You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

In the early trading session on January 12, equity investors are eyeing a mix of corporate disclosures, quarterly results, strategic agreements, and governance announcements that could influence stock price action. Broader market sentiment remains linked to global cues and domestic economic indicators, but company-specific news is driving near-term interest in individual equities.

One of the noteworthy corporate events shaping market sentiment today involves NTPC. The state-controlled power major has signed a shareholder agreement with Maharashtra State Power Generation Company for the acquisition of Sinnar Thermal Power Limited, a coal-based power plant with a capacity of 1,350 MW. The transaction is valued at over ₹3,800 crore and is expected to strengthen NTPC’s footprint in the thermal power segment.

The acquisition, once completed, will expand the NTPC Group’s installed and commercial capacity. For investors, this deal highlights management’s strategic focus on expanding operational scale and long-term earnings potential, especially in the energy sector that remains crucial for India’s infrastructure.

Retail powerhouse Avenue Supermarts, known for its DMart chain, reported solid quarterly earnings, with consolidated profit rising more than 18 percent year-on-year and revenue climbing over 13 percent. This performance reflects robust consumer demand and efficient cost management, further boosting investor confidence in the consumption theme.

In addition to earnings, the company announced a leadership update. The CEO-designate has been appointed as the Chief Executive Officer and Key Managerial Personnel, signaling a well-planned succession and continuity in strategic direction. Such governance developments often offer reassurance to shareholders around corporate stewardship and future growth prospects.

Lemon Tree Hotels has drawn attention following approval of a strategic reorganisation involving its subsidiary, Fleur Hotels. Under the new structure, an affiliate of private equity firm Warburg Pincus will acquire the current investor’s entire stake in Fleur and commit up to ₹960 crore in primary capital.

Fleur is proposed to be listed as a separate entity on Indian stock exchanges, subject to regulatory approvals. The move is designed to unlock value and provide greater focus to the hospitality arm’s growth trajectory. Investors generally see such structural changes as catalysts for re-rating sector valuations, especially in travel and hospitality.

In the metals and mining sector, Vedanta received a favourable ruling from the National Company Law Tribunal (NCLT) approving a comprehensive scheme of arrangement. The plan enables restructuring across various subsidiaries operating in aluminium, power, energy, and iron and steel.

This sanction paves the way for more streamlined operations and potentially greater operational synergies. For steel and metal investors, corporate restructuring is often interpreted as management’s commitment to efficient capital allocation and value creation.

State-owned Indian Renewable Energy Development Agency (IREDA) reported solid quarterly results, showcasing a nearly 38 percent year-on-year increase in net profit. Robust growth in net interest income was supported by higher loan disbursements and improved interest spreads, indicating strong momentum in renewable energy financing.

This performance underscores investors’ renewed interest in green energy financing and related stocks that could benefit from policy support and rising capital allocation toward sustainable infrastructure.

Real estate developers showed mixed quarterly trends. Signature Global reported a decline in pre-sales and area sold on a year-on-year basis — a sign of cautious buyer sentiment in some segments — while collections improved, indicating steady cash flow. Ashiana Housing also experienced softer booking volumes, reflecting a nuanced real estate landscape.

In contrast, Embassy Development reported sequential improvements in pre-sales and collections, and Phoenix Mills posted strong operational performance across retail, hospitality, and residential segments, buoyed by higher footfall and festive demand. These results suggest a segmented recovery within the broader real estate and consumption economy.

The automobile sector provided an update with Mahindra & Mahindra reporting a year-on-year increase in production and overall sales volumes during the December quarter. However, exports saw a decline. The mixed data highlights resilience in domestic demand, even as international headwinds impact export volumes.

Several companies have disclosed governance changes or board decisions that could influence stock performance:

Akzo Nobel India announced board reconstitution, including appointing a new Chairman and redesignating the Managing Director as Joint Managing Director and CEO.

Spandana Sphoorty Financial granted in-principle approval to explore merging its subsidiary into the parent company, with a steering committee constituted for further evaluation.

ICICI Lombard General Insurance informed stock exchanges about an internal inquiry into a draft financial information disclosure, with examination underway per insider trading norms and regulatory requirements.

These disclosures can influence investor perception of corporate governance and transparency, which are increasingly factored into stock valuations.

Institutional flows continued to be a feature of the market through bulk and block deals. A foreign institutional investor acquired a small stake in Tata Capital, while an overseas institutional entity increased its position in MTAR Technologies. EPW India saw stake reduction by an existing investor.

These institutional moves often reflect broader portfolio realignments and can lead to short-term price action in the stocks involved.

Today’s market focus is on company-specific developments that could shape trading sentiment ahead of broader index trends. While global macro cues and technical factors remain important, corporate actions — from acquisitions to earnings to leadership changes — are taking center stage.

Investors tracking these stocks should consider how each development aligns with longer-term themes such as energy transition, consumption resilience, hospitality recovery, and governance quality.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice. Market conditions can change rapidly, and readers should consult qualified professionals before making investment decisions.

Deadly Bushfires in Victoria Leave One Dead, 300 Structures Lost

Bushfires across Victoria have destroyed hundreds of homes, claimed one life, and forced evacuations

Himalayas Turn Rocky as Winter Snowfall Falls, Scientists Warn

Himalayas see record low winter snow, accelerating glacier melt and threatening water supply, forest

Virat Kohli Fastest to 28,000 Runs, Celebrates Career Milestone

Virat Kohli reached 28,000 international runs, reflecting on his journey with gratitude, joy, and de

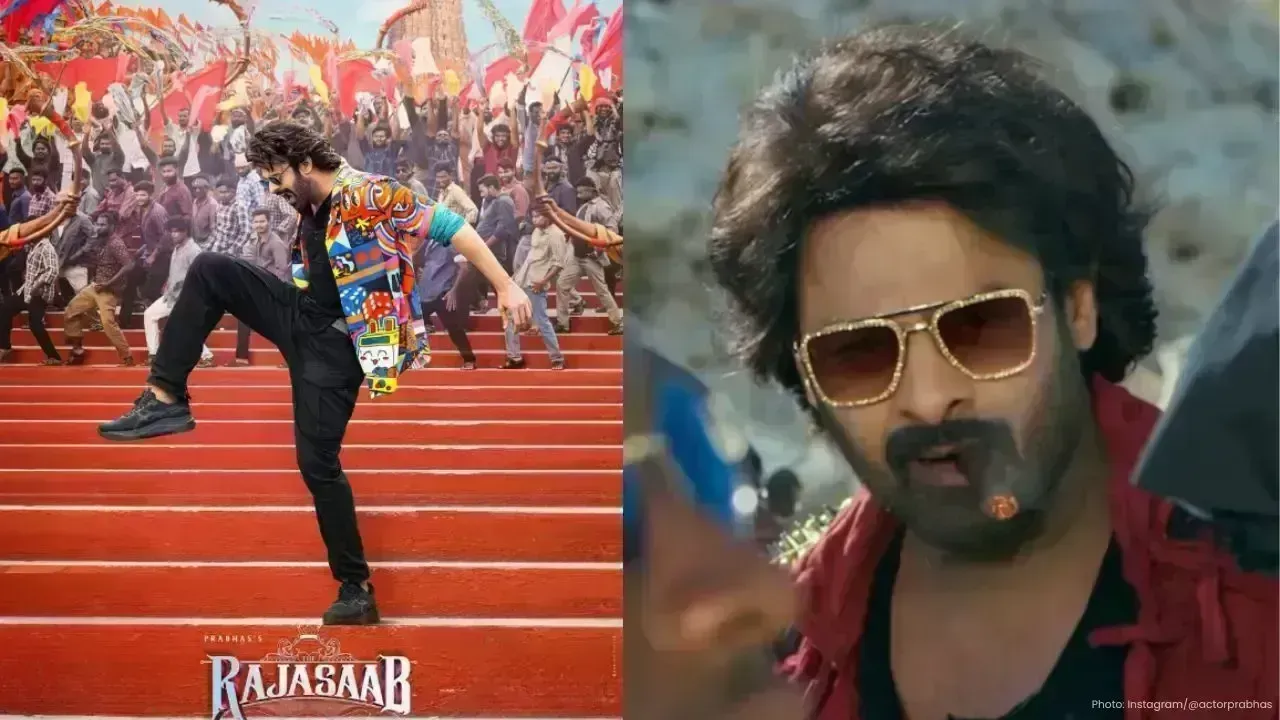

Prabhas’ The Raja Saab Tops ₹100 Crore in India on Day 3 Box Office

The Raja Saab collects Rs 108 crore in India; worldwide total nears Rs 200 crore. Sequel announced w

Malaysia Blocks Grok AI Over Sexualized Image Misuse

Malaysia restricts access to Grok AI after misuse for sexualized, non-consensual images, pending str

Thailand Exports to Grow 2–4% in 2026, Driven by Foreign Investment

Thailand’s exports are projected to grow 2–4% this year, largely due to foreign investment, raising