You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Badri Ariffin

American crypto exchange Kraken has secured a major financial boost, announcing an $800 million funding round on Tuesday that marks one of the largest capital raises in the company’s history. The fresh cash arrives at a moment when global digital asset markets remain volatile, yet investor appetite for infrastructure-focused crypto firms is clearly holding strong.

Kraken said the new funding was completed in two tranches. The primary investment came from major institutional players including Jane Street, DRW Venture Capital, HSG, Oppenheimer Alternative Investment Management, and Tribe Capital. Additional backing also came from the family office of Kraken Co-CEO Arjun Sethi.

Alongside the main round, a separate $200 million strategic investment from Citadel Securities was sealed at a $20 billion valuation. Earlier reports suggested Kraken was targeting a $500 million raise at a $15 billion valuation, but the final amount and valuation surpassed expectations—signaling growing conviction in the company’s long-term roadmap.

The raise is especially notable given Kraken’s historically limited reliance on outside funding. Before this round, the exchange had secured only $27 million in primary capital. Despite that lean approach, Kraken generated $1.5 billion in revenue in 2024 and said it has already exceeded that figure within the first nine months of 2025.

With fresh capital in hand, Kraken plans to accelerate its expansion across Latin America, Asia Pacific, and the EMEA region. The company also aims to broaden its offerings beyond cryptocurrency, adding new asset classes, advanced trading tools, expanded payment services, and deeper institutional features.

The funding comes amid a broader market cooling, with recent crypto price drops tied to tighter dollar liquidity. Still, Kraken’s successful raise suggests that investors see long-term opportunity in regulated and scalable trading infrastructure—even as the industry navigates short-term pressures.

Kraken has also been weighing a public listing for several years, with reports earlier this year indicating that the company is considering an early 2026 IPO. While the timeline remains fluid, this substantial funding round places Kraken in a stronger position ahead of any potential move to go public.

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting

Japan Snap Election Sparks Bond Surge Amid Finance Concerns

Japan’s PM calls early election to back reflation plan. Bond yields hit decades-high as voters weigh

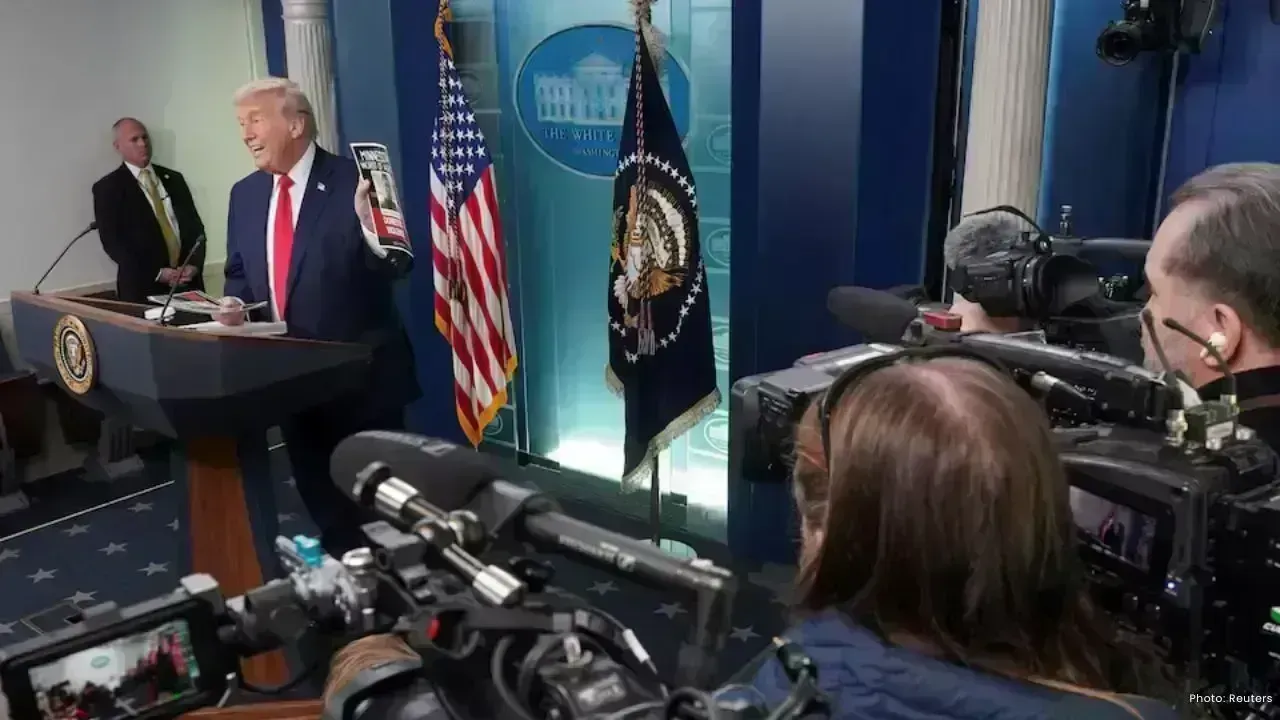

Trump Threatens Huge Tariffs on French Wine Over Peace Board Snub

Donald Trump warned of 200% tariffs on French wine after France rejected his Peace Board plan and mo

Prince Harry, Elton John Sue UK Tabloids Over Privacy Breaches

Prince Harry and Elton John accuse UK tabloids of phone hacking and stealing private info, calling i

Minnesota Man Says ICE Broke In, Handcuffed Him, Dragged Him Into Snow

A U.S. citizen in Minnesota says ICE officers broke down his door, handcuffed him in shorts and Croc