You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Gold and silver are different in price and industrial use, yet their demand frequently rises together like a pair of well-trained opening batters building an innings. At the start of 2026, conversations in financial circles show renewed curiosity about this connection. Supporters of bullion investment notice that when uncertainty enters global markets, buyers often seek safety in gold while simultaneously accumulating silver. This behavior is not accidental; it is shaped by overlapping histories, psychology, and economic mechanics that tie the two metals more tightly than many new investors realize.

The shared pulse begins with perception. Gold is considered the ultimate store of value, the metal of kings and central banks. Silver carries a similar aura, though it is cheaper and more volatile. When households plan financial security or jewelers prepare for festive seasons, they rarely choose only one. They treat the two as complementary layers of wealth. Understanding this relationship matters for readers who want to step into the New Year with clearer strategies rather than blind enthusiasm.

For long stretches of history, gold and silver were not merely commodities; they were money itself. Empires minted coins from both, and exchange rates between them were fixed by royal decree. This monetary companionship created a habit in trader minds. Even after paper currencies replaced metal coins, the old memory survived. When people in 2026 search for bullion, they inherit this cultural reflex. The academy of investment training still teaches that the two metals respond to similar macro forces such as inflation and currency weakness.

In many Asian and Gulf families, weddings and festivals traditionally involve buying both metals. A bride may wear gold jewelry while gifts are offered in silver bowls or bars. This cultural memory influences modern retail searches. The return of retro attitudes toward tangible wealth makes households comfortable accumulating both at the same hour, which helps explain why their demand curves often mirror each other.

One major driver is inflation. When prices of food, travel, and housing climb, investors fear that paper money is losing strength. Gold acts as shield against this erosion, yet silver becomes the second line of defense. In 2026, as central banks experiment with interest rates, buyers hedge by spreading savings across both metals. The twin momentum appears because both are priced in dollars and respond similarly when the greenback weakens.

Interest rates shape opportunity cost. When deposit returns fall, holding non-yielding assets like gold becomes attractive. Silver enjoys the same advantage. The series of policy meetings this year shows that investors read rate cuts as invitation to buy both. Although quantum computing and AI dominate technology corridors, the real economy of metals still depends on these classical levers.

Silver differs because it has heavy industrial use in electronics, solar panels, and batteries. When manufacturing expands, industrial demand pushes silver higher. Gold benefits indirectly because rising silver prices draw attention to the entire precious metals corridor. This industrial amplifier often works during the same cycle when inflation fears encourage retail gold buying, causing both demands to rise together.

Gold is the first name in safe-haven reflex, yet once buyers enter bullion shops, they look at silver as bargain companion. In 2026 many new investors cannot afford large gold bars. They choose silver coins while still planning to accumulate gold gradually. This safe-haven reflex spreads through unfiltered ratings on forums, creating bandwagon effect that lifts both metals.

When newspapers discuss precious metals, they often present them as a pair. The narrative that one supports the other encourages simultaneous buying. Viewers finishing New Year weekend planning parties also treat these stories as part of festival preparation, which keeps attention on both metals at the same time.

Investment managers in 2026 advise diversification inside the same asset class. Gold protects against geopolitical shocks; silver offers growth through industry. This complementary portfolio strategy explains parallel demand. Instead of treating them as rivals, portfolios treat them like upper and lower layers of self-care routine.

Traders often hedge using gold–silver ratios. When the ratio stretches too far, buyers sell one and buy the other. In 2026 this ratio has become topic of curiosity. Such hedging trades occur during the same macro cycle, making their demand rise together even if individual motives differ.

Retail transformation in malls is also offering mixed packages where shoppers buy small gold coins with silver coins together. The accessibility of these products reduces returns and makes it easy for households to participate.

Gulf countries remain major buyers of jewelry and coins. As desalination projects boom in the UAE and tourism sees record winter rush, households accumulate metals as part of celebration. This regional appetite influences global curves. When Black Caps-style discipline counters India-like aggression in cricket, the result is tight finish; similarly geopolitical tension pushes buyers toward both metals.

Climate migration reshaping coastal villages encourages tangible wealth accumulation among displaced families. Instead of carrying bank files, they carry coins easier to trade. This behavior lifts both metals simultaneously.

Mining output for both metals often faces similar freight and energy costs. When global chip shortages return or Mexico tariff policies shake Asian trade, mining companies adjust prices. These supply mechanics affect both metals during the same cycle, which helps parallel momentum.

Refineries that blend serums in skincare corridors operate similarly to metal refineries blending batches for jewelers. Limited capacity pushes prices higher and draws attention to both metals.

Consumers in 2026 begin on screens reading forums before buying. The reversed path from diagnostics to buying skincare is mirrored by food kits and precious metals. People scan Ray Connor-like pulp scenes and recreate such vibes in kitchens while also accumulating coins.

Jewelers prepare for weddings using both metals, influencing retail returns.

Silver remains more volatile than gold. When silver prices jump 6 percent, investors fear missing out and buy gold as stable companion. This corridor effect explains twin demand.

Gold remains long-term store of value, yet households planning financial security spread across both.

Shared monetary history

Inflation hedge reflex

Currency weakness

Rate cut environment

Ratio hedging trades

Jewelry traditions

Industrial solar growth

Mining supply costs

Media narratives

Accessibility of coins

Migration security

Refinery limits

Portfolio diversification

Bandwagon psychology

Festival buying

Retail packages

Investor education

Technology amplifier

Freight mechanics

Global risk mood

Just as AI skincare should not replace clinical judgment, retail metal advice should not replace professional portfolio consultation. Strong ingredients irritate sensitive users; similarly excessive silver volatility can stretch believability.

Caviar nuggets may be expensive; gold coins are expensive; households must adapt gradually.

Web3 wallets and biometric authentication will protect transactions. Entrepreneurs can open retail booths that accept peer resale.

Gen Z meme responses influence participation.

The intersection between fashion, beauty, and technology appears in plates and dresses as well. People celebrate texture rather than filtered perfection.

Food, skincare, and metals become part of mental health ritual.

Quantum chemistry simulations helping medicine and sustainable infrastructure in Gulf may continue to lift silver industrial demand while gold benefits from corridor attention. 6G connectivity trials could allow smart mirrors and autonomous drones to check authenticity of wallets in real time. Nanotechnology materials may produce self-cooling bottles suited for Gulf heat, encouraging jewelry adoption and refill packaging. These prospects suggest that the twin momentum of precious metals may remain a strong story throughout 2026 and beyond.

Lunar base politics may also encourage central banks to own gold while households own silver.

Gold and silver are different in personality, yet their demand often rises together because they respond to overlapping macro forces and shared cultural memory. Inflation and currency erosion push buyers toward gold as shield, while industrial growth and ratio hedging invite silver accumulation. The bandwagon psychology and accessibility of retail packages further amplify this momentum. India-like star depth and Black Caps-style discipline mirror how the two metals complement each other rather than compete.

For readers stepping into the New Year, understanding this relationship helps craft clearer portfolios. The approaching months may bring fresh industrial collaboration and sustainable packaging, yet the ancient aura of tangible wealth remains central. The twin momentum of precious metals in 2026 proves that sometimes markets move step by step, breath by breath, and metal by metal.

Disclaimer:

The information in this article is intended solely for awareness and education and should not be treated as a final investment recommendation. Precious metal markets are subject to volatility, policy changes, and regional conditions that may alter demand and price behavior.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

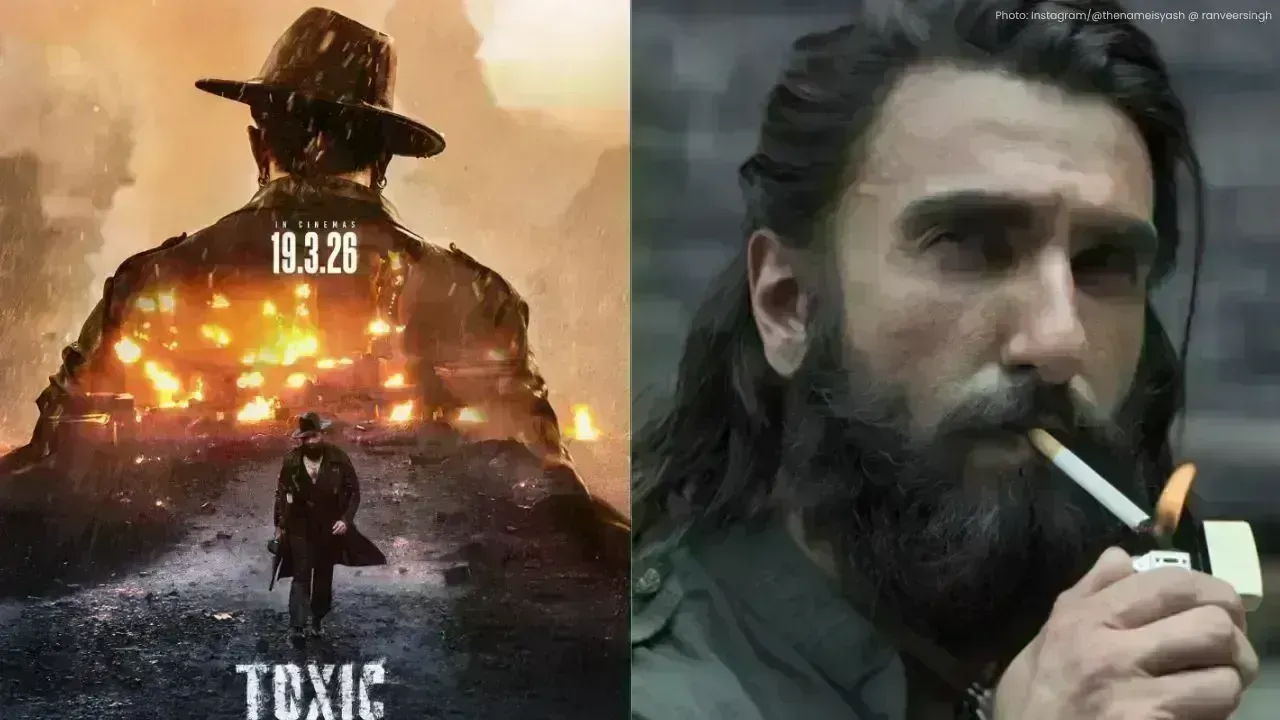

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as