You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Managing finances can be particularly challenging for individuals with unpredictable, seasonal, or variable income. Freelancers, gig workers, and other professionals often find it difficult not due to a lack of earnings, but because of the erratic nature of their cash flow.

Standard budgeting guidelines presuppose a steady salary, which does not apply to those with inconsistent earnings. Instead, a flexible, priority-driven budgeting approach can lead to better financial stability and reduced anxiety.

This comprehensive guide will help individuals with unreliable incomes formulate a sustainable, adaptable, and low-stress budget, accommodating wide income variations.

Most budgeting frameworks are based on the false assumptions relevant only to those with stable earnings.

Consistent salary every month

Set pay dates

Uniform monthly expenses

Easy savings automation

In cases of fluctuating earnings, income may vary by 30% to 70% monthly. Experiencing both prosperous and constrained months can lead to mistakes when relying on a static budget.

Facing anxiety during low-income months

Overshooting budgets during high-earning months

Struggling to save consistently

Apprehension about future uncertainties

Effective budgeting needs to emphasize control instead of limitation.

The primary rule for those with unpredictable income is: never estimate based on your best month.

Planning expenses around a high-income month could lead to panic or missed payments during quieter months.

Pinpoint your lowest average monthly income over the past 6 to 12 months

Base your core budget on this figure

Treat additional earnings as unexpected bonuses

This simple strategy effectively diminishes financial stress.

Achieving clarity starts with this separation.

Mortgage or rent

Basic utilities

Food costs

Transportation

Insurance costs

Minimum debt obligations

These necessary expenses sustain your daily life.

Dining experiences

Shopping

Entertainment

Travel

Subscriptions

When facing uneven income, priority should always be given to essential costs.

A bare-essential budget acts as your financial safeguard.

Only core survival costs

No non-essential spending

No heavy savings

This budget isn’t permanent—it's your backup plan for times of low income.

Helps prevent financial panic

Reduces decision fatigue

Secures stability

When your essentials are taken care of, other finances can be more flexible.

Minimum monthly income

Average monthly income

Maximum monthly income

This creates three budgeting states:

Survival mode (minimum month)

Normal mode (average month)

Growth mode (maximum month)

Each mode carries its unique spending and saving guidelines.

One effective method is to distribute a steady, monthly amount, regardless of income fluctuations.

Consolidating all revenue into a primary account

Transferring a fixed sum monthly to your spending account

Keeping surplus income as a buffer

This helps create a sense of stability and shields against financial variability.

For those with inconsistent incomes, establishing an income buffer is crucial before traditional savings.

This is the amount that will cover 3 to 6 months of survival expenses.

Soothing income fluctuations

Averting debts during low months

Diminishing stress and impulsive choices

Once a buffer is established, saving becomes smoother and more manageable.

Using fixed amounts can backfire when incomes vary.

Distribute percentages rather than fixed amounts.

For instance:

50 to 60% for essentials

20 to 30% for savings and buffer

10 to 20% for lifestyle

With this approach, savings increase automatically in prosperous months and decrease in leaner periods.

Irregular earners often stumble during high-earning months.

Upgrading lifestyle

Impulsive buys

Overcommitting to expenses

Assuming high income will remain

Maintaining discipline in successful months fosters peace during slow times.

First increase your income buffer

Prepay any future commitments

Invest in tools or education that boost income

A measured approach during good months secures peace later.

Full automation can be problematic for those with inconsistent income.

Minimum debt repayments

Insurance premiums

Regular bills

Savings contributions

Leisure spending

Investment activities

This equilibrium helps avoid overdrafts and unexpected costs.

Monthly reviews may prove too slow for sporadic income.

Identifies shortfalls promptly

Enhances spending management

Facilitates better financial choices

A quick weekly check-in is often more effective than complex budgeting tools.

Those with fluctuating incomes frequently overlook sporadic costs.

Taxes

License renewals

Equipment upgrades

Healthcare costs

Travel obligations

Distributing annual expenses into monthly sums can ease financial planning.

Every irregular earner may encounter phases of slow or zero income.

Keeping an emergency buffer handy

Curbing fixed costs

Avoiding long-term commitments

Successful preparation turns challenging months into manageable pauses.

Financial decisions are often emotional, particularly when income is unstable.

Spending driven by fear

Comparisons with traditionally employed peers

Feelings of guilt in lean times

Overly optimistic during profitable months

Being mindful of emotions can encourage better self-control.

Stable costs can hinder flexibility.

Housing expenses relative to income

Long-term contracts

Debt commitments

Reducing fixed costs increases financial stability.

Distinct accounts can lead to clearer financial oversight.

Income account

Essential expenses account

Discretionary account

Buffer/savings account

This differentiation diminishes the likelihood of accidental over-expenditure.

With time, irregular income patterns can shift.

Adjust your salary amount

Rebalance budgetary percentages

Enhance buffer targets

Delineate income trends

Budgeting should be a dynamic process.

Estimating based on peak income

Disregarding tax obligations

Considering savings optional

Overcommitting in high-earning periods

Failing to build buffers

Avoiding these missteps is crucial for enduring financial health.

With the proper approach:

Profitable months can expedite success

Quiet months can be made manageable

Savings can grow organically

Stress can significantly decrease

Having irregular income rewards discipline more than a consistent paycheck.

Budgeting with an inconsistent income is a matter of fostering resilience. By ensuring your financial system accommodates fluctuations rather than resists them, managing money becomes more straightforward, calmer, and clearer.

Adopting a flexible strategy often outweighs striving for perfection.

This article is intended solely for informational purposes and does not serve as financial, tax, or professional advice. Financial circumstances can vary widely based on personal situations and obligations. It is advisable to consult a certified financial professional before making substantial financial choices.

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from

Lakshya Sen Wins, Malvika Bansod Loses at Malaysia Open 2026

Lakshya Sen advances to second round at Malaysia Open, while Malvika Bansod exits early after return

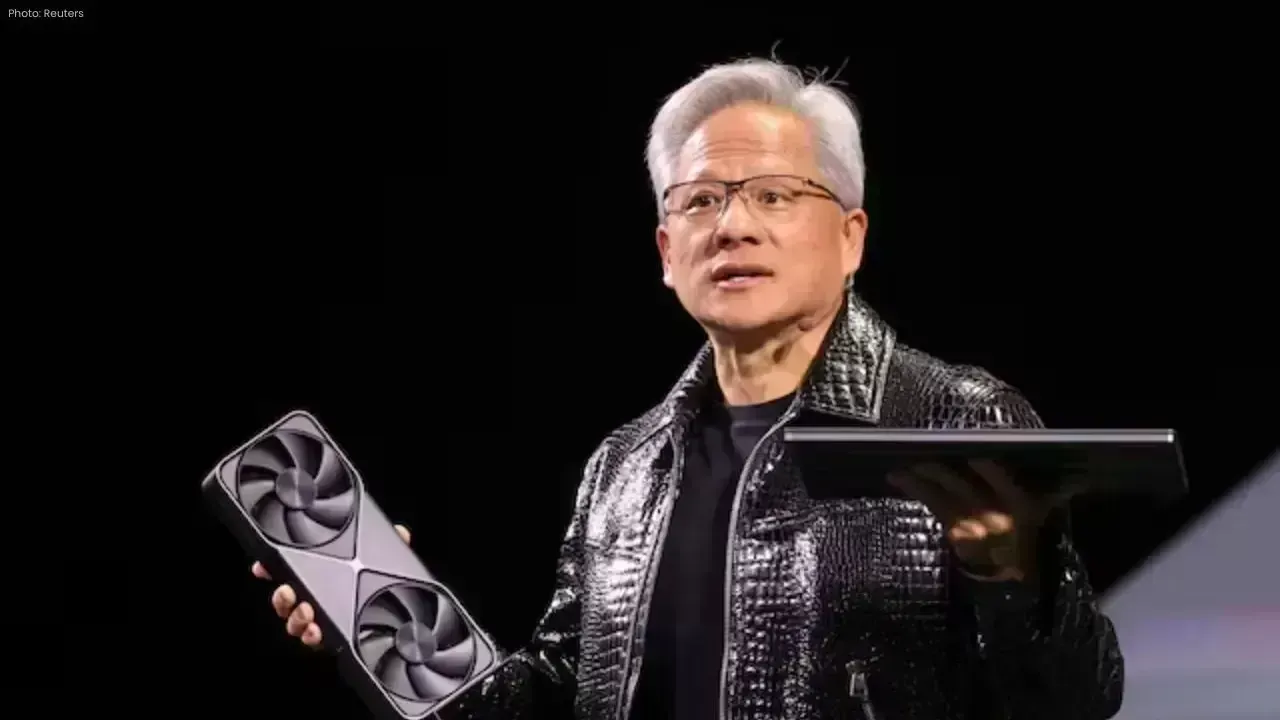

Nvidia's CEO Introduces Vera Rubin AI Chips Promising 5x Performance Gains

Nvidia has officially launched its Vera Rubin AI chips, aiming for faster chatbots, reduced costs, a

Avatar: Fire and Ash Surpasses $1 Billion Globally

James Cameron's latest installment, Avatar: Fire and Ash, has crossed $1.03 billion worldwide, showc

Canada Opens Skies to Middle East Airlines, Raising Competition Bar

Canada is expanding flight access for Saudi and UAE airlines, increasing competition and pressuring