You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Indian benchmark indices begin the week on a cautiously optimistic note after a phase of consolidation. The Sensex and the Nifty 50 have spent recent sessions trading in a narrow band, reflecting profit booking at higher levels and selective accumulation by institutional investors.

This sideways movement is widely seen as a healthy pause rather than a trend reversal. With earnings season gradually picking up pace and global cues remaining stable, stock-specific action is expected to dominate the week. Investors are increasingly focusing on quality names with earnings visibility, balance sheet strength, and sectoral tailwinds.

Stocks with predictable earnings and improving margins are likely to attract attention. Sectors such as banking, capital goods, energy, and select IT services continue to offer opportunities despite near-term volatility.

Market leadership is gradually shifting from high-momentum pockets to value-driven and defensive sectors. Energy, PSU banks, and infrastructure-linked stocks are seeing renewed interest, while selective IT and FMCG names remain on investors’ radars.

Institutional flows, both domestic and foreign, remain crucial in determining near-term market direction. Stocks witnessing steady accumulation by large investors tend to show resilience during broader market pauses.

Reliance Industries remains a core portfolio stock for many long-term investors. The company’s diversified business model spanning energy, telecom, and retail provides stability and growth optionality.

Strong cash flows from core businesses

Digital and retail arms continue to scale

Balance sheet strength supports future expansion

With energy prices stabilizing and telecom margins improving, the stock is well-placed for steady performance this week.

HDFC Bank continues to command investor confidence due to its consistent execution and conservative risk management.

Healthy credit growth outlook

Stable asset quality

Strong institutional ownership

The stock is expected to benefit from continued domestic credit demand and remains a preferred pick in the banking space.

ONGC has emerged as a strong performer amid renewed interest in energy stocks.

Favorable crude-linked realizations

Attractive valuations compared to peers

Dividend yield appeal

Energy stocks are acting as a hedge against volatility, making ONGC a tactical and medium-term bet.

Larsen & Toubro continues to benefit from India’s infrastructure push and robust order inflows.

Strong execution pipeline

Exposure to capex revival

Improved margin outlook

The stock remains a solid play on long-term infrastructure and industrial growth.

Tata Power is gaining traction amid increasing focus on renewable energy and power infrastructure.

Expanding renewable portfolio

Distribution business turnaround

Policy support for clean energy

The stock offers a blend of stability and growth, appealing to investors seeking thematic exposure.

While the IT sector has seen pressure, selective names with strong client diversification remain attractive.

Strong deal pipeline

Resilient balance sheet

Focus on digital transformation

The stock may witness short-term volatility but offers value at current levels for patient investors.

State Bank of India continues to benefit from improved asset quality and strong loan growth.

Improved balance sheet health

Strong retail and corporate lending

PSU banking re-rating potential

The stock remains a favorite among investors looking for exposure to the PSU banking revival theme.

Bajaj Finance remains a high-quality NBFC with strong execution capabilities.

Consistent earnings growth

Strong customer franchise

Digital-led business model

Despite near-term consolidation, the long-term outlook remains constructive.

ITC offers stability amid market volatility, supported by its diversified FMCG and hotel businesses.

Strong cash generation

Pricing power

Dividend support

The stock continues to attract conservative investors seeking steady returns.

For the Nifty 50, the 26,300 zone remains a crucial support area, while resistance is seen near recent highs. A breakout on either side could set the tone for the rest of January.

Stocks showing higher volumes with stable price action are likely to outperform. Investors are advised to track volume trends alongside price movements.

Global interest rate cues, inflation data, and geopolitical developments can influence market sentiment during the week.

As earnings season progresses, sharp stock-specific reactions are likely. Position sizing and risk management remain crucial.

In a consolidating market, quality stocks with strong fundamentals tend to offer better risk-adjusted returns.

Frequent churning during sideways markets can erode returns. A disciplined approach focused on select opportunities is advisable.

Short-term traders looking for momentum in large and liquid names

Medium-term investors aiming to benefit from sectoral rotation

Long-term investors building portfolios around fundamentally strong companies

The week starting January 5, 2026, is expected to be characterized by consolidation, stock-specific action, and cautious optimism. While headline indices may remain range-bound, opportunities continue to emerge across sectors for discerning investors.

Focusing on companies with strong fundamentals, earnings visibility, and sectoral tailwinds can help navigate the current market environment effectively. As always, patience and discipline remain key in extracting value from equity markets.

Disclaimer:

This article is intended for informational purposes only and does not constitute investment advice. Stock market investments are subject to market risks. Readers should consult certified financial advisors and conduct independent research before making any investment decisions.

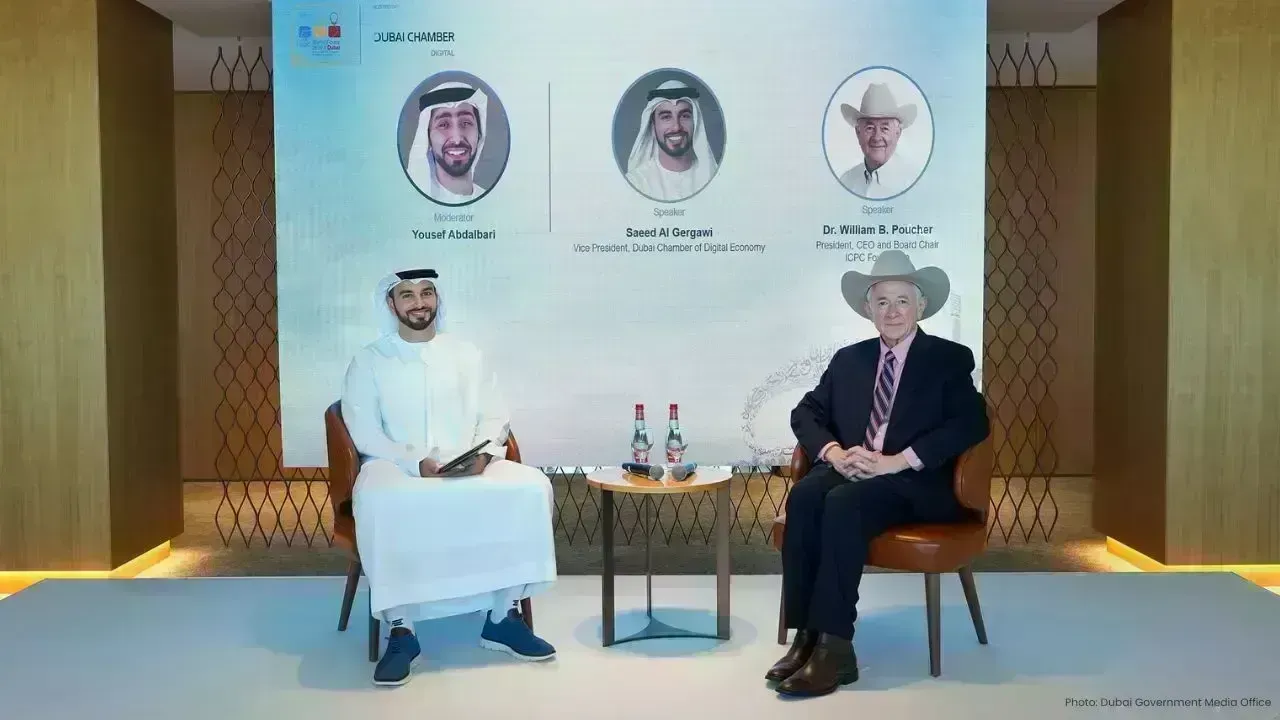

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from

Lakshya Sen Wins, Malvika Bansod Loses at Malaysia Open 2026

Lakshya Sen advances to second round at Malaysia Open, while Malvika Bansod exits early after return

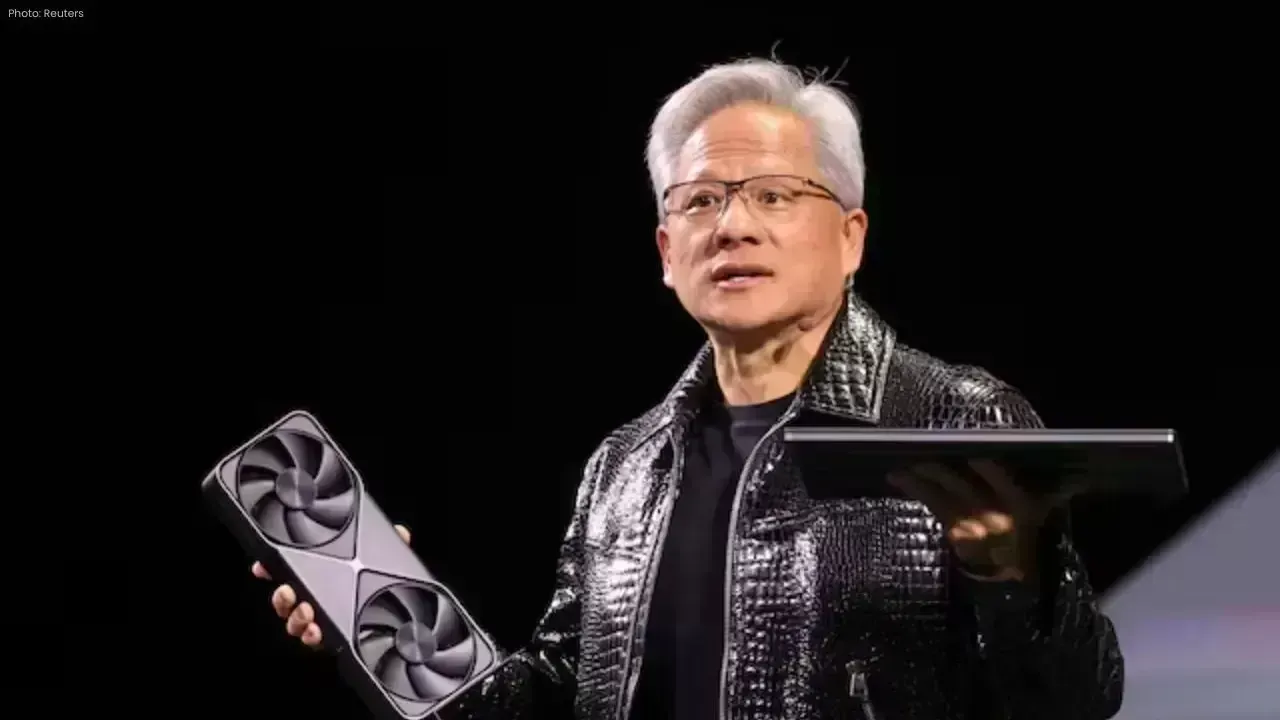

Nvidia's CEO Introduces Vera Rubin AI Chips Promising 5x Performance Gains

Nvidia has officially launched its Vera Rubin AI chips, aiming for faster chatbots, reduced costs, a

Avatar: Fire and Ash Surpasses $1 Billion Globally

James Cameron's latest installment, Avatar: Fire and Ash, has crossed $1.03 billion worldwide, showc

Canada Opens Skies to Middle East Airlines, Raising Competition Bar

Canada is expanding flight access for Saudi and UAE airlines, increasing competition and pressuring