You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

The ongoing market fluctuations often instill fear and doubt among investors. With sharp changes in stock prices and a deluge of negative news headlines, many question the wisdom of maintaining long-term investment strategies—particularly Systematic Investment Plans (SIPs). A key concern today is whether investors should continue their SIP commitments or pause until market stability returns.

This article delves into how SIPs function in volatile conditions, their strategic design for uncertain times, existing risks, and how investors should realistically approach SIP contributions currently. The aim is to provide clarity over blind reassurance.

A Systematic Investment Plan enables you to consistently invest a set amount into mutual funds, no matter the market circumstances. SIPs emphasize regularity, integrity, and the power of time instead of market predictions.

Here are the cornerstone principles driving SIPs:

Investing across diverse market phases

Lessening timing risks

Utilizing volatility as an advantage rather than a concern

Gradually constructing wealth over the long haul

In SIP investing, volatility isn't a drawback—it's the very element that enhances its effectiveness.

The current feelings of market instability stem from myriad factors:

Global economic unpredictability

Inflation and fluctuating interest rates

Geopolitical conflicts

Rapid information dissemination via news and social media

Short-term trading trends shaping public sentiment

Though volatility may feel overwhelming, historically, it’s not out of the ordinary. Markets have perpetually cycled through phases of optimism, corrections, recoveries, and growth.

A prevalent myth among investors is that SIPs are effective only in steadily rising markets. This belief is misguided.

In fact, SIPs are most beneficial during turbulent and downtrending markets, rather than during continued uptrends.

When markets decline:

Your SIP acquires a greater number of units at reduced prices

Average costs per unit decrease over time

The potential for recovery amplifies your holdings

Halting SIPs during volatility can lead to missed opportunities.

One of the key processes within SIP investments is rupee cost averaging.

You consistently invest a defined amount

When the markets are soaring, fewer units are purchased

During downturns, more units are acquired

Your average cost per purchase balances out over time

Price volatility enhances this advantage by increasing unit accumulation during declines.

Market downturns are only losses if you exit. For SIP investors, these dips represent opportunities to gather assets at lower costs.

You miss the chance to purchase units at more advantageous prices

You sacrifice investment discipline

You risk losing out on market recoveries

You convert transient volatility into lasting opportunity loss

Many investors cease SIPs when the market dips, only to restart after recoveries—this contradicts wealth-building strategies.

Investing lump sums during volatile periods carries heightened risks due to necessity of accurate timing.

SIPs distribute risk over time

No need to forecast market lows

Less emotional strain

Funds are allocated over an extended period

For those uncertain about market trajectories, SIPs provide managed exposure without timing stress.

In the short-term, SIP returns may not seem favorable.

NAV changes reflect prevailing market feelings

Recent acquisitions might show negative outcomes

Market distractions can magnify concern

SIPs aren’t meant to be assessed over short periods. Evaluating performance over months rather than years results in misleading judgments.

The success of SIPs largely hinges on investment duration.

1-2 years: Elevated volatility risks

3-5 years: Partial risk reduction

7-10 years: Marked stabilization of volatility

10+ years: High likelihood of substantial real returns

As time extends, volatility’s impact diminishes.

Inflation steadily diminishes the purchasing power of stagnant cash.

Cash's value decreases

Saving returns may remain below inflation rates

Postponing investments elevates future goal costs

SIPs facilitate growth that counters inflation, even amid market instability.

Continuing SIPs is advisable if:

Your objectives extend beyond 5 years

You’re investing through regular income

Immediate liquidity isn’t necessary

You comprehend market cycles

You’re focused on long-term wealth development

For these investors, volatility is simply a phase, not a threat.

Continuing your SIP doesn't imply ignoring current circumstances.

Job instability or loss of income

Significant immediate financial responsibilities

Insufficient emergency savings

Altered financial targets

In such situations, adjusting the SIP contribution amount is smarter than halting entirely.

It's usually more beneficial to reduce SIPs than to fully stop.

Ensures market engagement

Keeps investment discipline intact

Maintains compounding benefits

Eases financial pressure

Flexibility nurtures lasting commitment.

Data indicates that markets typically recover following downturns.

Bear markets are fleeting

Rebounds reward steadfast investors

Long-term SIP investors reap the most benefits post-recovery

Those who maintained their positions during prior downturns frequently attained superior outcomes compared to those who exited.

SIP success relies more on behavioral management than merely strategy.

Panic-induced halting of SIPs

Frequent checking of NAVs

Fretting over short-term results

Being swayed by news rather than adhering to plans

Emotional regulation takes precedence over market forecasting.

Balance equity with debt, considering your risk tolerance.

Enhancing unit accumulation can lead to improved future outcomes.

Switching aversively can often impair returns.

Long-term investments necessitate long-term assessment timelines.

Volatility serves as a benefit due to the extended horizon.

A balanced SIP strategy alleviates anxiety.

Potentially lower equity stakes while maintaining SIPs in more secure funds.

Age and objectives overshadow market sentiment.

The most significant risks encompass:

Failure to invest

Market timing attempts

Making emotional judgments

Letting fear suppress discipline

While volatility is evident, inactivity can inflict far greater harm.

Current market volatility can be an opportune entry point for SIP investments.

Lower average acquisition prices

Minimized timing anxieties

Forming an investment habit

Waiting for “stability” may result in missed prospects.

SIPs were crafted not solely for calm conditions. They are, in fact, designed to thrive amid unpredictability. For investors, volatility isn’t a test of strategy but of patience. Those who grasp this distinction stand to gain in the long run.

Rather than questioning if SIPs are beneficial during volatility, it's more productive to ask whether your objectives still favor long-term growth. If so, SIPs stand as among the most reliable, disciplined tools at your disposal.

This article serves informational and educational purposes solely and does not represent investment, financial, or tax advice. Investing in mutual funds entails market risks, and prior achievements do not assure future success. Individual financial situations, aspirations, and risk appetite differ. It is recommended to consult a certified financial consultant before making any investment choices.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

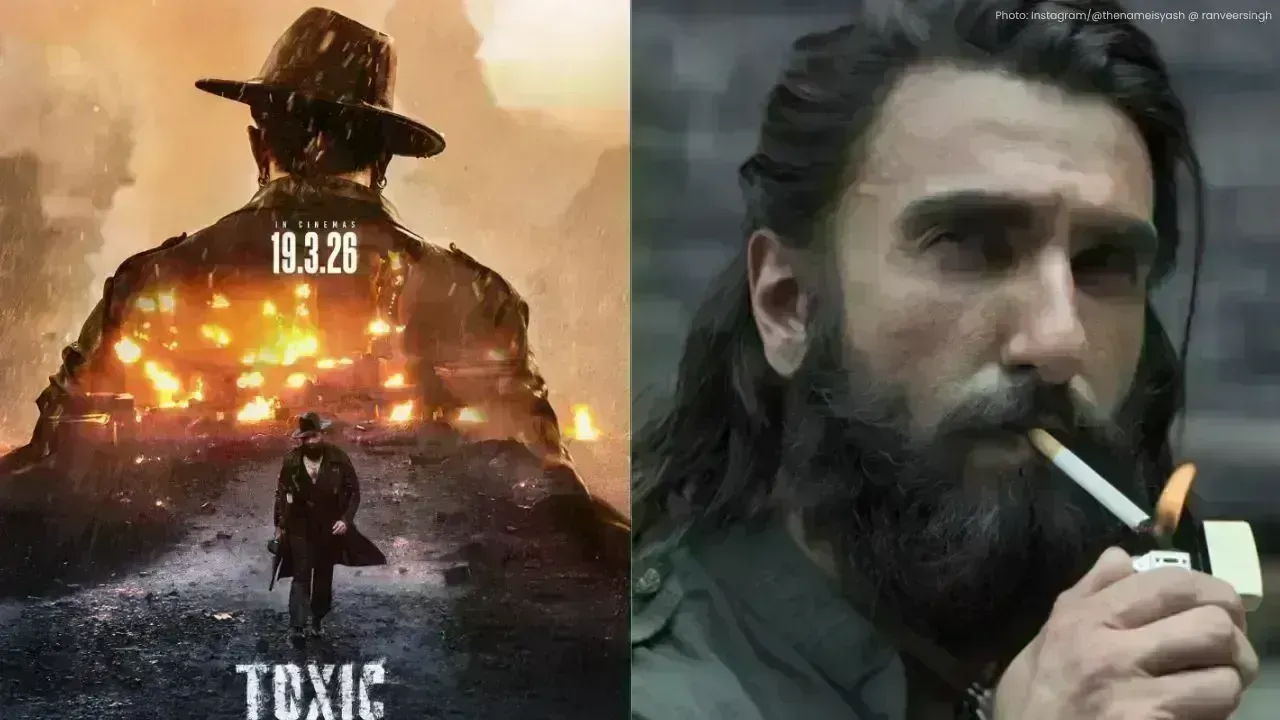

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as