You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The Indian stock market began the session on a restrained and uneasy note, reflecting growing investor caution at the start of the trading day. Early indicators suggested that market participants were in no rush to take fresh exposure, choosing instead to closely track global developments and technical levels. The mood on Dalal Street was shaped by a combination of offshore signals, overnight global market performance, and recent domestic trends that had already softened sentiment.

At the heart of the cautious opening was the weak signal from GIFT Nifty, which hinted that benchmark indices were likely to face selling pressure from the very beginning. This pre-market indication, when viewed alongside mixed cues from the United States and a broad decline across Asian markets, reinforced the perception that risk appetite was under strain.

Rather than a sharp sell-off driven by panic, the early weakness reflected controlled caution. Investors appeared aware that markets had entered a sensitive phase, where even small triggers could lead to heightened volatility. As a result, the opening session became less about chasing momentum and more about preserving capital and reassessing near-term strategies.

GIFT Nifty has emerged as one of the most closely watched indicators for gauging how Indian markets may open. Traded outside domestic market hours, it captures offshore sentiment and often reacts swiftly to global developments. On this particular morning, GIFT Nifty was trading lower, clearly pointing towards a subdued start for Indian equities.

A weaker reading in this indicator generally suggests that global investors are in a risk-averse mood. It can reflect concerns ranging from foreign fund outflows to broader macroeconomic uncertainty. Traders and institutions tend to factor in this signal while planning early trades, especially on days when international cues lack clarity.

The softness in GIFT Nifty did not signal panic, but it did highlight hesitation. It indicated that market participants were likely to open with defensive positioning rather than aggressive buying, particularly in index-heavy stocks.

As trading commenced, the cautious pre-market signal translated into visible weakness on the screens. Market breadth tilted negative, with a larger number of stocks trading in the red compared to those advancing. This imbalance suggested that selling pressure was not limited to a few counters but was spread across sectors.

Benchmark indices slipped early, reflecting pressure from heavyweight stocks. The movement reinforced the view that investors were trimming positions rather than selectively accumulating shares. Such broad-based weakness often signals underlying uncertainty rather than a reaction to any single piece of news.

Overnight cues from the United States failed to offer strong directional support. Major indices closed with mixed outcomes, as gains in certain pockets were offset by weakness elsewhere. This lack of a clear trend added to investor unease in Asia, including India.

US markets have recently been navigating concerns around interest rates, economic growth signals, and sector-specific pressures. When Wall Street struggles to establish momentum, emerging markets often feel the impact, as global investors become more selective about risk exposure.

The mixed finish in the US created an environment where Indian traders had little positive global reassurance to rely on. Instead of drawing confidence from a strong overseas rally, they were forced to prepare for a session driven largely by caution.

Across Asia, equities traded lower, reflecting a broad risk-off sentiment. Major indices in the region saw selling pressure, driven by concerns over global growth, commodity price movements, and currency fluctuations. This regional weakness added another layer of pressure on Indian markets at the open.

Asian markets often act as an early barometer for global risk sentiment. When most regional indices trade in negative territory, it becomes difficult for Indian equities to ignore the trend. The decline across Asia reinforced the perception that investors were stepping back from riskier assets.

As the session began, benchmark indices moved lower, slipping below important psychological levels. Such levels often act as confidence markers for traders, and any breach tends to invite additional selling or cautious positioning.

The early decline in benchmark indices reflected selling in large-cap stocks, which typically have a significant influence on overall market direction. Financials, technology stocks, and industrial names were among those facing pressure, contributing to the downward move.

While the losses were not extreme, the direction was clear. The market was signalling discomfort rather than confidence, prompting traders to monitor intraday support levels closely.

The weakness was not confined to a single sector. Multiple segments showed signs of selling, suggesting that the mood was driven by overall sentiment rather than sector-specific developments. Information technology stocks faced pressure amid global uncertainty, while metals and consumer-oriented stocks also struggled.

Such broad-based weakness often indicates that investors are reducing exposure across portfolios rather than making targeted adjustments. In these situations, even fundamentally strong stocks can come under pressure due to short-term risk aversion.

The cautious opening did not emerge in isolation. Indian markets had already experienced pressure in previous sessions, with indices giving up recent gains. This cumulative decline had made investors more sensitive to negative cues, increasing the likelihood of further selling on weak signals.

When markets decline over multiple sessions, confidence tends to erode gradually. Traders become less willing to buy dips, preferring to wait for clearer signs of stability. This mindset was evident in the early trade, where buying interest appeared muted.

Technical analysts have been closely monitoring support zones that could determine near-term market direction. Levels around round numbers often hold psychological significance, and any sustained move below them can trigger further selling.

As the session progressed, these technical thresholds remained in focus. Traders watched closely to see whether the market could hold these levels or whether additional selling pressure would emerge. The outcome was expected to shape intraday sentiment.

The dominant theme at the open was risk management. Investors appeared more focused on protecting existing gains and limiting downside rather than chasing short-term opportunities. This approach was reflected in lower volumes and selective participation.

Defensive positioning often emerges during periods of uncertainty, especially when global cues are unclear. Investors may shift towards relatively stable stocks or reduce leverage, waiting for a more favourable risk-reward environment.

Aggressive trades were notably absent in the early session. Even in stocks that showed relative strength, buying was cautious and measured. This behaviour suggested that traders were not convinced about a quick turnaround and preferred to wait for confirmation.

Such restraint can sometimes prevent sharp intraday declines, but it also limits the potential for a strong rebound unless sentiment improves significantly.

Macroeconomic considerations continued to influence sentiment. Inflation trends, interest rate expectations, and central bank commentary remain critical drivers for equity markets. Any shift in these factors can quickly alter market direction.

Investors were mindful that upcoming economic data could influence both domestic and global markets. As a result, many chose to stay on the sidelines until more clarity emerged.

Currency fluctuations and commodity price trends also played a role in shaping sentiment. Movements in crude oil prices and the domestic currency can impact corporate earnings expectations, especially for import-dependent sectors.

Uncertainty on these fronts added to the cautious mood, reinforcing the preference for defensive positioning.

One of the key questions for the day was whether the market would stabilise after the weak start or continue to slide. Early declines sometimes attract value buying, but only if investors believe that downside risks are limited.

Traders closely monitored intraday charts and volume patterns to assess whether selling pressure was easing or intensifying. Any signs of stability could encourage selective buying, while continued weakness might invite further caution.

Despite the overall cautious tone, individual stocks can still move based on company-specific developments. Earnings updates, corporate actions, or sectoral news have the potential to create pockets of activity even in a weak market.

Active traders often look for such opportunities, but the broader sentiment can still cap upside potential.

Given the combination of weak global cues and cautious domestic sentiment, volatility was expected to remain elevated. Markets in such phases tend to react sharply to news, both positive and negative.

For investors, this environment calls for discipline and patience. Short-term movements can be unpredictable, making it important to focus on risk control rather than chasing every fluctuation.

While short-term sentiment was under pressure, long-term investors often view such phases as part of the broader market cycle. Periods of consolidation or correction can eventually create opportunities, but timing remains crucial.

Maintaining a balanced perspective helps investors avoid emotional decisions during volatile sessions.

The Indian stock market’s weak start reflected a convergence of negative pre-market signals, mixed global cues, and recent domestic softness. Rather than panic-driven selling, the early trade was characterised by measured caution, with investors prioritising risk management over aggressive positioning.

As the session unfolded, markets remained sensitive to global developments, technical levels, and any fresh economic signals. In such an environment, a cautious and disciplined approach appeared to be the preferred strategy, allowing investors to navigate uncertainty while staying alert to emerging opportunities.

This article is intended for informational purposes only and does not constitute investment advice. Market conditions are subject to change, and readers should conduct their own research or consult a qualified financial advisor before making investment decisions.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

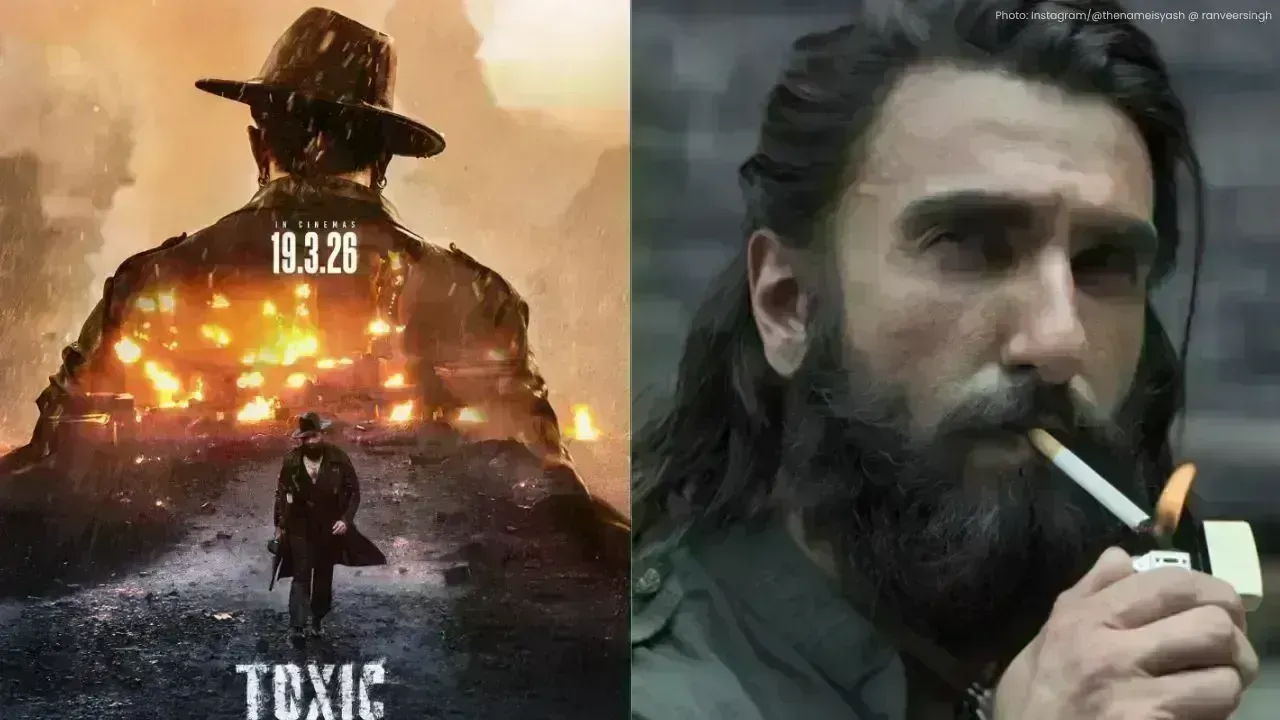

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as