You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Indian markets enter today’s trading session amid cautious global cues and selective domestic triggers. While benchmark indices have recently shown signs of consolidation after touching higher levels, stock-specific action continues to dominate market trends. Investors are increasingly focusing on fundamentals, earnings visibility, and sector-specific developments rather than broad-based rallies.

Profit booking in heavyweight stocks, mixed global sentiment, and anticipation around upcoming macroeconomic data are likely to keep volatility elevated. In this backdrop, certain stocks are expected to remain in sharp focus due to fresh news flow and technical setups.

Shares of HDFC Bank are expected to see heightened activity today following recent developments related to business growth outlook and sector-wide trends.

The stock has been under pressure in recent sessions, reflecting broader concerns around banking margins and deposit growth. However, analysts remain optimistic about the bank’s long-term fundamentals, citing its strong balance sheet, diversified loan book, and improving asset quality.

Credit growth momentum

Net interest margin trends

Asset quality and slippage levels

Management commentary on deposits

Given its heavy weight in benchmark indices, any sharp movement in HDFC Bank could significantly influence overall market direction.

Retail-focused Trent continues to attract investor attention amid expectations of sustained consumption-led growth.

The company has been expanding its store network aggressively, capitalizing on rising discretionary spending and strong brand recall. Market participants are keenly tracking updates related to store additions, same-store sales growth, and profitability trends.

Expansion pace of retail outlets

Consumer demand outlook

Margin sustainability amid rising costs

Long-term scalability of business model

Trent remains a favorite among investors betting on India’s structural consumption growth story.

Pharmaceutical major Torrent Pharmaceuticals is expected to be active following developments related to its domestic formulations business and international markets.

The stock has been supported by stable demand in chronic therapies and a strong presence in key geographies. Investors are also watching regulatory updates and product pipeline progress.

Performance of domestic formulations segment

Export market traction

Regulatory approvals and compliance

Margin trends amid input cost fluctuations

Pharma stocks often act as defensive plays during volatile markets, making Torrent Pharma an important name to track.

FMCG major ITC remains on investor radar as a defensive bet during uncertain market conditions.

With stable cash flows from cigarettes and growing traction in FMCG and hospitality segments, ITC offers a balance of stability and gradual growth. Market participants are tracking margin performance and volume growth across segments.

Engineering and construction giant Larsen & Toubro is in focus amid sustained momentum in infrastructure spending.

Order inflows, execution efficiency, and outlook on government-led capex remain key triggers. The stock often reflects broader sentiment in the capital goods and infrastructure space.

Auto major Tata Motors is expected to see action as investors assess demand trends across passenger vehicles and commercial vehicles.

The performance of its electric vehicle portfolio and global luxury arm remains crucial for long-term valuation.

IT heavyweight Infosys remains in focus as the sector navigates global macro uncertainties.

Investors are keen on commentary related to deal wins, client spending patterns, and revenue visibility in key markets.

State-run utility Power Grid Corporation of India continues to attract attention as a stable dividend-yielding stock.

With consistent earnings and regulated returns, the stock is often favored during volatile phases.

Pharma bellwether Sun Pharmaceutical Industries remains a key stock to watch due to its leadership in specialty drugs and strong global presence.

Pipeline updates and regulatory developments are critical for near-term movement.

Logistics major Adani Ports and Special Economic Zone is expected to remain active as investors track cargo volumes and global trade trends.

The company’s diversified port operations and infrastructure assets make it a key proxy for trade and economic activity.

While benchmark indices may remain range-bound, stock-specific movements are expected to dominate today’s session. Midcap and smallcap stocks could see selective interest, particularly in sectors like manufacturing, defense, and renewables.

Market experts advise investors to focus on quality names with strong earnings visibility and avoid chasing momentum blindly.

Nifty Support: Near-term support around key psychological levels

Nifty Resistance: Immediate resistance at recent highs

Bank Nifty: Movement in banking heavyweights will be crucial

A decisive move above resistance could revive bullish momentum, while a breakdown below support may lead to short-term pressure.

Track news-driven stocks closely

Maintain strict stop-loss levels

Avoid over-leveraging in volatile markets

Focus on fundamentally strong stocks for long-term positions

Intraday traders should remain nimble, while long-term investors can use volatility to accumulate quality stocks gradually.

Today’s trading session is likely to be driven by stock-specific triggers rather than broad market trends. Stocks like HDFC Bank, Trent, and Torrent Pharmaceuticals are expected to remain in sharp focus, along with several other frontline names.

As markets navigate a phase of consolidation, staying selective and informed will be key to navigating volatility and identifying opportunities.

This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to market risks. Readers are advised to consult certified financial professionals before making any investment decisions.

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as

Bangladesh Cricket to Work with ICC on T20 World Cup Security

Bangladesh Cricket Board will cooperate with ICC to resolve security concerns and ensure team partic

Flash Floods in Indonesia’s North Sulawesi Kill 16, Hundreds Displaced

Deadly flash floods triggered by heavy monsoon rains in North Sulawesi, Indonesia, killed 16 people,

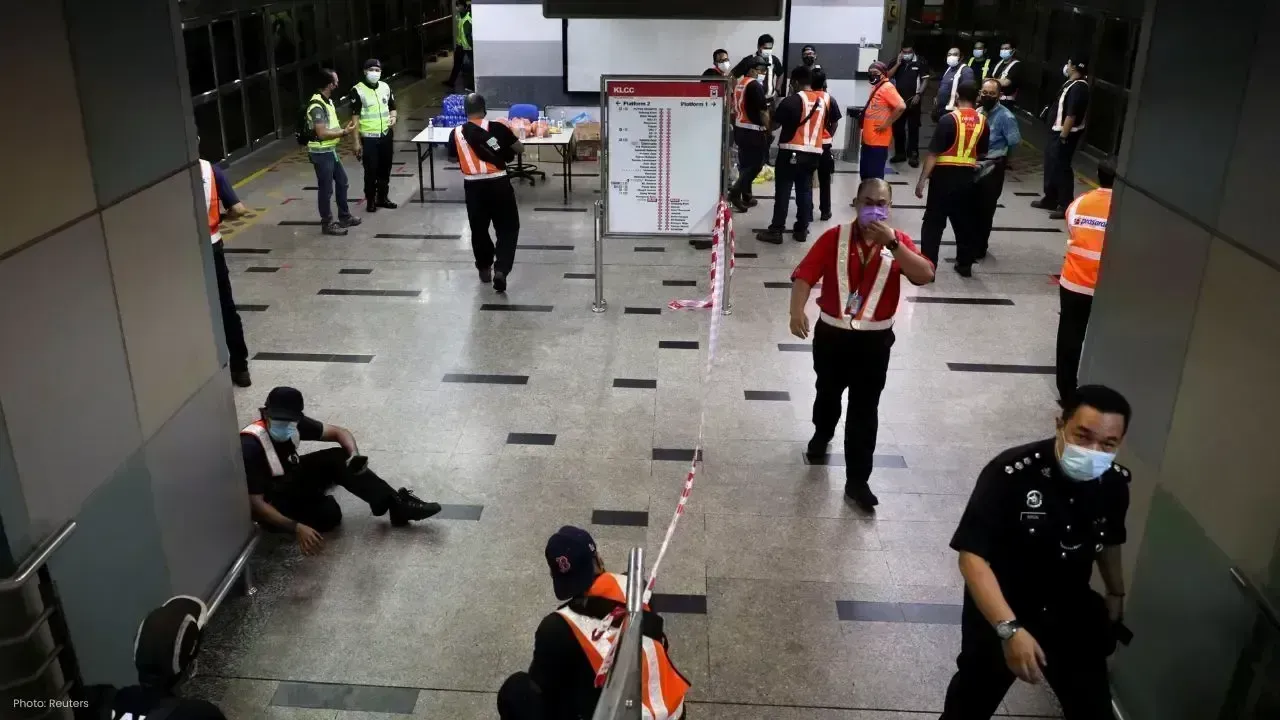

Prasarana Rail Reliability Soars as Service Breakdowns Fall in 2025

Prasarana records a major drop in rail service disruptions in 2025, while rising ridership signals r

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from