You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The global economy in 2025 is witnessing a substantial rise in commodity prices, impacting households, businesses, and governments across continents. From energy and metals to agricultural goods, the upward trend has triggered debates about inflation, trade, and economic stability. Commodities, which form the backbone of both industrial production and everyday consumption, have seen price fluctuations that are influenced by multiple interconnected factors.

Several elements have converged to create this situation. Supply chain disruptions, geopolitical tensions, and monetary policies in major economies have all contributed to the escalation. At the same time, changing demand patterns driven by post-pandemic recovery, population growth, and industrial expansion are placing additional pressure on global markets. Understanding the causes, implications, and potential future scenarios is essential for policymakers, investors, and consumers alike.

Global supply chains are still facing aftershocks from past disruptions caused by the pandemic, natural disasters, and logistical bottlenecks. Shipping delays, container shortages, and port congestion have restricted the movement of goods, causing scarcity in crucial commodities. For example, essential raw materials like steel, copper, and aluminum have experienced constrained supply due to delayed production and transport issues.

Labor shortages in key sectors, such as shipping and manufacturing, have further complicated supply. In addition, fluctuations in energy prices have increased the cost of transporting goods, which has been passed on to end consumers. Even minor delays in raw material delivery can amplify the impact on industries that rely heavily on continuous supply, leading to a ripple effect that drives commodity prices higher.

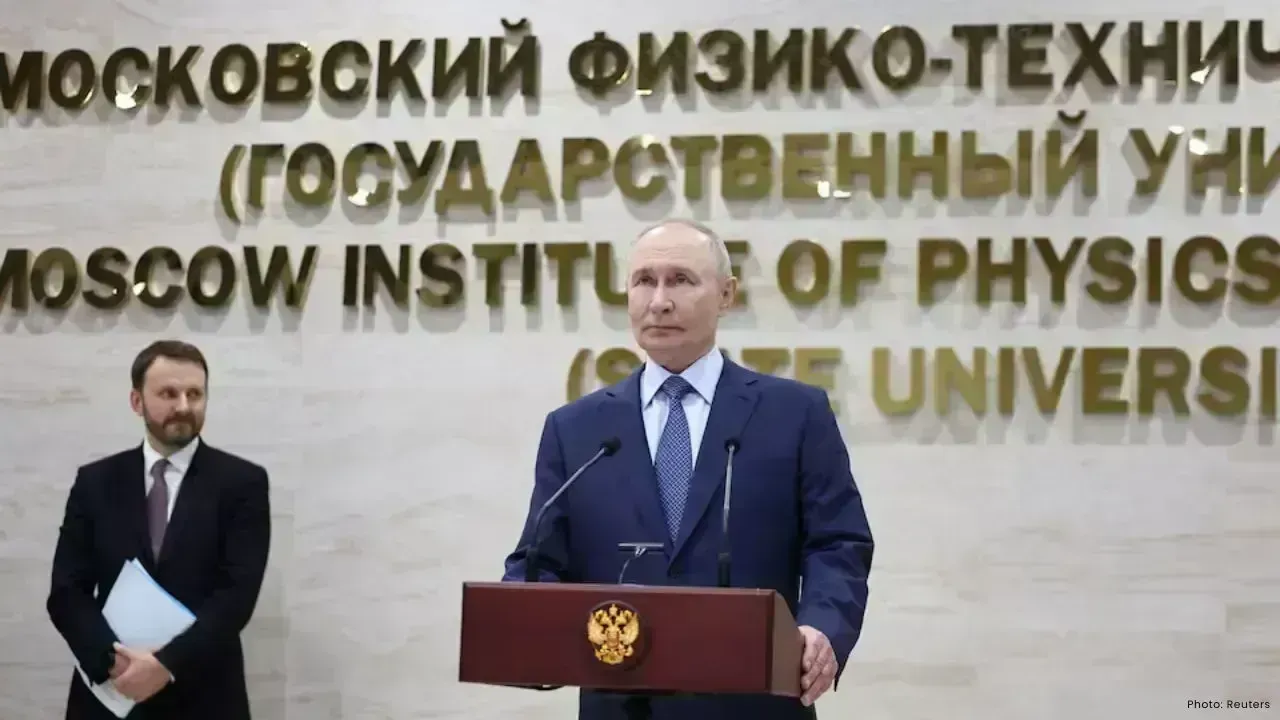

Geopolitical conflicts and trade disputes have emerged as another major factor influencing commodity markets. Tensions in regions rich in natural resources, such as the Middle East and parts of Africa, have raised concerns about potential supply disruptions. Export restrictions, sanctions, and tariffs implemented by nations in response to political disputes have disrupted trade flows, creating uncertainty and volatility in commodity pricing.

For example, oil and gas markets are particularly sensitive to tensions in key producing countries. Even minor escalations or threats of conflict can cause price spikes, reflecting market anxiety over potential shortages. Similarly, metals like copper, nickel, and aluminum are affected by export policies in producer nations, impacting global availability and costs.

Expansionary fiscal and monetary policies in major economies have also contributed to the surge in commodity prices. Stimulus measures, low interest rates, and large-scale government spending have increased purchasing power and stimulated demand. While this has helped economic recovery, it has also generated inflationary pressures that are felt in the cost of commodities.

Rising inflation reduces the real value of money, prompting investors and businesses to turn to tangible assets like commodities as a hedge. This increased demand further accelerates price growth. Inflationary trends in major economies, such as the United States and the European Union, have a global impact, as commodity markets are highly interconnected.

The direct consequence of rising commodity prices is heightened inflation. Energy, metals, and food are core components of the global economy, and price increases in these sectors raise production costs. Companies often pass these costs on to consumers, leading to higher prices for everyday goods.

In particular, energy price hikes influence transportation, manufacturing, and heating costs, which in turn affect the overall cost of living. For emerging economies with limited domestic production capabilities, inflationary pressures can be even more pronounced, as imported commodities become significantly more expensive.

Commodity price fluctuations have profound implications for global trade. Countries that rely heavily on imports of oil, gas, metals, or food face increased trade deficits when prices rise. Conversely, exporting nations can benefit from higher revenues but may face diplomatic or trade-related challenges.

Price volatility complicates international trade agreements and can affect the balance of payments. Businesses engaged in international supply chains may struggle to forecast costs accurately, resulting in slower investment and reduced economic growth. Traders, investors, and policymakers must closely monitor commodity markets to manage these risks effectively.

Emerging markets are particularly vulnerable to rising commodity prices. Many of these countries import a significant portion of their energy, metals, and food requirements. When global prices escalate, these economies face increased import bills, widening fiscal deficits, and potential currency pressures.

Higher commodity costs can also translate into social and political challenges. Governments may be forced to subsidize essential goods to protect citizens from inflation, placing additional strain on public finances. In some cases, prolonged price increases could lead to balance of payments crises or even social unrest.

Energy commodities have experienced some of the most pronounced price increases. Oil and natural gas prices, influenced by supply constraints and geopolitical tensions, have surged, affecting electricity production, transportation, and heating costs globally.

Energy-intensive industries, such as manufacturing and logistics, face higher operational expenses, which eventually filter down to consumer prices. Renewable energy sources, while growing, have not yet fully offset reliance on fossil fuels, keeping the market sensitive to disruptions in oil and gas supply.

Agricultural commodities like wheat, rice, corn, and soybeans have been affected by multiple factors. Adverse weather events, including floods, droughts, and unseasonal rainfall, have reduced yields in key producing countries. Supply chain disruptions, such as delayed shipping and labor shortages, further exacerbate shortages.

Food price inflation has a direct impact on households, particularly in low-income nations where a significant portion of income is spent on food. Global food security concerns are rising, with governments and international organizations seeking strategies to ensure sufficient supply at affordable prices.

Prices for metals such as copper, aluminum, and nickel have climbed due to increased industrial demand and production constraints. These metals are essential for construction, electronics, and automotive sectors, making them critical to the global economy.

Mining disruptions, whether due to labor strikes, environmental restrictions, or logistical challenges, limit the availability of metals, driving prices higher. Investors often view these commodities as safe havens during periods of economic uncertainty, adding upward pressure on prices.

Analysts suggest that while some stabilization in commodity prices may occur in the latter half of 2025, uncertainties remain. Supply chains may gradually improve as logistical bottlenecks are addressed, but geopolitical tensions and inflationary pressures could continue to influence markets.

Technological innovations, such as improvements in energy efficiency and renewable energy adoption, may help moderate price increases over time. Strategic reserves, international cooperation, and alternative sourcing strategies can also mitigate some of the volatility. However, stakeholders should prepare for ongoing fluctuations, as commodity markets are inherently dynamic and sensitive to global developments.

The rise in global commodity prices in 2025 is the result of a complex interplay of supply chain disruptions, geopolitical tensions, inflationary pressures, and changing demand patterns. The impacts are far-reaching, affecting inflation, global trade, emerging economies, and multiple industrial sectors.

While some measures may stabilize prices, volatility is expected to continue, requiring vigilance and strategic planning by businesses, governments, and consumers. Understanding the drivers behind these price movements is essential for navigating the economic landscape and making informed decisions.

This article is intended for informational purposes only. Commodity markets are subject to rapid changes due to geopolitical events, economic policies, climate conditions, and unforeseen global developments. Readers are advised to seek professional advice and conduct independent research before making financial or investment decisions.

Devotees Flock to Khao Khitchakut for 2026 Buddha Footprint Pilgrimage

Hundreds visit Khao Khitchakut National Park to pray at the sacred Buddha footprint for blessings an

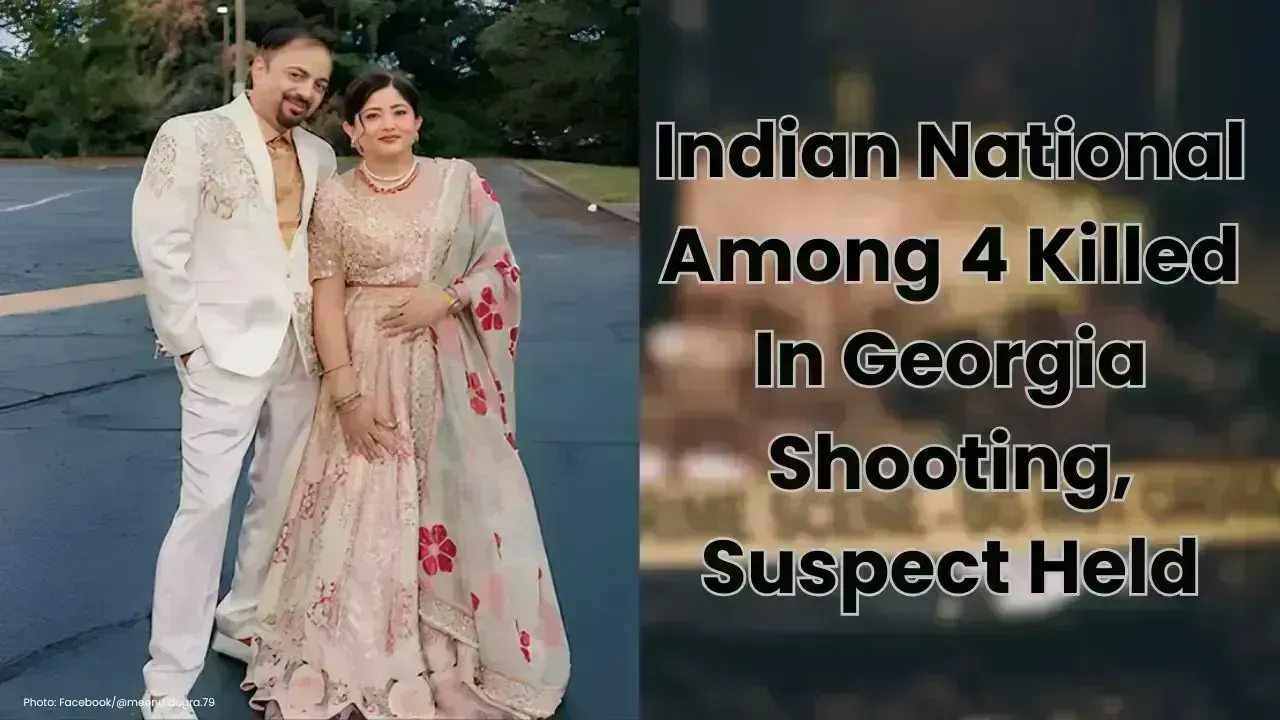

Indian National Among 4 Killed In Georgia Shooting, Suspect Held

An Indian national was among four people killed in a Georgia home shooting linked to a family disput

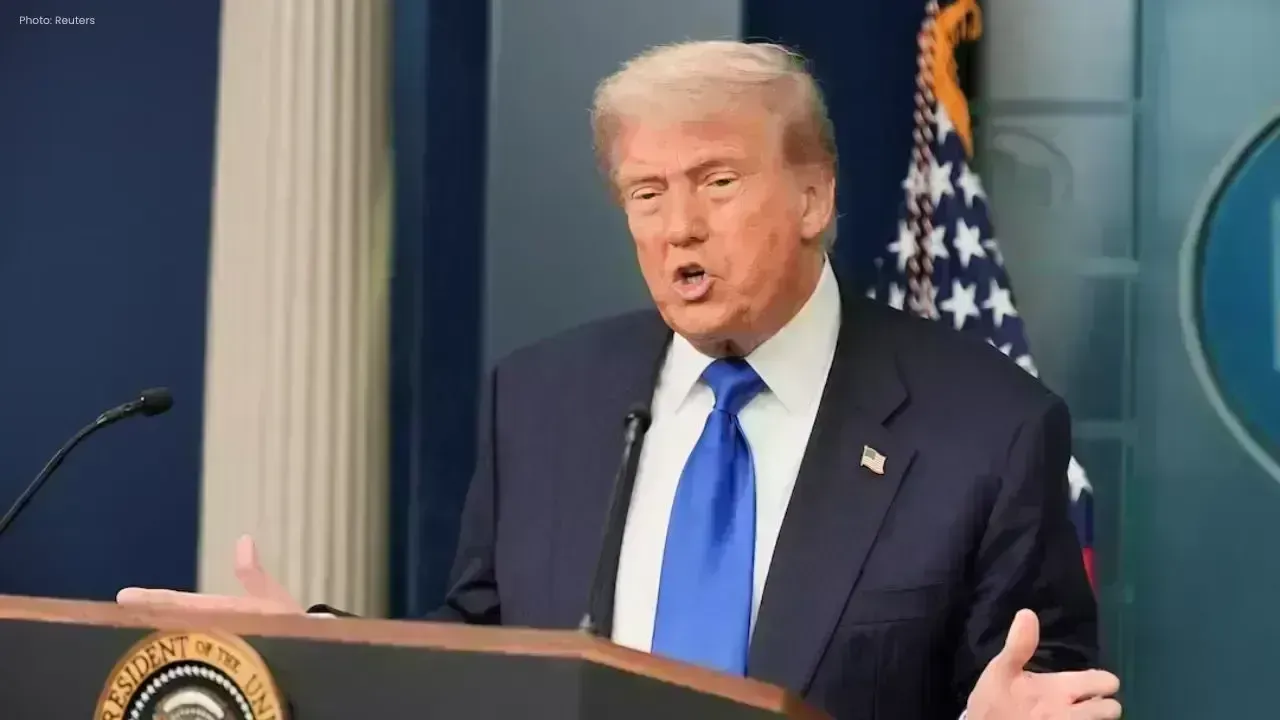

Trump Slams Canada Over “Golden Dome”, Warns China May Take Over Soon

Trump criticised Canada for rejecting the “Golden Dome” plan over Greenland and warned China could d

Pritchard’s 32 Points Push Celtics Past Nets 130-126 in 2OT Thriller

Payton Pritchard scored 32 as Boston beat Brooklyn 130-126 in double overtime, sealed by Amari Willi

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting