You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Jyoti Gupta

China is working harder to collect taxes from people who earn money outside the country. Before, the government mainly focused on very rich people. Now, they’re also looking at people with smaller amounts of money overseas.

Officials are checking different kinds of income like profits from investments, dividends (money earned from stocks), and employee stock options. These earnings can be taxed up to 20%.

Tax experts say more people with less than $1 million in assets have been asking for help recently. This shows a shift from last year when only the super-rich—those with over $10 million—were being looked at. People in China who invest in stocks from the US or Hong Kong are now a key target.

The government hasn’t made any official comments yet.

China is trying to make more money through taxes because its spending has gone up while its income has gone down. In the first four months of this year, government income dropped by 1.3%, but spending increased by 7.2%. This led to a record budget gap of more than $360 billion.

Local governments also need money. They used to get it from selling land or borrowing a lot, but that’s not working anymore because of a weak property market and efforts to reduce debt.

At the same time, many Chinese people have been moving their money out of the country because of the slow economy and tight rules on private businesses. President Xi Jinping has talked about making society fairer for everyone, but that has made some business owners nervous. Lately, he’s been trying to rebuild trust with them.

So far this year, mainland Chinese investors have put about HK$658 billion ($83.9 billion) into Hong Kong stocks. That’s more than double the amount they pulled out during the same time last year.

The Ministry of Finance believes it can bring in more money by collecting taxes from people who haven’t reported their overseas income. Tax offices in cities like Beijing and Shanghai have asked people to declare their foreign income before June 30, the deadline for 2024 tax reports.

Since March, local tax offices have been working together. They used data analysis to find people who didn’t report their overseas earnings. In some cases, people had to pay back taxes and fines starting from about 127,200 yuan ($17,720).

China’s push to collect overseas taxes started after it joined a global system in 2018 called the Common Reporting Standard (CRS). This system helps countries share financial data so people can’t hide their money. Even though China always had rules to tax worldwide income, it only started enforcing them seriously last year.

Experts believe that by 2030, China’s investable assets could grow to $80 trillion, and more families will invest money overseas—possibly up to 11% of their total assets.

Kim Jong Un Celebrates New Year in Pyongyang with Daughter Ju Ae

Kim Jong Un celebrates New Year in Pyongyang with fireworks, patriotic shows, and his daughter Ju Ae

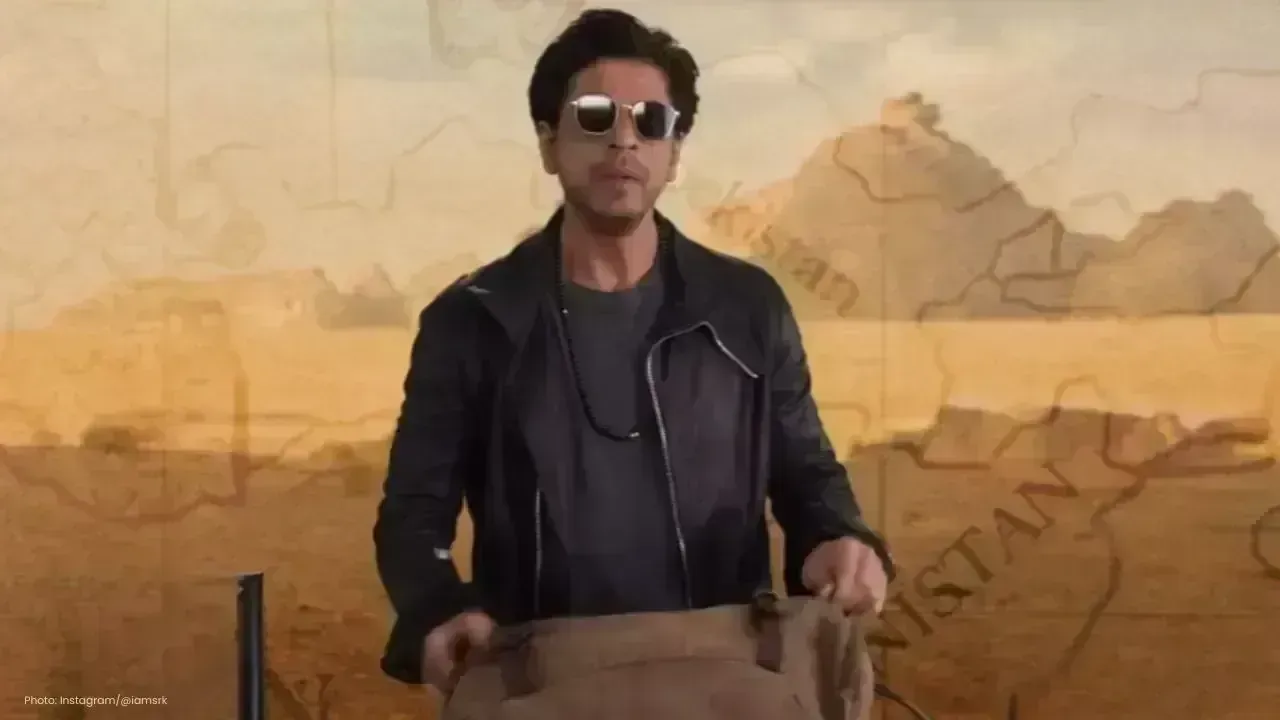

Dhurandhar Day 27 Box Office: Ranveer Singh’s Spy Thriller Soars Big

Dhurandhar earns ₹1117 crore worldwide by day 27, becoming one of 2026’s biggest hits. Ranveer Singh

Hong Kong Welcomes 2026 Without Fireworks After Deadly Fire

Hong Kong rang in 2026 without fireworks for the first time in years, choosing light shows and music

Ranveer Singh’s Dhurandhar Hits ₹1000 Cr Despite Gulf Ban Loss

Dhurandhar crosses ₹1000 crore globally but loses $10M as Gulf nations ban the film. Fans in holiday

China Claims India-Pakistan Peace Role Amid India’s Firm Denial

China claims to have mediated peace between India and Pakistan, but India rejects third-party involv

Mel Gibson and Rosalind Ross Split After Nearly a Decade Together

Mel Gibson and Rosalind Ross confirm split after nearly a year. They will continue co-parenting thei