You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

For many individuals, depending on a single source of income seems standard. A consistent paycheck, a stable business, or a main client offers reassurance and a sense of control. Bills are settled, routines established, and life feels orderly. However, this reliance introduces a hidden financial vulnerability that often surfaces only in times of trouble.

In today’s economy, depending solely on one income is more than a gamble; it is structurally unstable. Job markets evolve rapidly, businesses undergo unexpected changes, and costs can rise suddenly. This article delves into what truly occurs when depending on a single income, its implications for financial security, mental wellness, future aspirations, and the steps you can take to mitigate this risk without overwhelming your lifestyle.

A singular income stream often provides a comforting illusion of stability due to its familiarity.

Consistent monthly income

Predictable budget management

Established daily routine

Social acceptance of “stable work”

This feeling of safety is psychological rather than financial. The income seems secure because it has succeeded thus far, not because it is insulated from disruptions.

Relying on one income implies:

A single point of failure

No safety net

No flexibility during emergencies

The notion of stability without a backup is not truly stable; it’s merely temporary comfort.

Many underestimate how swiftly an income source can vanish.

Job displacement due to restructuring or tech advancements

Business downturns from shifting market conditions

Loss of clients or delayed payments

Health challenges affecting work capability

Company shutdowns or acquisitions

Income loss can occur abruptly, not gradually.

Finding a replacement for lost income is often a lengthy process. Even seasoned professionals can face delays due to hiring bottlenecks, market saturation, or diminishing demand. Meanwhile, expenses continue unabated.

The moment a single income ceases, the financial impact is immediate.

EMIs are still due

Rent payments remain unchanged

Utilities, educational fees, and insurance persist

Without an additional income, savings become the primary buffer.

Many underestimate how quickly savings can dwindle. What might seem like a substantial savings generally suffices for only a few months once income halts.

Credit cards, personal loans, and informal loans become essential tools for survival, turning a temporary income issue into a long-term financial strain.

Financial stress transcends monetary factors.

With everything hinged on one income, the dread of losing it becomes relentless. This anxiety escalates and diminishes overall quality of life.

People often refrain from:

Changing careers

Enhancing skills

Starting a business

Seizing relocation chances

Income instability stifles both personal and professional growth.

Many remain in toxic jobs or unfulfilling positions, fearing jeopardizing their income. Consequently, mental wellness suffers.

A single income can maintain a lifestyle only as long as it remains consistent.

Immediate cuts in expenses

Lowered living standards

Forced sale of assets

Health or education compromises

Such transitions often happen unexpectedly, causing significant emotional turmoil.

Sudden financial limitations are perceived as losses rather than adjustments. They adversely impact confidence levels, relationships, and self-esteem.

With only one income stream, most funds go toward:

Daily living costs

Fixed financial obligations

Savings and investments are typically minimal.

Goals like:

Homeownership

Education for children

Planning for retirement

become precarious. Any disruption in income can extend the timeline significantly.

Income growth often lags behind rising expenses, hindered progress over time.

Concentrating income exposes weaknesses.

Income dependence lowers confidence during salary discussions or negotiations.

Small business proprietors with one major client frequently concede to unfavorable deal terms to secure income.

Negotiation power stems from alternatives, which a single income undermines.

Financial strain negatively influences physical health.

Insufficient sleep

Chronic stress levels

Weakened immune system

Burnout

When income is tied to survival, rest becomes associated with guilt rather than recovery.

The fear of job loss drives individuals to work longer hours, yet diminishes their efficiency over time, leading to reduced output.

The hazards of depending on a single income escalate with increased responsibilities.

Dependents, such as children or elderly relatives, amplify financial responsibilities. One income must meet multiple needs.

EMIs, rent, subscriptions, and insurance obligations curtail flexibility. Any disruption becomes increasingly detrimental.

Though emergency funds are essential, they are not exhaustive.

They provide temporary relief, not lasting protection.

They can be depleted

They do not substitute lost income

They heighten anxiety as balances dwindle

True security is built on income continuity, not merely savings.

Relying on a single income restricts potential growth.

Procrastination on side ventures

Postponement of skill enhancement

Avoidance of potentially lucrative investments

Safety-first decisions often lead to missed long-term benefits.

Over time, the habit of sidestepping risk can seem wise but gradually diminishes future earning potential.

Dependency on income transcends mere finance and becomes emotional entwinement.

Individuals frequently associate their identity with their job or business, making income loss feel like an identity crisis.

Decisions are influenced more by income protection than by personal enhancement, leading to stagnation.

Diversifying income is not intended to displace your primary source overnight.

Establishing supplementary income streams

Mitigating reliance on a single source

Enhancing financial flexibility

Even minor additional income can significantly alleviate anxiety.

The loss of one income source no longer signifies total collapse.

Individuals negotiate more effectively, embrace calculated risks, and invest in growth.

Financial shocks turn manageable rather than catastrophic.

Freelance work

Consulting services

Teaching or mentoring

Content or service initiatives

Royalties

Digital offerings

Subscription formats

Interest returns

Dividend distributions

Real estate income

Successful diversification hinges on having varied risk and effort levels among income types.

Waiting until a crisis arises to diversify can be perilous.

Reduced pressure

Enhanced learning opportunities

Incremental scaling

Lower emotional strain

Diversification created in stable times holds stronger viability.

Diversifying should not lead to distraction.

Safeguard your primary income

Develop secondary income steadily

Avoid excessive commitments

Balance focus with diversification to establish stability without chaos.

Transitioning away from reliance on a single income calls for a change in thinking.

Dependency assumes a state of unchanging conditions. Resilience optimally prepares for transformation.

Preparedness alleviates anxiety and bolsters confidence.

Individuals with diverse income sources:

Rebound more swiftly from job loss

Adjust more effectively to market fluctuations

Experience lower financial stress

Formulate long-term strategies confidently

The contrast becomes stark during economic strain.

Disregarding the risks associated with concentrated income can result in:

Unexpected debt

Emotional exhaustion

Health complications

Postponed aspirations

These repercussions extend beyond financial concerns to personal fulfillment.

While relying on one income isn’t inherently problematic, having no contingency plan for that single income is risky. Achieving financial stability today necessitates adaptability rather than merely predictability. Income diversification should be viewed as critical, not optional.

Shifting from complete income reliance doesn't demand immediate, drastic changes. Awareness, strategic planning, and gradual implementation can achieve this goal. The intention is to ensure that your life isn't jeopardized by one unforeseen event.

This article serves solely for informational purposes and should not be interpreted as financial, legal, or professional advice. Financial situations vary based on personal income, obligations, and goals. Consulting a qualified financial professional is advised before making significant financial decisions.

#Business & economy #Financial planning #Passive income #Finance News

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as

Bangladesh Cricket to Work with ICC on T20 World Cup Security

Bangladesh Cricket Board will cooperate with ICC to resolve security concerns and ensure team partic

Flash Floods in Indonesia’s North Sulawesi Kill 16, Hundreds Displaced

Deadly flash floods triggered by heavy monsoon rains in North Sulawesi, Indonesia, killed 16 people,

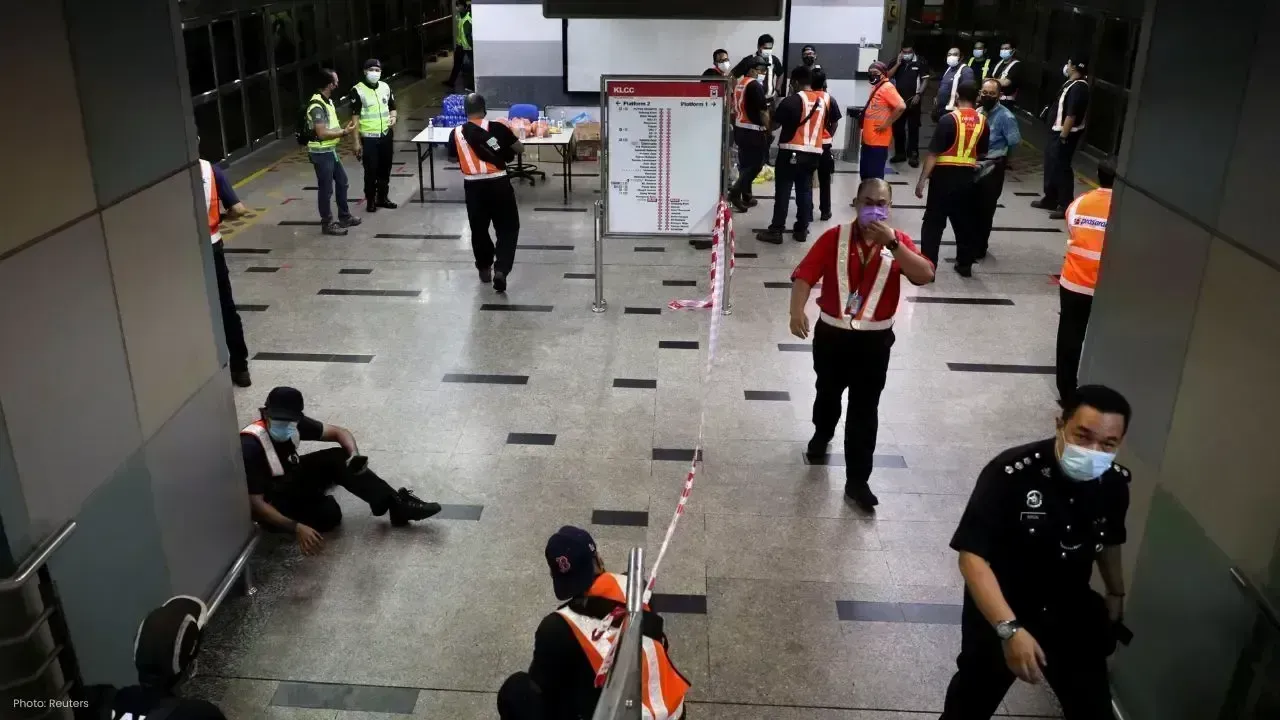

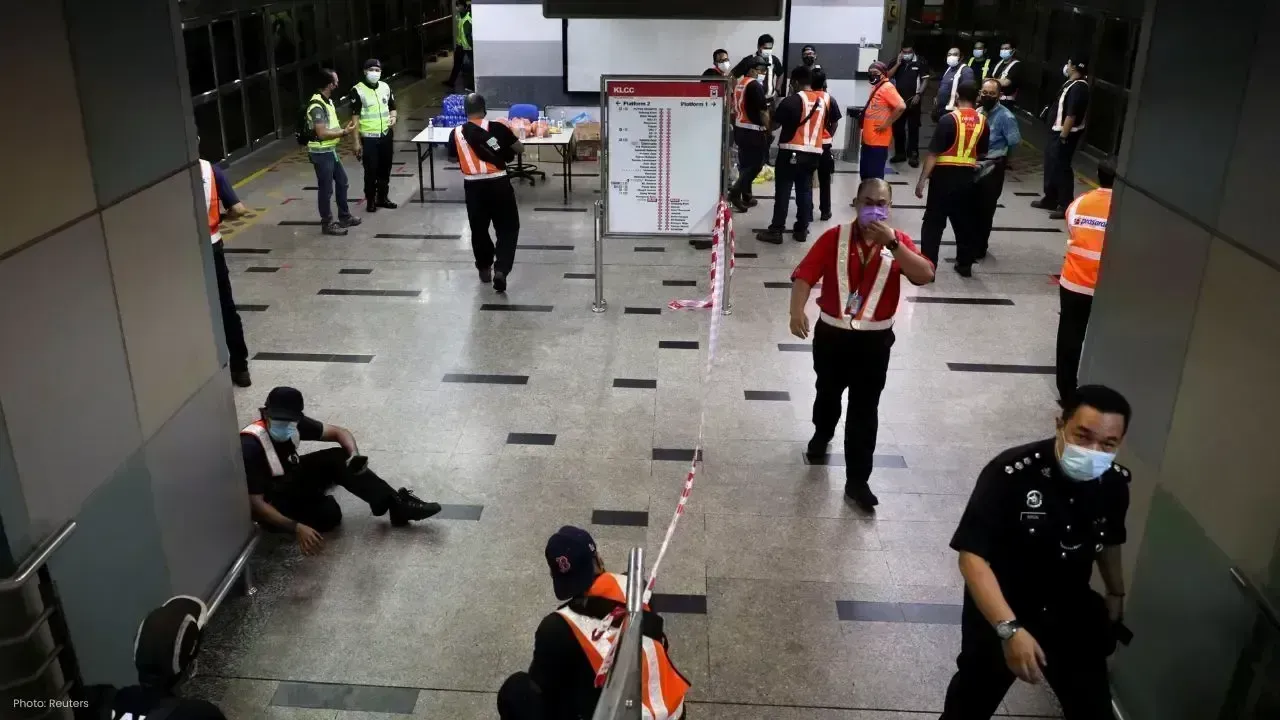

Prasarana Rail Reliability Soars as Service Breakdowns Fall in 2025

Prasarana records a major drop in rail service disruptions in 2025, while rising ridership signals r

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from