You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Saif Rahman

Oil prices remained largely unchanged on Thursday after a two-day decline, as global traders sought clarity from fresh U.S. data and evolving oil flows worldwide.

As of Thursday morning, Brent crude was priced around $60 a barrel, while U.S. West Texas Intermediate hovered close to $56.

This period of steady oil prices followed a significant drop, which analysts attributed to prospects of an oversupply in oil anticipated by 2026. Some experts predict a notable surplus in the first half of the year due to increased output from various producing nations.

A crucial factor contributing to this stability was the recent report regarding U.S. fuel inventories. The Energy Information Administration disclosed that crude stockpiles decreased more than expected, but at the same time, gasoline and diesel reserves surged. Rising fuel inventories may indicate a temporary reduction in crude demand, potentially influencing price declines.

Meanwhile, developments in Venezuela have introduced uncertainty to the global market landscape. The United States has negotiated a deal for access to approximately $2 billion in Venezuelan crude. Some oil shipments initially bound for China may now be redirected to the U.S. Additionally, the U.S. has confiscated two oil tankers connected to Venezuela, including one operating under a Russian flag, intensifying efforts to manage regional oil transactions.

These actions represent a significant shift in U.S. policy regarding Venezuelan oil, with U.S. officials engaging with Venezuela’s state oil firm and collaborating with companies like Chevron to broaden oil exports under new permits. As a result, there is a possibility of increased Venezuelan oil entering global markets.

This blend of news has made traders exercise caution. On one hand, rising fuel inventories and the anticipated global supply increase may exert downward pressure on oil prices. On the other hand, the shifting oil flows from Venezuela alongside geopolitical maneuvers continue to introduce volatility.

Currently, the oil market appears to be balanced between these contrasting influences. Investors are poised to monitor U.S. fuel data and international political trends closely, as any shifts in these areas could sway prices in the near future.

Gold Prices Slide as Strong Dollar and Futures Selling Weigh

Gold prices dipped as investors adjusted positions ahead of a commodity index reshuffle, while a str

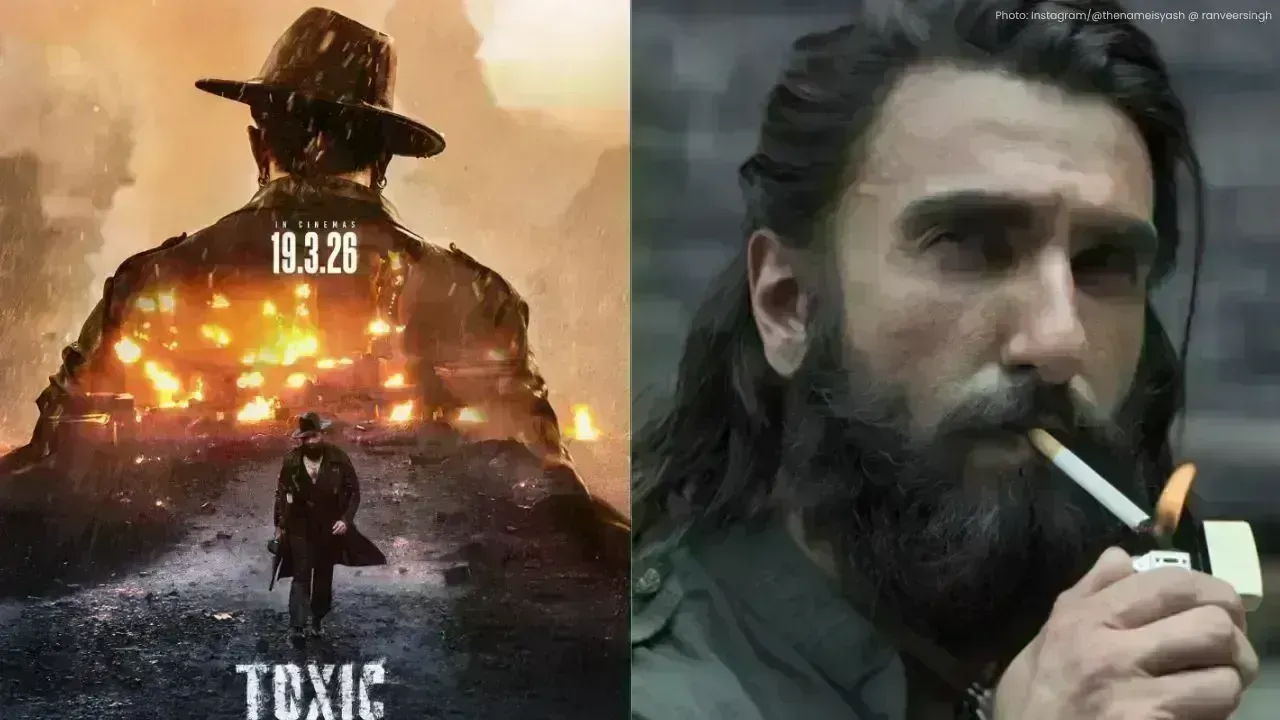

Yash’s Toxic to Clash with Ranveer’s Dhurandhar 2 on March 19 Release

Yash’s Toxic and Ranveer Singh’s Dhurandhar 2 will battle at the box office on March 19, promising a

Australia Wins Final Ashes Test, Clinches Series 4-1; Khawaja Retires

Australia won the final Ashes Test by 5 wickets, sealing a 4-1 series win. Usman Khawaja retired aft

Malaysia Declares 2026 as ‘Year of Execution’ for 13MP Rollout

Malaysia’s Economy Minister says 2026 will focus on execution, ensuring 13MP policies turn into real

Trump Unveils New Tariffs on Iraq, Brazil and the Philippines

Donald Trump issues new tariff letters to eight countries, imposing duties up to 50 percent, citing

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as