You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Global inflation has been one of the most closely watched economic indicators over the past two years. Following unprecedented price surges driven by post-pandemic recovery, supply chain disruptions, and energy market volatility, central banks have been navigating a complex environment to stabilize economies.

In recent months, inflation rates in several major economies—including the United States, European Union, Japan, and parts of Southeast Asia—have begun to stabilize. While prices are still elevated compared to historical norms, the pace of growth in consumer goods and services has slowed, signaling that prior monetary policy interventions may be taking effect.

This stabilization is crucial not only for policymakers but also for businesses, investors, and households, as uncontrolled inflation can erode purchasing power, disrupt investment planning, and lead to social and economic instability.

Several factors have contributed to the recent moderation of inflation rates globally:

Supply Chain Recovery: Many industries have gradually resolved bottlenecks that previously drove prices higher. Transportation networks, manufacturing supply chains, and logistics systems are stabilizing, reducing costs for goods and raw materials.

Energy Market Adjustments: Energy prices, which surged due to geopolitical tensions and reduced production in prior months, have begun to stabilize. While still elevated, oil, gas, and electricity prices are fluctuating less dramatically, providing relief to both businesses and consumers.

Policy Interventions: Governments and central banks implemented a series of policy measures—including interest rate adjustments, fiscal support moderation, and targeted subsidies—to balance economic growth with inflation control.

Consumer Behavior Shifts: As households adapt to higher prices, spending patterns have changed. Reduced discretionary spending on non-essential items has eased demand-pull inflation pressures in some regions.

Central banks play a pivotal role in controlling inflation through monetary policy. The recent stabilization of prices reflects the impact of several strategic interventions:

Interest Rate Adjustments: Many central banks, including the Federal Reserve in the United States and the European Central Bank, increased benchmark interest rates to curb excessive spending and borrowing. Higher rates typically reduce consumer demand and slow inflation.

Quantitative Tightening: Some central banks have reduced the size of their balance sheets after years of expansive monetary policies. This approach limits the availability of liquidity, helping moderate price growth.

Forward Guidance: Clear communication about future policy actions has helped stabilize market expectations, reducing uncertainty and promoting economic confidence.

Targeted Interventions: In certain economies, central banks implemented sector-specific measures, such as controlling energy price spikes or supporting food security, to prevent localized inflationary pressures from spreading.

The U.S. Consumer Price Index (CPI) showed moderate growth in recent months after peaking in mid-2024. Stabilization reflects a combination of cooling housing markets, easing commodity prices, and monetary tightening by the Federal Reserve. While core inflation remains above pre-pandemic levels, economists note that the rate of increase has slowed significantly.

Eurozone inflation has also shown signs of moderation. The European Central Bank’s policy adjustments and stabilization in energy prices contributed to easing price pressures. While southern European countries still face higher food and energy costs, the overall inflation trend across the bloc is now more predictable.

In Japan, inflation remains below central bank targets, reflecting a long-term struggle with low consumer demand. In contrast, Southeast Asian economies, such as Malaysia, Thailand, and Indonesia, are experiencing moderate inflation rates, balancing domestic demand with global price fluctuations. Central banks in these countries have employed cautious interest rate hikes to manage inflation without stifling economic growth.

The stabilization of inflation has several implications:

Consumer Confidence: Slower price growth helps restore purchasing power, allowing households to plan expenditures more effectively. Consumers are more likely to engage in discretionary spending, which can support economic growth.

Business Planning: Predictable inflation enables companies to set pricing strategies, plan investments, and manage supply chains more effectively. Reduced volatility in input costs improves profitability and encourages long-term investment.

Interest Rates and Borrowing: Stabilized inflation influences borrowing costs. Businesses and consumers benefit from predictable interest rates, which facilitate planning for mortgages, loans, and capital investments.

Wage Negotiations: With inflation slowing, wage demands may become more manageable for employers. This helps maintain employment stability while protecting workers’ real income growth.

While stabilization is a positive sign, several risks remain:

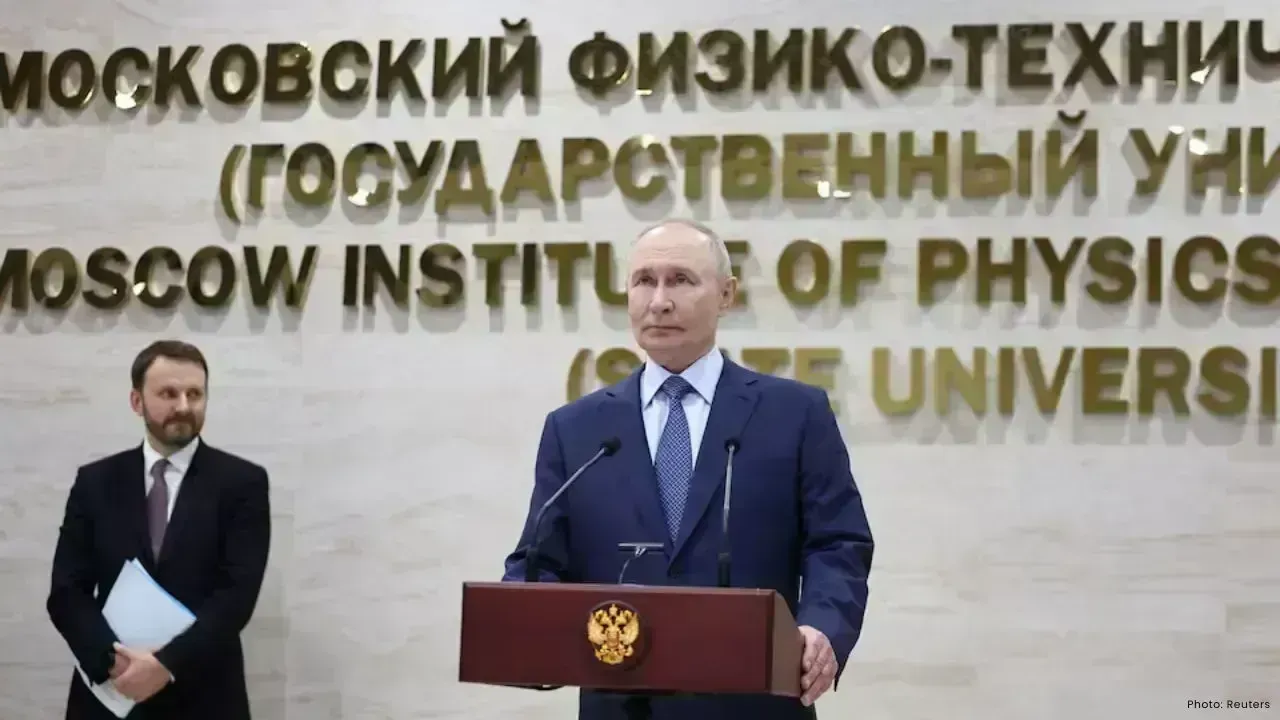

Geopolitical Tensions: Conflicts, trade disputes, and sanctions can disrupt supply chains and energy markets, reigniting inflationary pressures.

Commodity Price Volatility: Energy, food, and metal prices remain vulnerable to climate events, production disruptions, and speculative markets. Sudden spikes could undo recent stabilization gains.

Debt Levels: High public and private debt levels make economies more sensitive to interest rate changes. Excessive tightening could slow growth, while leniency could trigger renewed inflation.

Currency Fluctuations: Exchange rate volatility can influence import prices, particularly in countries heavily dependent on imported goods and energy.

The strategies adopted by central banks have long-term economic consequences:

Balancing Growth and Inflation: Central banks aim to stabilize prices without triggering recessions. Careful calibration of interest rates is essential to maintain sustainable growth.

Inflation Expectations: Managing expectations is critical. Persistent inflation fears can lead to higher wage demands and speculative behavior, reinforcing inflation. Forward guidance and transparent communication are key tools in preventing this cycle.

Global Coordination: As economies are interconnected, coordinated monetary policies can help prevent currency volatility and cross-border inflationary effects. International collaboration is becoming increasingly important in a globalized economic environment.

Innovation and Productivity: By keeping inflation in check, central banks indirectly support long-term investment in technology, infrastructure, and human capital, which are essential for productivity growth.

Monetary policy alone cannot fully control inflation. Governments play an essential role through fiscal measures:

Subsidies and Price Controls: Targeted interventions, such as energy subsidies or temporary price controls on essential goods, can reduce immediate inflationary pressures.

Taxation Policies: Adjusting indirect taxes, such as VAT or excise duties, can influence consumer prices and manage demand-pull inflation.

Public Investment: Investments in infrastructure, education, and technology can enhance productivity and reduce structural inflation in the long term.

Social Programs: Safety nets and income support measures help protect vulnerable populations from the impact of high prices while maintaining overall economic stability.

Recent stabilization trends provide several insights for policymakers:

Early Intervention Works: Prompt interest rate adjustments and coordinated policy measures help prevent runaway inflation.

Supply Chain Resilience Matters: Diversifying supply chains and investing in local production can mitigate the impact of external shocks on prices.

Communication is Crucial: Clear messaging from central banks and governments fosters confidence among investors and consumers, reducing panic-induced economic behavior.

Data-Driven Decisions: Continuous monitoring of inflation metrics, employment trends, and economic indicators allows for responsive and adaptive policy decisions.

Economists expect that global inflation will continue to stabilize in the short term if current monetary and fiscal policies remain effective. However, vigilance is necessary due to potential shocks from geopolitical tensions, climate events, and market disruptions.

Central banks are likely to maintain a cautious approach, balancing interest rates to prevent inflation resurgence while supporting economic recovery. Continued collaboration between monetary authorities, governments, and international institutions is essential to ensure long-term economic stability.

Consumers and businesses must remain adaptable, preparing for both opportunities and challenges arising from inflationary shifts. By focusing on productivity, efficiency, and sustainable growth, economies can navigate inflation risks without compromising development goals.

This article is for informational purposes only and does not constitute financial or investment advice. Readers should consult economic experts or financial advisors for guidance tailored to their circumstances.

Devotees Flock to Khao Khitchakut for 2026 Buddha Footprint Pilgrimage

Hundreds visit Khao Khitchakut National Park to pray at the sacred Buddha footprint for blessings an

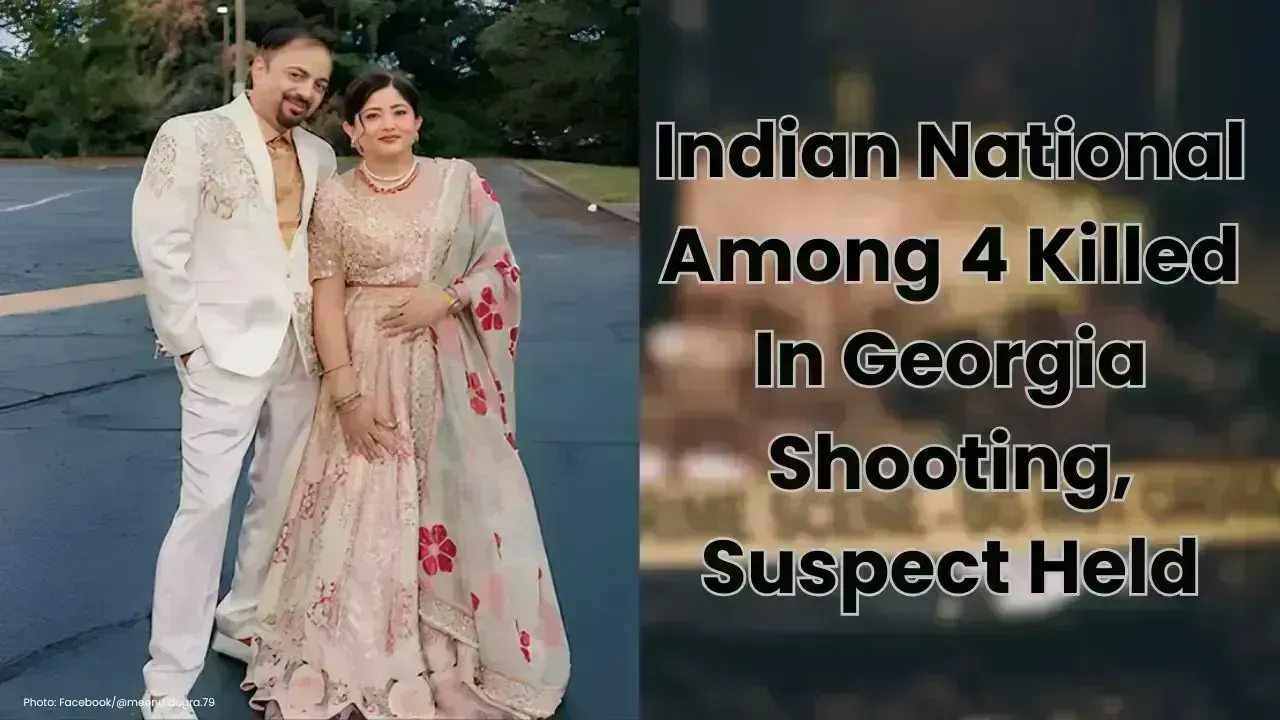

Indian National Among 4 Killed In Georgia Shooting, Suspect Held

An Indian national was among four people killed in a Georgia home shooting linked to a family disput

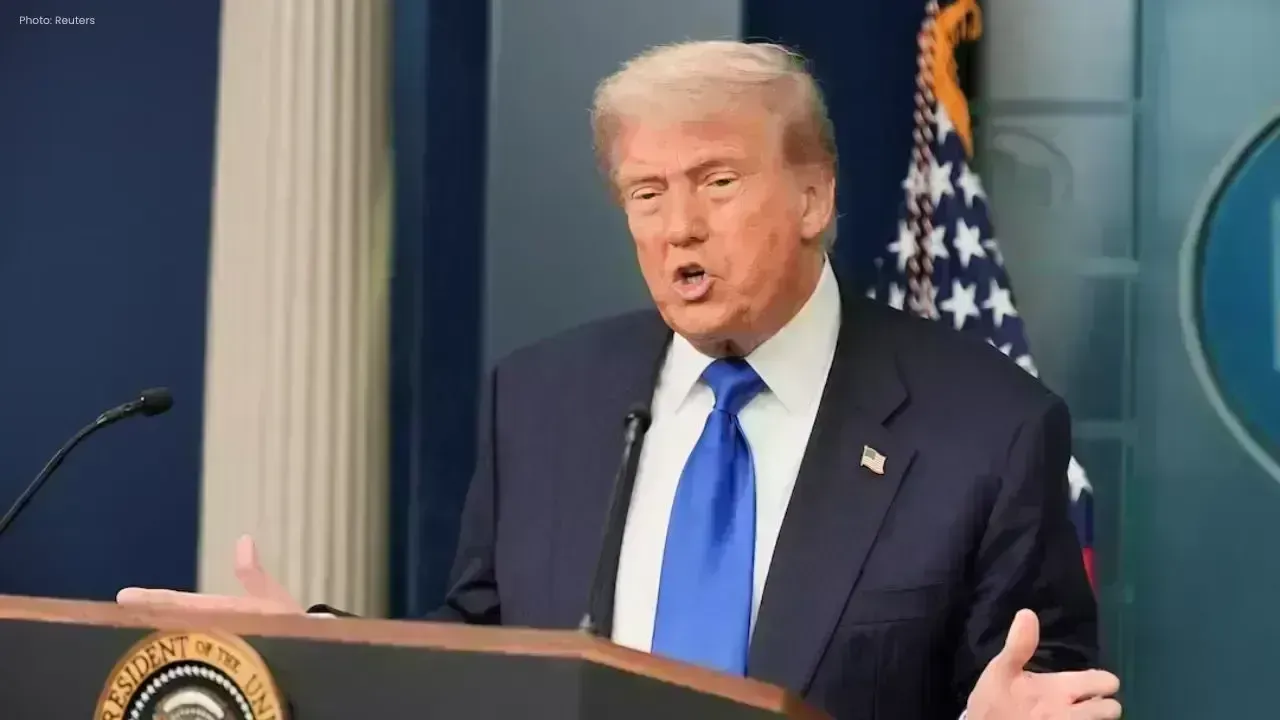

Trump Slams Canada Over “Golden Dome”, Warns China May Take Over Soon

Trump criticised Canada for rejecting the “Golden Dome” plan over Greenland and warned China could d

Pritchard’s 32 Points Push Celtics Past Nets 130-126 in 2OT Thriller

Payton Pritchard scored 32 as Boston beat Brooklyn 130-126 in double overtime, sealed by Amari Willi

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting