You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The past two decades have been defined by lithium-ion chemistry powering everything from phones to electric cars. But as demand explodes and ambitions shift toward long-duration grid storage, faster charging, higher safety and lower raw-material risk, the spotlight is now on what comes next. The alternatives are not a single “drop-in” replacement — they are a menu of technologies, each addressing specific gaps: cheaper low-cost cells for mass EVs, long-duration storage for grids, ultra-fast charge systems for transport, and sustainable chemistries that reduce reliance on scarce minerals. This article breaks down the leading contenders, where they stand in 2025, why they matter, and how policymakers, utilities and industry should plan for a multi-technology future.

Solid-state batteries replace the liquid electrolyte of conventional lithium-ion cells with a solid electrolyte. That change can unlock higher energy density, faster charging and a much lower fire risk — attractive traits for both passenger EVs and premium applications. In 2025 the industry has moved from lab claims to high-profile demos and near-commercial pilots: major automotive groups and specialist firms have showcased vehicles and prototypes using solid-state cells, signaling realistic product pathways over the next few years. These demonstrations underscore solid-state’s potential to deliver denser, safer packs — but scaling manufacturing and cutting materials cost remain the main hurdles.

Key issues to watch: solid electrolyte cost, mechanical robustness (solid materials can crack under stress), and supply chains for new precursor chemicals. Several suppliers are investing in dedicated production lines and partnerships with carmakers; timelines vary, but limited commercial rollouts for niche vehicles are now plausible within this decade.

Sodium-ion chemistry swaps sodium for lithium in the intercalation process. Sodium is abundant and inexpensive, easing geopolitical and material constraints tied to lithium, cobalt and nickel. In 2025 some manufacturers have started commercial launches of sodium-ion products aimed at stationary storage and lower-cost EVs and portable power stations, positioning sodium-ion as a pragmatic short-to-medium term alternative where ultra-high energy density is not essential.

Why sodium-ion matters practically: it can cut raw material costs and provides adequate cycle life for many consumer and grid applications. The tradeoff is lower energy density compared with best-in-class lithium formulations, so sodium-ion is unlikely to replace lithium in long-range EVs but can accelerate electrification in mass markets and expand affordable home and community storage.

Lithium-sulfur (Li-S) batteries promise substantially higher theoretical energy densities than conventional lithium-ion, using sulfur — cheap and abundant — as the cathode material. Recent laboratory and startup advances in stabilizing the anode and mitigating polysulfide shuttling have pushed Li-S closer to practical lifetimes and cycle counts needed for commercialization. Pilot projects and announcements in 2024–2025 suggest progress, but Li-S still faces durability and manufacturing scale-up challenges before it can be widely adopted in EVs or aviation.

Li-S could be transformative for sectors where weight matters — drones, aviation-like applications and possibly long-range EVs if cycle life improves. For grid storage, where energy density is less critical, the emphasis will be on cost, materials availability and lifecycle performance.

For multi-hour to multi-day energy storage that smooths renewables and replaces peaker plants, redox flow batteries (RFBs) are one of the most compelling options. Unlike conventional batteries, flow systems store energy in liquid electrolytes pumped through electrochemical cells — allowing duration to scale by increasing tank size rather than cell stacks. Vanadium redox flow batteries (VRFBs) are the most mature chemistry, offering long lifetimes and good safety characteristics, and the market for flow systems has been growing rapidly for utility projects.

New variants using iron, organic molecules, and hybrid chemistries are targeting lower cost and wider temperature ranges. Governments and developers see flow batteries as key to integrating high shares of wind and solar because they provide predictable, long-duration services with simpler end-of-life recycling pathways.

Metal-air systems (notably zinc-air and iron-air) use a metal anode reacting with oxygen from the air, promising very low material costs because they rely on cheap metals and air as a reactant. Iron-air in particular has attracted interest for long-duration applications because iron is abundant and the cells can, in principle, be made very inexpensive. Demonstrations and pilot plants are underway, focusing on cycle life and round-trip efficiency improvements. If they scale with acceptable performance, metal-air batteries could displace expensive long-duration solutions in many markets.

The core challenge remains improving cycle life and energy efficiency while keeping manufacturing predictable and scalable. Commercialization likely proceeds first in stationary applications where energy density is secondary to cost per kWh stored. (See grid storage section above for how these economics play out in utility procurement.)

Supercapacitors store energy electrostatically, enabling extremely fast charge and discharge cycles and exceptional cycle life. Historically their low energy density limited them to power-assist roles (regenerative braking, power smoothing). Recent materials breakthroughs, including improved surface accessibility and novel carbon architectures, are narrowing the gap. New hybrid devices that combine battery-like energy density with supercapacitor power characteristics are emerging, offering ultra-fast charging EV systems, micro-grid stabilizers, and industrial power buffers.

The likely near-term role for supercapacitors is complementary: short bursts of power, rapid charge support, and extending battery life by handling high-power events, rather than wholesale replacement of energy-dense batteries.

Not all storage needs to be electrical. Thermal energy storage (TES) — using molten salts, phase change materials or packed-bed systems — stores heat for later use in power generation or industrial processes. Large molten-salt projects and pilot facilities have shown utility-scale, inexpensive storage for hours to days, and are particularly relevant where heat is the primary need, such as industry or concentrated solar power (CSP) plants. Recent commercial projects highlight TES as a pragmatic, lower-cost complement to electrochemical storage for balancing demand and decarbonizing heat-intensive industries.

TES systems are inherently simpler to scale and often cheaper per kWh than chemical batteries for long durations, but their applications are sector-specific: they excel when thermal output can be used directly or reconverted efficiently to electricity.

For seasonal and very long-term storage, converting surplus renewable electricity into molecules — notably hydrogen or ammonia — offers an alternate pathway. Green hydrogen (made by electrolysis using renewable power) can be stored, transported and used in industry, shipping, and as a feedstock for synthetic fuels. Ammonia emerges as a practical hydrogen carrier because it packs hydrogen more densely and is easier to move with existing infrastructure. Recent industrial partnerships and pilot projects are accelerating ammonia-to-hydrogen solutions and cracking technologies to enable ammonia as a flexible carrier for renewable energy.

Molecule-based storage suffers from conversion losses and added infrastructure costs, but it becomes attractive for balancing seasonal differences in renewable output, for industrial decarbonization, and for sectors where batteries are impractical (long-haul shipping, aviation feedstocks).

A recurring theme across alternatives is the supply chain: many technologies reduce dependence on lithium, nickel and cobalt, but bring their own material demands — vanadium, sodium, sulfur, iron, zinc, novel electrolytes, or advanced carbon materials like graphene. Scaling production responsibly means establishing mining, processing and recycling pathways now. Policy incentives and extended producer responsibility will be crucial to build circular supply chains that avoid merely shifting environmental burdens.

Recycling infrastructure for next-gen chemistries remains immature compared with lithium-ion recycling. Governments and industry must invest in R&D and pilot recovery plants to ensure raw materials can be reclaimed economically at end-of-life.

Short-term, cost-sensitive stationary storage and portable power: Sodium-ion, flow batteries for moderate durations.

Long-duration grid storage (8+ hours to days): Redox flow, iron-air, metal-air and thermal storage.

High energy density, near-term transport improvements: Solid-state and lithium-sulfur target EVs, aviation and applications where weight matters.

Ultra-fast charge and high cycle life: Supercapacitors and hybrid supercap-battery systems for power buffering and rapid charge events.

Seasonal and industrial decarbonization: Green hydrogen and ammonia as carriers for long-term, large-scale storage.

No single technology will dominate all markets. The most likely outcome is a polyglot energy system where chemistry and technology choices depend on duration, cost, location, safety and lifecycle impacts.

Deploying these technologies at scale requires clearer market signals: long-duration contracts, capacity payments that value multi-hour storage, and incentives for domestic manufacturing and recycling. Governments can accelerate adoption by aligning procurement rules with low-carbon targets and funding pilot projects that derisk manufacturing scale-up. Private capital is following clear early winners — companies demonstrating realistic manufacturing roadmaps and partnerships with industrial customers or utilities attract disproportionate investment.

International cooperation on standards — for safety, recyclability and interchangeability — will also reduce market friction and encourage wider deployment.

Technical advances alone are not enough. Key systemic challenges include:

Cost trajectories: Many next-gen technologies must demonstrate steep cost declines through scale.

Manufacturing scale-up: Transitioning from lab to gigafactory is capital-intensive and often unexpected engineering challenges arise.

Performance under real conditions: Lab cycle life and real-world operational life can diverge; long field trials are essential.

Environmental impacts: Mining for alternative metals, electrolyte toxicity, and end-of-life processing must be managed.

Integration complexity: Grid operators and vehicle makers need standardization and predictable supply to redesign systems.

Addressing these requires coordinated public-private efforts, patient capital, and regulatory clarity.

Pilot to production milestones: Companies that move from successful pilots to announced commercial lines with credible timelines are the most likely to succeed.

Project economics for long-duration storage: Compare levelized cost per kWh for durations beyond four hours — flow and thermal systems often win here.

Recycling and second-life strategies: Policies that require recycling and enable second-life markets will reduce raw-material pressures.

Cross-sector partnerships: Alliances between automakers, material suppliers and utilities accelerate practical deployment (e.g., cell supply contracts, pilot projects for ammonia cracking).

The reality after lithium is not a single “winner” but a diversified toolbox. Each technology brings distinct strengths: sodium-ion for cheaper mass markets, solid-state and lithium-sulfur for energy-dense mobility, flow batteries and thermal storage for long durations, and molecular storage for seasonal balancing and hard-to-electrify sectors. The coming decade will be defined by competitive specialization, informed procurement, and pragmatic integration — where the right storage solution is chosen for the right job.

For consumers, that means more choices: cheaper home storage, safer vehicle packs, and cleaner grids. For policymakers and industry, it means designing policy and procurement to value duration, safety, lifecycle impacts and resilience — and investing now in recycling and manufacturing capacity to avoid recreating the supply bottlenecks of the past.

This article is for informational purposes only. It summarizes publicly available developments and expert discussions on energy storage technologies as of 2025. It is not financial, technical or regulatory advice. Readers should consult technical reports, vendors and regulators for decisions that affect investment, operations or safety.

Kim Jong Un Celebrates New Year in Pyongyang with Daughter Ju Ae

Kim Jong Un celebrates New Year in Pyongyang with fireworks, patriotic shows, and his daughter Ju Ae

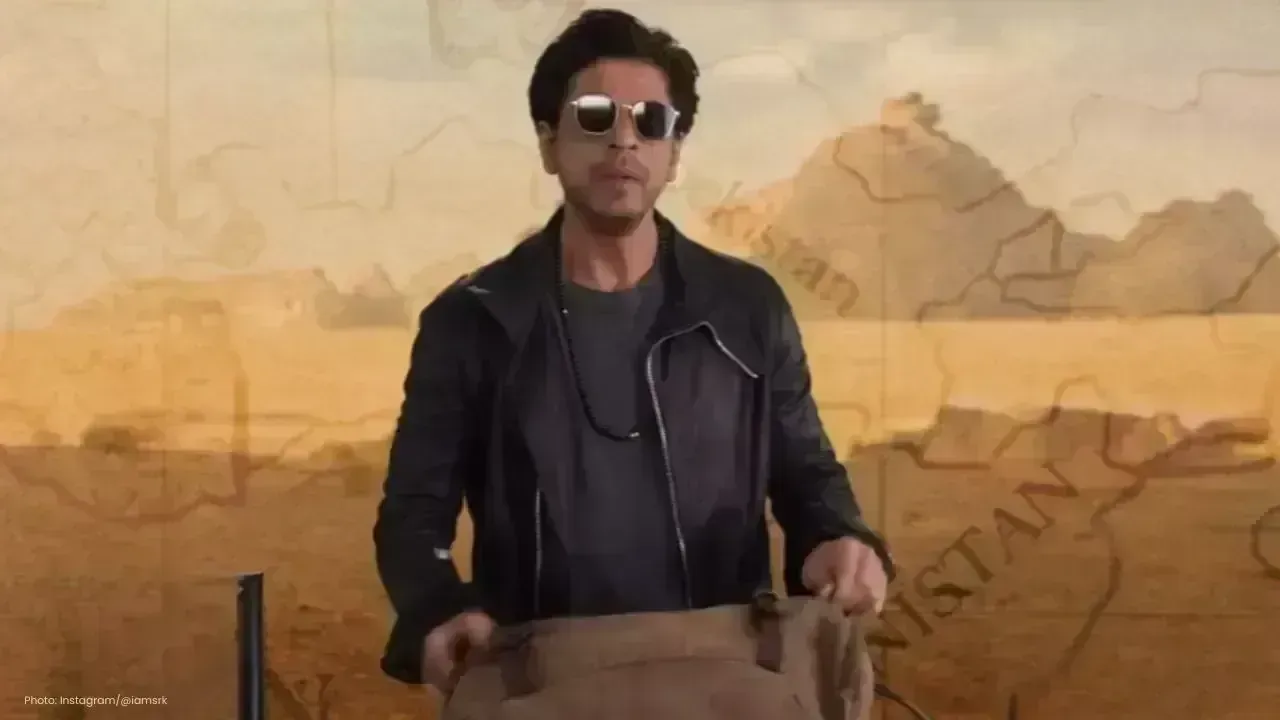

Dhurandhar Day 27 Box Office: Ranveer Singh’s Spy Thriller Soars Big

Dhurandhar earns ₹1117 crore worldwide by day 27, becoming one of 2026’s biggest hits. Ranveer Singh

Hong Kong Welcomes 2026 Without Fireworks After Deadly Fire

Hong Kong rang in 2026 without fireworks for the first time in years, choosing light shows and music

Ranveer Singh’s Dhurandhar Hits ₹1000 Cr Despite Gulf Ban Loss

Dhurandhar crosses ₹1000 crore globally but loses $10M as Gulf nations ban the film. Fans in holiday

China Claims India-Pakistan Peace Role Amid India’s Firm Denial

China claims to have mediated peace between India and Pakistan, but India rejects third-party involv

Mel Gibson and Rosalind Ross Split After Nearly a Decade Together

Mel Gibson and Rosalind Ross confirm split after nearly a year. They will continue co-parenting thei