You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

In recent years, households from various income brackets have been experiencing substantial pressure on their monthly financial plans. Surging costs for essentials such as groceries, housing, education, healthcare, and utilities have compelled families to rethink their monetary management. What was once a predictable outlay is now characterized by variability, undermining traditional budgeting strategies. Families are reevaluating their spending priorities and embracing more adaptable financial planning techniques essential for maintaining their financial footing.

Budgeting has long been a cornerstone of family financial stewardship, but the strain of escalating expenses has complicated this process significantly. Inflation, surging service fees, rising school tuition, healthcare expenses, and lifestyle costs have altered how families allocate their earnings. What was feasible five years ago may no longer suffice. In this article, we delve into the impact of rising costs on family budget planning, the challenges at hand, and the wise modifications families are making to secure their financial wellbeing.

Basic necessities have increasingly consumed larger portions of family budgets.

Effect on household finances

Grocery prices, transportation, utilities, and more have seen a steady rise, leaving less space for discretionary purchases.

Significant shifts families are observing

• Escalating grocery expenditures

• Climbing fuel and transport charges

• Seasonal spikes in utility fees

Prioritizing essentials has forced families to reduce non-essential spending to maintain a balanced budget.

Housing-related expenses have emerged as a major source of budgetary strain.

Factors behind rising housing costs

• Increased demand for rentals

• Growing maintenance costs

• Upward trends in property-related overheads

How families are adjusting their budgets

• Opting for smaller living spaces

• Moving to lower-cost areas

• Splitting rent with others

Housing outlays now demand long-term strategic planning instead of short-term fixes.

The cost of education is a growing concern for families with children.

Typically incurred educational costs

• School tuition and fees

• Equipment and resources for online learning

• Transportation and extra-curricular costs

Changes families are implementing

• Establishing education savings from an early age

• Cutting expenses in other categories

• Evaluating educational institutions and options

Education, for many, has become a steadfast, essential budget line item.

Medical costs are increasingly a consistent part of household budgeting.

Growing healthcare expenditures

• Doctor visits

• Prescription medications

• Health coverage premiums

Financial planning adaptations

Families are creating specialized healthcare funds to mitigate unexpected medical costs.

Fixed budgets are becoming increasingly challenging to sustain.

The importance of adaptability

Volatile prices for essentials mean that rigid budgeting is often ineffective.

Innovative budgeting methodologies

• Variable expenditure limits

• Monthly review cycles

• Contingency funds for fluctuating costs

Such flexible approaches allow families to respond to reserve funds more adeptly.

Discretionary spending is typically the first to be curtailed.

Common reductions families are undertaking

• Cutting down on restaurant outings

• Limiting entertainment-related expenses

• Delaying significant purchases

Families have begun to prioritize value over convenience.

While saving is becoming increasingly tough, it remains crucial.

Reasons to prioritize savings

• Enhanced emergency readiness

• Financial stability during turbulent times

• Pursuit of long-term goals

How families continue to save

• Automated small-scale savings

• Minimizing impulsive purchases

• Focusing on emergency funds

Even small savings contribute significantly to family resilience.

Families are being more diligent about monitoring their expenditure.

Popular methods for expense tracking

• Regular expenditure logs

• Budget management applications

• Manual monitoring for essential items

This awareness aids in spotting unnecessary financial outflows and enhancing spending choices.

Growing expenses are prompting changes in lifestyle decisions.

Adaptation of lifestyle

• Prioritizing experiences over material possessions

• Choosing entertainment at home

• Preparing more homemade meals

Such choices enable families to uphold quality while managing their expenses.

Open conversations about finances are becoming normal in many households.

Benefits of greater transparency

• Shared financial duties

• Enhanced clarity on priorities

• Diminished financial stress levels

Involving all family members encourages responsible spending habits.

Households are starting to look beyond immediate monthly finances.

Long-term financial considerations

• Retirement savings plans

• Future costs for children's education

• Comprehensive insurance policies

Increasing costs have underscored the value of forward-thinking financial tactics.

The implications of rising costs vary among different household structures.

For dual-income families

• More stable revenue streams

• Amplified expenditures related to lifestyle

For single-income families

• Heightened financial pressure

• Increased caution in spending

Both types necessitate meticulous planning for sustainable expenses.

Families are becoming more diligent in chasing cost-saving avenues.

Effective strategies employed

• Price comparisons prior to purchases

• Utilization of discounts and promotional offers

• Buying essentials in bulk for savings

Value-focused spending practices are becoming foundational to budgeting.

Rising costs are impacting emotional wellbeing beyond just financial numbers.

Common emotional hurdles

• Anxiety about future financial demands

• Stress tied to monthly obligations

• Trepidation regarding unexpected expenses

Understanding the emotional aspects enables families to tackle budgeting with empathy and realism.

Financial goals are being refined rather than set aside altogether.

Revised goal-setting strategies

• Shorter, achievable targets

• Quick financial victories

• Ongoing reassessment of financial ambitions

This method keeps families engaged and motivated despite prevailing financial challenges.

While the challenges of rising costs are substantial, they also foster a greater awareness surrounding finances.

Optimistic outcomes

• Improved financial management habits

• Decreased wastage in spending

• Heightened fiscal discipline

Families that adapt effectively ultimately find themselves in a stronger financial position.

Escalating living costs have fundamentally transformed family budgeting. Essentials are now consuming a bigger portion of family finances, while adaptability, diligent tracking, and conscious expenditures have become indispensable. Families are shifting their lifestyles, prioritizing savings, and engaging in open dialogues about finances to navigate changing economic landscapes. Though pressures abound, intelligent budgeting, realistic goals, and flexible planning can aid families in maintaining stability and crafting future financial resilience.

This article is intended for informational purposes. Financial circumstances differ based on income, location, and individual situations. Readers are urged to evaluate their financial requirements and consider professional financial advice prior to making substantial budgeting or investment choices.

#Business News #Business & economy #Finance News #Market Analysis

Deadly Bushfires in Victoria Leave One Dead, 300 Structures Lost

Bushfires across Victoria have destroyed hundreds of homes, claimed one life, and forced evacuations

Himalayas Turn Rocky as Winter Snowfall Falls, Scientists Warn

Himalayas see record low winter snow, accelerating glacier melt and threatening water supply, forest

Virat Kohli Fastest to 28,000 Runs, Celebrates Career Milestone

Virat Kohli reached 28,000 international runs, reflecting on his journey with gratitude, joy, and de

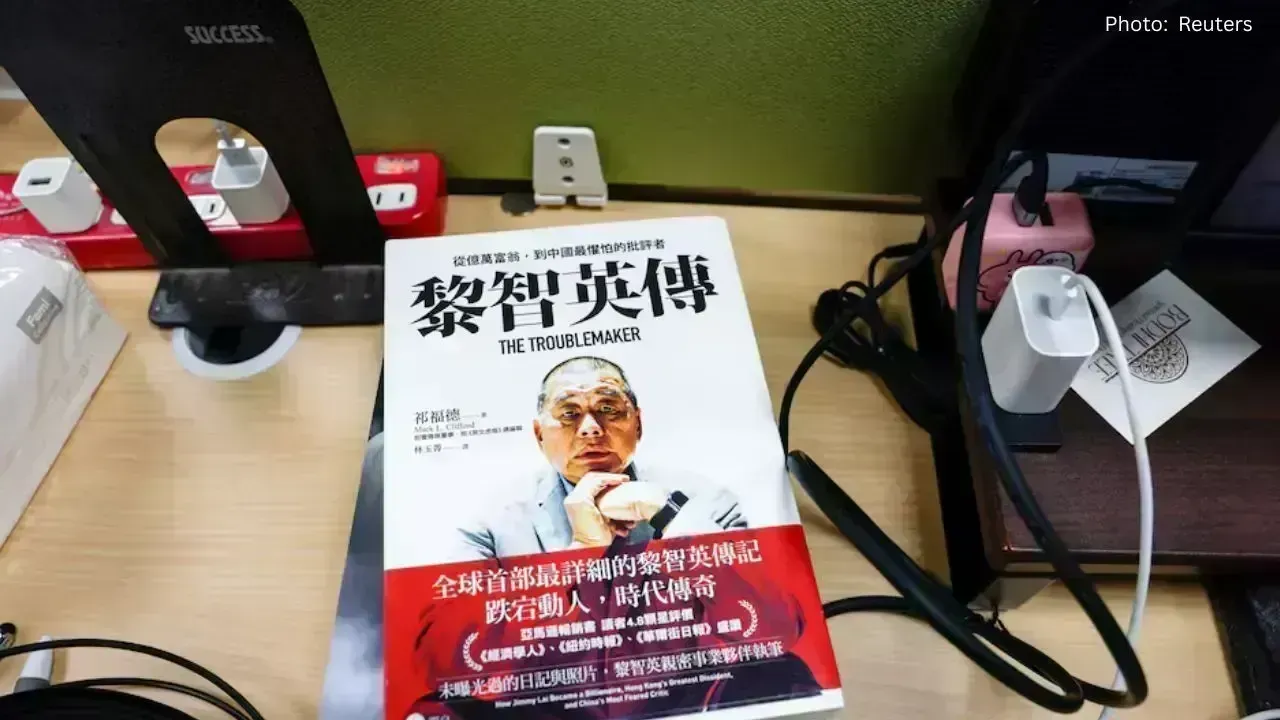

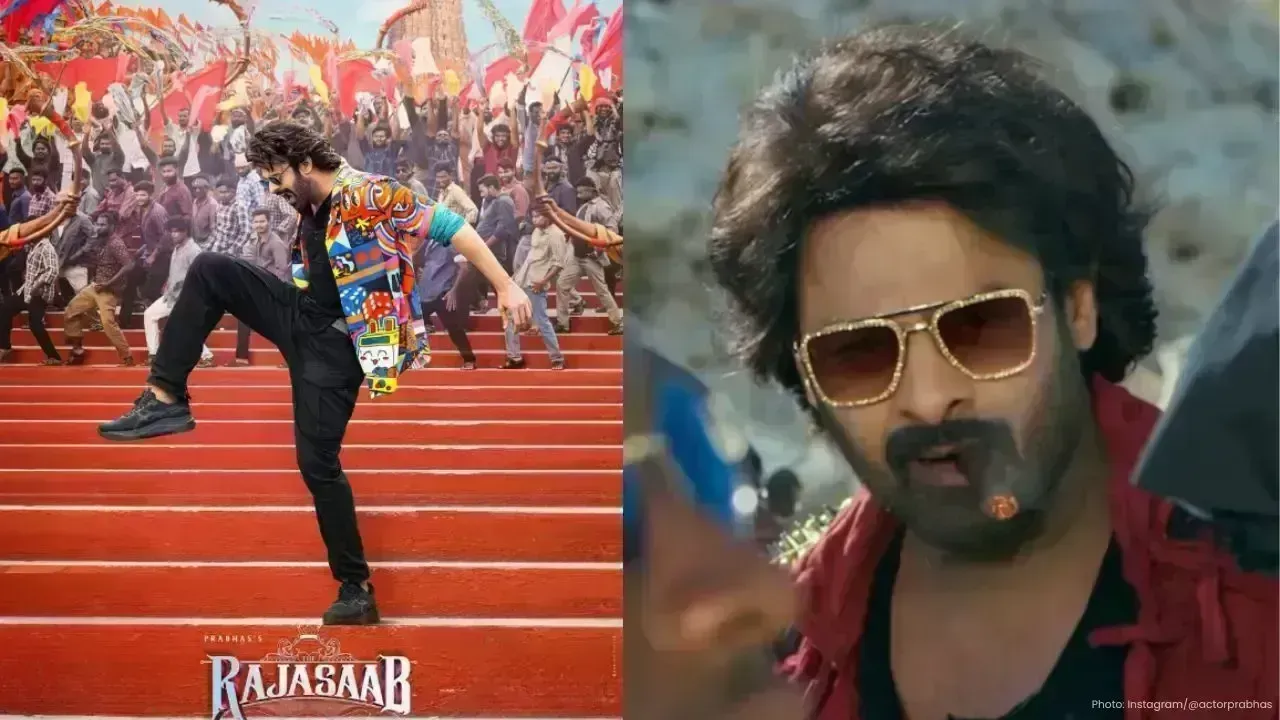

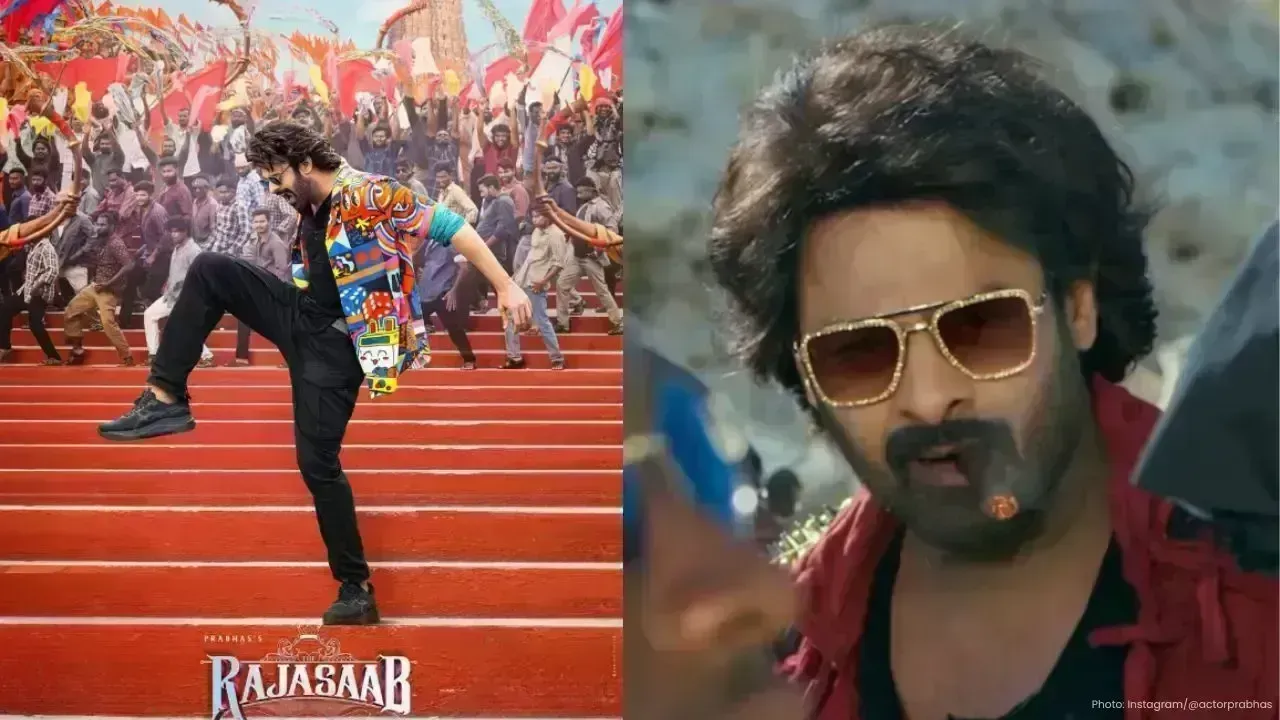

Prabhas’ The Raja Saab Tops ₹100 Crore in India on Day 3 Box Office

The Raja Saab collects Rs 108 crore in India; worldwide total nears Rs 200 crore. Sequel announced w

Malaysia Blocks Grok AI Over Sexualized Image Misuse

Malaysia restricts access to Grok AI after misuse for sexualized, non-consensual images, pending str

Thailand Exports to Grow 2–4% in 2026, Driven by Foreign Investment

Thailand’s exports are projected to grow 2–4% this year, largely due to foreign investment, raising