You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Indian stock markets entered a phase of heightened volatility as benchmark indices recorded a steep fall, unsettling investors who had grown accustomed to relative stability. The Sensex and Nifty, often seen as barometers of economic confidence, declined sharply amid growing global uncertainty. The fall was not confined to a single sector or theme but reflected a broad reassessment of risk as geopolitical developments abroad began to cast long shadows over domestic markets.

The selloff highlighted how interconnected modern financial systems have become. Events unfolding thousands of kilometres away can quickly influence sentiment on Dalal Street. For market participants, the session served as a reminder that while domestic fundamentals may remain resilient, external risks can still dominate short-term market direction.

Markets opened on a cautious note, tracking weak cues from global peers. Asian markets were already trading lower, and this nervousness spilled over into Indian equities. Selling pressure intensified soon after the opening bell as investors reacted to overnight developments in global politics and trade relations.

Large-cap stocks bore the brunt of early selling, dragging benchmark indices lower. As losses deepened, sentiment weakened further, prompting additional selling across sectors. By mid-session, it was clear that the market was headed for a decisively negative close.

By the end of the trading session, both the Sensex and Nifty had fallen by more than one per cent. The magnitude of the decline was significant not only in percentage terms but also in absolute value, with a substantial portion of market capitalisation wiped out in a single day. The breadth of the market was clearly negative, with a majority of stocks ending in the red.

This kind of broad-based decline typically signals a risk-off environment, where investors prioritise capital preservation over returns. The closing figures reflected a decisive shift in sentiment, with buyers largely stepping aside as uncertainty dominated trading decisions.

At the heart of the market’s decline were escalating geopolitical concerns that unsettled investors worldwide. Renewed tensions between major global powers raised fears of economic disruption, trade barriers, and slower global growth. Such developments often prompt investors to reduce exposure to equities, particularly in emerging markets perceived as more vulnerable to global shocks.

For Indian markets, these concerns translated into heightened caution. Even though the issues originated outside the country, their potential impact on trade, capital flows, and economic stability was enough to trigger widespread selling.

Uncertainty around global trade policies added another layer of concern. Any disruption to international trade can affect export-oriented sectors, supply chains, and corporate profitability. Investors, anticipating potential headwinds, chose to pare back positions in sectors sensitive to global demand and currency movements.

This cautious approach was evident in the sharp declines seen in sectors such as information technology and metals, which are closely linked to global economic conditions. The fear was not of immediate impact alone, but of prolonged uncertainty that could weigh on earnings visibility.

Indian equities do not operate in isolation, and the day’s trading reflected this reality. Major global markets had already shown signs of stress, with investors reacting negatively to geopolitical headlines. The weakness in overseas indices set the tone for domestic markets, reinforcing a negative feedback loop.

When global markets turn volatile, foreign investors often adopt a conservative stance, reallocating funds to safer assets. This shift in global asset allocation can have immediate consequences for markets like India, which rely significantly on foreign capital inflows.

As equities declined, investors gravitated towards traditional safe-haven assets. Demand for assets perceived as stable during times of uncertainty increased, underscoring the defensive mindset prevailing in financial markets. This rotation away from riskier assets further drained liquidity from equity markets, exacerbating the fall in stock prices.

Such movements are typical during periods of geopolitical stress, as investors seek to shield portfolios from unpredictable swings. The resulting reduction in risk appetite often leads to sharp, short-term corrections in equity markets.

One of the most significant contributors to the market decline was continued selling by foreign institutional investors. These investors play a crucial role in determining market direction, and their sustained outflows added considerable pressure to benchmark indices.

Foreign investors tend to react swiftly to global developments, adjusting portfolios to reflect changing risk perceptions. In times of geopolitical uncertainty, emerging markets often see accelerated outflows as funds move to perceived safer destinations.

The withdrawal of foreign capital affects market liquidity, making it harder for prices to stabilise during selloffs. Reduced liquidity can amplify price movements, leading to sharper declines than would otherwise occur. It also impacts valuations, as fewer buyers are willing to step in at prevailing levels.

For domestic investors, foreign selling often acts as a signal to adopt a cautious stance. The combination of lower liquidity and negative sentiment can create a self-reinforcing cycle of declines, as seen during the session.

Technology stocks were among the worst performers, reflecting concerns about global demand and currency fluctuations. Given their reliance on overseas clients, IT companies are particularly sensitive to global economic signals. Weakness in this sector had a pronounced impact on the indices due to the heavy weight of IT stocks.

Financial stocks also faced selling pressure, as worries about global instability raised questions about capital flows and credit growth. Banking and financial services stocks, often seen as proxies for economic health, declined as investors reassessed growth prospects.

Other sectors were not spared. Auto stocks fell amid concerns about demand and rising costs, while realty stocks declined on fears of tighter financial conditions. Consumer-facing sectors also witnessed selling, as broader market weakness overshadowed otherwise stable domestic consumption trends.

The widespread nature of the decline underscored that the selloff was driven by macro-level concerns rather than sector-specific issues. This kind of environment leaves few safe pockets within the equity market.

Alongside global factors, domestic considerations also influenced sentiment. Investors remained cautious about corporate earnings, with some recent results failing to meet expectations. Earnings uncertainty can magnify the impact of external shocks, as investors have fewer positive catalysts to counterbalance negative news.

When earnings visibility is limited, markets become more sensitive to global developments. Even fundamentally strong companies can see their stock prices decline if overall sentiment turns negative.

Movements in the domestic currency added another layer of complexity. A weaker currency can raise input costs for companies and affect profitability, particularly for those dependent on imports. Currency volatility often heightens investor caution, as it introduces additional uncertainty into the economic outlook.

These domestic factors, combined with global risks, created a challenging environment for equities, making it difficult for markets to find support during the session.

From a technical perspective, the market’s fall was exacerbated by the breach of key support levels on benchmark indices. Such breaches often trigger automated selling by traders and algorithms, accelerating downward momentum.

Once these technical thresholds are crossed, selling can become more intense, as short-term traders seek to limit losses or capitalise on falling prices. This dynamic was evident as losses deepened during the session.

Market volatility increased significantly, reflecting heightened uncertainty and rapid price movements. Elevated volatility often discourages long-term investors from entering the market, further reducing buying interest. In such conditions, even small negative triggers can lead to outsized reactions.

The rise in volatility served as both a symptom and a cause of the market decline, reinforcing the cautious stance adopted by investors.

In the near term, market direction is likely to remain influenced by global developments. Geopolitical news flow, movements in global markets, and foreign investor behaviour will continue to shape sentiment. Until there is greater clarity on these fronts, volatility is expected to persist.

Investors may prefer to adopt a defensive approach, focusing on capital preservation and avoiding excessive exposure to high-risk segments. Prudence and patience are likely to be key virtues in such an environment.

Despite short-term turbulence, long-term investors may view sharp corrections as part of the natural market cycle. Historically, periods of heightened uncertainty have often been followed by recovery once risks subside. For investors with a longer horizon, maintaining focus on fundamentals can help navigate temporary volatility.

The challenge lies in distinguishing between short-term noise and long-term structural trends. While geopolitical risks can cause sudden market swings, underlying economic resilience can support recovery over time.

The sharp fall in the Sensex and Nifty serves as a clear illustration of how interconnected global and domestic factors shape market outcomes. Geopolitical tensions, global market cues, foreign investor behaviour, and domestic fundamentals all converged to produce a challenging trading session.

For investors, the episode reinforces the importance of diversification, risk management, and staying informed about global developments. Markets may recover, but uncertainty remains an inherent feature of investing.

As markets move forward, attention will remain focused on geopolitical developments and their potential economic implications. While volatility may persist, informed decision-making and a balanced approach can help investors navigate uncertain terrain with greater confidence.

Disclaimer:

This article is intended for informational purposes only and does not constitute financial advice. Market conditions can change rapidly, and readers should evaluate their own financial situations or consult qualified professionals before making investment decisions.

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting

Japan Snap Election Sparks Bond Surge Amid Finance Concerns

Japan’s PM calls early election to back reflation plan. Bond yields hit decades-high as voters weigh

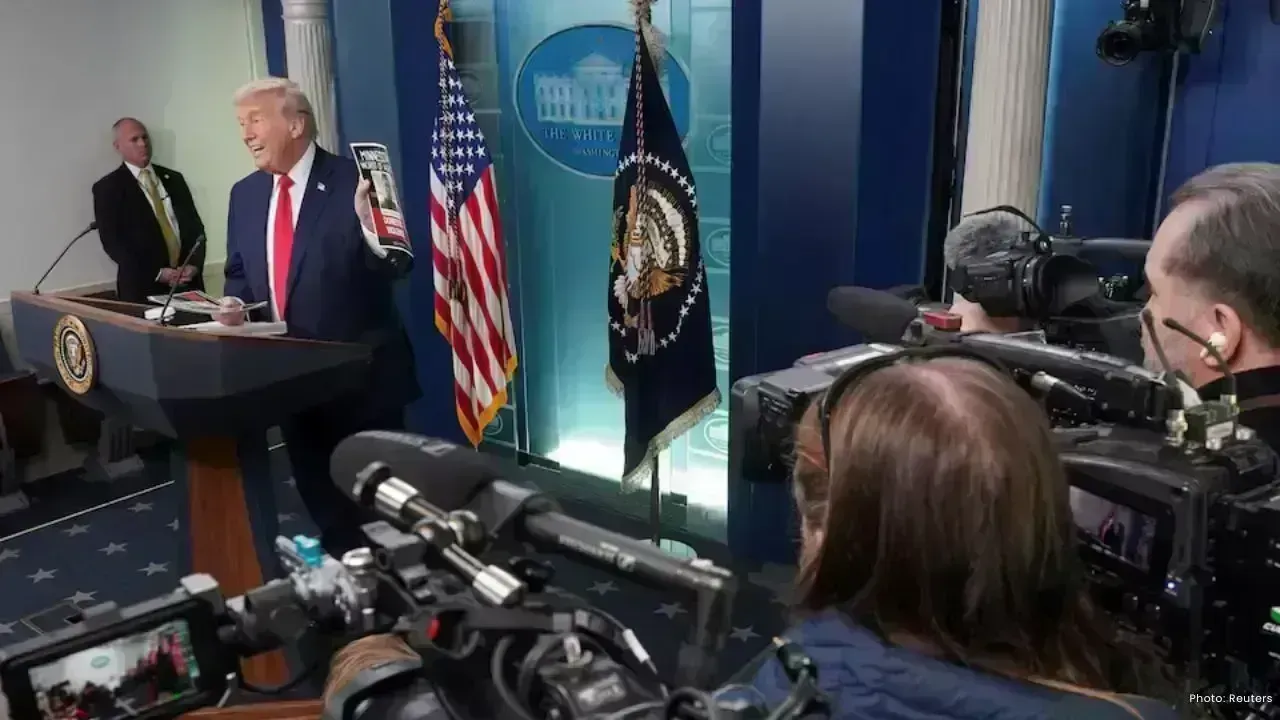

Trump Threatens Huge Tariffs on French Wine Over Peace Board Snub

Donald Trump warned of 200% tariffs on French wine after France rejected his Peace Board plan and mo

Prince Harry, Elton John Sue UK Tabloids Over Privacy Breaches

Prince Harry and Elton John accuse UK tabloids of phone hacking and stealing private info, calling i

Minnesota Man Says ICE Broke In, Handcuffed Him, Dragged Him Into Snow

A U.S. citizen in Minnesota says ICE officers broke down his door, handcuffed him in shorts and Croc