You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Meena Ariff

China has recently launched three large-scale venture capital funds, each with a capital contribution exceeding 50 billion yuan (approximately $7.14 billion), totaling more than $21 billion. These funds are specifically aimed at investing in the development of “hard technology” sectors, a critical focus area for the country’s innovation-driven growth strategy.

The newly established funds will primarily target early-stage startups that are valued at less than 500 million yuan. By concentrating on these smaller, emerging companies, China aims to nurture innovative technologies from the ground up and accelerate their commercialization.

An official involved in the fund management revealed that individual investments in startups will be limited to a maximum of 50 million yuan. This approach ensures that the funds can support a wide range of promising startups without overconcentrating capital on a single company.

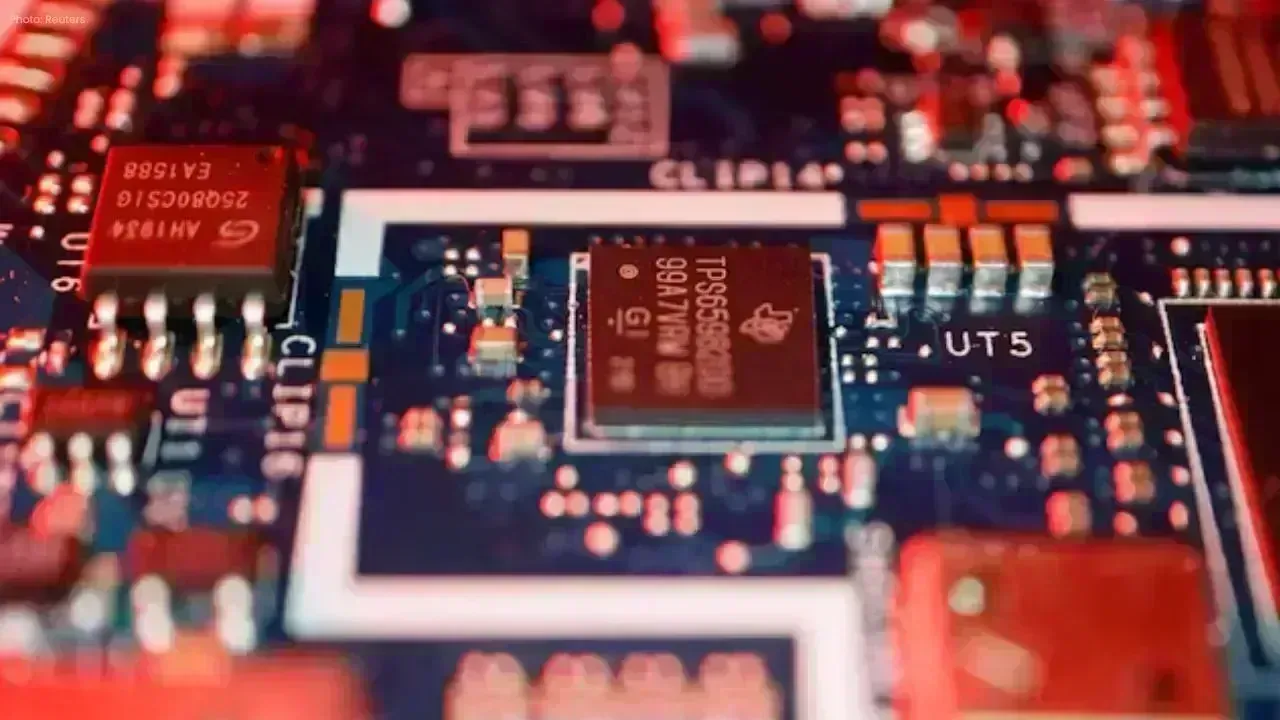

“Hard technology” typically refers to industries involving advanced scientific and engineering innovations such as semiconductors, artificial intelligence, robotics, aerospace, new materials, and biotechnology. China’s move to launch these funds reflects its ambition to become a global leader in these strategic technology sectors.

The initiative comes amid growing global competition in innovation and technology leadership. By fueling early-stage companies with significant venture capital, China hopes to strengthen its domestic technology ecosystem and reduce dependence on foreign technology.

These funds are expected to accelerate the commercialization of cutting-edge technologies and contribute to the long-term economic development of China. Moreover, the move aligns with the country’s broader economic goals to transition from traditional manufacturing toward high-tech and innovation-driven industries.

China’s launch of these three venture capital funds with over $21 billion in total capital marks a major step in fostering technological innovation and supporting early-stage startups focused on hard technology. This strategic investment will likely play a vital role in shaping China’s future technological landscape.

BCCI Central Contracts Shake-Up: Kohli, Rohit Moved to Grade B as Board Reshapes 2025–26 List

Virat Kohli and Rohit Sharma have been placed in Grade B in the BCCI’s 2025–26 central contract list

Dalal Street Spotlight: Top 10 Stocks Investors Are Watching as Markets Open on a High

Indian stock markets begin the week with strong momentum, and several blue-chip and mid-cap stocks a

Market Movers Today: Key Stocks Set To Watch In Indian Markets

Indian equity markets are poised for active trading as several major companies, including Bharti Air

Milan Welcomes the World: Inside the Grand Opening Ceremony of the 2026 Winter Olympics

The 2026 Winter Olympics opening ceremony in Milan marked a defining moment for global sport, blendi

Unfolding Market Drama: Sensex & Nifty Trade Volatility Amid Budget Fallout and India-US Trade Breakthrough

Indian equity markets exhibited high volatility this week as the 2026 Union Budget triggered sharp s

Dhurandhar 2 Teaser Countdown Ignites Fan Frenzy: All You Need to Know

The highly anticipated sequel to the blockbuster Dhurandhar is building intense excitement as the Dh