You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Saif Rahman

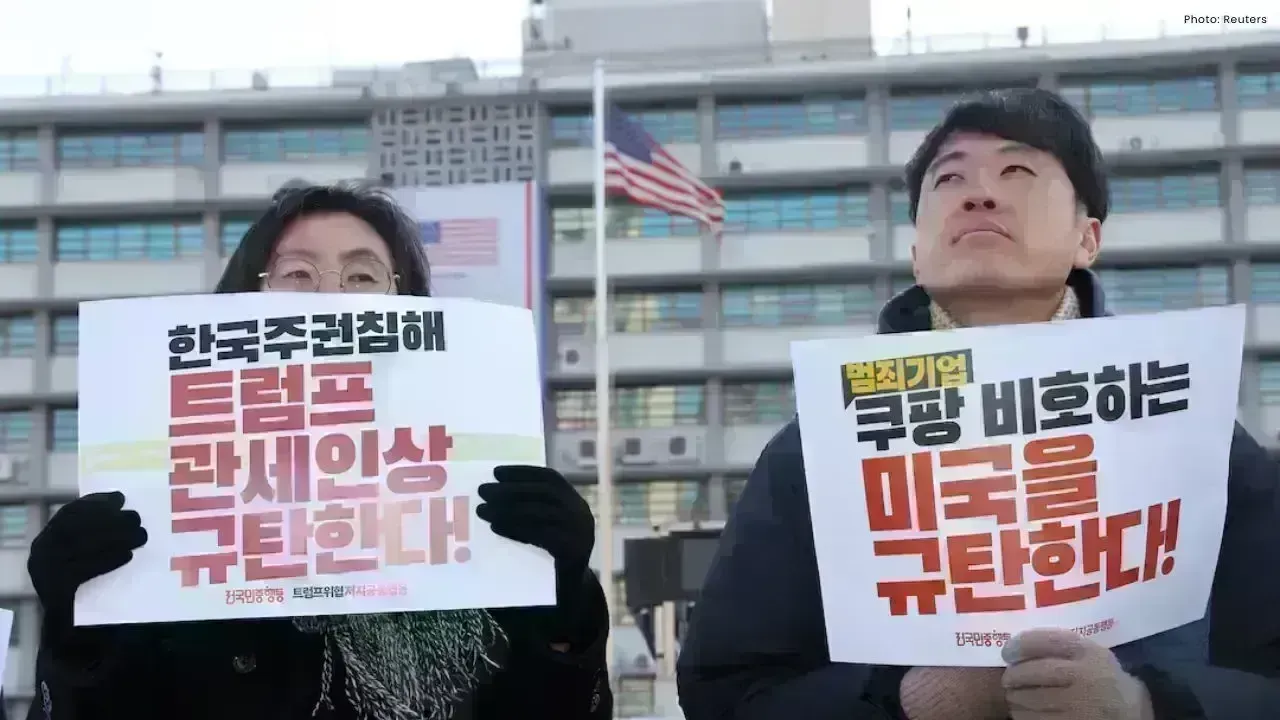

President Donald Trump has implemented a significant increase in tariffs on imports from South Korea, heightening tensions in a critical trade and security partnership for the U.S. The change is attributed to delays in a trade agreement reached last year, with Trump placing the blame on South Korea's legislature for its inaction.

With the new directive, tariffs on South Korean automobiles, lumber, pharmaceuticals, and various goods will surge from 15% to 25%. Trump justified this adjustment by pointing out that the South Korean parliament had failed to endorse the terms of the agreement brokered in July 2025, which was reconfirmed during his South Korea visit later that year. He labeled the arrangement as equitable for both nations, but insisted that the lack of movement left him no alternative.

This tariff increase caught officials in Seoul off-guard. The South Korean presidential office indicated it had not received formal notification from Washington and is now urgently assessing the situation. This announcement arrives at a challenging time for South Korea, which is grappling with a weakening currency, declining exports, and growing uncertainties about global trade regulations under Trump's ongoing presidency.

The previous year's agreement aimed to mitigate trade friction between the two allies. In exchange for reduced U.S. tariffs on South Korean exports, Seoul pledged $350 billion in investments in the United States, targeting vital strategic sectors. Of this total, $200 billion was to be disbursed over time, with annual caps to prevent adverse impacts on South Korea's currency. Nevertheless, political delays and economic challenges have impeded progress, leading to frustrations in Washington.

Trump's latest action may also relate to recent regulatory actions by South Korea against Coupang, a U.S.-listed e-commerce platform. Concerns have been raised by U.S. officials and companies regarding perceived inequities in regulations affecting American tech firms. Trade discussions have similarly addressed these kinds of non-tariff barriers, which remain a contentious topic.

Market responses signaled unease. Initially, South Korea's primary stock index dipped before recovering, while the won depreciated against the dollar. Shares of prominent automakers Hyundai and Kia plummeted briefly before making a slight recovery. These firms heavily rely on the U.S. market, where auto exports constitute about 25% of South Korea's overall trade. Any sustained rise in tariffs could substantially harm both profitability and employment.

The United States ranks as South Korea's second-largest export market after China. In 2025, exports from South Korea to the U.S. decreased by almost 4%, despite a record-high in total exports. Auto exports to the U.S. fell more than 13%, demonstrating that the sector was already experiencing strain before the new tariff implementation.

South Korean officials now face a challenging task. They must act swiftly to reassure stakeholders, collaborate with parliament to advance the investment initiative, and preserve strong relations with Washington, crucial for both trade and national security. The government has indicated that its industry minister will be traveling to the U.S. for discussions with American representatives.

From an editorial perspective, Trump’s decision underscores his typical approach of using tariffs to expedite action from trading partners. While such pressure may yield immediate results, it also fosters uncertainty and strains alliances. Abrupt changes in tariffs can destabilize markets, erode trust, and complicate long-term planning for businesses across both borders.

For South Korea, the indication is clear: delays come with repercussions in today’s aggressive trade climate. For the U.S., the challenge lies in harmonizing firm negotiations with stability and predictability. Strong partnerships rely not solely on pressure but also on effective communication and mutual respect.

As global markets observe closely, the resolution of this dispute will determine whether 2026 ushers in intensified trade conflicts or a reinstatement of steady collaboration. One thing is evident: tariffs are again reshaping both economic and political relationships extending beyond mere trade figures.

Study Warns Using AI for Medical Advice Is ‘Dangerous’ as Users Get Inaccurate Health Guidance

A major new study reveals that artificial intelligence (AI) chatbots and tools may give misleading o

Top Sci-Fi Movies Streaming on Netflix This February: Must-Watch Picks for Genre Fans

A curated news-style guide to the best science fiction films currently available on Netflix in Febru

BCCI Central Contracts Shake-Up: Kohli, Rohit Moved to Grade B as Board Reshapes 2025–26 List

Virat Kohli and Rohit Sharma have been placed in Grade B in the BCCI’s 2025–26 central contract list

Dalal Street Spotlight: Top 10 Stocks Investors Are Watching as Markets Open on a High

Indian stock markets begin the week with strong momentum, and several blue-chip and mid-cap stocks a

Market Movers Today: Key Stocks Set To Watch In Indian Markets

Indian equity markets are poised for active trading as several major companies, including Bharti Air

Milan Welcomes the World: Inside the Grand Opening Ceremony of the 2026 Winter Olympics

The 2026 Winter Olympics opening ceremony in Milan marked a defining moment for global sport, blendi