You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The pace at which technology creates wealth has never been faster. In previous decades, fortunes were built over generations through manufacturing, real estate, or traditional finance. Today, entire industries can be disrupted within a few years, enabling individuals and small teams to build multi-million-dollar businesses at unprecedented speed. By 2026, this acceleration is expected to intensify as several cutting-edge technologies move from early adoption into mass deployment.

What separates these technologies from short-lived trends is their ability to solve large-scale problems, scale globally, and integrate deeply into existing economic systems. The following ten technologies stand out not because they are flashy, but because they offer real pathways to value creation, ownership, and monetization.

Autonomous AI agents are rapidly evolving from experimental tools into full-fledged digital workers. Unlike traditional software, these agents can plan tasks, make decisions, coordinate with other systems, and execute goals without continuous human supervision.

In 2026, entrepreneurs who build, customize, or deploy autonomous AI agents for specific industries—such as finance, legal research, logistics, marketing, or healthcare administration—are likely to see significant financial upside. Companies are willing to pay premium prices for systems that reduce labor costs while improving efficiency. Those who own niche agent platforms or vertical-specific AI solutions stand to benefit the most.

While much attention goes to AI applications, the real wealth often accumulates at the infrastructure level. Technologies focused on model optimization, inference efficiency, deployment frameworks, and AI orchestration are becoming essential as enterprises scale their AI usage.

In 2026, startups and individuals offering tools that reduce compute costs, improve performance, or simplify AI deployment will be in high demand. These solutions generate recurring revenue and are often acquired by larger technology firms, creating lucrative exit opportunities.

Generic software markets are saturated, but vertical SaaS platforms tailored to specific industries are booming. When combined with AI, these platforms can automate workflows that were previously manual, error-prone, and expensive.

Examples include AI-driven software for construction planning, legal case analysis, medical billing, supply chain forecasting, or agricultural optimization. Founders who deeply understand an industry’s pain points and embed AI directly into core processes are well positioned to create high-margin, defensible businesses by 2026.

Healthcare is undergoing a shift from reactive treatment to proactive and personalized care. Technologies that analyze individual health data to predict risks, optimize lifestyle choices, or guide early interventions are gaining traction.

In 2026, companies and individuals developing platforms for personalized diagnostics, preventive analytics, or remote health monitoring could see massive adoption. Wealth creation in this space often comes from subscription models, enterprise healthcare contracts, or data-driven insights licensed to insurers and research institutions.

Robotics is no longer limited to large factories. Advances in affordability, flexibility, and AI integration are making robots viable for small and medium businesses. These robots can handle tasks such as inventory management, food preparation, cleaning, packaging, and last-mile logistics.

Entrepreneurs who design, lease, or service robotic solutions tailored to small businesses may unlock scalable revenue streams. In 2026, the biggest winners will not be those building general-purpose robots, but those offering specialized, task-focused robotic systems with clear return on investment.

As energy costs rise and sustainability becomes a priority, technologies that optimize energy usage are becoming financially attractive. Decentralized power systems, smart grids, and AI-driven energy management platforms allow businesses and households to reduce costs and increase resilience.

Millionaire-making opportunities in 2026 will emerge for those who develop software, hardware, or hybrid solutions that help organizations manage energy intelligently. Long-term contracts, infrastructure partnerships, and government incentives make this sector particularly lucrative.

Content creation is being transformed by synthetic media technologies that can generate video, audio, images, and interactive experiences at scale. While basic tools are becoming commoditized, advanced platforms that offer customization, brand safety, localization, and workflow integration remain valuable.

In 2026, individuals and companies who control proprietary synthetic media pipelines or specialized creative platforms can monetize through licensing, enterprise subscriptions, and white-label solutions. The key lies in differentiation, not volume.

As systems become more autonomous, security risks increase. Traditional cybersecurity approaches are insufficient for AI-driven environments that make independent decisions. This gap creates opportunities for technologies focused on securing AI models, data pipelines, and autonomous agents.

By 2026, cybersecurity solutions that address AI-specific threats—such as model manipulation, data poisoning, and decision hijacking—will command premium valuations. Specialists in this area are likely to see both high salaries and strong entrepreneurial outcomes.

Financial systems are becoming increasingly complex, with regulations, cross-border transactions, and digital assets adding layers of friction. Technologies that automate compliance, risk management, and financial operations are in high demand.

In 2026, fintech platforms that simplify complex financial workflows using AI and automation will attract enterprise clients and investors alike. Wealth creation here often comes from transaction-based revenue, enterprise licensing, or strategic acquisitions by larger financial institutions.

Education is shifting away from traditional credentials toward skills that can be directly monetized. Platforms that help individuals acquire, validate, and sell high-value skills are becoming powerful economic engines.

In 2026, education technologies that combine AI-driven personalization with clear career outcomes are likely to generate substantial wealth. This includes platforms focused on reskilling, professional certification, and creator-led learning ecosystems where knowledge itself becomes a product.

Across all ten technologies, several common factors determine whether they lead to wealth creation:

Scalability is critical. Technologies that can serve global markets without proportional increases in cost offer the highest upside. Ownership also matters; those who control platforms, data, or intellectual property capture more value than those who simply provide services.

Timing plays a decisive role. Entering too early can be risky, while entering too late limits growth potential. The technologies listed here are approaching inflection points where adoption accelerates, making 2026 a particularly important year.

While large corporations will dominate some segments, individuals and small teams still have enormous opportunities. The most successful technology millionaires are often those who identify narrow problems, build focused solutions, and scale efficiently rather than trying to compete directly with giants.

The barrier to entry has lowered dramatically. Cloud infrastructure, open-source tools, and global distribution channels enable individuals to build sophisticated products with limited capital. What matters more than resources is insight, execution, and adaptability.

Not every cutting-edge technology guarantees success. Markets shift, regulations change, and competition intensifies quickly. Sustainable wealth in 2026 will favor those who focus on real value creation rather than hype.

Understanding customer needs, building defensible advantages, and maintaining ethical practices will separate lasting success from short-term gains. Technology amplifies outcomes, but fundamentals still apply.

By 2026, many of these technologies will transition from experimentation to widespread adoption. This phase often produces the greatest wealth opportunities, as demand surges and valuation multiples expand. Those positioned early, with refined products and clear market fit, stand to benefit disproportionately.

The window will not remain open indefinitely. As markets mature, competition increases and margins compress. The next two years represent a critical period for builders, investors, and professionals seeking to capitalize on technological transformation.

The technologies most likely to create millionaires in 2026 are not speculative fantasies. They are grounded in real problems, measurable value, and accelerating adoption. Success will come to those who combine technical understanding with strategic thinking and long-term vision.

Technology does not create wealth automatically. It creates opportunity. The difference between those who benefit and those who watch from the sidelines lies in execution, timing, and the willingness to build rather than wait.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Outcomes depend on market conditions, execution, and individual circumstances.

Japan Says Farewell to Last Giant Pandas Amid Rising China Tensions

Thousands bid goodbye to Japan’s last giant pandas before their return to China, as diplomatic tensi

Doctor Tried to Save Man Shot by Immigration Agents in Minneapolis

A doctor tried to revive Alex Pretti after immigration agents shot him, but was initially stopped. T

Minneapolis Tension After U.S. Citizen Shot by Federal Immigration Agents

A U.S. citizen was fatally shot by immigration agents in Minneapolis. Officials cite self-defense, b

Devotees Flock to Khao Khitchakut for 2026 Buddha Footprint Pilgrimage

Hundreds visit Khao Khitchakut National Park to pray at the sacred Buddha footprint for blessings an

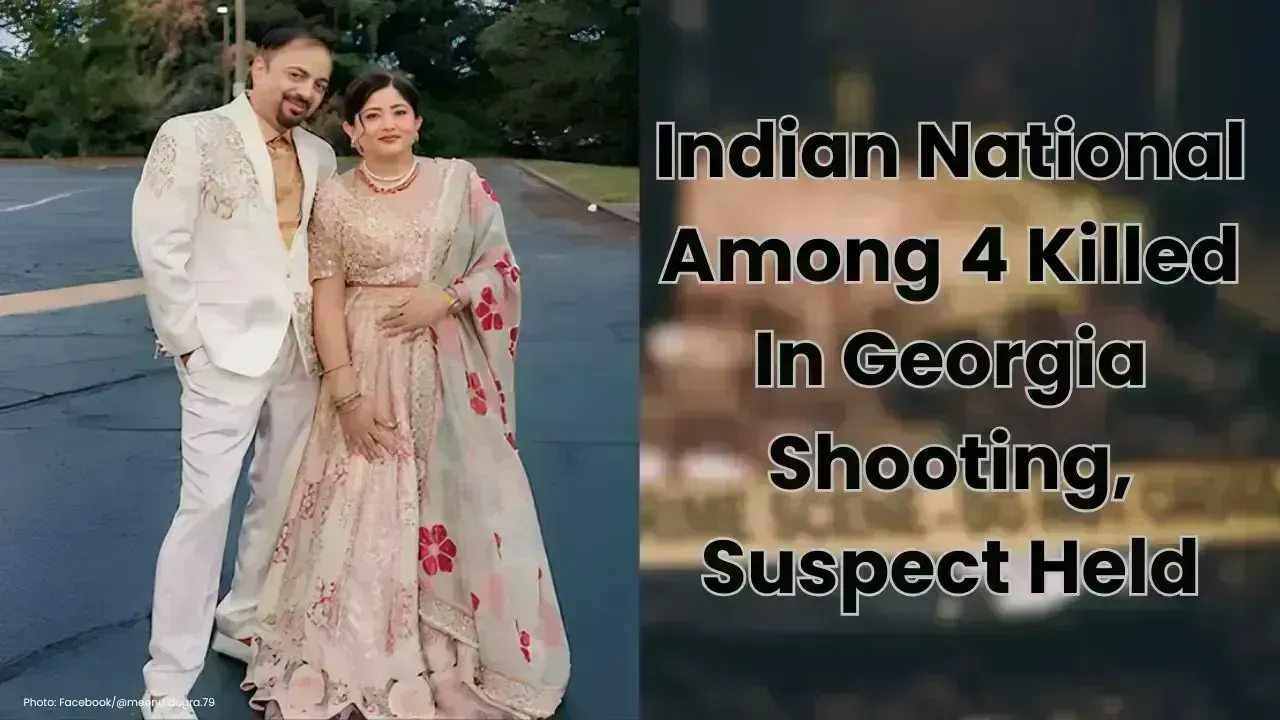

Indian National Among 4 Killed In Georgia Shooting, Suspect Held

An Indian national was among four people killed in a Georgia home shooting linked to a family disput

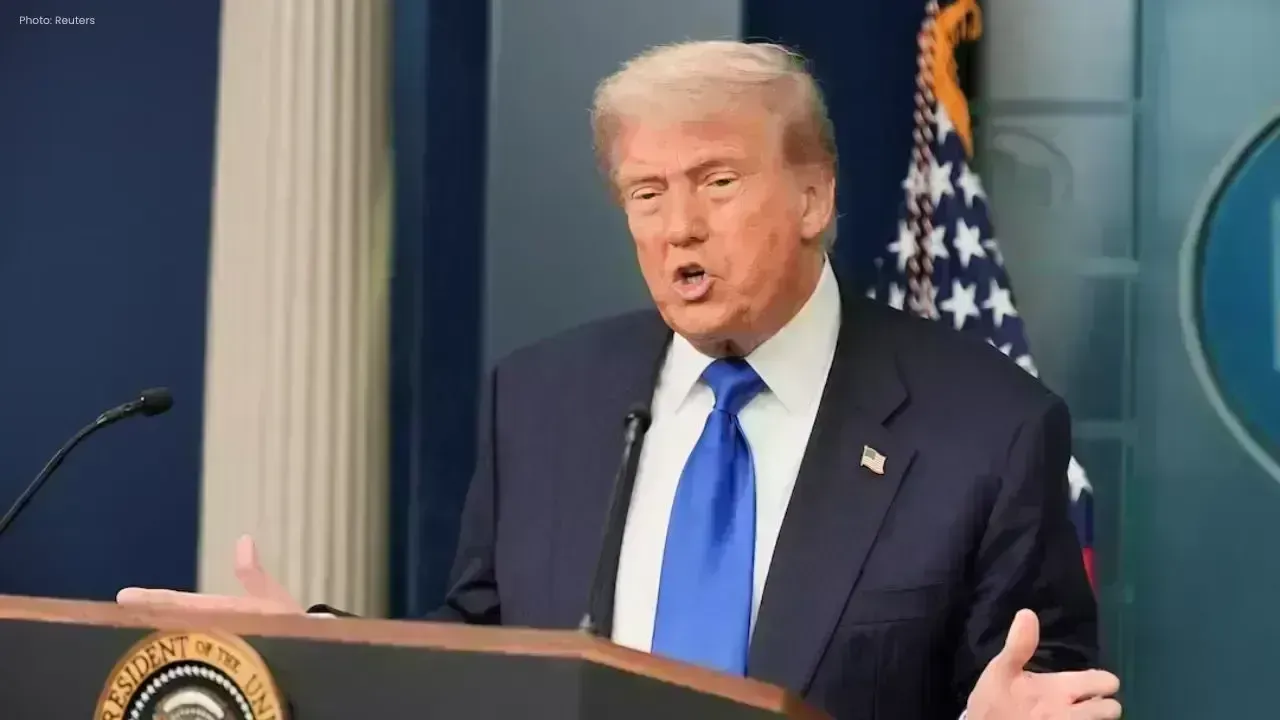

Trump Slams Canada Over “Golden Dome”, Warns China May Take Over Soon

Trump criticised Canada for rejecting the “Golden Dome” plan over Greenland and warned China could d