You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

There was a time when money meant crisp banknotes, jangling coins, and physical wallets stuffed with receipts. Fast forward to today, and payments have taken a radical turn. A growing number of people now pay with their smartphones, transfer money through digital wallets, and even experiment with cryptocurrencies like Bitcoin and Ethereum. What once seemed futuristic is becoming everyday reality.

Digital money is not just about convenience—it is transforming how societies function. Governments are exploring official digital currencies, businesses are shifting to cashless models, and younger generations see crypto not as a novelty but as a natural part of financial life. The change is so profound that it is reshaping banking, commerce, and even personal finance habits.

Digital wallets such as Apple Pay, Google Pay, and PayPal have become everyday companions. They store card details securely, enable contactless payments, and often provide additional services like loyalty points or rewards. For many people, especially in urban centers, wallets have become redundant as everything is now stored on their phones.

The pandemic accelerated this trend, with contactless payments becoming the norm for safety reasons. Today, it’s rare to see younger consumers carry much cash at all.

When Bitcoin first appeared in 2009, it was dismissed as an experimental project. Today, cryptocurrencies represent a multi-trillion-dollar market. While volatility continues to define the sector, crypto has moved far beyond niche investors. Retailers, travel agencies, and even charities are beginning to accept digital coins as payment.

Cryptocurrencies offer the promise of decentralized finance (DeFi), where individuals transact directly without banks or middlemen. For people in countries with unstable currencies, crypto provides a lifeline—an alternative to inflation and capital controls.

Governments are not staying on the sidelines. Dozens of countries are developing Central Bank Digital Currencies (CBDCs), which are official e-versions of their national currencies. Unlike cryptocurrencies, CBDCs are regulated and backed by governments, offering the benefits of digital transactions with the trust of traditional money.

China’s digital yuan, for example, is already in advanced stages of rollout, while the European Union and the United States are exploring their own versions. If successful, CBDCs could redefine global payments and international trade.

The shift to e-currency and crypto brings practical advantages:

Convenience: No more carrying cash or worrying about exact change.

Speed: Transactions happen instantly, even across borders.

Cost Savings: Lower transaction fees compared to traditional banking.

Transparency: Blockchain-based payments can be tracked, reducing fraud.

Access: People without traditional bank accounts can still participate in digital finance.

For travelers, digital money eliminates the hassle of currency exchange, while for businesses, it simplifies international transactions.

Despite its promise, digital money is not without risks. Cybersecurity threats remain a pressing concern, as hackers target wallets and exchanges. The volatility of cryptocurrencies also deters many from adopting them for everyday use.

Moreover, the digital divide poses challenges. Not everyone has smartphones or internet access, particularly in rural or developing areas. A fully cashless economy risks leaving these populations behind.

Finally, privacy is a growing debate. While crypto advocates praise anonymity, government-backed e-currencies may allow unprecedented monitoring of personal transactions.

The digital money revolution is influencing how economies operate. For businesses, accepting digital payments opens doors to global customers. For governments, it provides better tools for tax collection and financial oversight. For consumers, it offers convenience and speed that physical money cannot match.

In emerging markets, mobile-based money transfers are already lifting millions out of poverty by allowing them to send and receive funds easily. Countries like Kenya, with platforms such as M-Pesa, have shown how digital money can empower communities with little access to traditional banking.

Younger generations—Millennials and Gen Z—are driving this change. They are more comfortable with apps, QR codes, and digital wallets than with cash. Many of them even prefer investing in crypto assets over gold or real estate. For them, money is not something you carry in a wallet; it is something that flows seamlessly across devices and platforms.

This cultural shift ensures that the digital money trend is not temporary—it is a fundamental change in financial behavior.

The next decade is likely to bring even more integration of digital and crypto payments. Wearables may replace smartphones for transactions, biometric authentication could eliminate passwords, and cross-border payments may become instant and almost cost-free.

For cryptocurrencies, regulation will play a key role. If governments strike the right balance between innovation and oversight, digital coins could become as common as debit cards. Meanwhile, CBDCs are likely to coexist with traditional currencies, offering a hybrid model that blends security with innovation.

Digital money—whether through wallets, crypto, or CBDCs—is no longer an experiment. It is an evolution of how humans exchange value. While challenges like security, regulation, and inclusivity remain, the benefits are undeniable.

From the perspective of individuals, businesses, and governments, e-currency and crypto are making money simpler, faster, and more versatile than ever. Cash may not disappear completely, but its role in everyday life is shrinking fast. The future of money, it seems, is already in our pockets—and sometimes, on the blockchain.

This article is intended for informational and editorial purposes only. It discusses general trends in digital money, cryptocurrencies, and e-currency but does not offer financial or investment advice. Readers should seek professional guidance before making financial decisions.

Rashmika Mandanna, Vijay Deverakonda Set to Marry on Feb 26

Rashmika Mandanna and Vijay Deverakonda are reportedly set to marry on February 26, 2026, in a priva

FIFA Stands by 2026 World Cup Ticket Prices Despite Fan Criticism

FIFA defends the high ticket prices for the 2026 World Cup, introducing a $60 tier to make matches m

Trump Claims He Ended India-Pakistan War, Faces Strong Denial

Donald Trump says he brokered the ceasefire between India and Pakistan and resolved eight wars, but

Two Telangana Women Die in California Road Accident, Families Seek Help

Two Telangana women pursuing Master's in the US died in a tragic California crash. Families urge gov

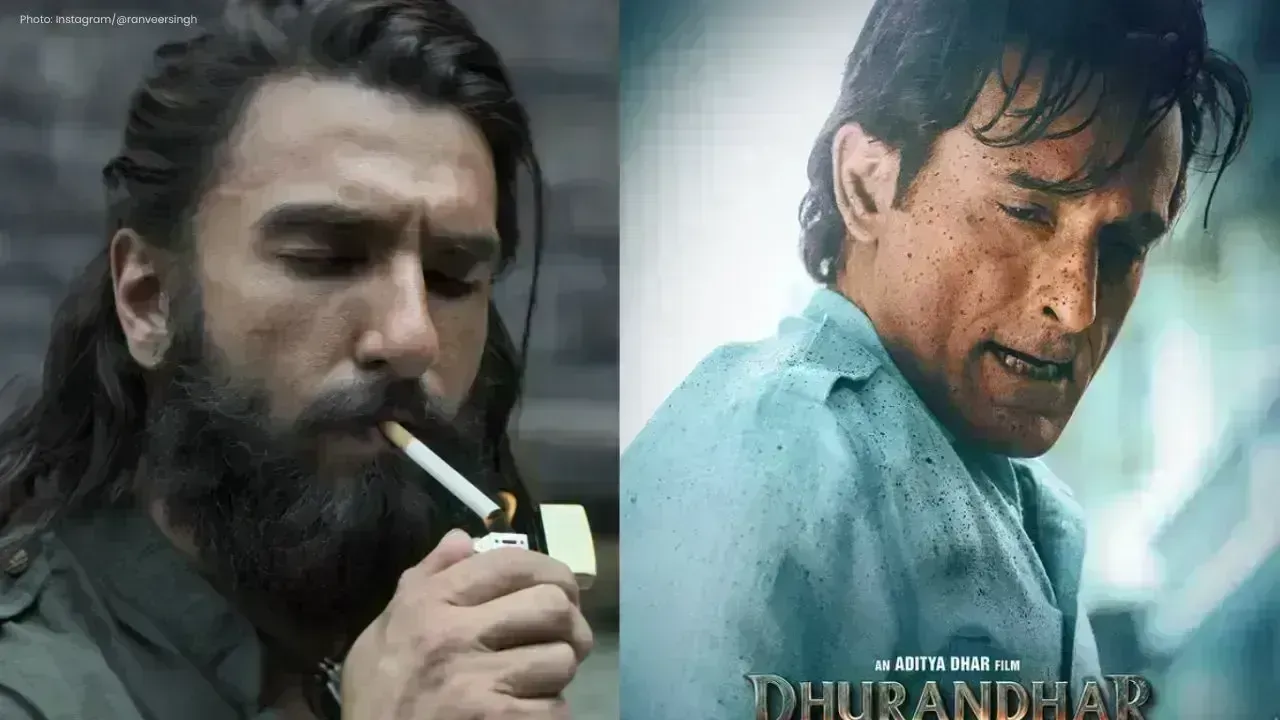

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex