You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Bulgaria’s formal entry into the Eurozone in 2026 represents one of the most significant economic developments in Europe in recent years. For a nation that joined the European Union nearly two decades ago, adopting the euro signals the completion of a long and often challenging convergence process. At the same time, it reflects the European Union’s determination to strengthen economic unity amid global uncertainty.

For Europe, Bulgaria’s transition from the lev to the euro is not merely a technical monetary shift. It is a political statement about confidence in enlargement, fiscal discipline, and the long-term resilience of the shared currency project.

Bulgaria joined the European Union in 2007, but euro adoption was never automatic. Membership in the Eurozone requires meeting strict economic and legal criteria designed to ensure stability and convergence with existing members.

For years, Bulgaria remained outside the common currency due to concerns over inflation control, judicial reforms, and institutional readiness. The country’s decision to maintain a currency board system, pegging the lev to the euro, provided stability but also limited monetary flexibility.

By 2025, Bulgaria had satisfied the core convergence benchmarks, including price stability, sound public finances, stable exchange rates, and long-term interest rate alignment. These achievements paved the way for its official entry into the Eurozone in 2026.

At a time when global economies face inflationary pressures, geopolitical tensions, and supply chain disruptions, Bulgaria’s adoption of the euro sends a message of trust in Europe’s monetary framework. It reinforces the idea that the euro remains a pillar of stability rather than a vulnerability.

The inclusion of Bulgaria deepens economic integration within the European Union, narrowing gaps between eastern and western member states. This move supports the EU’s broader goal of reducing internal economic fragmentation.

With the euro replacing the lev, Bulgarian businesses benefit from the elimination of currency exchange risks within the Eurozone. This change is expected to encourage cross-border trade, attract foreign direct investment, and simplify transactions for exporters and importers.

Euro adoption typically leads to lower interest rates over time, as markets perceive reduced currency risk. For Bulgaria, this could translate into cheaper financing for businesses, households, and the government.

One of the most debated aspects of euro adoption is its potential effect on prices. Many Bulgarians have expressed concern that switching to the euro could lead to hidden price increases, especially in everyday goods and services.

Authorities have implemented dual pricing periods and strict monitoring mechanisms to prevent unjustified price hikes. While minor rounding effects may occur, long-term evidence from previous Eurozone entrants suggests that inflationary impacts are usually limited and temporary.

With Bulgaria’s entry, the Eurozone expands further into southeastern Europe, increasing its geographic and economic diversity. This enlargement strengthens the euro’s position as one of the world’s most widely used currencies.

Although Bulgaria’s economy is relatively small compared to core Eurozone members, its inclusion carries symbolic weight. It demonstrates that the path to euro adoption remains open for committed member states.

Upon joining the Eurozone, Bulgaria comes under the monetary policy framework of the European Central Bank. Interest rates, liquidity measures, and inflation control will now be shaped at the Eurozone level rather than nationally.

Bulgarian banks also fall fully within the EU’s banking supervision architecture, strengthening financial oversight and reducing systemic risks.

Bulgaria’s euro adoption provides fresh momentum to the European integration project, especially at a time when enlargement fatigue and euroscepticism persist in parts of the continent.

For countries still outside the euro area, Bulgaria’s success reinforces the idea that disciplined reforms and policy alignment can lead to deeper integration and economic benefits.

Despite preparations, the transition requires adaptation. Consumers must adjust to new price perceptions, while small businesses face administrative and accounting changes.

Euro adoption does not eliminate the need for domestic reforms. Productivity growth, innovation, and governance improvements remain critical for Bulgaria to fully benefit from its new monetary status.

In an era marked by geopolitical fragmentation and shifting alliances, euro adoption enhances Bulgaria’s economic security by anchoring it firmly within Europe’s core economic institutions.

By integrating more deeply into the Eurozone, Bulgaria reduces its exposure to external currency shocks and speculative pressures.

Public sentiment in Bulgaria has been divided. While businesses and younger, urban populations largely support euro adoption, some citizens worry about loss of monetary sovereignty and cultural identity tied to the lev.

Over time, increased economic stability, job creation, and rising incomes could help ease these concerns and build broader public support.

Experiences of countries that joined the Eurozone in the past decade indicate that benefits often outweigh short-term disruptions. Increased investor confidence and economic predictability tend to support long-term growth.

European institutions have applied lessons learned from earlier expansions, placing greater emphasis on banking stability, fiscal oversight, and consumer protection.

Bulgaria’s entry alone will not dramatically alter EU growth figures, but it contributes to cumulative stability and cohesion within the bloc.

Eliminating currency barriers enhances the efficiency of the EU’s internal market, supporting smoother movement of goods, services, and capital.

Bulgaria’s success keeps the door open for other EU members considering euro adoption. It reinforces the euro as a living project rather than a closed club.

As the Eurozone grows, managing economic diversity becomes increasingly important. Policymakers must balance uniform monetary policy with varied national economic realities.

Bulgaria’s adoption of the euro in 2026 is more than a currency change. It marks a turning point in the country’s European journey and reaffirms the EU’s commitment to deeper economic integration. For Europe, it is a reminder that unity, though complex and gradual, continues to evolve.

As euro banknotes replace the lev and Bulgaria takes its place at the heart of Europe’s monetary system, the move stands as both a practical economic step and a powerful symbol of shared destiny within the European Union.

This article is intended for informational and editorial purposes only. Economic outcomes may vary based on global conditions, policy decisions, and market responses. Readers should not treat this content as financial or investment advice.

Avatar: Fire and Ash Surpasses $1 Billion Globally

James Cameron's latest installment, Avatar: Fire and Ash, has crossed $1.03 billion worldwide, showc

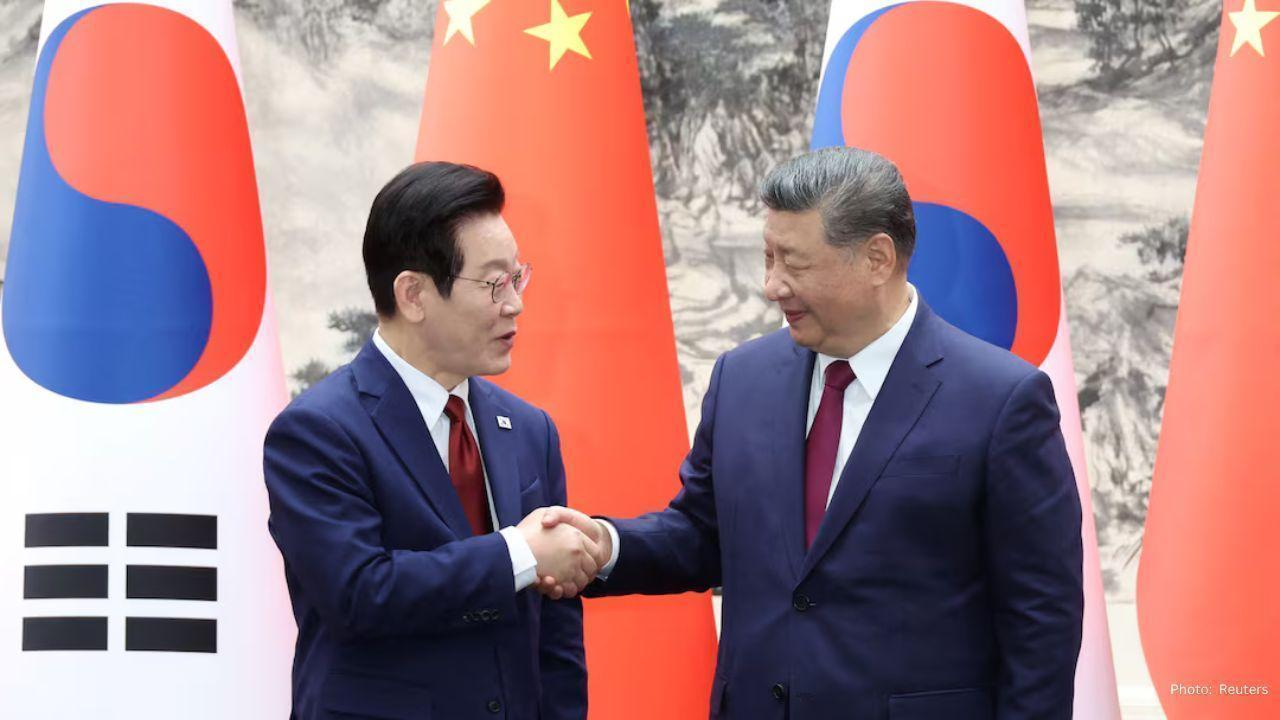

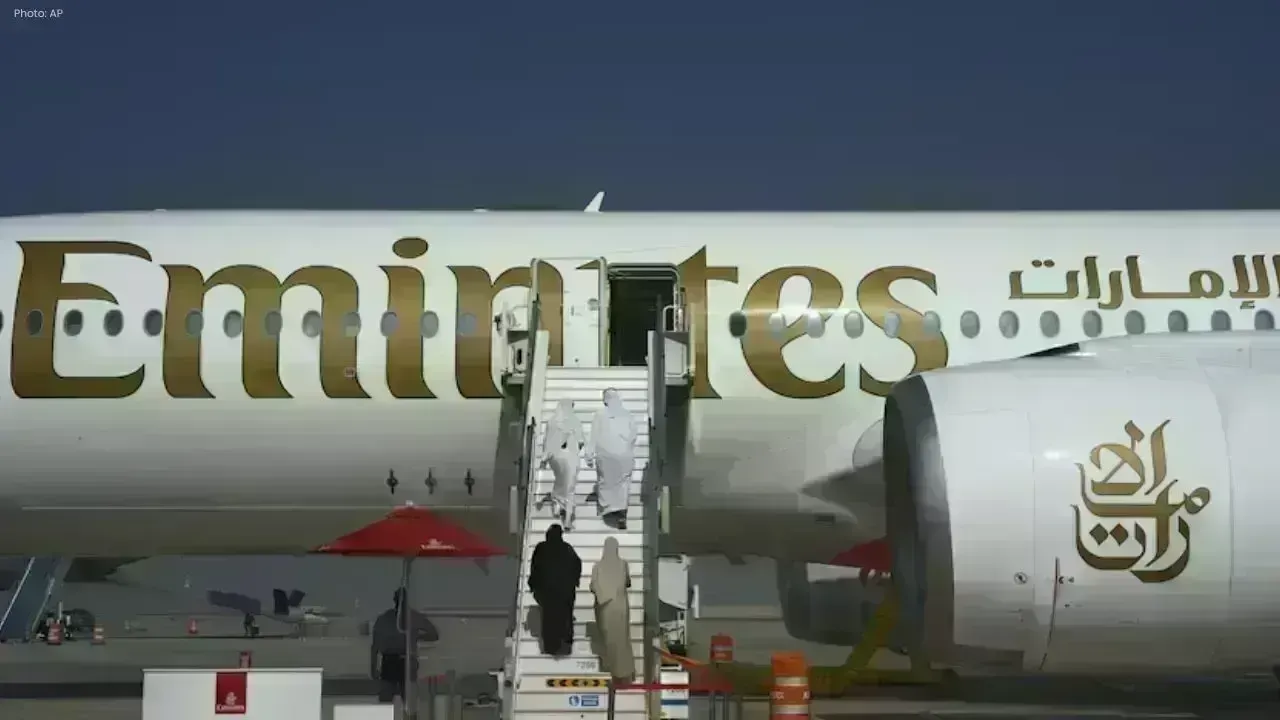

Canada Opens Skies to Middle East Airlines, Raising Competition Bar

Canada is expanding flight access for Saudi and UAE airlines, increasing competition and pressuring

Indian Woman Found Dead in US, Ex-Boyfriend Named Prime Suspect

An Indian woman was found dead in Maryland, US. Police have named her former boyfriend as the main s

Nupur Sanon Gets Engaged to Singer Stebin Ben in Dreamy Proposal

Nupur Sanon and singer Stebin Ben got engaged in a dreamy proposal. The couple will marry on January

Paush Purnima 2026: The Stunning ‘Wolf Moon’ Illuminates the Night Sky Tonight

The first full moon of 2026, known as the Wolf Moon will shine brightly tonight appearing larger and

KKR Releases Mustafizur Rahman From IPL 2026 Squad After BCCI Directive

Kolkata Knight Riders have released Bangladesh pacer Mustafizur Rahman from their IPL 2026 squad aft