You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Meena Ariff

The Malaysian ringgit started today’s trading session steady against the US dollar as investors paused to await important economic data from the United States. At 8 am, the local currency was quoted at 4.2335/2365 against the greenback, the same as the previous day’s closing rate.

Traders and economists are keeping a close eye on the upcoming US personal consumption expenditures (PCE) inflation report, which is expected to influence global financial markets. The PCE inflation data is a key indicator that reflects changes in consumer prices and provides insights into the health of the US economy. Analysts believe that the report could guide the next steps of the US Federal Reserve in adjusting interest rates.

Expert Opinion: Ringgit May See Small Fluctuations

Dr Mohd Afzanizam Abdul Rashid, chief economist at Bank Muamalat Malaysia, said the ringgit could fluctuate within the range of RM4.22 to RM4.24 today. He pointed out that some investors might take profits ahead of the US PCE data, which could temporarily influence the ringgit’s movements.

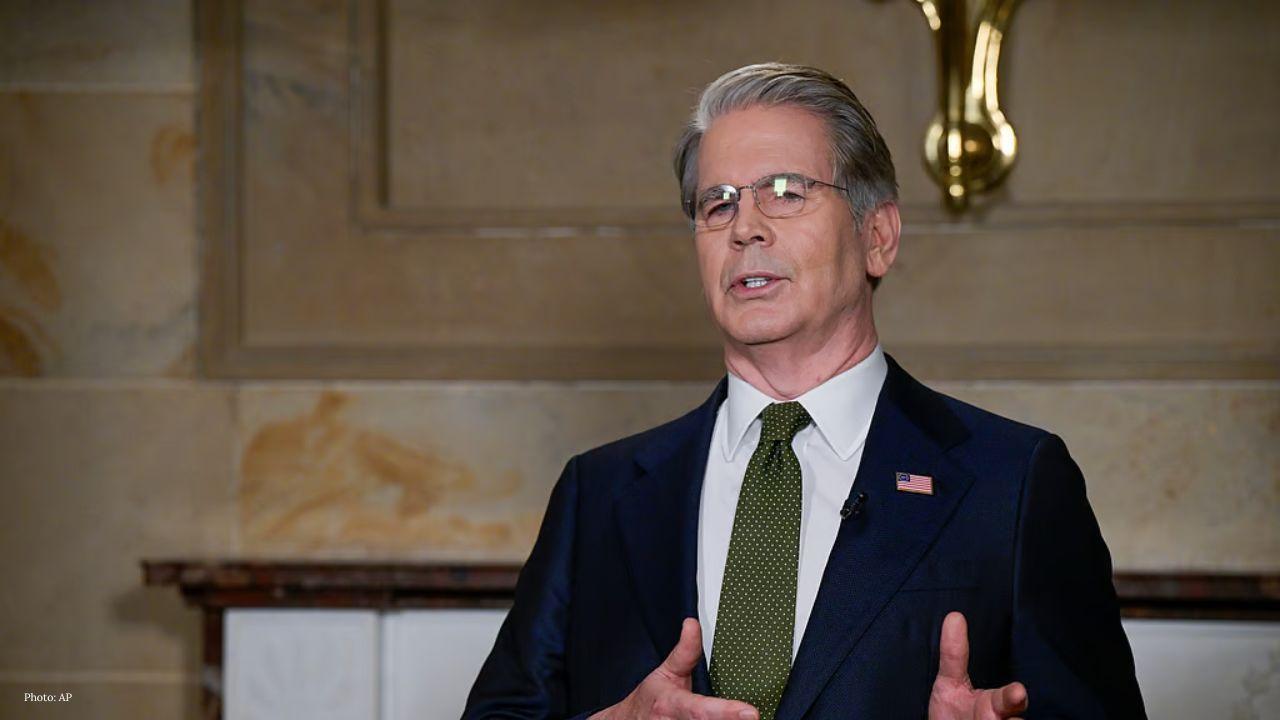

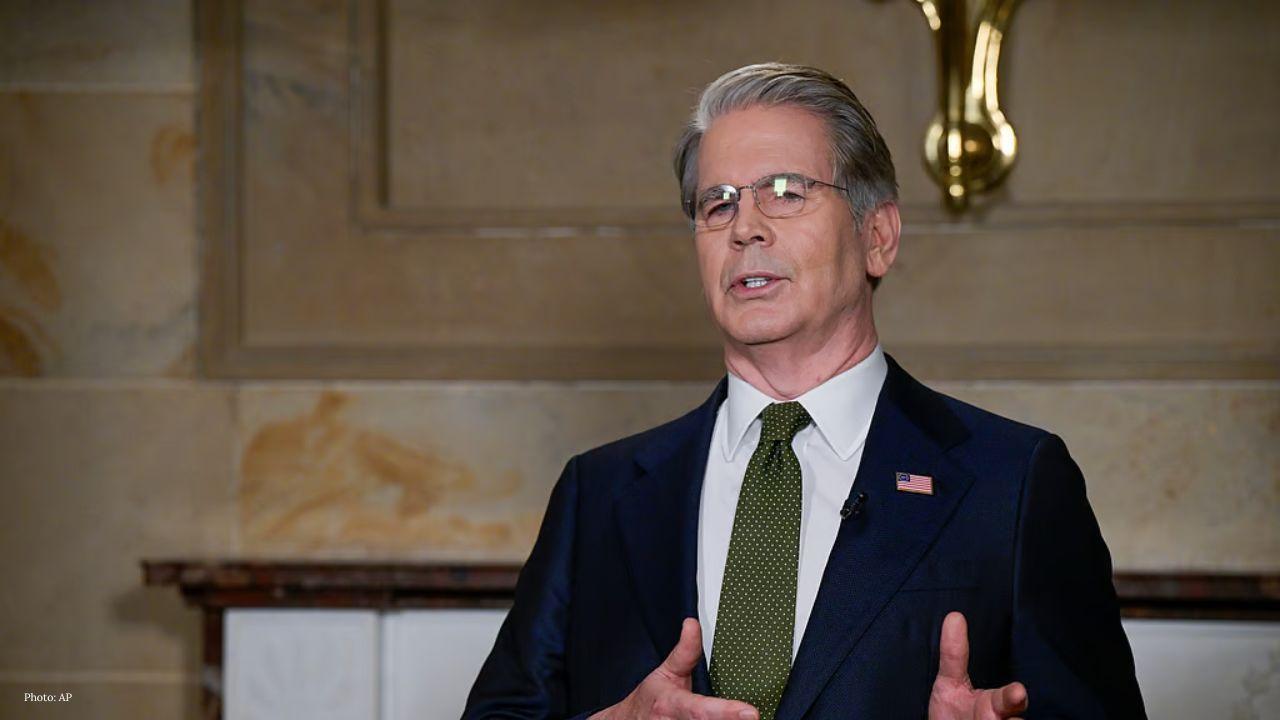

“The US Dollar Index (DXY) has been hovering around 98 points as traders remain cautious about the Federal Reserve’s potential actions in September,” said Dr Mohd Afzanizam. He also mentioned that Federal Reserve Bank of Richmond President Tom Barkin recently indicated that only modest adjustments to interest rates are expected, reflecting limited changes in the US economy.

Ringgit Falls Against Key Foreign Currencies

In early trading, the ringgit weakened against a basket of major foreign currencies. It fell against the euro, trading at 4.9312/9347 from Wednesday’s 4.9058/9093, and declined versus the Japanese yen to 2.8737/8759 from 2.8591/8611. Similarly, the ringgit lost ground against the British pound, quoted at 5.7169/7210 compared with 5.6890/6930 previously.

The local currency also faced pressure against several regional currencies. It traded lower against the Singapore dollar at 3.2940/2966 from 3.2843/2869, and against the Thai baht at 13.0631/0784 from 13.0330/0474. Meanwhile, the ringgit remained unchanged against the Philippine peso and Indonesian rupiah, at 7.40/7.41 and 258.6/258.9, respectively.

Market Sentiment: Traders Cautious Ahead of US Data

Market watchers say that traders are adopting a cautious approach, as any significant movement in US inflation figures could trigger changes in currency flows. The US PCE report is particularly important because it helps the Federal Reserve determine whether inflation is rising too quickly, which could lead to interest rate adjustments.

A stronger-than-expected PCE inflation reading could push the US dollar higher and pressure the ringgit, while a lower reading may provide some relief for the local currency. Investors are also watching global events, trade developments, and regional economic indicators that could affect Malaysia’s forex market.

Outlook for the Ringgit

Despite today’s flat opening, analysts expect the ringgit to remain relatively stable in the short term, moving within a narrow band unless there is a major surprise in the US inflation data. Profit-taking, global dollar movements, and regional market trends are likely to be the main drivers for the currency’s performance in the coming days.

Overall, the ringgit’s movement reflects the cautious sentiment among traders, who are waiting for clear signals from the US economy before making significant trades. The currency’s stability against the dollar and other ASEAN peers shows that investors are carefully balancing risks and opportunities in a global market influenced by inflation, interest rates, and economic recovery trends.

US Grants India 30‑Day Waiver to Buy Russian Oil

Temporary relaxation to allow Indian refiners to purchase stranded Russian crude aims to ease global

Thai Baht Falls as Dollar Gains on War Tensions

Currency slips to 31.77 per dollar as investors seek safe-haven assets and watch US economic data an

Japan and Canada Boost Defense Energy Ties

Tokyo summit between leaders expected to strengthen security economic ties and support for a Free an

Indonesia May Exit US Peace Board Over Palestine

President Prabowo Subianto says Indonesia will withdraw from the initiative if it does not benefit P

Judge’s Wife Found Dead in Train Toilet During Journey

Usha Chauhan wife of Additional District Judge found lifeless in washroom of Kanchiguda–Bhagat Ki Ko

Bangladesh Government Declares Seven-Day Eid-ul-Fitr Holiday

Extra public holiday on 18 March approved by cabinet to create week-long break from 17–23 March