You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

On January 16, several Indian equities emerged as key focal points for traders and investors due to a combination of recent quarterly results, corporate developments, and sector-specific catalysts. Market participants are closely watching stocks including Infosys Ltd, ICICI Prudential Asset Management Company, HDB Financial Services Ltd, Zydus Lifesciences Ltd, Shriram Finance Ltd, Zaggle Prepaid Ocean Services Ltd, and Transrail Lighting Ltd. These names feature prominently due to earnings performance, industry positioning, and anticipated growth opportunities.

Investors typically focus on a set of benchmark names each trading session, but this particular lineup represents a diverse mix of sectors — technology, financial services, pharmaceuticals, non-banking finance companies (NBFCs), and emerging midcaps. Their inclusion in the watchlist points to shifting market sentiment and evolving expectations around corporate earnings and strategic momentum.

Understanding why these stocks are gaining attention requires a closer look at individual company developments, broader economic trends, and sector-specific factors that could influence trading activity throughout the day.

Infosys has drawn attention this session largely because of its latest third-quarter results. The company’s earnings update showed mixed outcomes, fueling investor discussions around future growth prospects in the IT sector. While consolidated profit experienced a slight year-over-year dip, revenues continued to grow across key service lines.

These results are significant because Infosys is one of India’s largest technology exporters, and its performance often sets the tone for sentiment in the broader IT pack. As analysts and market watchers digest the details of the quarterly performance, the stock’s trading behaviour is expected to reflect the market’s interpretation of growth sustainability and margin pressures.

Looking beyond the headline numbers, investors are parsing management’s forward-looking guidance and commentary on demand trends, particularly in digital services and cloud transformation projects. These segments are viewed as critical long-term drivers for Indian IT companies, and any signals of momentum (or slowdown) tend to influence both sentiment and valuation multiples.

ICICI Prudential Asset Management Company has drawn investor interest after reporting strong third-quarter profit growth of more than 40% year-over-year, propelled by rising revenues and stable fee income. Higher asset under management (AUM) levels and effective cost management contributed to this performance.

Such results are important for AMC stocks, as they reflect the company’s ability to capture investor flows in mutual funds and other managed products. This is particularly relevant in a market environment where retail participation and systematic investment plans (SIPs) continue to be a driving force for industry growth.

In addition to earnings, announcements around interim dividends can influence investor confidence, particularly among long-term shareholders who value steady income in addition to capital appreciation. Any regulatory or strategic developments related to fund offerings, digital distribution, or expanding product suites are likely to be closely monitored by market participants.

HDB Financial Services Ltd has attracted attention after reporting a significant rise in quarterly profit, accompanied by notable revenue expansion. According to investor sentiment and early market reads, net profit surged by more than 30% year-over-year, while total revenue grew strongly — a performance that underscores the NBFC’s operational momentum.

These figures come against a backdrop of steady credit demand in both retail and commercial segments, and they position HDB Financial as a name to watch among financial stocks this trading session.

Market sentiment on HDB Financial has shown positive leanings, with traders and analysts pointing to robust fundamentals and earnings continuity. This growing confidence could influence intraday trading dynamics and longer-term positioning among institutional investors.

Zydus Lifesciences Ltd features on the watchlist amid renewed investor interest in pharmaceutical stocks. Healthcare and pharma names often attract attention based on regulatory news, product approvals, and global demand for treatment portfolios. While the specific trigger for Zydus’s inclusion in the watchlist may relate to broader sector developments, investors will be observing earnings updates and growth prospects across key therapeutic segments.

Given the global and domestic importance of pharmaceuticals — especially in a world with evolving healthcare priorities — stocks like Zydus often fluctuate based on anticipation around clinical pipelines, export opportunities, and generic drug demand. These industry-wide factors can lead to heightened trading volumes and price action in related equities.

Shriram Finance Ltd has surfaced among stocks to watch as market participants monitor shifts within the NBFC universe. With credit demand evolving and non-bank lenders often outperforming peers in specific segments like retail loans and vehicle financing, Shriram’s stock activity reflects broader sector interests.

Valuation metrics and recent trading ranges can provide clues to short-term momentum, especially if the stock sees higher volumes or shifts in major support and resistance levels.

Shriram Finance’s performance spotlight underscores investor interest in credit growth stories at a time when interest rate expectations and macroeconomic signals remain central to financial markets. How the NBFC manages asset quality and capital deployment could shape investor sentiment in coming quarters.

Zaggle Prepaid Ocean Services Ltd, a provider of corporate spend management and prepaid solutions, appears on the radar as an emerging midcap stock with improving sales metrics. Recent quarterly sales growth — reportedly strong on a year-over-year basis — contributes to its presence in the watchlist, attracting attention from traders looking for growth beyond traditional large-cap names.

Emerging companies operating at the intersection of financial services and technology have been gaining traction among investors seeking diversified exposure. Performance indicators such as net sales expansion and market penetration can amplify trading interest and liquidity in such names.

Transrail Lighting Ltd has piqued investor interest, with community sentiment showing strong buy recommendations among retail traders. This technical interest — often reflected in price momentum and increased volume — highlights how mid-tier stocks can rise in prominence during sessions when broader markets take cues from company-specific news and technical patterns.

While fundamentals remain a long-term consideration, short-term trading interest in names like Transrail can be driven by price action and breakout potential. Investors evaluating trend indicators may view such stocks as tactical opportunities.

On January 16, other large-cap names and sector indices also saw activity linked to corporate earnings announcements and macroeconomic cues. Indices like the Nifty and Sensex reflected mixed sentiment, with select sectors outperforming while others consolidated recent gains.

Several companies beyond the key stocks listed are scheduled to release quarterly results, adding to the market’s dynamic as traders price in forward expectations. Earnings calendars often influence volatility, sector rotation, and short-term positioning.

Investors should keep an eye on possible revisions to earnings guidance or management commentary that could alter short-term market expectations, especially for names like Infosys and ICICI Prudential AMC.

Shifts between defensive and cyclical sectors, particularly financials and technology, may shape broader market themes in the sessions ahead.

Price action in midcap and small-cap stocks like Zaggle and Transrail often reflects momentum and sentiment, offering clues to trader psychology and sector interest.

Disclaimer:

This article is an independent market summary based on publicly available reports and data. It is intended for informational purposes only and should not be construed as investment advice.

Air India Airbus A350 Engine Damaged by Cargo Container in Delhi Incident

An Air India A350’s engine sucked in a cargo container while taxiing in Delhi, grounding the flight.

Pakistan Expands Arms Influence, Eyes Islamic NATO in Arab World

Pakistan strengthens military ties in the Arab world, negotiating arms deals and a trilateral Islami

Harvard Drops to Third in Global Science Ranking, China Leads Again

Harvard University falls to third in the CWTS Leiden 2025 Science ranking, while Chinese universitie

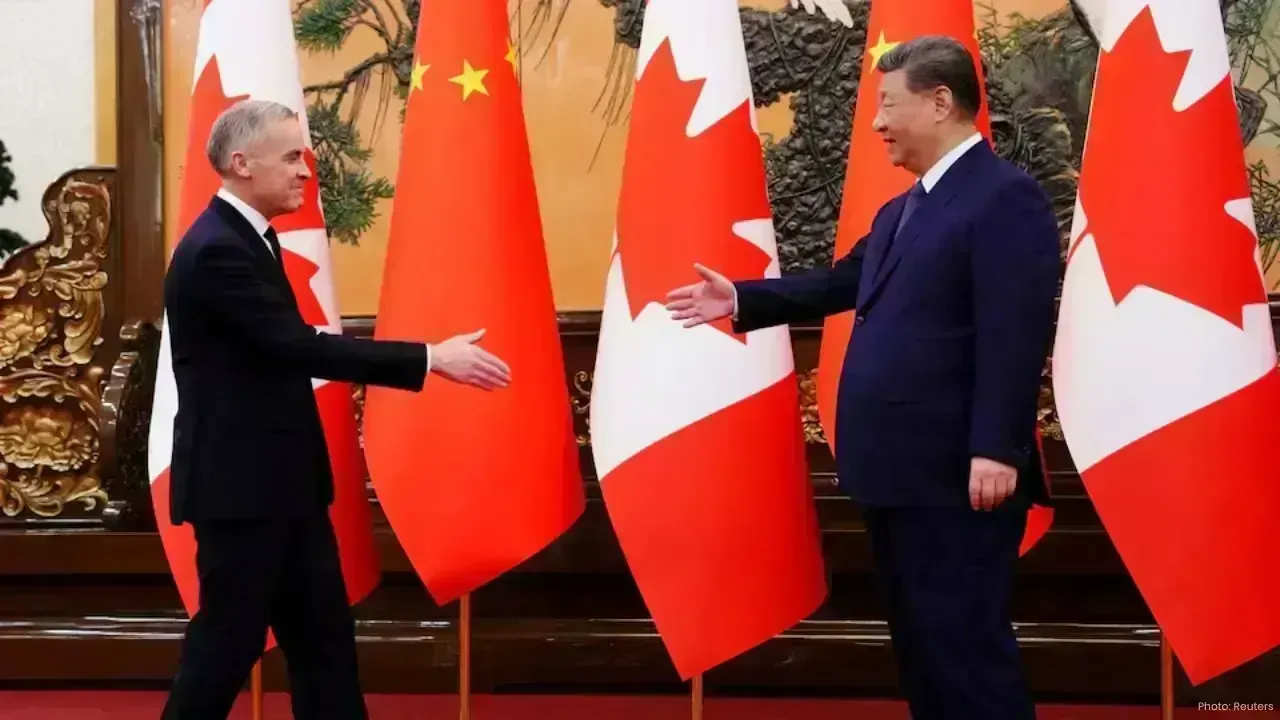

Canada, China Open New Chapter With Strategic Partnership Talks

Canada and China begin rebuilding relations as Prime Minister Mark Carney meets President Xi Jinping

Batangas Court Orders Arrest of Atong Ang in Missing Sabungeros Case

A Batangas court has ordered the arrest of tycoon Atong Ang and others over the disappearance of sab

China Gives $2.8M Aid to Thailand After Fatal High-Speed Rail Accident

China provides 20 million yuan in cash and relief supplies to Thailand after the deadly crane collap