You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Bharat Coking Coal Limited is a wholly owned subsidiary of Coal India Limited, established in 1972 to operate and manage coking coal mines, primarily in the rich Jharia and Raniganj coalfields across Jharkhand and West Bengal. The company is one of the country’s largest producers of coking coal, a vital feedstock for the steel industry, and contributes a dominant share of India’s domestic coking coal output. Being a key strategic arm of Coal India, BCCL plays a crucial role in supporting the nation’s industrial ecosystem, especially steel production.

The Bharat Coking Coal IPO is open for public subscription from January 9 to January 13, 2026. The price band has been set at ₹21 to ₹23 per equity share, with a lot size of 600 shares. Allotment is expected by January 14, followed by listing on the BSE and NSE around January 16, 2026.

This IPO is structured entirely as an Offer for Sale (OFS), meaning that the parent company, Coal India Limited, will sell down part of its stake to public shareholders. BCCL, the company itself, will not receive fresh capital from this offering.

Investor response has been overwhelming. On the first day of bidding, the IPO saw robust subscription rates across multiple investor categories. Retail and non-institutional investor segments led demand, resulting in total subscriptions of several times the shares on offer. By the second day, overall bids had crossed multiple folds, reflecting strong appetite among investors across categories. Grey market indicators have also shown significant premiums, indicating expectations of a high debut listing price relative to the issue price.

This strong early subscription and healthy secondary market signals indicate confidence, especially for short-term listing gains.

BCCL controls a substantial share of India’s coking coal reserves and production capacity. With coking coal being an indispensable raw material for steelmaking, the company’s strategic relevance for domestic infrastructure development, industrial growth, and policy focus remains high.

Being a subsidiary of Coal India—one of the world’s largest coal producers—BCCL benefits from operational stability, access to extensive resources, and established infrastructure. This backing also enhances investor confidence and risk perception, especially in PSU-led IPOs.

Grey market trading, which is an unofficial measure of investor sentiment ahead of official listings, has shown strong premiums relative to the issue price. These indicators often suggest strong listing day performance and can act as an early gauge of market expectations.

BCCL operates in the core coking coal segment and accounts for a large portion of domestic production. Its extensive reserves and critical role in the steel supply chain position it as a strategically important enterprise—especially in a nation with a fast-growing infrastructure base.

The company’s mines in the Jharia and Raniganj coalfields benefit from long-standing mining infrastructure and logistics. This operational history supports consistent production volumes and steady supply capabilities to core industry players.

The IPO’s strong subscription figures, particularly from retail and non-institutional investors, highlight widespread interest and belief in the company’s prospects. Such momentum can translate into strong market liquidity and price discovery early in the stock’s life.

As a coal-focused entity, BCCL’s business is tied closely to commodity cycles. Demand for coking coal can fluctuate with global steel production trends, energy policies, and macroeconomic factors. These external variables can introduce volatility in earnings and stock performance.

Some market observers note that BCCL’s valuation parameters, when compared with parent Coal India or global peers, may appear rich. For example, its price-to-earnings (PE) ratio might seem elevated relative to historical norms for a small-cap or mid-cap PSU stock. Investors should weigh whether pricing aligns with long-term value expectations.

The company’s operations are geographically concentrated in specific coalfields. While these areas are rich in reserves, such concentration exposes BCCL to region-specific operational and regulatory risks that might affect continuity of production or cost efficiencies.

For investors eyeing short-term listing gains, the BCCL IPO may present an attractive opportunity based on strong grey market premiums and early subscription traction. The PSU backing and strategic importance of coking coal add to its near-term appeal.

However, for long-term wealth creation, potential investors should consider broader thematic factors beyond listing day premiums. These include sector cyclicality, shifts in the global energy mix, and structural risks inherent in commodity businesses.

Experienced investors often balance these considerations against their own risk tolerance, investment horizon, and portfolio diversification goals before subscribing.

The Bharat Coking Coal IPO stands out as one of the most anticipated public offerings at the start of 2026. Backed by Coal India, characterized by strong investor interest, and tied to India’s industrial core, the IPO is poised to generate significant market attention.

Whether viewed through the lens of short-term listing profits or long-term strategic holding, the issue offers a compelling case for in-depth analysis. Investors should weigh all facets, from subscription trends to valuation and sector outlook, before making informed decisions.

Disclaimer:

This article is for informational and educational purposes only and does not constitute financial or investment advice. Investing involves risks, and readers should consult qualified financial advisors before making decisions.

Deadly Bushfires in Victoria Leave One Dead, 300 Structures Lost

Bushfires across Victoria have destroyed hundreds of homes, claimed one life, and forced evacuations

Himalayas Turn Rocky as Winter Snowfall Falls, Scientists Warn

Himalayas see record low winter snow, accelerating glacier melt and threatening water supply, forest

Virat Kohli Fastest to 28,000 Runs, Celebrates Career Milestone

Virat Kohli reached 28,000 international runs, reflecting on his journey with gratitude, joy, and de

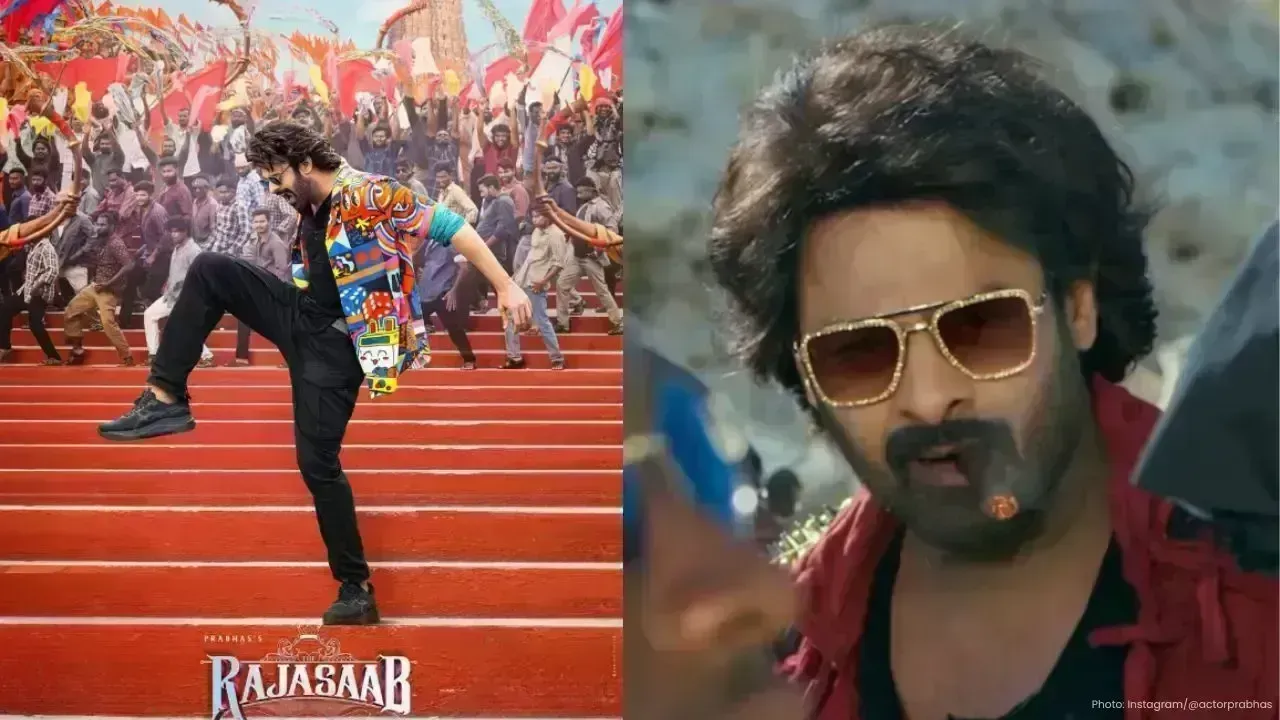

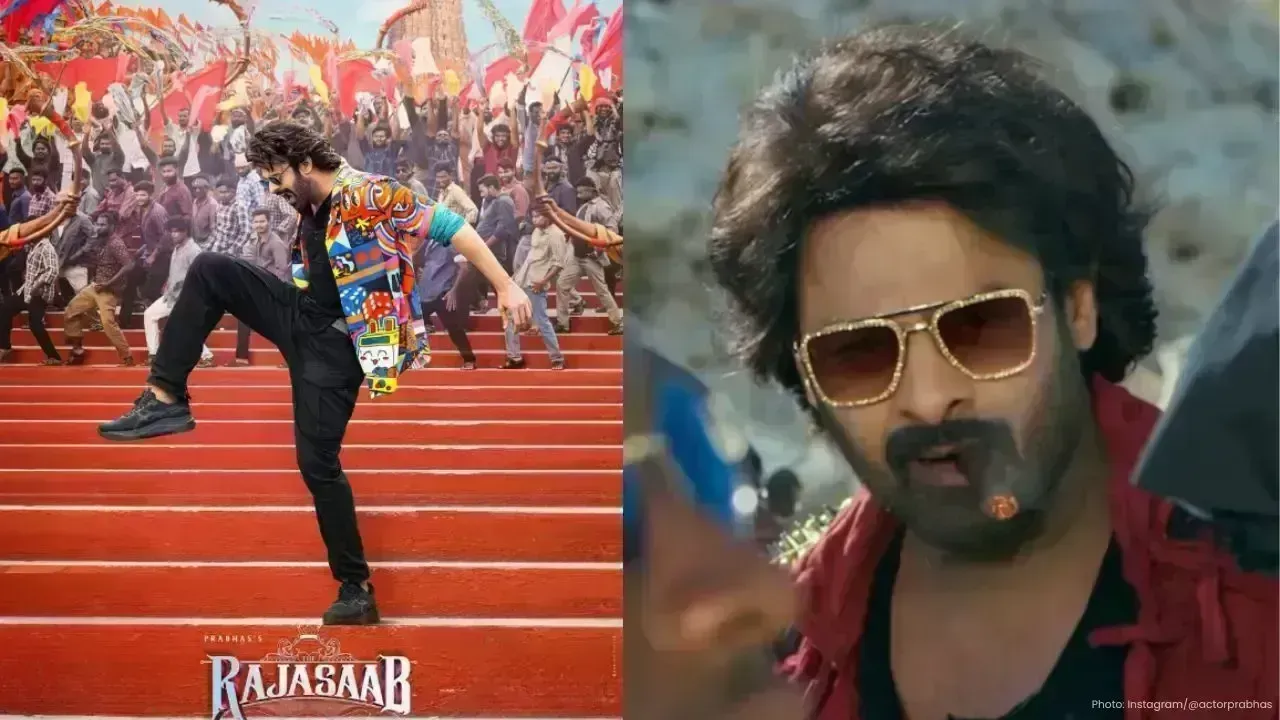

Prabhas’ The Raja Saab Tops ₹100 Crore in India on Day 3 Box Office

The Raja Saab collects Rs 108 crore in India; worldwide total nears Rs 200 crore. Sequel announced w

Malaysia Blocks Grok AI Over Sexualized Image Misuse

Malaysia restricts access to Grok AI after misuse for sexualized, non-consensual images, pending str

Thailand Exports to Grow 2–4% in 2026, Driven by Foreign Investment

Thailand’s exports are projected to grow 2–4% this year, largely due to foreign investment, raising