You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Badri Ariffin

LONDON – The UK government gears up to present a critical budget this Wednesday, focusing on curbing inflation, minimizing debt, and revitalizing a languid economy. With a year since Labour's sweeping electoral victory, the expected economic revival has yet to surface, causing unease among both citizens and commerce.

Despite attempts to stabilize the fiscal landscape, inflation is persistently high and borrowing continues to surge. Experts caution that the administration has limited flexibility, depending primarily on tax increases to bridge financial gaps instead of unpopular cuts to spending, particularly among Labour members.

Economic Challenges and Growing Debt

The UK's economy, which consistently underachieves compared to historical norms, is entangled in numerous challenges. The aftermath of the COVID-19 pandemic, trade disruptions from Brexit, and global pressures like the Russia-Ukraine conflict and tariffs have culminated in weak economic growth. Current debt levels hover around 95% of national income, accruing over £100 billion yearly in interest payments alone.

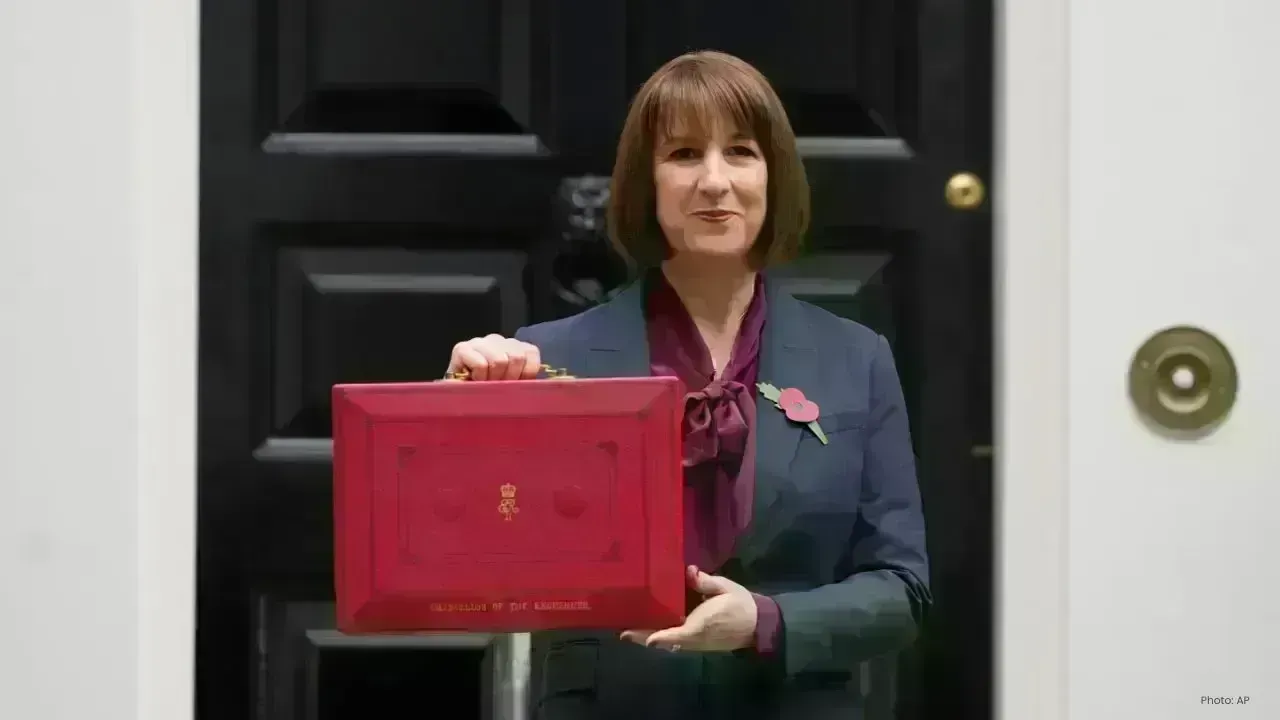

Labour’s Treasury chief, Rachel Reeves, is set to reveal various revenue-boosting strategies. Proposed measures include levying taxes on high-value properties, introducing pay-per-mile fees for electric vehicles, and potentially adjusting corporate and employee tax rates. Concurrently, the government intends to implement targeted relief strategies such as above-inflation pension increases and freezing train fares to mitigate public backlash.

Increased Political Pressures

This budget comes at a time of heightened anxiety within the Labour Party. Prime Minister Keir Starmer, previously lauded for his electoral success, is now encountering concerns from party members regarding stagnant public support and persistently low polling figures. Some analysts caution that an ill-conceived budget could significantly harm the party's credibility, even though elections aren't mandated until 2029.

The government's challenge is evident: implementing tax increases may stabilize financial markets but risks alienating voters, while restraining tax hikes could reflect fiscal fragility and discourage investors. The upcoming budget represents a pivotal juncture for Labour’s economic trustworthiness and future political prospects.

Study Warns Using AI for Medical Advice Is ‘Dangerous’ as Users Get Inaccurate Health Guidance

A major new study reveals that artificial intelligence (AI) chatbots and tools may give misleading o

Top Sci-Fi Movies Streaming on Netflix This February: Must-Watch Picks for Genre Fans

A curated news-style guide to the best science fiction films currently available on Netflix in Febru

BCCI Central Contracts Shake-Up: Kohli, Rohit Moved to Grade B as Board Reshapes 2025–26 List

Virat Kohli and Rohit Sharma have been placed in Grade B in the BCCI’s 2025–26 central contract list

Dalal Street Spotlight: Top 10 Stocks Investors Are Watching as Markets Open on a High

Indian stock markets begin the week with strong momentum, and several blue-chip and mid-cap stocks a

Market Movers Today: Key Stocks Set To Watch In Indian Markets

Indian equity markets are poised for active trading as several major companies, including Bharti Air

Milan Welcomes the World: Inside the Grand Opening Ceremony of the 2026 Winter Olympics

The 2026 Winter Olympics opening ceremony in Milan marked a defining moment for global sport, blendi