You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The Asian Development Bank (ADB) has revised its economic forecast for Southeast Asia, signaling a more cautious outlook amid rising trade tensions and the growing impact of fresh tariffs imposed by the United States. The downgraded growth projection reflects the mounting economic uncertainty faced by several emerging economies, particularly in the ASEAN region, as geopolitical frictions and global supply chain shifts begin to bite. This revision underscores a critical phase for regional policymakers and businesses as they brace for tighter financial conditions and lower export demand.

In its latest report, the ADB downgraded its 2025 growth projection for Southeast Asia to 4.3%, down from the 4.7% predicted earlier this year. Key economies including Malaysia, Thailand, Vietnam, and Indonesia are now expected to see slower expansion due to subdued manufacturing output, weaker global demand, and the ongoing fallout from the US tariff measures against China and other Asian economies.

Countries heavily dependent on exports—particularly electronics, semiconductors, and automotive parts—are facing the brunt of the impact. For instance, Vietnam, which had enjoyed years of double-digit export growth, is now seeing a noticeable slump in foreign orders. Similarly, Thailand’s automotive sector and Indonesia’s raw material exports are also under pressure, squeezing growth potential across the board.

Much of the current economic strain can be traced back to the escalating tariff policies rolled out by the United States in recent months. As part of its evolving trade strategy, the US has reimposed and expanded tariffs on a wide range of goods from Asia, citing security concerns and protection of domestic industries. While the primary focus remains on China, the ripple effects are being felt across Southeast Asia, especially in countries that are part of global production networks linked to Chinese suppliers.

Even nations that sought to benefit from the US-China decoupling are now discovering that heightened scrutiny and expanded tariffs are casting a wider net. The result? ASEAN’s trade-driven economies are getting caught in the crossfire, facing reduced investment inflows, disrupted supply chains, and elevated input costs.

Beyond trade, another critical consequence of the current climate is the growing investor hesitation. Foreign direct investment (FDI), which had rebounded post-pandemic, is now showing signs of contraction. Businesses are either slowing down new investments or rerouting capital to less volatile markets.

This shift is particularly visible in Malaysia and Thailand, where key infrastructure and industrial projects have slowed due to financing delays or policy reconsiderations. The ADB has noted a drop in FDI inflows of over 8% across the ASEAN-5 nations in the first half of 2025 alone.

The situation is further exacerbated by tightening global financial conditions, as central banks in the US and Europe maintain higher interest rates to tame inflation, making capital more expensive and harder to access for developing nations.

China’s economic cooling is another factor contributing to Southeast Asia’s struggle. Once the engine of growth for much of Asia, China is now facing its own challenges—stagnant domestic demand, a declining property sector, and weakening business confidence. As a major trading partner and investor in Southeast Asia, any slowdown in China inevitably pulls down prospects for the region.

Exports to China have already dropped significantly for countries like Malaysia and Indonesia. Singapore, which serves as a hub for China-related finance and logistics, is also grappling with lower transshipment volumes and financial services demand.

In response to these evolving challenges, Southeast Asian governments are introducing various policy tools aimed at stimulating domestic demand and softening the external blow. Malaysia has announced fresh incentives for small and medium enterprises, while Indonesia is pushing ahead with subsidies to boost consumption. Thailand is offering tax breaks for foreign investors in an effort to stabilize inflows.

However, analysts warn that fiscal space is limited. With elevated public debt following years of pandemic spending, many economies do not have the financial flexibility to implement large-scale stimulus measures. Central banks, on the other hand, are also constrained—raising interest rates may stem capital outflows, but could further dampen growth.

One of the more subtle but equally important developments is the divergence in how ASEAN nations are responding to the crisis. While some are leaning towards protectionist strategies to shield domestic industries, others are advocating greater trade openness and diversification.

This difference in approach could test the unity of ASEAN at a time when regional cooperation is most needed. The long-term goal of achieving a seamless ASEAN Economic Community could face new hurdles if national interests begin to outweigh collective objectives.

Another angle worth noting is the realignment of global supply chains. Several multinational companies are now accelerating plans to move operations to India, Mexico, and Eastern Europe, looking to de-risk from Southeast Asia’s increasingly vulnerable position. While some ASEAN nations had hoped to capitalize on the China exodus, they now face the possibility of being bypassed entirely.

This trend, if not reversed, could mark a structural loss of competitive advantage for Southeast Asia—one that would take years to rebuild, even with aggressive policy and incentives.

The remainder of the year looks challenging for the region. With elections approaching in Thailand and Indonesia, and global uncertainties—ranging from oil prices to conflicts in Ukraine and the Middle East—looming large, there is little room for complacency.

The ADB’s message is clear: without structural reforms, regional collaboration, and a focus on internal economic resilience, Southeast Asia could face a multi-year growth slowdown. Recovery will depend not only on global macroeconomic shifts but also on how quickly individual nations can pivot their policies and reposition themselves in a reshaped global economy.

Southeast Asia has weathered economic storms before—from the Asian Financial Crisis in 1997 to the COVID-19 pandemic. What sets this period apart is the confluence of trade, investment, and geopolitical shocks. Navigating through these turbulent times will require more than just fiscal prudence or reactive trade measures. It will require visionary leadership, innovation-driven growth models, and stronger regional cohesion.

While the path ahead may seem uncertain, Southeast Asia still holds immense potential. The region’s youthful population, digital transformation momentum, and strategic location give it a base to bounce back. But without concerted action and forward-thinking policy moves, the ADB’s downgrade may not be the last.

This article is based on current developments and economic forecasts as of August 2025. Information presented here is intended for informational purposes only and does not constitute investment, financial, or political advice. Readers are encouraged to consult official sources and updated economic data before making decisions.

Two Telangana Women Die in California Road Accident, Families Seek Help

Two Telangana women pursuing Master's in the US died in a tragic California crash. Families urge gov

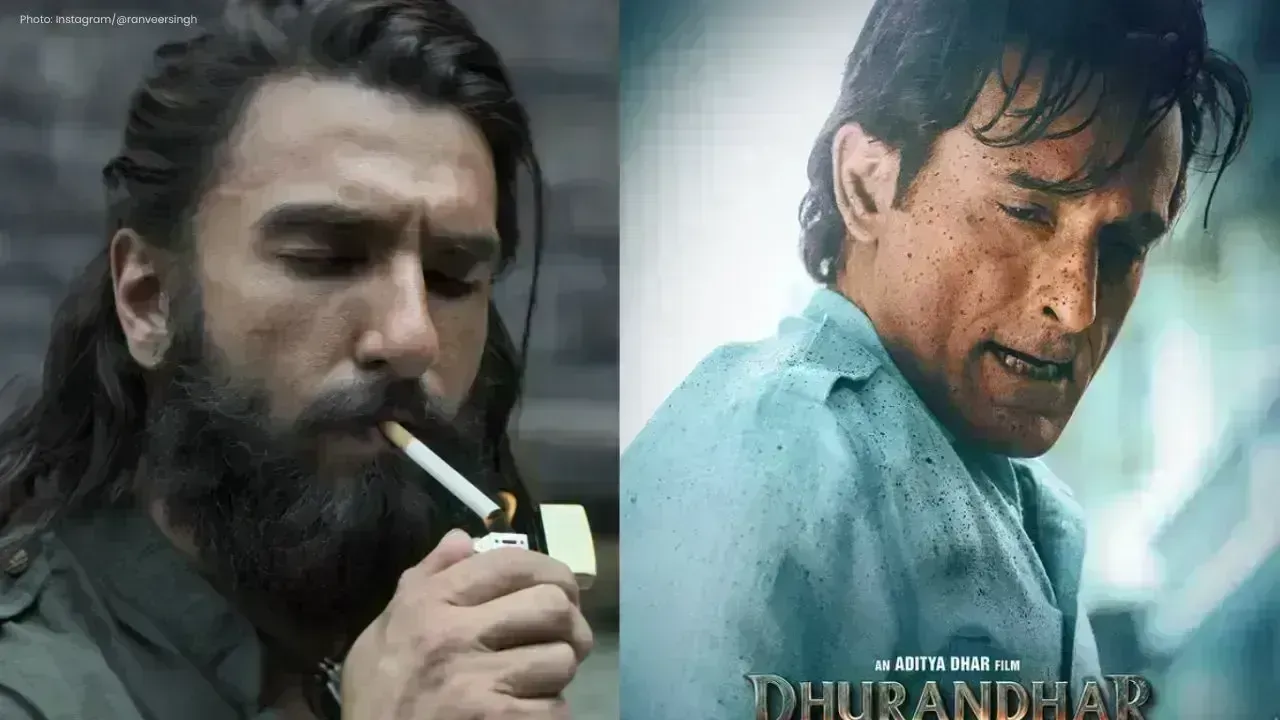

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex

Balendra Shah Joins Rastriya Swatantra Party Ahead of Nepal Polls

Kathmandu Mayor Balendra Shah allies with Rastriya Swatantra Party, led by Rabi Lamichhane, to chall

Australia launches review of law enforcement after Bondi shooting

Australia begins an independent review of law enforcement actions and laws after the Bondi mass shoo

Akshaye Khanna exits Drishyam 3; Jaideep Ahlawat steps in fast

Producer confirms Jaideep Ahlawat replaces Akshaye Khanna in Drishyam 3 after actor’s sudden exit ov