You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Saif Rahman

Iveco, the renowned Italian commercial vehicle manufacturer, has revised its expected industrial free cash flow for 2025, highlighting disappointing results from a crucial segment. The firm now predicts a cash flow of approximately 60 million euros, down significantly from a previous estimate ranging between 250 million and 350 million euros. This update has drawn notable interest from investors and analysts, particularly as the company prepares for its acquisition by India's Tata Motors.

Free cash flow serves as a crucial measure of financial health, indicating the funds available after operational expenses and investments have been accounted for. A reduced forecast may signal immediate pressures, notwithstanding the company's enduring long-term strategy.

The primary catalyst for this adjustment lies in weaker-than-anticipated cash generation within the bus segment during the last quarter. The firm encountered elevated ramp-up expenses alongside production delays, which hampered cash inflow from this division.

Nevertheless, Iveco remains optimistic, asserting that most other financial objectives for 2025 are still attainable or may fall slightly short of previous forecasts. This indicates that, while challenges persist for the bus operations, the company's fundamental truck business performs better than expected.

The announcement holds particular significance as Iveco is on the brink of being acquired by Tata Motors, a strategic move anticipated to enhance Tata's global standing in the commercial vehicle sector. This acquisition is perceived as crucial for Tata Motors, especially in terms of strengthening its European presence.

Iveco will unveil its full-year and fourth-quarter financial results on February 12. These results are expected to shed light on the severity of the challenges faced by the bus segment and whether these setbacks are merely temporary or indicative of broader issues.

While this revised forecast may disappoint some, it does little to alter Iveco’s long-term outlook. Production hiccups and rising costs are not uncommon in the industrial arena, often manageable over time. With new ownership approaching, observers remain hopeful for the company’s recovery and future growth.

For now, Iveco’s announcement reminds us that even well-established players can encounter unexpected financial hurdles, particularly within a tough global landscape. The company's forthcoming actions will be closely monitored by investors, staff, and industry stakeholders alike.

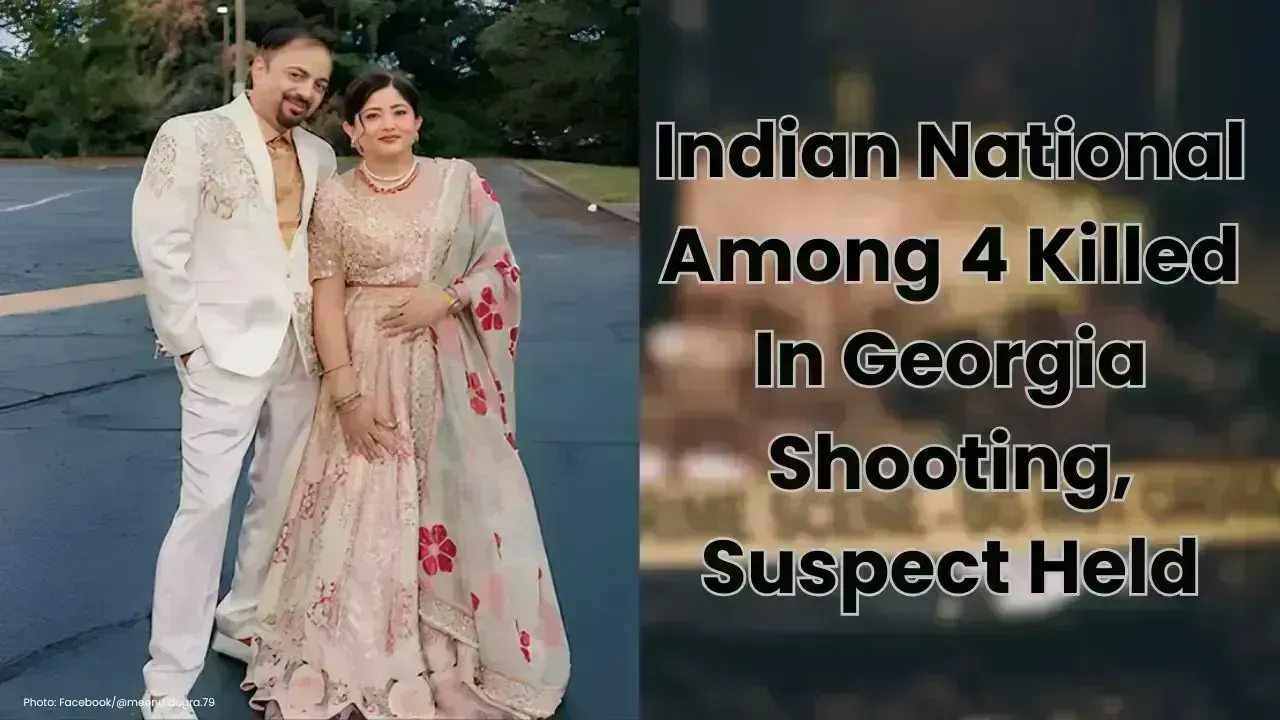

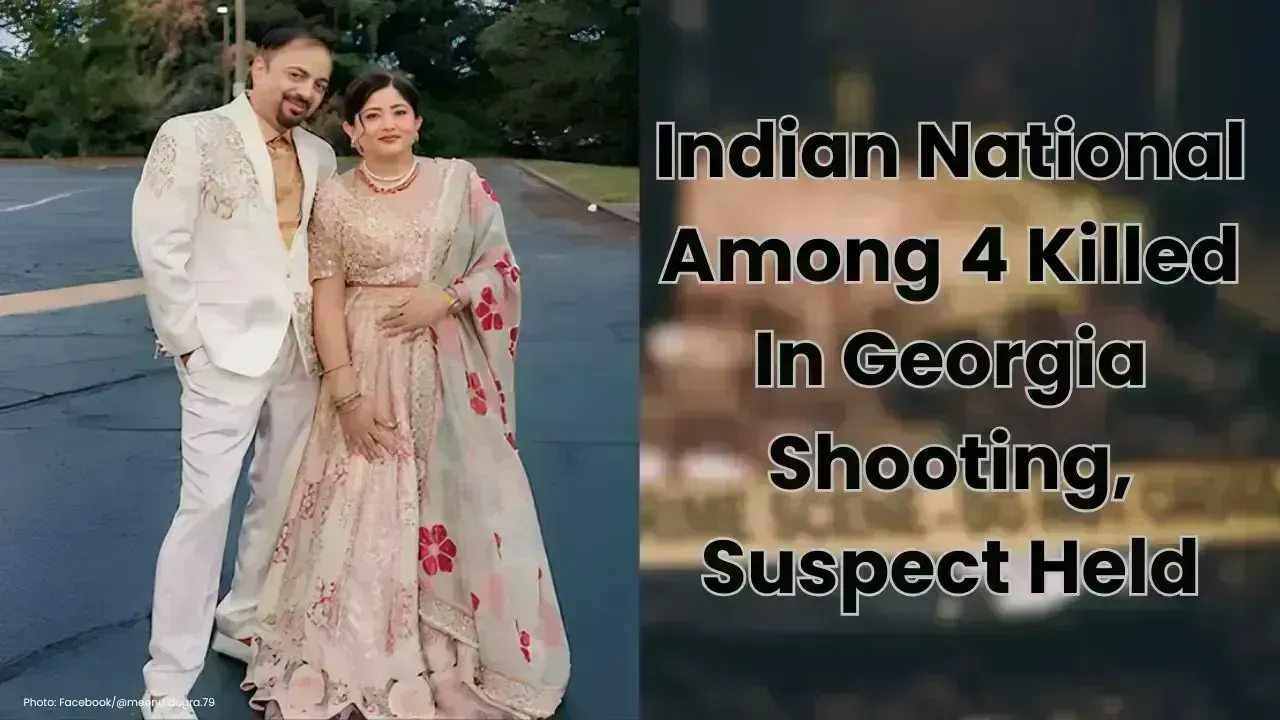

Indian National Among 4 Killed In Georgia Shooting, Suspect Held

An Indian national was among four people killed in a Georgia home shooting linked to a family disput

Trump Slams Canada Over “Golden Dome”, Warns China May Take Over Soon

Trump criticised Canada for rejecting the “Golden Dome” plan over Greenland and warned China could d

Pritchard’s 32 Points Push Celtics Past Nets 130-126 in 2OT Thriller

Payton Pritchard scored 32 as Boston beat Brooklyn 130-126 in double overtime, sealed by Amari Willi

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting

Japan Snap Election Sparks Bond Surge Amid Finance Concerns

Japan’s PM calls early election to back reflation plan. Bond yields hit decades-high as voters weigh