You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Germany’s economy — long hailed as Europe’s industrial powerhouse — grew in 2025 for the first time since 2022, breaking a multi-year period of stagnation and contraction. Official data released in January 2026 showed that gross domestic product (GDP) expanded by 0.2 per cent, signaling the end of two consecutive years of shrinking economic output. This modest rebound, though small, is a significant development for a nation grappling with structural headwinds, weakening exports, and slow industrial demand.

The return to growth has been widely viewed as tentative — a sign that the economy might be stabilizing rather than robustly expanding. What makes this development newsworthy is not only the statistical uptick but also the strategic economic shifts, ongoing policy debates, and geopolitical influences that underpin Germany’s recent performance. This article explores the factors behind the rebound, the roles of consumption, government spending and exports, structural constraints, political context, and future prospects.

Germany’s economy suffered back-to-back annual contractions in 2023 and 2024, ending nearly two decades of relative economic stability and consistent growth. Recent statistical estimates show that GDP shrank by 0.9 per cent in 2023 and 0.5 per cent in 2024 — a combination of external shocks and domestic challenges that undermined activity across key sectors. By contrast, the 0.2 per cent expansion in 2025 marks a notably slow but significant reversal of this trend.

This downturn followed a variety of pressures: a global energy crisis triggered by geopolitical turbulence, tariff actions in major trading markets like the United States, and intense competition from China. Each of these impeded Germany’s traditionally export-intensive industrial sector, forcing policymakers to rethink strategies and priorities.

Germany’s stagnation stemmed from structural vulnerabilities long masked by export strength. For decades, the country’s economic model depended heavily on its manufacturing and engineering prowess, exporting cars, machinery, and industrial capital goods around the world. But in recent years, demand patterns shifted, and competitors gained ground. A combination of rising global protectionism, a stronger euro making German goods more expensive abroad, and Chinese competitors gaining export share contributed to declining export volumes.

At the same time, domestic investment fell short of expectations. High regulatory burdens, complicated planning procedures, and cautious corporate sentiment resulted in subdued capital spending on new machinery and infrastructure, further slowing momentum in a key driver of national output.

A significant driver of growth in 2025 was a recovery in household consumption. Domestic spending by households increased, supported partly by structural policies aimed at boosting real incomes and easing stagnation in the labour market. Consumers — previously cautious due to inflationary concerns and economic uncertainty — began to increase discretionary spending on services and durable goods. This trend helped fill part of the gap left by weak external demand.

This shift is notable because German GDP growth has historically been export-driven. The recent uptick in household consumption reflects a rebalancing toward domestic demand, an essential component of a more resilient economic structure that does not solely depend on global trade.

The German federal government also played a pivotal role in supporting the rebound. In response to prolonged economic underperformance, policymakers embarked on a much larger fiscal stimulus than Germany traditionally pursues. These measures included increased public investment in infrastructure, defence, and targeted subsidies meant to boost productivity and aggregate demand. Both consumption and government expenditure contributed to the reported GDP increase, with public investment acting as a stabilizing force in the short term.

This shift in policy reflected a pragmatic departure from the country’s traditional emphasis on balanced budgets and fiscal conservatism. Following legislative adjustments that loosened constitutional spending constraints (such as earlier reforms to Germany’s “debt brake”), the government had more flexibility to allocate funds toward economic revitalization.

German exports remained weak in 2025 even as overall GDP expanded. After years of slow momentum, exports continued to decline, with the statistics indicating persistent headwinds in external demand — particularly due to the global tariff environment and currency effects. Higher U.S. tariffs and increasing global competition, especially from China, weighed on export volumes, hurting key manufacturing and engineering sectors that had been the backbone of Germany’s economic success.

The manufacturing sector’s performance has been mixed, and despite some signs of industrial resilience — such as pickup in car production reported earlier — export orders have not reflected strong international demand. Broader European industrial output has shown gains, but Germany’s own trade balance and overseas demand remain areas of concern.

Business investment did not match the pace of household consumption or government spending in 2025. Expenditure on equipment and fixed capital formation declined, suggesting that firms remained cautious about future demand and reluctant to commit to long-term expansion during an ongoing period of uncertainty. This underlines that while consumption and public spending helped avert recession, the private sector has not yet regained full confidence to drive investment-led growth.

Analysts argue that without a meaningful uplift in business investment, structural productivity gains will remain limited, undercutting long-term growth prospects. It also points to deeper, persistent issues in Germany’s economic fabric — issues that structural reforms, rather than short-term stimulus alone, must address.

Despite the 2025 rebound, Germany faces significant structural challenges. Issues such as an ageing workforce, skill shortages, rigid labour markets, and bureaucratic hurdles have undermined competitiveness over the longer term. Many small and medium-sized enterprises (SMEs), which form the backbone of the German economy, reported declining sales in 2025 while others warned that fiscal stimulus alone cannot counter deeper structural inefficiencies.

In sectors such as automotive manufacturing — once a global symbol of German industrial might — companies have struggled with declining demand, especially in key markets like the United States and China. Global shifts toward electric vehicle production and heightened competition in new technology segments have intensified the challenge rather than alleviated it.

Economic fragility is also reflected in recent trends in corporate bankruptcies. Business lobby groups have flagged the highest number of insolvencies in over a decade — a worrying indicator that prolonged economic stress is taking a toll on enterprises across multiple industries. These insolvencies underscore that while headline GDP growth can signal recovery, underlying socioeconomic pressures — such as financial distress among firms — require urgent attention if growth is to become sustainable.

This surge in corporate failures highlights that structural deficiencies and competitive disadvantages extend beyond simple cyclical downturns and into long-term competitiveness challenges that Germany must address to foster durable economic health.

The German political landscape has shifted significantly in recent years as leaders grapple with persistent economic stagnation. This has translated into major fiscal policy decisions aimed at encouraging recovery. Notable among these was the legislative reform that exempted defence and infrastructure spending from traditional fiscal limits, enabling the government to mobilize unusually large stimulus funds.

This reorientation has broad implications. By loosening the so-called “debt brake” — a constitutional fiscal rule intended to limit government borrowing — policymakers demonstrated a willingness to prioritize economic revival over stringent budgetary constraints. This marked a critical departure from Germany’s orthodox fiscal discipline and reflected a broader consensus that traditional policies were insufficient for addressing contemporary structural problems.

Though modest, the 2025 growth print sets the stage for cautiously optimistic forecasts in the medium term. Official forecasts from European sources suggest that GDP growth could accelerate to higher levels — potentially above 1 per cent in 2026 — as public spending continues and consumer demand stabilizes further.

Predictions from economic surveillance bodies suggest that while export performance may continue to be a drag, broader demand drivers — including consumption, public investment and potentially recovering global demand — will help sustain positive momentum. However, even these forecasts assume that structural reforms and firm investment gradually improve the economic environment.

For Germany to achieve more robust and sustained growth, several key areas will need attention. These include enhancing labour market flexibility, simplifying regulatory frameworks for business investment, and fostering innovation in emerging technology sectors. In addition, improving export competitiveness — possibly through diversification into higher-value products and services — will be important in counteracting global competitive pressures.

Germany’s return to growth in 2025 marks a symbolic turning point, reflecting a tentative end to recessionary pressures that weighed heavily on Europe’s largest economy. The 0.2 per cent GDP expansion — driven by household consumption and government expenditure — shows that the economy can stabilize after years of contraction.

However, the modest nature of this rebound, coupled with persistent export weakness and structural rigidity in key industries, signals that Germany’s economic recovery is still at an early stage. Last year’s growth should be viewed not as a dramatic turnaround but as a fragile foundation upon which stronger, more sustainable expansion must be built.

With thoughtful policy decisions, structural reforms and renewed confidence from the private sector, Germany’s economy might achieve stronger growth in the coming years. The journey from stagnation to robust expansion, however, remains uncertain and contingent on addressing deep-seated challenges that predate the most recent downturn.

Disclaimer:

This article synthesises verified information from multiple reputable sources to provide a comprehensive analysis of Germany’s economic performance in 2025 and its implications. It is intended for informational purposes only and does not constitute financial or investment advice.

Air India Airbus A350 Engine Damaged by Cargo Container in Delhi Incident

An Air India A350’s engine sucked in a cargo container while taxiing in Delhi, grounding the flight.

Pakistan Expands Arms Influence, Eyes Islamic NATO in Arab World

Pakistan strengthens military ties in the Arab world, negotiating arms deals and a trilateral Islami

Harvard Drops to Third in Global Science Ranking, China Leads Again

Harvard University falls to third in the CWTS Leiden 2025 Science ranking, while Chinese universitie

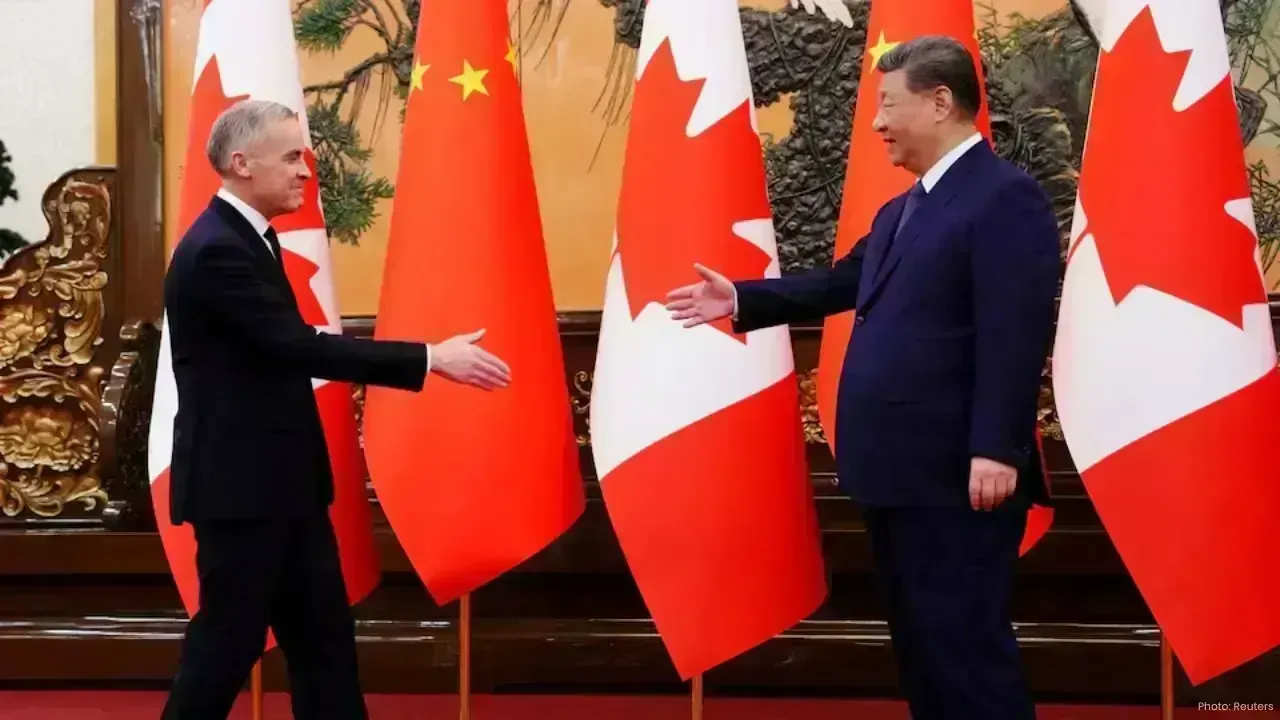

Canada, China Open New Chapter With Strategic Partnership Talks

Canada and China begin rebuilding relations as Prime Minister Mark Carney meets President Xi Jinping

Batangas Court Orders Arrest of Atong Ang in Missing Sabungeros Case

A Batangas court has ordered the arrest of tycoon Atong Ang and others over the disappearance of sab

China Gives $2.8M Aid to Thailand After Fatal High-Speed Rail Accident

China provides 20 million yuan in cash and relief supplies to Thailand after the deadly crane collap