You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Disclaimer: This article is for general informational purposes and not financial advice.

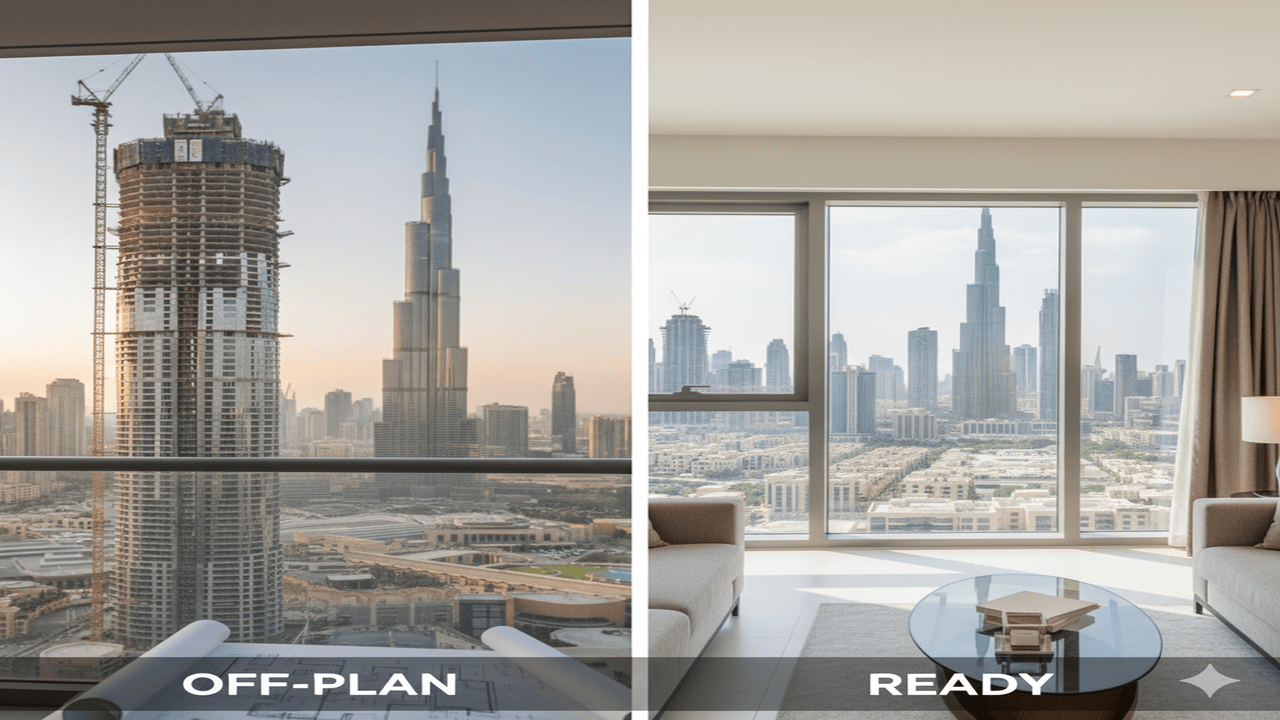

Choosing between off-plan properties and ready properties is a major decision for anyone entering the UAE real estate market. Both offer strong advantages, but the right choice depends on your goals, budget, and timeline. With the UAE attracting global investors and residents, understanding these two property types is essential for making a confident investment.

Off-plan properties are units that are under construction or not yet built. Buyers purchase them based on layouts, designs, and developer commitments. These properties typically come with lower prices and flexible payment structures, making them attractive for first-time buyers and long-term investors.

Ready properties are fully constructed homes available for immediate occupancy. Buyers can inspect the actual unit, evaluate building quality, and understand the community before purchasing. This gives stronger transparency and reduces uncertainty.

Lower Prices and Higher Appreciation Potential

Off-plan units are usually more affordable than ready homes, allowing buyers to enter the market at a low cost. As construction progresses, property values generally rise, offering substantial capital appreciation.

Flexible Payment Plans

Developers offer extended, construction-linked instalments and even post-handover payment plans. This makes off-plan buying financially manageable, especially for new investors.

Modern Designs and Updated Amenities

New developments include contemporary layouts, smart home systems, and modern community features. This appeals to future renters and boosts long-term resale value.

High Demand for New Projects

Many investors specifically look for newly launched communities, ensuring strong future demand in areas such as Dubai South, MBR City, and Yas Island.

Risk of Delays

Construction delays, though regulated, may occur due to approvals or market conditions, affecting move-in timelines.

Market Fluctuation

Real estate values can shift during the construction period. Buyers must be comfortable with uncertainty.

No Physical Inspection Before Buying

Since off-plan units are not ready to view, buyers depend on developer reliability, making reputation extremely important.

Immediate Move-In or Rental Income

Ready homes allow you to move in immediately or put the unit on rent, generating instant rental returns. This is ideal for investors seeking quick income.

Transparent Inspection

You can physically inspect the property, surroundings, and building quality. This reduces risk and increases buyer confidence.

Stable Market Value

Prices of ready homes reflect current market demand, making them less volatile and appealing to low-risk investors.

Higher Upfront Cost

Ready homes are typically priced higher than off-plan properties due to immediate usability and market demand.

Limited Payment Flexibility

Most ready units require full payment or a mortgage, lacking the flexibility of off-plan payment schemes.

Older Layouts

Some ready homes may not feature modern architectural designs, upgraded facilities, or new-age amenities available in upcoming projects.

Choose Off-Plan If You Want:

• Lower entry cost

• Long-term growth

• Flexible instalments

• New, modern projects

• Higher future resale potential

Off-plan is ideal for buyers focused on appreciation rather than immediate returns.

Choose Ready If You Want:

• Immediate rental income

• Lower risk

• Transparent inspection

• Fast ROI

Ready homes are best for investors who want instant returns and stability.

Choose Off-Plan If You:

• Do not need immediate handover

• Prefer brand-new homes

• Want modern layouts

• Prefer spread-out payments

Choose Ready If You:

• Want to move in quickly

• Need certainty

• Prefer inspecting the final product

• Want predictable timelines

Developer Reputation

Essential for off-plan purchases. Always check past delivery timelines and customer feedback.

Location Matters

A property’s location affects demand, rental value, and future appreciation.

Service Charges

Maintenance fees differ between communities. Premium areas often have higher yearly charges.

Financing Options

Banks easily finance ready homes, while off-plan mortgages may require additional steps.

Market Trends and Government Policies

Infrastructure growth, visa reforms, and new developments can strongly influence property value.

Both options offer strong benefits in the UAE. Choose off-plan for lower prices, modern features, and long-term appreciation. Choose ready properties for transparency, instant returns, and minimal risk. Your ideal choice depends on your investment goals, financial ability, and timeline.

Five Rising Stars Compete for BAFTA’s Only Public-Voted Film Award

BAFTA names five breakthrough actors for its public-voted award, celebrating bold new performances a

Scott Robertson Steps Down as All Blacks Coach After Review

Scott Robertson has agreed to leave his role as All Blacks head coach after a performance review, de

Afghanistan Limits Rashid Khan’s Overseas League Appearances

Afghanistan Cricket Board caps foreign league play for star players to protect fitness and ensure co

Philippines, Japan Strengthen Defence Ties Amid Regional Tensions

Philippines and Japan sign defence pacts, including military resupply deal and $6m naval support, am

Bounou the Hero as Morocco Beat Nigeria on Penalties to Reach AFCON Final

Goalkeeper Yassine Bounou shines as Morocco defeat Nigeria 4-2 on penalties to book a thrilling AFCO

Labubu Doll Factory Faces Worker Exploitation Allegations in China

Investigation claims Pop Mart supplier made employees work long hours, sign incomplete contracts, an