You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Long-term investing is fundamentally different from short-term trading, where prices react to daily news flow, global cues, and market sentiment. Wealth creation over extended periods is driven by owning fundamentally strong businesses that are aligned with long-term economic and sectoral trends. The stock ideas suggested by Nirmal Bang reflect this approach, focusing on companies that combine improving fundamentals with favourable industry dynamics.

India is currently moving through a multi-year growth phase shaped by manufacturing expansion, large-scale infrastructure development, rapid digital adoption, and rising consumer demand. These trends are structural in nature and are expected to play out over several years rather than a few quarters. Investors who remain invested through market cycles often benefit from compounding, where steady earnings growth translates into sustained value creation.

Another important aspect of these recommendations is balance. The list spans cyclical and defensive sectors, public and private companies, traditional manufacturing leaders, and new-age businesses. This diversity helps reduce concentration risk while ensuring exposure to multiple growth engines within the Indian economy.

Sequent Scientific operates in pharmaceutical and animal healthcare segments, both of which are witnessing consistent demand growth. Increasing awareness around livestock health, a stronger focus on food security, and the expansion of veterinary infrastructure are long-term structural drivers supporting this space.

The company has been strengthening its product portfolio while expanding its international footprint. Since animal healthcare tends to be less cyclical than many other industries, Sequent Scientific offers a blend of stability and growth. Over the long term, steady demand and improving operational efficiency could support meaningful shareholder returns.

Container Corporation of India plays a crucial role in India’s logistics ecosystem by managing containerized freight movement across rail and port networks. As trade volumes rise and supply chains modernize, logistics efficiency becomes central to economic competitiveness.

India’s emphasis on lowering logistics costs and upgrading freight infrastructure directly benefits organized players like Concor. Over time, higher cargo volumes, improved asset utilization, and policy support could drive consistent earnings growth, making it a steady long-term compounder.

One 97 Communications, the parent company of Paytm, sits at the core of India’s digital payments ecosystem. With millions of consumers and merchants on its platform, it has built a broad digital network spanning payments, lending, and financial services.

As digital adoption deepens and monetization improves, platform-based businesses can unlock operating leverage. While volatility is common in new-age companies, long-term investors may benefit as scale, efficiency, and diversified revenue streams gradually stabilize earnings.

SRF operates across specialty chemicals, fluorochemicals, and packaging films. These segments cater to both domestic consumption and export markets, providing diversified revenue streams and reducing dependence on a single business cycle.

SRF’s ability to adapt to changing market conditions and invest consistently in capacity expansion positions it well for sustained growth. As global manufacturing activity increases, demand for specialty chemicals and packaging solutions is expected to remain strong.

Birlasoft provides IT services focused on enterprise digital transformation. As companies worldwide modernize their operations and migrate to digital platforms, demand for specialized IT solutions continues to rise.

India’s IT sector remains globally competitive due to its skilled talent base and cost efficiency. Birlasoft’s focus on niche enterprise solutions could help it secure long-term contracts, supporting revenue visibility and margin stability over time.

Bharat Forge is a leading player in forgings and advanced engineering solutions, catering to automotive, industrial, and defence sectors. The company benefits from both domestic manufacturing growth and a strong export presence.

India’s push toward defence indigenization and rising global demand for precision engineering components strengthen Bharat Forge’s long-term outlook. As manufacturing shifts toward higher-value products, the company stands to gain from improved margins and stronger order inflows.

NBCC is closely associated with government-led infrastructure and redevelopment projects. With increasing focus on urban renewal and public infrastructure spending, the company’s order book visibility remains healthy.

Infrastructure stocks often reward investors gradually as projects move from award to execution. As NBCC improves project delivery and monetization, long-term investors could benefit from steady revenue recognition and earnings expansion.

Bank of Baroda is among India’s largest public sector banks, with a wide domestic and international presence. The overall health of the banking sector has improved significantly, supported by better asset quality and stronger capital adequacy.

As credit growth accelerates alongside economic expansion, large banks with diversified loan books stand to benefit. Bank of Baroda’s scale, reach, and improving operational efficiency make it a strong candidate for long-term portfolio inclusion.

R R Kabel operates in the wires and cables segment, supplying products to residential, commercial, and infrastructure projects. Urbanization and housing development remain long-term demand drivers for this industry.

As electrification, smart housing, and infrastructure development continue across India, demand for quality electrical products is expected to rise. R R Kabel’s established brand and distribution network support sustained growth potential.

Bajaj Auto is a leading two- and three-wheeler manufacturer with a strong domestic as well as export footprint. Its focus on innovation, cost efficiency, and product diversification has helped it navigate industry cycles effectively.

With rising mobility needs, improving rural demand, and expanding export opportunities, Bajaj Auto remains well-positioned for long-term growth. Its strong balance sheet and consistent cash flows add to its appeal for patient investors.

Long-term success is driven by investing in companies with durable business models, capable management, and consistent cash generation. Short-term price volatility should not overshadow long-term fundamentals.

This list spans multiple sectors, helping investors reduce reliance on any single industry cycle. Diversification enhances risk-adjusted returns over extended investment horizons.

Compounding works best when investments are given sufficient time. Market volatility is inevitable, but disciplined investing aligned with long-term goals often delivers superior outcomes.

Nirmal Bang’s long-term stock picks—from Bharat Forge and Bank of Baroda to Bajaj Auto and emerging sector leaders—highlight opportunities across India’s evolving economic landscape. While short-term market movements may remain unpredictable, businesses aligned with structural growth themes have the potential to generate meaningful returns over time.

For investors with patience, discipline, and a long-term horizon, these stocks represent more than tactical ideas—they form the foundation of sustainable wealth creation in the years ahead.

Disclaimer:

This article is for informational purposes only and does not constitute investment advice. Stock markets are subject to risk, and past performance does not guarantee future results. Readers should conduct their own research or consult a qualified financial advisor before making any investment decisions.

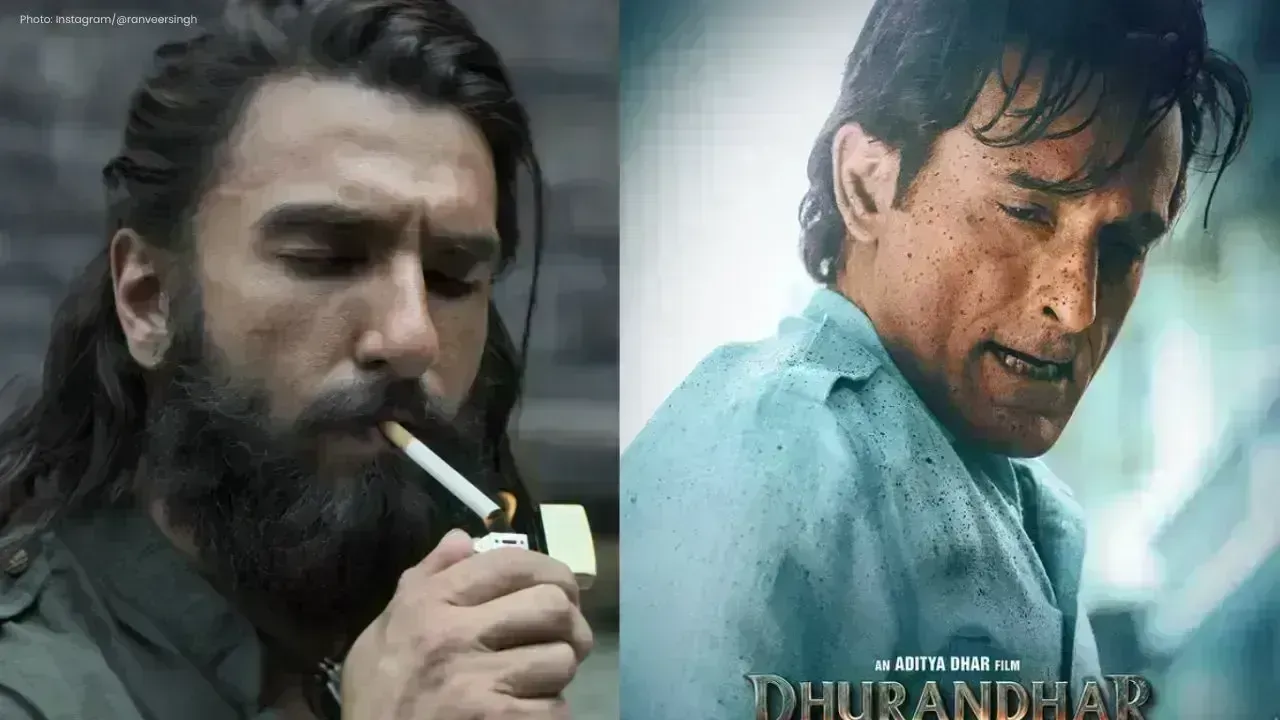

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex

Balendra Shah Joins Rastriya Swatantra Party Ahead of Nepal Polls

Kathmandu Mayor Balendra Shah allies with Rastriya Swatantra Party, led by Rabi Lamichhane, to chall

Australia launches review of law enforcement after Bondi shooting

Australia begins an independent review of law enforcement actions and laws after the Bondi mass shoo

Akshaye Khanna exits Drishyam 3; Jaideep Ahlawat steps in fast

Producer confirms Jaideep Ahlawat replaces Akshaye Khanna in Drishyam 3 after actor’s sudden exit ov

Kapil Sharma’s Kis Kisko Pyaar Karoon 2 to Re-release in January 2026

After limited screens affected its run, Kapil Sharma’s comedy film Kis Kisko Pyaar Karoon 2 will ret