You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The real estate market in 2025 is no longer defined by predictable cycles or traditional safe havens. Investors are actively seeking out new destinations for capital, often looking beyond the usual property hubs like New York, London, and Hong Kong. Economic resilience, favorable policies, and emerging infrastructure have given rise to fresh hotspots across Asia, the Middle East, and parts of Africa, shifting the balance of global property investment.

The COVID-19 pandemic altered the way people live, work, and travel — and those changes continue to influence real estate demand today. Hybrid work models have transformed office requirements, tourism patterns have influenced hospitality investments, and shifting demographics are creating opportunities in housing markets that were once overlooked.

Over the past two years, several cities have risen as preferred investment destinations. Dubai, for instance, has cemented its place as a global property magnet, attracting high-net-worth individuals with its tax-friendly environment, world-class infrastructure, and ambitious development projects. In Southeast Asia, cities like Bangkok and Ho Chi Minh City are benefiting from rapid economic growth, affordable entry prices, and strong rental yields.

Meanwhile, Africa is seeing a rise in investor interest, particularly in Nairobi and Lagos, as tech-driven economies fuel demand for commercial spaces and modern housing. These markets may not yet rival the transaction volumes of Western capitals, but they offer strong upside potential for early movers.

FDI remains a driving force behind global real estate expansion. Nations that actively court foreign investors with clear property ownership laws, long-term residency options, and reduced transaction costs are outperforming others. Portugal’s Golden Visa program, though recently modified, still draws global buyers seeking European market access. Similarly, countries like the UAE and Singapore are offering long-term visas tied to property investments, which in turn boosts demand and prices.

China’s economic slowdown and restrictive policies on foreign ownership have slightly dampened its property market, pushing investors toward alternative Asian destinations. Conversely, India is gaining traction, with commercial real estate and industrial logistics becoming attractive for global funds.

Sustainability has moved from a marketing buzzword to an essential investment criterion. Green-certified buildings, energy-efficient housing, and developments with sustainable infrastructure are commanding premium valuations. Regulatory pushes in the EU, along with increasing ESG mandates for institutional investors, mean that projects ignoring sustainability risk falling behind in both price appreciation and occupancy rates.

In emerging markets, sustainable developments also align with international funding requirements, allowing developers to access cheaper financing and wider investor pools.

PropTech — the integration of technology into property — is transforming how investors identify opportunities, assess value, and manage assets. AI-driven analytics, blockchain-based transactions, and virtual property tours are making global real estate more transparent and accessible.

Tokenization of real estate assets is gaining momentum, enabling fractional ownership and attracting a broader range of investors. While still in its early stages, tokenization could redefine liquidity in traditionally illiquid property markets.

Residential real estate continues to evolve in response to lifestyle changes. The demand for spacious suburban homes, which surged during the pandemic, has stabilized but not disappeared. Affluent buyers are increasingly looking for mixed-use developments that combine living, working, and leisure facilities within a single community.

Luxury waterfront properties in Dubai, Miami, and Lisbon remain hot commodities, while affordable housing demand is booming in cities with growing middle-class populations. Governments in countries like Malaysia and Indonesia are incentivizing developers to bridge the affordability gap, which is also attracting socially conscious investors.

While office demand in traditional CBDs has softened due to hybrid work, high-quality, flexible office spaces in strategic locations are still in demand. The logistics and warehousing sector continues to see strong growth, fueled by e-commerce expansion and supply chain reconfigurations.

Data centers are emerging as one of the most attractive asset classes globally, thanks to the exponential rise in cloud computing and AI-related data requirements. Investors in Singapore, Amsterdam, and Virginia are leading this trend, though secondary markets are quickly catching up.

Despite opportunities, global real estate faces headwinds. High interest rates in several major economies are pressuring buyers and slowing transaction volumes. Currency volatility can also impact cross-border investments, while political instability in certain emerging markets adds to investor caution.

Additionally, climate-related risks such as flooding, wildfires, and extreme weather are now factored into investment decisions. Insurers are becoming more selective, and properties in high-risk areas may face declining valuations.

Over the next three to five years, experts predict that capital will increasingly flow toward:

Mid-tier cities with strong infrastructure growth — offering higher yields than mature markets.

Mixed-use and sustainable developments — catering to changing lifestyle demands.

Logistics, data centers, and life sciences real estate — driven by structural economic shifts.

Tourism-led hospitality projects — particularly in countries with strong visa reforms and global connectivity.

Investors who can balance risk with innovation, and who adapt to regulatory and environmental changes, will be best positioned to capitalize on this evolving landscape.

This article is intended for informational purposes only and does not constitute financial or investment advice. Real estate markets are subject to fluctuations, and readers should conduct independent research or consult with professional advisors before making any investment decisions.

Two Telangana Women Die in California Road Accident, Families Seek Help

Two Telangana women pursuing Master's in the US died in a tragic California crash. Families urge gov

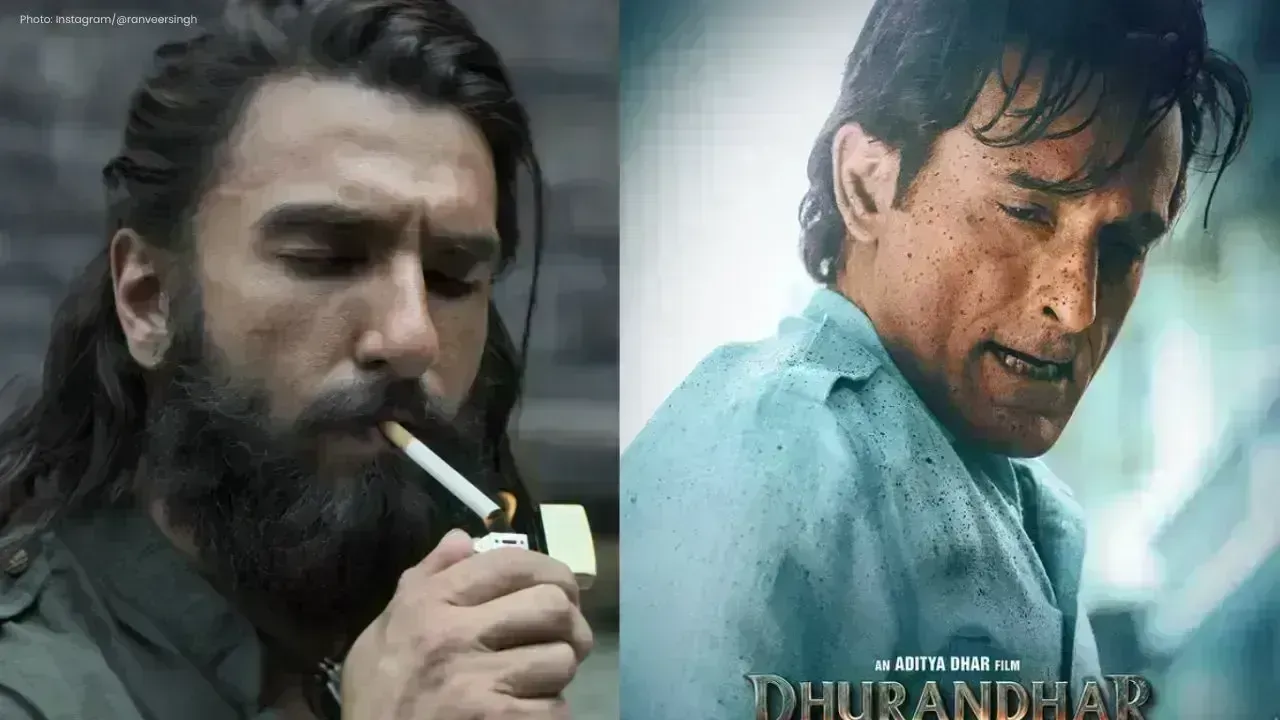

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex

Balendra Shah Joins Rastriya Swatantra Party Ahead of Nepal Polls

Kathmandu Mayor Balendra Shah allies with Rastriya Swatantra Party, led by Rabi Lamichhane, to chall

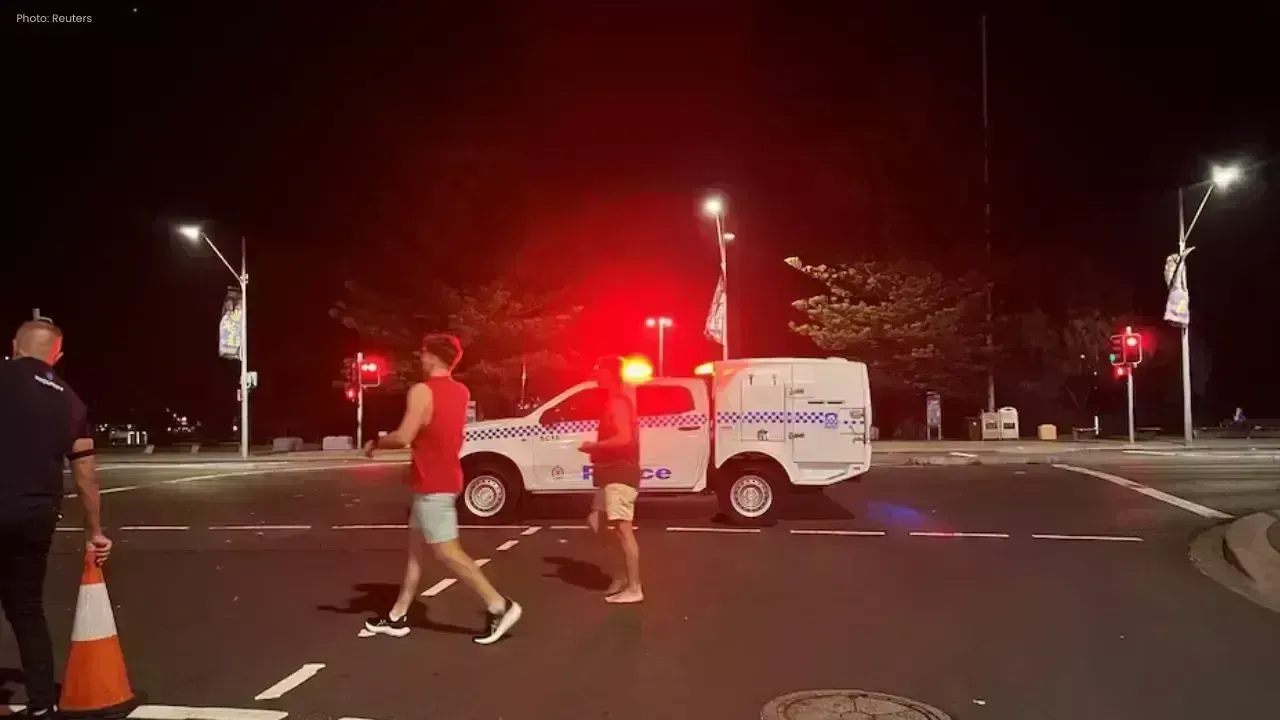

Australia launches review of law enforcement after Bondi shooting

Australia begins an independent review of law enforcement actions and laws after the Bondi mass shoo

Akshaye Khanna exits Drishyam 3; Jaideep Ahlawat steps in fast

Producer confirms Jaideep Ahlawat replaces Akshaye Khanna in Drishyam 3 after actor’s sudden exit ov