You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Maya Rahman

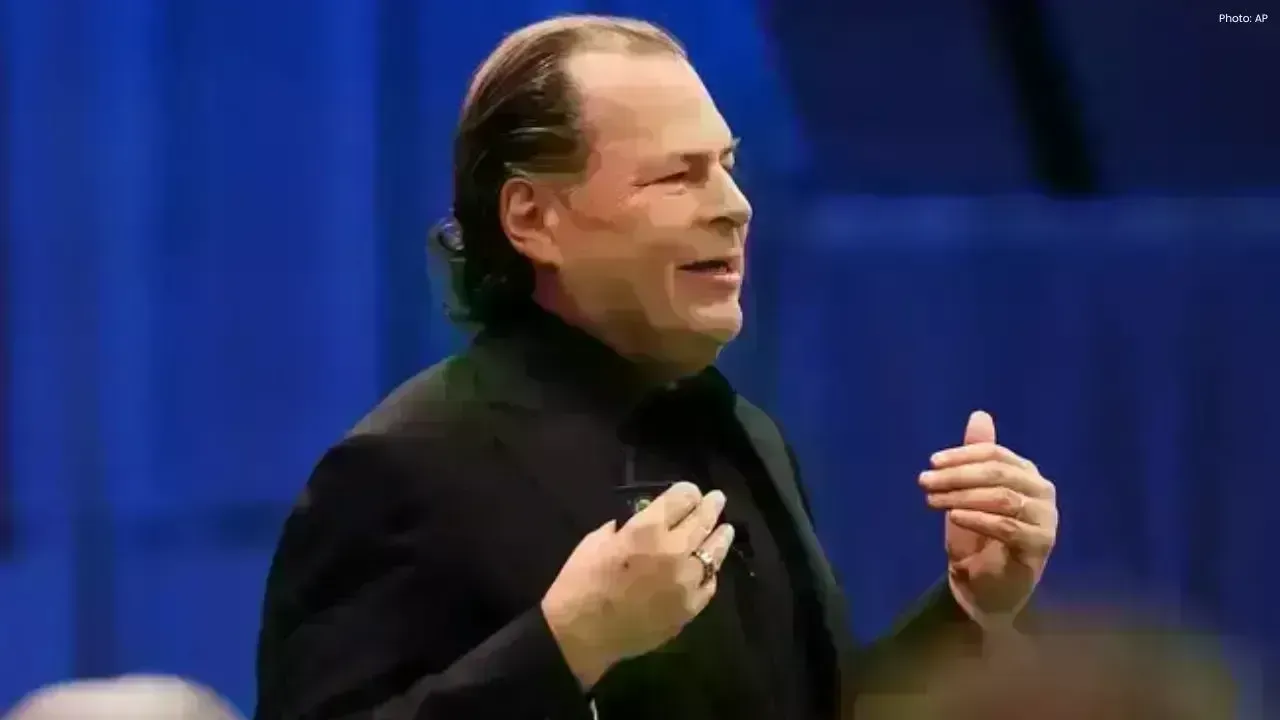

Salesforce, known for its innovative software solutions, has attracted significant attention recently as artificial intelligence continues to gain traction globally. However, the company's rapid ascent has also led to increasing skepticism among investors. This scrutiny places pressure on CEO Marc Benioff, whose optimistic leadership style is well recognized. Investors are now eager to witness tangible returns from Salesforce's substantial investments in AI.

On Wednesday, Salesforce released its quarterly earnings for the August–October period, offering Benioff a chance to reshape investor sentiment. The results exceeded expectations, revealing profits of $2.1 billion, or $2.19 per share—up 37% from the previous year. Revenue also climbed by 9%, reaching almost $10.9 billion, with an optimistic forecast for the January quarter that also surpassed analyst predictions.

During a conference call lasting 25 minutes, Benioff expressed confidence in Salesforce's unique positioning for the AI revolution, highlighting how customers often experience “wow” moments when utilizing the company's AI technologies. His remarks were infused with enthusiasm, resembling a stirring motivational address focused on the future of AI.

Initially, Salesforce's stock surged over 5% following the positive earnings news. However, after Benioff's presentation, the stock's gain settled at around 2%. The sustainability of this increase remains uncertain, as strong earnings alone may not be sufficient to buoy tech stocks amid prevailing uncertainties. Many investors are still apprehensive about the vast investments in AI across the industry and their potential returns.

Even market leader Nvidia, celebrated for its AI chips, has experienced volatile stock performance despite announcing impressive results last month. After briefly alleviating market fears, Nvidia's stocks retracted to pre-report levels, remaining 15% lower than its late October highs.

Salesforce's situation is even more precarious, with its market valuation slipping by 35% over the past year, erasing approximately $125 billion in shareholder wealth—a stark reality despite Benioff's ongoing advocacy for AI's advantages and Salesforce's central role in the AI dialogue.

Benioff has also been fortifying political ties, positioning himself among the prominent tech leaders who nurtured connections with President Trump this year, with a unified aim to push for pro-AI government policies, striving for U.S. competitiveness amid global rivals like China.

Salesforce is primarily focused on developing AI agents designed to automate customer service functions, aiming to take over roles traditionally filled by human staff. In a decisive move showcasing confidence in this technology, Salesforce reduced its workforce by 4,000 customer support roles as their “Agentforce” system assumed more responsibilities.

However, the uptake of AI agents by many of Salesforce’s clients is lagging behind investor expectations. Market strategist Jay Woods notes that this slow adoption has made Salesforce a “poster child” for the ongoing skepticism surrounding AI.

Yet, Benioff's optimism remains unwavering. He recently lauded Google’s new Gemini AI upgrade, expressing confidence that businesses and governments will soon ramp up their AI tool usage. Salesforce aspires to hit $60 billion in revenue by January 2030, demanding a steady growth rate of approximately 10% from this year’s anticipated $41.5 billion. Additionally, the company has finalized an $8 billion acquisition of Informatica, which specializes in AI-enhanced data tools.

Benioff insists that Salesforce is “executing on the path to our $60 billion dream,” maintaining faith that the company’s AI initiatives will ultimately yield significant results.

#Global News #Tech News #Artificial Intelligence #World News

BCCI Central Contracts Shake-Up: Kohli, Rohit Moved to Grade B as Board Reshapes 2025–26 List

Virat Kohli and Rohit Sharma have been placed in Grade B in the BCCI’s 2025–26 central contract list

Dalal Street Spotlight: Top 10 Stocks Investors Are Watching as Markets Open on a High

Indian stock markets begin the week with strong momentum, and several blue-chip and mid-cap stocks a

Market Movers Today: Key Stocks Set To Watch In Indian Markets

Indian equity markets are poised for active trading as several major companies, including Bharti Air

Milan Welcomes the World: Inside the Grand Opening Ceremony of the 2026 Winter Olympics

The 2026 Winter Olympics opening ceremony in Milan marked a defining moment for global sport, blendi

Unfolding Market Drama: Sensex & Nifty Trade Volatility Amid Budget Fallout and India-US Trade Breakthrough

Indian equity markets exhibited high volatility this week as the 2026 Union Budget triggered sharp s

Dhurandhar 2 Teaser Countdown Ignites Fan Frenzy: All You Need to Know

The highly anticipated sequel to the blockbuster Dhurandhar is building intense excitement as the Dh