You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Saving money each month can often feel unattainable. With fixed salaries, rising living costs, and the burdens of personal responsibilities, it’s tough to make ends meet. Many assume that increasing their income is the only way to save, yet the truth is that saving problems stem from systems, not solely income.

This comprehensive guide shares the most practical, achievable, and sustainable methods to save money from your monthly earnings, irrespective of how tight your budget may seem.

To tackle this issue effectively, we must first identify the underlying causes behind the lack of savings.

Most salaried workers confront:

Fixed income with minimal flexibility

Lifestyle inflation following salary increases

Absence of a defined money management plan

Emotional spending linked to stress

Lack of awareness regarding expenditures

Savings fail not due to low income, but because money flows aimlessly.

A critical shift involves perceiving savings as a mandatory expenditure rather than an option.

Just as rent and utilities are non-negotiable, savings should be treated similarly. If you postpone saving until the end of the month, there’s likely to be nothing left.

Remember to prioritize saving over spending.

Adopting this mindset can revolutionize your financial outlook.

Overly complex budgets tend to fail due to the constant tracking they require.

Instead, a straightforward structure can yield better results.

Essentials bucket: Rent, groceries, utilities, transport, EMIs

Savings bucket: Emergency fund, investments, future objectives

Lifestyle bucket: Shopping, dining out, subscriptions, travel

By intentionally allocating your money, you naturally gain better control over your spending.

Rather than saving arbitrary amounts, determine a fixed percentage.

Beginners: 10% of salary

Stable earners: 15%–20%

Aggressive savers: 25% or more

Begin small if necessary, maintaining consistency is crucial. It’s easier to scale up than to start high and then drop off.

Automation removes emotional decision-making from the saving process.

No temptation to spend first

No need to remember to make transfers

Discipline is achieved automatically

Set up automatic transfers to savings or investment accounts on payday.

If you don’t see the money, you won’t miss it.

Mixing your savings with spending money often leads to failure.

When savings are in the same account as daily expenses, they tend to disappear.

One account for salary and expenses

One account dedicated to savings and investments

One account for discretionary spending

Creating spaces for different purposes reinforces mental discipline.

Day-to-day tracking can be demanding and counterproductive.

A monthly overview is adequate.

Where unnecessary expenses occurred

Unused subscriptions

Impulsive purchases

Recurring minor expenses

Simply being aware can help mitigate overspending next month.

Lifestyle inflation poses a significant risk to savings.

When salaries increase, so do expenditures, often unnoticed.

Save at least 50% of any salary raise

Enhance lifestyle gradually, not all at once

Prioritize financial security over superficial appearances

This habit can exponentially boost your savings.

An emergency fund safeguards your savings from depletion.

Without one, every unplanned expense may lead to using credit or liquidating investments.

Minimum: 3 months of essential expenses

Ideal: 6 months of essential expenses

Ensure this fund remains easily accessible and low-risk.

Attempting to save while burdened with high-interest debt remains counterproductive.

Interest consumes future income

Monthly EMIs restrict financial flexibility

Mental strain can lead to poor financial choices

Focus on eliminating credit card debt and personal loans before intensifying investments.

Saving doesn’t necessitate eliminating joy but cutting waste instead.

Multiple streaming subscriptions

Frequent food deliveries

Unused gym memberships

Impulsive online purchases

Removing low-value costs allows for saving without sacrificing quality of life.

Impulse purchases often stem from emotional triggers like stress or boredom.

Delay non-essential purchases for 48 hours

Avoid shopping when fatigued or anxious

Unsubscribe from promotional emails

Intentional spending enhances satisfaction and minimizes regret.

Understanding your cash flow is more important than imposing restrictions.

Fixed expenses should be below 50%–60% of income

Savings should be at least 15%–25%

Lifestyle spending should fit into the remaining budget

If lifestyle costs breach these limits, saving will become unfeasible.

Purposeful saving transforms the experience from mundane to motivational.

Setting defined objectives invigorates the savings process.

Emergency fund

Home purchase

Educational expenses

Travel experiences

Retirement planning

Visible goals streamline spending decisions.

Manage the growth rate of expenses

Direct bonuses or incentives straight into savings

Utilize annual raises wisely

Achieving savings growth relies more on discipline than on salary increments.

Saving safeguards your finances; investing expands your wealth.

Long-term, leaving funds idle diminishes purchasing power.

Short-term needs should be met with safe options

Long-term aspirations should be directed toward growth-focused investments

Avoid the temptation to chase rapid returns

Steady investing will outperform market timing strategies.

Medical emergencies can deplete savings faster than other expenses.

Health insurance

Life insurance (if you have dependents)

Proper insurance helps prevent forced withdrawals from your savings.

Your salary, expenses, and objectives evolve annually.

Regular reviews keep your financial approach relevant.

Savings rate

Insurance coverage

Debt situation

Progress towards goals

This ensures your strategy remains aligned with your circumstances.

Social media fosters unwarranted spending pressure.

People often overspend not out of necessity, but due to perception.

Many online lifestyles are funded through debt

Achieving financial tranquility supersedes appearances

Saving in silence outshines conspicuous spending

Comparison is a significant threat to effective saving.

Saving proficiency improves with practice.

Initial phases might seem restrictive, yet it soon becomes routine.

Your psyche adapts to established spending thresholds.

Consistency is more valuable than perfection.

Individuals who master saving early on experience:

Lowered financial anxiety

The ability to manage unplanned expenses with confidence

Enhanced investment capabilities

Improved lifestyle choices over time

Savings grant you control instead of limitations.

The most effective way to save isn’t through drastic sacrifices. It lies in systematic approaches, automation, awareness, and persistence.

A robust income isn’t a prerequisite for building substantial savings; rather, a reliable system can facilitate saving effectively on an average salary.

Once saving becomes an automatic practice, money transitions from being a source of stress to a tool for empowerment.

The information provided in this article is for educational purposes and does not constitute financial, legal, or investment advice. Individual financial situations vary based on income, expenses, liabilities, and personal goals. Readers should consult a qualified financial advisor before making significant financial decisions or changes.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

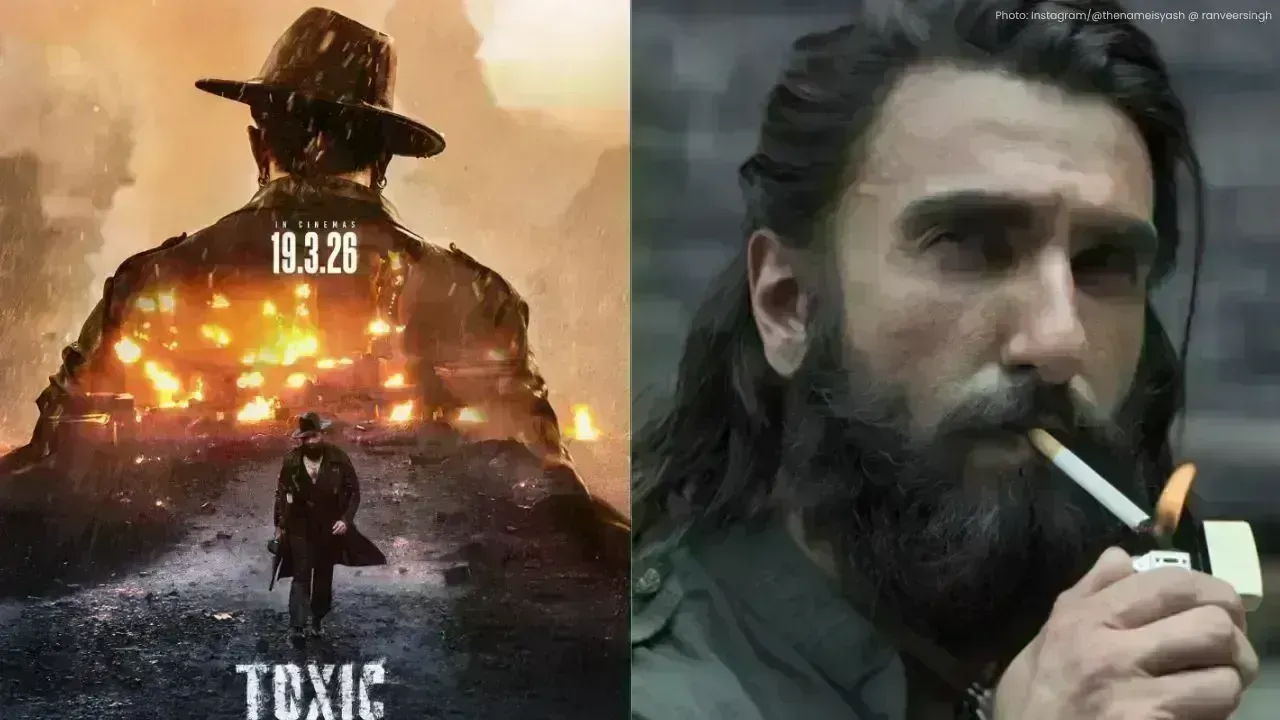

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as