You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

In many parts of Asia, small businesses have traditionally relied on cash. But in recent years, the shift toward digital payments has been dramatic. Technologies ranging from mobile wallets to QR codes are empowering vendors—even those in remote regions—to transact seamlessly, with fewer barriers and more transparency.

A recent survey found that over 73 percent of MSMEs across semi-urban and rural India experienced increased income or operational gains after adopting digital tools. Smartphones became the key medium for business management, and the Unified Payments Interface (UPI) emerged as the go-to transaction method. This marks a deeper, more confident shift toward digital inclusion at the grassroots level.

Meanwhile, in Singapore, nearly nine in ten small businesses reported benefits from adopting new payment methods—faster payments, more retained customers, and increased sales were among the most cited advantages.

QR code systems have become game-changers for many small merchants. Unlike traditional POS systems, a basic smartphone and a printed QR code often suffice for transactions. In Indonesia, the national QR code standard known as QRIS has exploded in use—with over 32 million merchants onboarded and transaction value soaring in 2024.

Across Southeast Asia, governments are actively creating interoperable QR systems—like in Malaysia, Thailand, and Vietnam—making cross-border digital transactions increasingly seamless.

New digital platforms are not just about transactions—they’re transforming how small businesses access commerce and credit. One inspiring example is a company in small-town India that equips micro-entrepreneurs with a local ecommerce platform and inventory, delivery, and marketing tools through a “business-in-a-box” model. Using UPI transaction records, even a roadside tea seller could secure a loan without traditional collateral.

Beyond payment acceptance, digital financing platforms are stepping in to fill credit gaps. A Southeast Asian fintech, serving countries like Indonesia, Singapore, and Vietnam, has disbursed billions in financing to MSMEs through digital means.

Digital wallets are rapidly dominating Asia-Pacific payment space. By 2027, forecasts show digital wallets will account for nearly two-thirds of all point-of-sale transactions. Entire economies—from everyday shops to rural markets—are joining this shift.

As Visa research notes, small and medium businesses adopting digital payments see higher turnover. The reasons are clear: meeting modern customer expectations, automating processes, and expanding reach to new channels.

But the transition isn’t entirely smooth. In Karnataka, India, some small traders have pulled back from using UPI out of concern over tax scrutiny tied to reported digital transactions. Even merchants selling exempt goods feel at risk due to poor communication, causing a swing back to cash and growing business frustrations.

Elsewhere, growth in fraud and scams undermines trust in digital systems, particularly for those with limited digital literacy.

Adoption also often masks deeper financial risks—such as over-reliance on digital loans. Studies warn digital finance can sometimes lead to indebtedness, especially when credit access lacks safeguards.

Despite challenges, the trend toward digital payments for small businesses is creating more equitable access to markets, financial services, and operational efficiencies. Digital tools are moving rural entrepreneurs onto equal footing with urban traders by formalizing operations and facilitating financial inclusion.

Digital payments are reshaping small businesses in Asia in profound ways—making them more efficient, connected, and financially capable. At the same time, the path forward depends on balancing innovation with trust-building, regulatory clarity, and financial responsibility.

This article is based on industry reports, regional surveys, and observed trends as of mid-2025. Digital infrastructure, policy landscapes, and market dynamics may evolve rapidly, potentially altering the pace and nature of change.

Two Telangana Women Die in California Road Accident, Families Seek Help

Two Telangana women pursuing Master's in the US died in a tragic California crash. Families urge gov

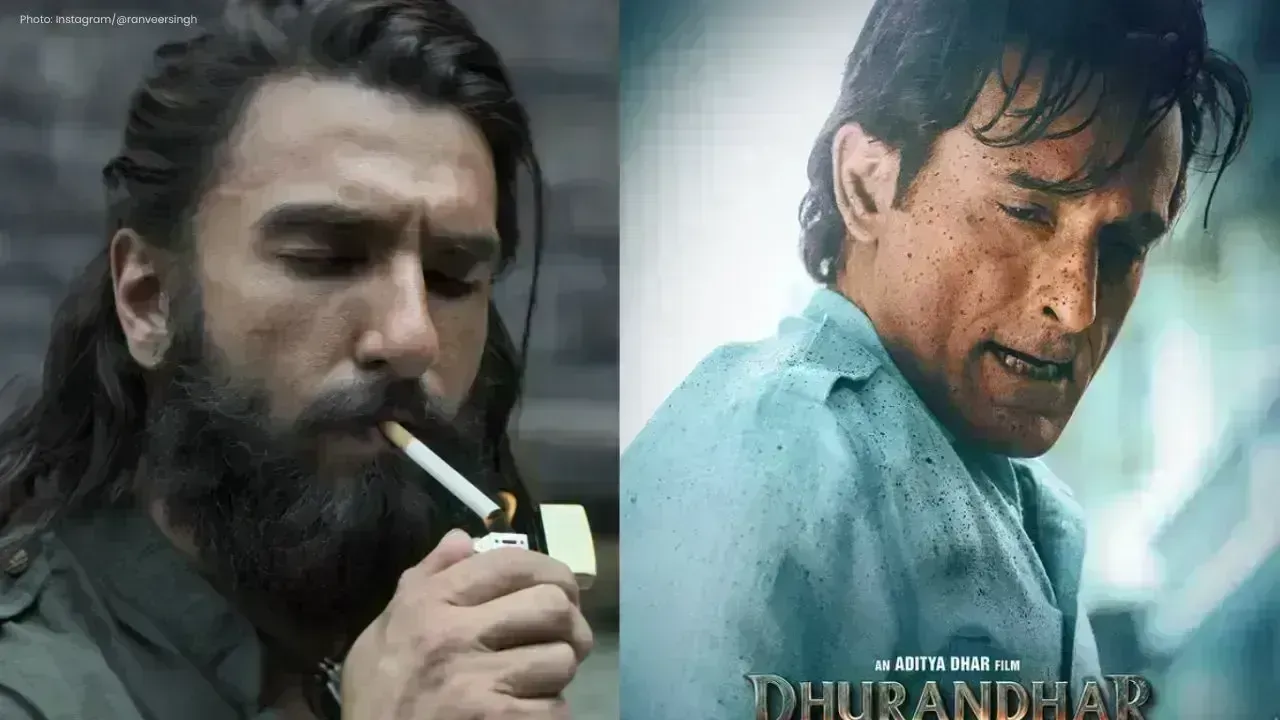

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex

Balendra Shah Joins Rastriya Swatantra Party Ahead of Nepal Polls

Kathmandu Mayor Balendra Shah allies with Rastriya Swatantra Party, led by Rabi Lamichhane, to chall

Australia launches review of law enforcement after Bondi shooting

Australia begins an independent review of law enforcement actions and laws after the Bondi mass shoo

Akshaye Khanna exits Drishyam 3; Jaideep Ahlawat steps in fast

Producer confirms Jaideep Ahlawat replaces Akshaye Khanna in Drishyam 3 after actor’s sudden exit ov