You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Badri Ariffin

Capillary Technologies, the AI-focused SaaS provider from Bengaluru, made waves on November 21 as its stock hit the markets. Despite starting below its IPO price, the shares quickly regained traction, showcasing robust investor confidence.

The shares opened at Rs 560 on the BSE, reflecting a 2.95% drop from the IPO price of Rs 577. On the NSE, they started slightly better at Rs 571.90, which was a 0.88% decrease. Nonetheless, sentiment shifted positively, allowing the stock to soar 8.38% to close at Rs 606.90 on the BSE—an overall gain of 5.18% from the initial price. This uptick pushed the company's market value past Rs 4,813 crore on its first day of trading.

Capillary’s IPO, valued at Rs 877.5 crore, witnessed immense traction during its three-day public offering from November 14 to 18, achieving a subscription rate of nearly 53 times. Qualified Institutional Buyers (QIBs) showed significant interest, subscribing over 57 times their allotted share. Retail investors were also enthusiastic, oversubscribing their portion by around 16 times.

Prior to the listing, the company’s shares were trading at a grey market premium of roughly 10.39% over the IPO price, leading to high expectations. However, the initial performance didn't meet these projections before the impressive recovery.

Capillary Technologies specializes in AI-based SaaS solutions aimed at enhancing customer engagement and loyalty management. The IPO structure included a fresh issue of Rs 345 crore and an offer-for-sale of Rs 532.5 crore from promoters and early investors.

The company garnered around Rs 394 crore from 21 anchor investors just one day ahead of the public offering, with significant stakes taken by domestic mutual funds such as SBI, ICICI Prudential, Kotak Mahindra, Axis, Aditya Birla Sun Life, and Mirae Asset. International entities like Amundi, HSBC Global, and Matthews India Fund also contributed.

The funds from the fresh issue will primarily be allocated towards enhancing cloud infrastructure (Rs 143 crore), research and development (Rs 71.6 crore), new IT systems (Rs 10.3 crore), and supporting inorganic growth alongside other corporate needs.

The listing day performance for Capillary Technologies showcases a dynamic response from investors, reflecting both initial caution and swift recovery, underlining confidence in its AI-driven SaaS offerings and subscription-based revenue model.

Disney Cancels Live-Action Robin Hood Film Project

Director Carlos López Estrada says planned remake of 1973 animated classic will no longer move forwa

Malaysia PM Anwar Says IS-Linked Extremism Under Control

Prime Minister urges vigilance after police detect radicalisation among several Malaysian youths

Taiwan Begins Review of Massive Defence Bill Amid Political Divisions

Rival proposals from major parties clash over US arms purchases and locally developed ‘T-Dome’ air d

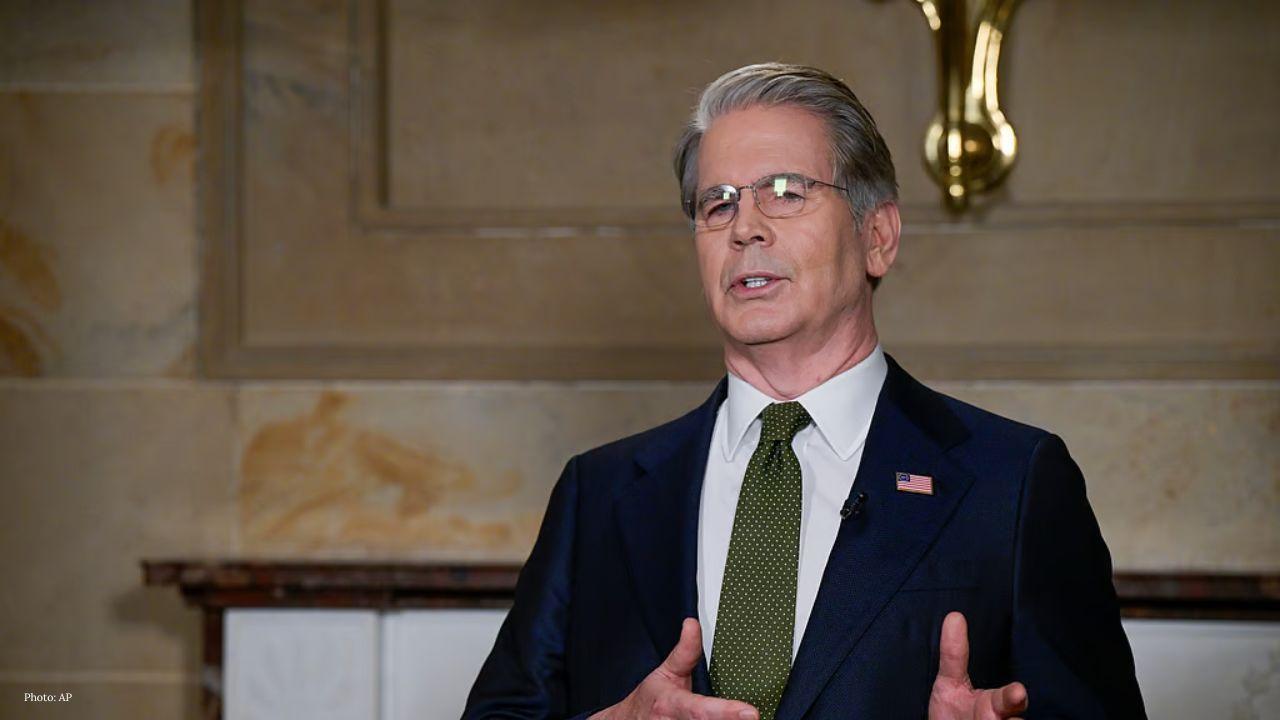

Jimmy Lai Will Not Appeal 20-Year Sentence in Hong Kong Security Case

Jailed media tycoon and Apple Daily founder accepts verdict in landmark national security case that

US Grants India 30‑Day Waiver to Buy Russian Oil

Temporary relaxation to allow Indian refiners to purchase stranded Russian crude aims to ease global

Thai Baht Falls as Dollar Gains on War Tensions

Currency slips to 31.77 per dollar as investors seek safe-haven assets and watch US economic data an