You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

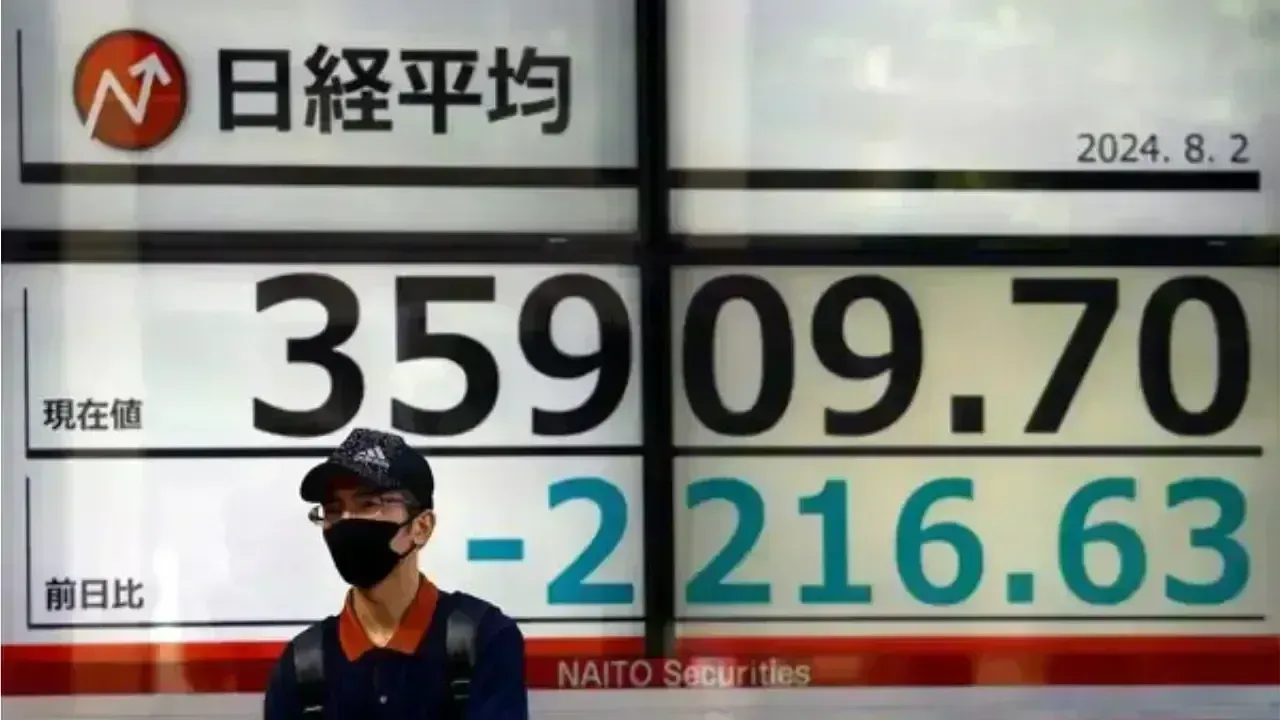

Japan’s stock markets experienced significant weakness as major indices closed sharply lower in response to a confluence of domestic and global factors that rattled investor confidence. The Nikkei average fell about 1.11 per cent, while the broader Topix index also settled lower, marking an extended run of losses over multiple sessions as markets remained vulnerable to negative catalysts.

This downturn was triggered by fresh political developments that intensified market volatility and wider concerns about fiscal policy and rising borrowing costs. Investors reacted swiftly, assessing the implications for corporate profitability and broader economic prospects in one of the world’s largest financial markets.

The immediate catalyst for the sell-off was the announcement of a snap general election scheduled for February 8, 2026 by Japan’s Prime Minister, Sanae Takaichi. Markets responded negatively as political uncertainty increased, with investors concerned that the election could lead to aggressive fiscal policy measures and heightened public spending that might exacerbate Japan’s already substantial debt burden.

Japan’s debt-to-GDP ratio is one of the highest among advanced economies — historically exceeding 250 per cent — and any prospect of increased fiscal stimulus without clear funding strategies tends to rattle financial markets. The snap election, coupled with potential policy shifts, heightened uncertainty about the future course of Japan’s economic management.

Another key factor that amplified equity market stress was a sharp rise in Japanese government bond yields, especially at longer maturities. Yields on 40-year government bonds climbed to around 4 per cent for the first time since 2007, reflecting strong investor concern over fiscal trajectory and bond sell-offs.

Rising long-term yields can have a direct negative impact on stock markets in several ways: higher yields increase borrowing costs for firms, reduce the present value of future earnings, and often lead to portfolio reallocations away from equities toward fixed-income assets offering relatively better returns.

The Nikkei average bore the brunt of the decline, reflecting weakness in key sectors that are sensitive to financing conditions and global demand. The broader Topix index, which encompasses a wider range of stocks including mid- and small-caps, also closed lower, indicating that the downturn was broad-based rather than confined to specific industries.

This broad sell-off suggests that investors were not simply repositioning within subsectors but responding to systemic risks that affect Japan’s macroeconomic and corporate outlook more generally.

While the latest data did not break down sector performance in detail, historically, equities in sectors such as technology, consumer discretionary and financials tend to show heightened sensitivity to both rising bond yields and shifts in economic policy expectations. Higher borrowing costs and political uncertainty typically compress valuations for firms that rely on growth narratives and investment-led expansion.

Japan’s equity weakness did not occur in isolation. Global financial markets have been under pressure amid mounting geopolitical uncertainty, including renewed tariff threats by the United States and broader concerns about trade tensions with European allies. These global factors have contributed to a risk-off environment where investors seek safer assets like gold and government bonds, reducing demand for equities across regions.

Such cross-border ripple effects illustrate how interconnected markets have become, with negative developments in one major economy quickly influencing sentiment and flows in others.

Japan’s traditionally low interest-rate environment made the yen carry trade — where investors borrow in yen to invest in higher-yielding assets overseas — a common strategy for global investors. However, with rising Japanese yields and a weaker yen, some of these trades may be unwinding, causing further volatility in equity and bond markets alike.

Any significant movement in the carry trade can have wider implications for global capital flows and asset pricing, given the scale of assets tied to this strategy.

Prime Minister Sanae Takaichi’s decision to call a snap election was partly motivated by a desire to secure a mandate for her economic agenda, which includes fiscal initiatives such as reducing consumption tax on food items for two years. However, markets are wary that such tax cuts — while potentially stimulative — would widen the fiscal gap and increase government debt without clear compensatory measures.

Her political leadership has also placed focus on structural reforms and national economic resilience, but investors are cautious about immediate market-disruptive effects as policymakers navigate the election cycle.

Snap elections often introduce short-term uncertainty into financial markets, as investors grapple with potential shifts in policy direction and macroeconomic strategy. In Japan’s case, the proximity of the election and the timing of fiscal announcements have compounded fears over future government spending and debt sustainability, contributing to market nervousness.

Japanese long-term government bonds have been at the centre of market stress, with 30- and 40-year yields surging to multi-year or all-time highs. Investors have responded to political developments and fiscal expectations by demanding higher yields to compensate for risk, leading to significant price declines in government debt.

Higher yields can filter through the economy, affecting corporate borrowing costs, government refinancing expenses, and investor risk calculations. The bond market’s behaviour is often seen as a leading indicator of broader financial conditions, and in this instance, it has foreshadowed equity market volatility.

The unrest in Japan’s bond market has implications beyond national borders due to the currency ’carry trade’ dynamic. When Japanese yields rise to levels comparable with or higher than those abroad, the incentive to borrow in yen diminishes. This can reduce capital flows into foreign equities and bonds that had previously benefited from the strategy, tightening financial conditions globally.

This reversal can put additional pressure on global equities if risk assets lose a key source of foreign capital inflows.

While the current downturn is notable, it is not the first time that Japan’s markets have experienced significant stress. Historical episodes — such as the broad declines associated with global crises or periods of systemic financial pressure — show that Japanese markets can be volatile when external and internal pressures align. For example, during the COVID-19 recession, Japanese equity indices suffered sharp declines along with global markets, reflecting synchronized global sell-offs.

However, today’s context includes unique elements, such as a combination of political uncertainty, yield spikes and global risk-off sentiment, that differentiate this episode from more cyclical downturns in the past.

In the near term, volatility is likely to persist in Japanese equity and bond markets. With political uncertainty still unfolding and global growth concerns looming, investors may adopt defensive positions, reduce exposure to risk assets, or seek refuge in safe havens.

For long-term investors, this episode reinforces the importance of understanding macroeconomic fundamentals and fiscal sustainability. While market downturns can present buying opportunities, they also underscore risks associated with government policy shifts, demographic trends and global capital flow dynamics.

Japan’s demographic challenges — including an ageing population and slow growth — continue to influence long-term economic prospects and market valuations.

Japanese financial markets are currently navigating a complex juncture marked by political shifts, rising bond yields and global risk-off pressures. The sharp decline in equity benchmarks reflects deep-seated concerns about fiscal policy, investor sentiment and cross-border financial linkages. As the nation moves into an election period with uncertain economic policy outcomes, financial markets will remain sensitive to both domestic developments and global macroeconomic signals.

Disclaimer:

This article is based on available market reports and public domain information at the time of writing. Financial markets are inherently volatile, and readers should consider their own research or seek professional advice before making investment decisions.

Indian Man Dies Mysteriously at Phuket Music Festival, Cause Unknown

remove news channal name give me rewrit in this news and full detaike news.news like orignal and tre

Manchester City Signs England Defender Marc Guehi From Crystal Palace

Manchester City signs 25-year-old England defender Marc Guehi from Crystal Palace for £20m, boosting

Japan Snap Election Sparks Bond Surge Amid Finance Concerns

Japan’s PM calls early election to back reflation plan. Bond yields hit decades-high as voters weigh

Trump Threatens Huge Tariffs on French Wine Over Peace Board Snub

Donald Trump warned of 200% tariffs on French wine after France rejected his Peace Board plan and mo

Prince Harry, Elton John Sue UK Tabloids Over Privacy Breaches

Prince Harry and Elton John accuse UK tabloids of phone hacking and stealing private info, calling i

Minnesota Man Says ICE Broke In, Handcuffed Him, Dragged Him Into Snow

A U.S. citizen in Minnesota says ICE officers broke down his door, handcuffed him in shorts and Croc