You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The latest trading session on Wall Street delivered yet another historic close with major benchmarks touching record territory. The rally was clearly led by heavyweight technology companies that have continued to surprise investors with robust earnings and expanding business models. Traders described the day as a classic example of how innovation driven optimism can dominate macro fears. Although questions around tariffs, bond yields, and the strength of the US dollar remained part of conversations, buying interest refused to slow. Market breadth was healthy, and volatility gauges cooled, suggesting that participants are becoming comfortable with higher valuations in digital leaders.

The Dow Jones Industrial Average, the S&P 500, and the Nasdaq ended the day in the green, extending the gains seen through the week. The Nasdaq, known for its concentration of technology names, outperformed peers and became the headline index. Dealers said that fund managers rotated money from traditional sectors into tech counters, a pattern visible since the start of the year. Volumes in exchange traded funds linked with artificial intelligence and cloud computing rose sharply. Options premiums declined as fear of immediate correction faded. The session therefore strengthened the narrative that the American market is firmly in bull control.

Large pension funds and mutual houses were active buyers during the day. Their interest centered on companies that are investing heavily in future platforms. Several houses upgraded targets for semiconductor and software majors, encouraging fresh entries. Short sellers were forced to cover positions as indices marched higher. Traders pointed out that institutional conviction matters more than retail emotion in the United States. The day’s trade offered proof of this behavior.

Benchmarks continued to trade above their long-term averages. Momentum oscillators such as RSI and MACD remained in strong buy region. Chart readers highlighted that the Nasdaq has not broken its rising channel for months. Any dip has been used as an opportunity to add positions. This setup invited algorithm driven buying as well. Therefore, the technical picture matched the fundamental optimism perfectly.

The American technology sector has become the central pillar of global equity sentiment. Companies operating in semiconductors, digital advertising, online retail platforms, and artificial intelligence services have reported consistent growth. The latest session followed the same template where a rally in chipmakers and mega software names pushed indices to new peaks. Dealers said that optimism about AI monetization has entered a more mature phase. Earlier investors worried whether AI would deliver revenue; now they are discussing how large the revenue might become. This change in mindset has turned technology into a magnet for money.

Chip manufacturing majors surged as analysts raised demand estimates for data centers and edge devices. Artificial intelligence platforms require massive processing power, increasing orders for semiconductors. The United States government has supported domestic chip production through incentives, adding another layer of confidence. Traders today believe that semiconductor demand is not cyclical anymore but structural. The session witnessed strong gains in these counters, setting the tone.

Mega software names gained because corporate clients continue to increase spending on cloud migration. Subscription driven revenue models provide visibility and help justify richer multiples. Artificial intelligence assistants embedded within enterprise software have opened cross selling opportunities. Dealers therefore treated software counters as safe havens within growth pack. The day’s outperformance by Nasdaq reflected this enthusiasm clearly.

Another reason for the fresh high was strong quarterly earnings from technology leaders. Several companies beat street estimates on revenue as well as profit. Analysts said that digital advertising recovered faster than expected, while e-commerce volumes remained firm. Artificial intelligence related revenue started to contribute meaningful share in top lines. This improvement eased worries about high interest rates. Traders believe that as long as earnings beat estimates, valuations will remain secondary.

Traditional sectors such as utilities and consumer staples underperformed because fund managers moved money into technology. The Dow traded positive but lagged Nasdaq. Dealers pointed out that this rotation is not new; it has continued for many quarters. Investors prefer companies that promise faster growth rather than high dividends. The day therefore strengthened the pattern again.

When American markets hit record highs, it influences other regions including Asia and the Middle East. Technology heavy indices in several countries take cues from Nasdaq. The latest close is expected to create positive opening in allied markets tomorrow. Dealers across the world track US futures for daily strategy building. Therefore, the session holds global importance.

Although benchmarks rose, macro concerns were not completely absent. The United States Federal Reserve has kept rates elevated to manage inflation. Bond yields have remained firm, usually a negative signal for equities. However, the technology sector has managed to rise despite these factors. Analysts say that investors are becoming confident that inflation will remain under control without hurting growth. The day’s decline in options premiums supported this belief.

The US dollar has stayed strong against most currencies. This factor attracts global funds toward the United States and sometimes drains emerging markets. Dealers in Asia are watching whether this trend may continue after tariff discussions. However, the present rally indicates that foreign money is comfortable staying in American technology leaders. Therefore, dollar strength did not hurt benchmarks today.

Conversations about tariffs have increased globally. Investors feared that higher tariffs might dent margins of semiconductor importers. However, companies that manufacture chips within the United States may actually benefit. Dealers therefore differentiated between winners and losers within technology. The day’s trade reflected that investors are not panicking but evaluating carefully.

While technology surged, a few other sectors traded mixed. Real estate investment trusts showed mild consolidation because higher yields affect property valuations. Banking majors traded positive but did not match Nasdaq performance. Analysts said that credit growth remains firm in the United States, yet investors want clarity on net interest margins. However, the overall impact of these sectors on benchmarks was limited compared to technology.

Retail traders in America have increased participation through zero brokerage apps. They prefer technology counters because they understand the products personally. The day witnessed strong discussion on social forums about AI platforms and new gadgets. This retail enthusiasm matched institutional conviction. Therefore, market breadth remained healthy.

The VIX index declined during the session, suggesting that fear of immediate correction faded. When volatility cools, algorithm trading becomes aggressive buyer. Dealers said that the VIX decline helped Nasdaq extend gains in last hour. Therefore, the technical and emotional picture both favored bulls.

Large technology giants such as those operating in search engines, social media platforms, and online retail contributed most to index gains. Their combined market capitalization forms a heavy weight in the Nasdaq. Analysts said that these companies are investing billions in AI data centers, creating future revenue visibility for semiconductor makers. The session witnessed strong gains in these counters.

Companies manufacturing graphic processors, memory chips, and networking equipment surged as demand estimates rose. Artificial intelligence platforms require not merely processors but complete ecosystem including cooling systems and power management. Analysts therefore upgraded targets for this entire chain. The day’s trade provided evidence that investors are ready to pay richer multiples for ecosystem leaders.

Subscription driven cloud companies gained because corporate clients continue to migrate workloads. Artificial intelligence assistants embedded within cloud platforms have improved stickiness of clients. Analysts said that revenue per user is rising steadily. Therefore, the rally in software counters was justified by real numbers rather than hope alone.

The Nasdaq index ended the day with stronger percentage gain compared to the Dow Jones. Dealers said that fund managers rotated money from utilities into semiconductor and software majors. This rotation has pushed Nasdaq to record highs for many months. Chart readers highlight that the index has not broken its rising channel.

The S&P 500 also touched fresh highs but its move was balanced between technology and a few industrial names. Analysts said that industrial companies connected with data center building may benefit from technology spending indirectly. Therefore, the S&P move reflected broader confidence.

The Dow traded positive but lagged Nasdaq because its composition contains more traditional companies. Dealers said that the new bull phase belongs to innovation driven businesses rather than dividend driven giants. Therefore, Nasdaq remained the star.

Investors have started to see real revenue contribution from AI platforms. Earlier AI was a concept; now it has entered daily life of American corporations. Semiconductor demand has become structural. Software subscription models provide visibility. Therefore, technology counters continue to attract money.

Online advertising has recovered strongly as consumer spending remained firm in the United States. Technology giants benefit directly from this recovery. Analysts upgraded targets for search engine companies because ad revenue beat estimates. Therefore, the latest rally was not blind optimism but earnings driven.

American consumers continue to shop through online platforms, supporting technology counters. Logistics and cloud spending related with e-commerce remain firm. Therefore, investors prefer technology giants again and again.

Although the VIX cooled, analysts warn that if bond yields spike again, real estate and banking may correct sharply. Technology might resist but not ignore completely. Tariff discussions may also hurt semiconductor importers. Therefore, investors must stay alert.

Tariff conversations continue across the world. Any sudden policy change might dent margins of a few companies. However, those manufacturing within the US may benefit. Therefore, differentiation remains key.

The Federal Reserve stance on inflation remains crucial. If inflation refuses to cool, rates may stay elevated longer, hurting valuations. Therefore, macro cannot be ignored.

The fresh high in US benchmarks is expected to create positive opening in Asian indices tomorrow. Technology counters across the world take cues from Nasdaq. The session therefore holds global importance.

Focus on semiconductor ecosystem, software subscription models, and companies monetizing AI directly. Keep exposure light in real estate and banking until yields clarify. Use declines as opportunities.

Benchmarks ended at record highs due to technology surge and earnings beats. The Nasdaq outperformed the Dow. VIX cooled, encouraging algorithm buying. Macro concerns stayed in background. Therefore, bulls remained in firm control.

This article is prepared solely to explain market behavior in United States equities and is not a solicitation or recommendation for investment in any security or index. Financial markets can change direction quickly based on macroeconomic policy, earnings performance, and trade decisions. Readers should rely on personal research or consult registered financial professionals before taking any decision.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

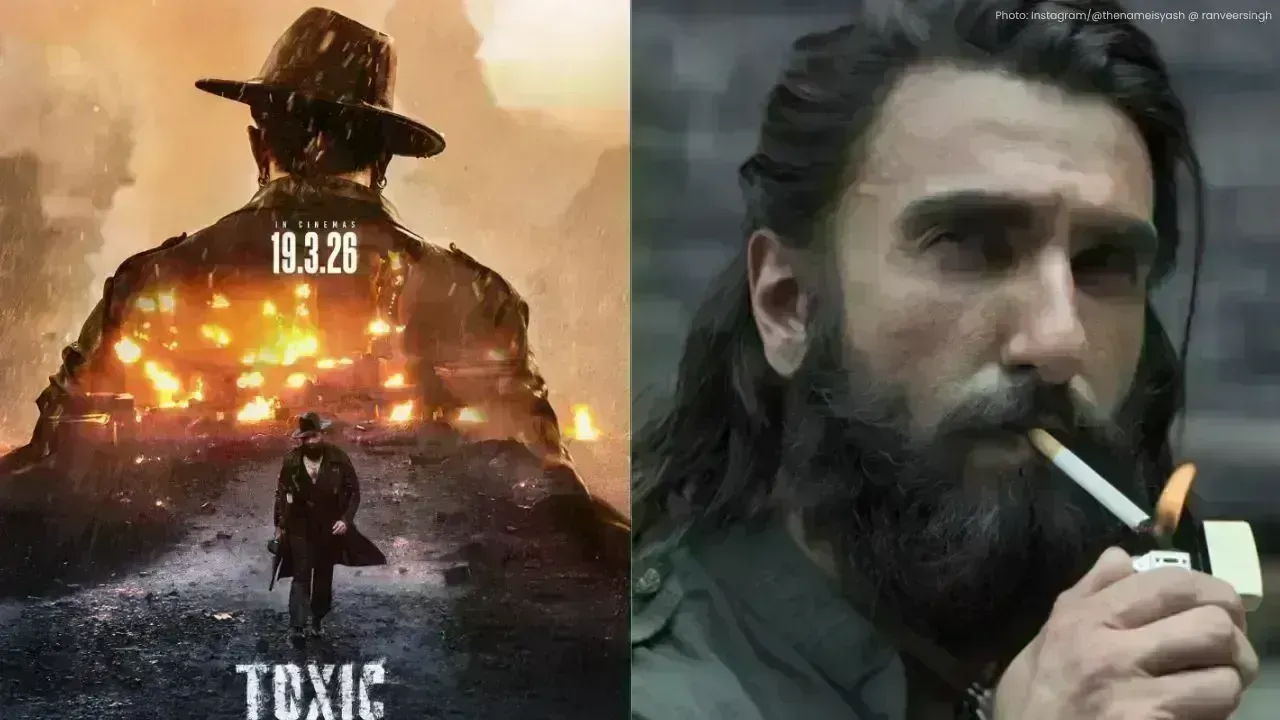

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as