trading trends as market participants recalibrate positions.

Investor focus on such corporate events and earnings prospects typically influences market breadth and volatility. Understanding the context behind these names — from strategic corporate actions to fundamental performance — can help retail and institutional players navigate short-term fluctuations while aligning with evolving market narratives.

Angel One Ltd, a well-known retail brokerage and financial services firm in India, is expected to be in the news again as its board has scheduled a meeting later in January to consider a potential stock split along with interim dividend proposals. This planned board meeting — set for January 15 — signals that the company is evaluating ways to enhance investor engagement and potentially make its shares more attractive to retail participants through a stock split, subject to regulatory and shareholder approvals. The company’s earnings performance and corporate actions remain key triggers for short-term stock movement.

Stock splits can make shares more accessible by lowering the face value per share, which often improves liquidity and encourages broader participation, especially from retail investors. If approved, the split could lead to increased trading activity in Angel One shares in the weeks that follow the formal announcement, as market participants factor in the structural change.

Eternal Limited — formerly known as Zomato Limited — continues to attract attention as one of the prominent technology companies listed on Indian exchanges. It serves as the parent entity for several consumer-facing digital platforms, including Zomato’s core food delivery business and Blinkit, a quick-commerce grocery delivery service that rapidly expanded its presence across multiple Indian cities. Eternal’s diversified digital ecosystem positions it to leverage growth across food delivery, express commerce and related services.

The company’s recent rebranding to Eternal reflects a strategic push toward building a broader portfolio beyond its original food delivery roots, reinforcing its position in competitive digital markets.

Investors tracking Eternal’s stock are likely to focus on its earnings trajectory, strategic partnerships, user engagement metrics and profitability trends. Given the rapid evolution of the online services landscape and intensifying competition, developments linked to user growth, monetization and cost discipline will guide near-term sentiment around the stock.

Infosys, one of India’s largest information technology services firms, remains a key index stock and a bellwether for the Indian IT sector. With a strong presence across digital transformation, cloud services, consulting and enterprise software delivery, Infosys often mirrors sector sentiment in broader market movements. Investors typically watch the company’s quarterly results, client acquisition metrics and revenue guidance for cues on how the global demand environment is shaping up for IT services.

Infosys has consistently delivered steady earnings growth and maintained a robust order book, which continues to underpin confidence among long-term institutional investors.

As global enterprises continue investing in digital technologies, Infosys is positioned to benefit from transitions to cloud, automation and cybersecurity spending. The company’s ability to manage margins amid currency headwinds and wage inflation remains an important factor for analysts and portfolio managers alike.

Housing and Urban Development Corporation Limited — widely known as HUDCO — is a public sector enterprise operating in the infrastructure finance space. Its core mandate includes supporting development projects in housing, urban infrastructure and related sectors across India. The company’s financial performance is closely linked to government outlays, project award cycles and credit demand from state and local bodies.

Recent policy thrusts on infrastructure augmentation, housing affordability and urban renewal programs have kept HUDCO relevant among investors tracking government-linked securities and infrastructure plays.

Stocks like HUDCO are often viewed as defensive choices when markets face mixed sentiment. The company’s steady credit portfolio and focus on infrastructure financing provide a hedge against cyclical volatility in other segments of the economy. Investors monitor its asset quality, loan book growth and return metrics for insights into sustainable performance.

A-1 Ltd has taken center stage as it enacts a significant stock split, converting each existing equity share with a face value of ₹10 into ten shares with a face value of ₹1 while preserving the total value of share capital. The record date for this subdivision is January 8, 2026, making this a key date for investors to hold shares if they want to benefit from the split. The stock split aims to increase the tradability and affordability of A-1 Ltd shares, particularly among retail investors. The new ISIN for the subdivided shares has been activated by depositories, facilitating the transition.

Stock splits are often pursued to enhance liquidity and improve participation from a wider shareholder base. By reducing the price per share, companies can make their stock accessible to smaller investors who may have been previously priced out. For A-1 Ltd, this corporate action comes on the heels of strong performance in past years and a broader strategic shift into areas such as chemicals and industrial trading, as well as expansion into adjacent sectors.

Investors typically look at stock splits as confidence signals, although the underlying fundamentals determine long-term value.

As markets reopen, sector rotation remains a key theme. Technology and financial services stocks often lead movements when global trends favor risk assets, while defensive plays like infrastructure names provide stability during periods of uncertainty. Investor risk appetite, global cues and domestic economic indicators collectively shape short-term trading.

Corporate actions — including stock splits, dividends, and strategic decisions — can influence liquidity patterns and valuations. Stocks undergoing structural adjustments tend to see heightened interest in the trading session surrounding key dates. A-1 Ltd’s split, Angel One’s upcoming strategic review and earnings trajectories for large caps like Infosys are examples of events likely to drive focused trading.

Investors holding or considering positions in stocks undergoing corporate actions should pay close attention to record dates, ex-split calendars and technical signals. Understand how adjusted share prices trade post-action to align entry or exit decisions accordingly.

Earnings expectations and macroeconomic data — including inflation trends, interest rate cues and policy updates — may also influence immediate market sentiment. Stocks tied to earnings growth and robust fundamentals often outperform during periods of macro volatility.

Tracking how capital flows between sectors such as technology, financials and infrastructure can provide insights into broader investor sentiment. Shifts in rotation often herald changing risk preferences and may guide portfolio adjustments.

The Indian stock market on January 8, 2026 presents a blend of corporate actions, sector‐specific movements and macroeconomic signals that together will shape the trading session. Stocks like Angel One Ltd, Eternal Limited, Infosys, HUDCO and A-1 Ltd offer varied narratives — from structural share changes and strategic positioning to thematic exposure in technology and infrastructure. Investors attentive to these developments — and disciplined in balancing risk and opportunity — will be better positioned to navigate a dynamic market environment.

This article is for informational and educational purposes only. Investment decisions should be based on thorough research and individual risk assessment. Market conditions can change rapidly, and past performance is not indicative of future results.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

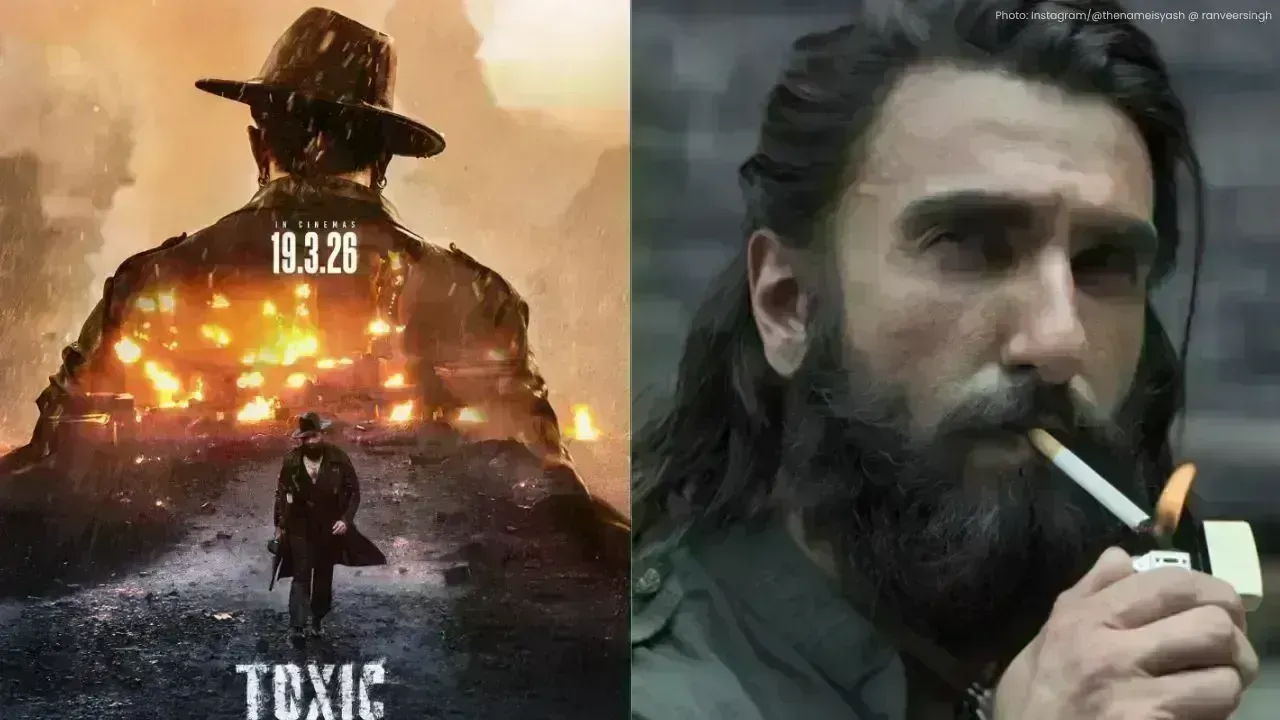

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as