You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Across Asia, governments and investors are accelerating a once-unthinkable transformation: shifting from fossil fuels to large-scale renewable energy. The region, long known for coal-powered economies, is now the frontline of a global green investment wave. From India’s desert solar farms to offshore wind turbines in Vietnam and mega hydropower projects in Central Asia, a series of “electric green deals” are redrawing Asia’s energy map.

The motivations are both environmental and economic. Asia accounts for more than half of global carbon emissions, making it central to the fight against climate change. At the same time, surging demand for energy, rising oil prices, and the need for energy independence are pushing countries to rethink their strategies. Renewable investments are no longer just about sustainability—they are about competitiveness, resilience, and long-term growth.

China, already the world’s largest producer of solar panels and wind turbines, is leading Asia’s green transition. Massive state-led investments have turned the country into a clean energy powerhouse. The government has pledged to achieve carbon neutrality by 2060, and in pursuit of that goal, it has built the world’s largest solar farms in Inner Mongolia and expanded offshore wind capacity at record speed.

But China’s strategy is not confined within its borders. Through the Belt and Road Initiative, Beijing is financing renewable projects in Southeast Asia, South Asia, and Central Asia. These investments not only reduce emissions but also tie recipient countries more closely to China’s supply chains and financing structures. In effect, China is exporting both clean power and geopolitical influence.

India is racing to become a solar superpower. With vast sunlight-rich lands, the country has set ambitious targets—450 GW of renewable capacity by 2030. The government’s International Solar Alliance, which partners with dozens of countries, has positioned India as a leader in global solar diplomacy.

Large projects such as the Bhadla Solar Park in Rajasthan, one of the biggest in the world, symbolize India’s commitment to green energy. Yet, the transition is not without challenges: financing gaps, grid stability, and fossil fuel dependency still weigh heavily. Still, India’s emphasis on renewables is reshaping regional dynamics by positioning it as both a consumer and exporter of clean power technology.

Southeast Asia, once heavily reliant on imported fossil fuels, is experiencing a wind and solar boom. Vietnam, for instance, has become one of the fastest-growing solar markets in the world after introducing supportive feed-in tariffs. In Indonesia, the government is pushing for greater renewable adoption to reduce coal use, while the Philippines is exploring offshore wind projects to diversify its energy mix.

Foreign investment plays a critical role here. Japanese, South Korean, and European companies are pouring billions into Southeast Asian renewables, creating a competitive landscape where energy security and climate goals overlap. These partnerships are also fostering regional cooperation, as power grids are upgraded and cross-border trade in electricity becomes more feasible.

For decades, Central Asia has been synonymous with oil and gas exports. But now, countries like Kazakhstan and Uzbekistan are embracing renewables. Kazakhstan, with its vast steppes, is turning into a hub for wind energy, while Uzbekistan is investing in solar farms that harness its abundant sunlight.

Much of this transition is enabled by partnerships with China, the Gulf states, and multilateral institutions. By diversifying away from hydrocarbons, Central Asia hopes to attract new investment, reduce vulnerability to price shocks, and align with global sustainability goals. The region’s renewable awakening could also reshape geopolitical alignments, as reliance on traditional energy exports gives way to cleaner and more diversified economies.

Japan and South Korea, both heavily dependent on energy imports, are investing heavily in renewables as part of broader decarbonization strategies. Japan is betting big on offshore wind and hydrogen technology, while South Korea has pledged a “Green New Deal” that includes expanding solar capacity and phasing out coal.

Both countries see renewables not only as a climate obligation but also as an economic opportunity. By leading in green technologies, they aim to strengthen industrial competitiveness and reduce vulnerability to global energy disruptions. Their push is also influencing energy strategies across Asia, as smaller economies follow suit.

Interestingly, some of Asia’s renewable funding comes from Gulf states like the UAE and Saudi Arabia. Known for oil wealth, these nations are diversifying their portfolios by investing in Asian solar and wind projects. Their participation underlines a broader trend where energy exporters are positioning themselves for a post-oil world.

For Asian countries, Gulf investments provide much-needed capital, while for Gulf states, it represents an entry point into the rapidly expanding clean energy economy. This partnership is symbolic of a global realignment where fossil fuel powers seek to secure relevance in the green future.

Renewables are no longer just about climate responsibility—they make economic sense. Falling costs of solar panels and wind turbines mean that in many parts of Asia, renewables are now cheaper than coal or natural gas.

This cost advantage is attracting private capital and driving large-scale infrastructure deals. Sovereign wealth funds, pension funds, and private equity are all flocking to Asia’s green projects, confident in long-term returns. For governments, renewable deals also reduce dependence on volatile fossil fuel imports, strengthening economic stability.

Despite the surge in investments, Asia’s renewable transition faces obstacles. Grid infrastructure remains outdated in many countries, limiting the ability to integrate intermittent power sources like solar and wind. Political instability, regulatory uncertainty, and financing constraints also pose risks.

Additionally, some economies remain deeply tied to coal, with powerful lobbies resisting the transition. Balancing the need for growth with climate commitments will require strong political will, regional cooperation, and innovative financing models.

Asia’s green transformation is not just about electricity—it is about reshaping geopolitics, economies, and society. Renewable investments are shifting alliances, creating new dependencies, and redefining who controls the region’s future.

If current trends continue, the “electric green deals” being signed today will determine Asia’s position in the global economy for decades to come. Those who lead in renewables will secure not only cleaner air and lower emissions but also influence over regional energy markets. For Asia, the energy map is being redrawn—not with oil pipelines, but with solar panels and wind turbines.

This article is intended for informational purposes only. It does not constitute financial, investment, or policy advice. Readers are encouraged to seek independent guidance before making energy-related decisions.

Rashmika Mandanna, Vijay Deverakonda Set to Marry on Feb 26

Rashmika Mandanna and Vijay Deverakonda are reportedly set to marry on February 26, 2026, in a priva

FIFA Stands by 2026 World Cup Ticket Prices Despite Fan Criticism

FIFA defends the high ticket prices for the 2026 World Cup, introducing a $60 tier to make matches m

Trump Claims He Ended India-Pakistan War, Faces Strong Denial

Donald Trump says he brokered the ceasefire between India and Pakistan and resolved eight wars, but

Two Telangana Women Die in California Road Accident, Families Seek Help

Two Telangana women pursuing Master's in the US died in a tragic California crash. Families urge gov

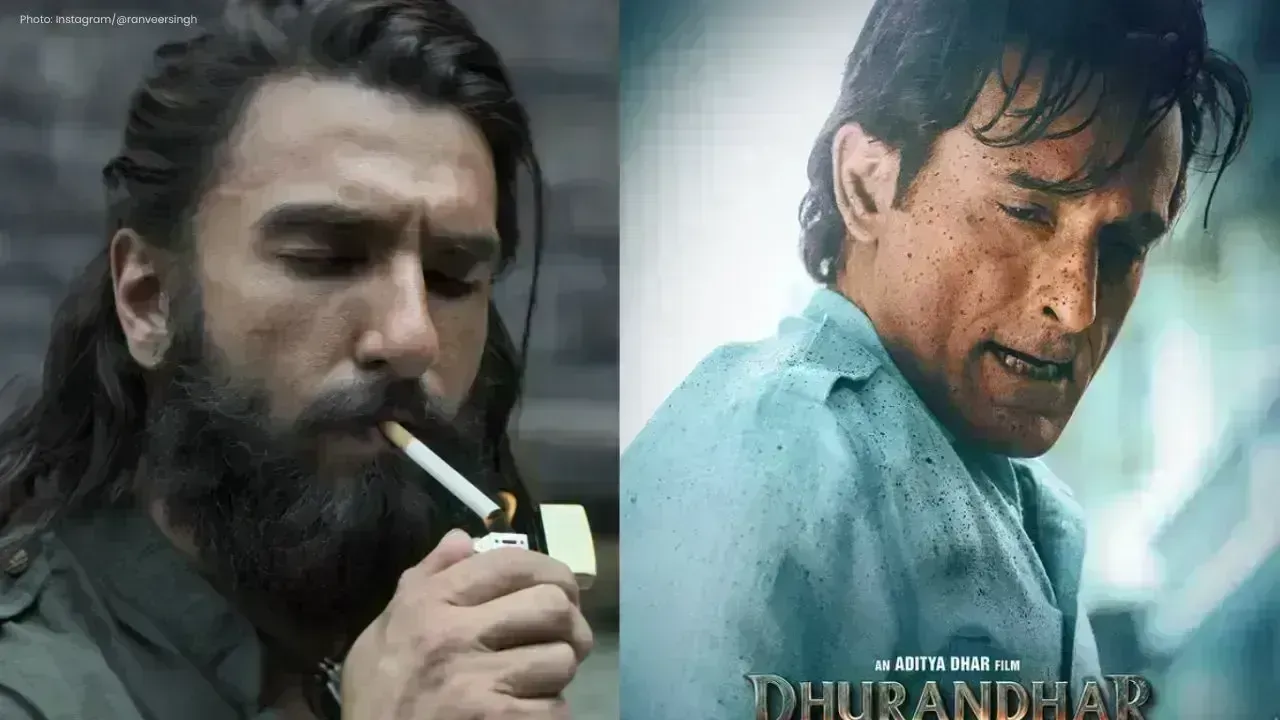

Ranveer Singh’s Dhurandhar Roars Past ₹1100 Cr Worldwide

Ranveer Singh’s Dhurandhar stays unstoppable in week four, crossing ₹1100 crore globally and overtak

Asian Stocks Surge as Dollar Dips, Silver Hits $80 Amid Rate Cut Hopes

Asian markets rally to six-week highs while silver breaks $80, driven by Federal Reserve rate cut ex