You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Revolutionizing your financial future doesn’t have to involve drastic sacrifices or sweeping lifestyle changes. In truth, the most substantial enhancements come from small, consistent adjustments over time. These habits alleviate financial stress, boost savings, and allow for long-term security, all without the need for stringent restrictions. This guide highlights practical modifications anyone can initiate today to attain better financial management and stability for the future.

Many individuals postpone financial planning, assuming it requires a hefty income, strict budgets, or significant investments. However, minor daily decisions—such as where to store your cash, your spending habits, and what to automate—play a critical role in building long-term wealth.

They’re simple to maintain, require less willpower, and foster robust habits over time. Even slight modifications can lead to significant outcomes over the years.

Automation guarantees that funds are allocated to the right areas before you can spend them.

Set up monthly automatic transfers, designating a portion for savings, investments, and emergency funds. Create digital “buckets” for objectives such as travel, education, or home acquisition.

This single habit assures steady progress without requiring manual input.

Many individuals leave their funds in ordinary savings accounts that yield minimal interest.

Higher interest helps shield your money from inflation and maximizes passive income. It ensures better growth without additional risk.

Transferring your savings alone can significantly elevate your long-term wealth without altering your spending habits.

Financial stability begins with awareness. No need for complex budgeting tools or detailed spreadsheets.

Review your expenses from the past week. Pinpoint any unnecessary expenditures. Make adjustments in one spending category at a time.

Minor corrections will help keep you on track without feeling overwhelmed.

Recurring charges quietly drain your finances.

Unused subscriptions. Unnecessary premium services. App auto-renewals. Overpriced delivery services.

A single monthly reduction yields long-term savings without impacting your lifestyle.

A robust safety net guards against debt, anxiety, and financial instability.

Tier one: Basic emergency funds in a savings account.

Tier two: Additional backup in a liquid mutual fund.

Tier three: Short-term fixed deposits to ensure stability.

This plan protects you during job losses, health crises, or unexpected costs.

Many never negotiate prices, although companies often allow flexibility.

Internet service fees, credit card charges, insurance costs, rental negotiations, and EMIs.

A simple phone call can substantially lower your monthly expenses.

Your credit score influences loans, home purchases, credit limits, and interest rates.

Pay bills before deadlines. Keep credit usage low. Keep older accounts active.

These practices safeguard your score and can save thousands in future interest.

Most unnecessary expenses arise from unplanned purchases.

Implement a 24-hour rule for non-essential buys. Remove saved payment info from apps. Curate a monthly list of essential purchases.

These measures mitigate emotional spending and promote discipline.

Delaying for the “perfect moment” stifles financial growth.

Systematic Investment Plans (SIPs). Recurring deposits. Government- backed programs. Low-risk short-term funds.

Small, regular investments accumulate over time and instill financial confidence.

Financial growth requires monitoring rather than perfection.

Progress in savings, spending leaks, debt clearance, and investment success.

A quarterly evaluation keeps you aligned with your objectives and encourages ongoing improvement.

Transforming your financial landscape doesn’t necessitate stringent discipline or massive life changes. Steadily incorporating simple practices—automating savings, tracking expenses, minimizing waste, and making conscious decisions—fosters enduring financial stability. The sooner you adopt these habits, the more manageable it becomes to forge a future with less anxiety, greater savings, and enhanced opportunities.

This article serves as general financial information and is not intended as professional guidance. Individual financial circumstances vary, and these strategies may not suit everyone. Consider consulting a certified financial advisor or conducting your own research before making significant financial decisions. The author holds no responsibility for any financial choices made based on this content.

Kim Jong Un Celebrates New Year in Pyongyang with Daughter Ju Ae

Kim Jong Un celebrates New Year in Pyongyang with fireworks, patriotic shows, and his daughter Ju Ae

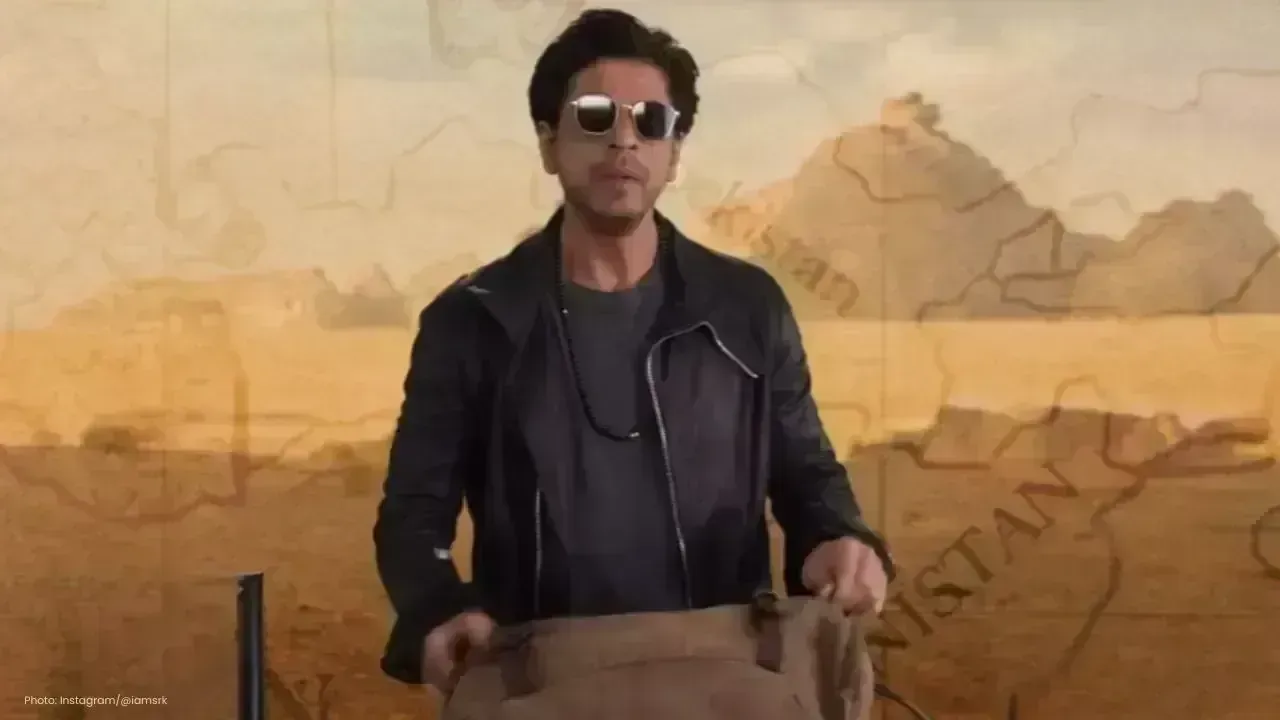

Dhurandhar Day 27 Box Office: Ranveer Singh’s Spy Thriller Soars Big

Dhurandhar earns ₹1117 crore worldwide by day 27, becoming one of 2026’s biggest hits. Ranveer Singh

Hong Kong Welcomes 2026 Without Fireworks After Deadly Fire

Hong Kong rang in 2026 without fireworks for the first time in years, choosing light shows and music

Ranveer Singh’s Dhurandhar Hits ₹1000 Cr Despite Gulf Ban Loss

Dhurandhar crosses ₹1000 crore globally but loses $10M as Gulf nations ban the film. Fans in holiday

China Claims India-Pakistan Peace Role Amid India’s Firm Denial

China claims to have mediated peace between India and Pakistan, but India rejects third-party involv

Mel Gibson and Rosalind Ross Split After Nearly a Decade Together

Mel Gibson and Rosalind Ross confirm split after nearly a year. They will continue co-parenting thei