You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

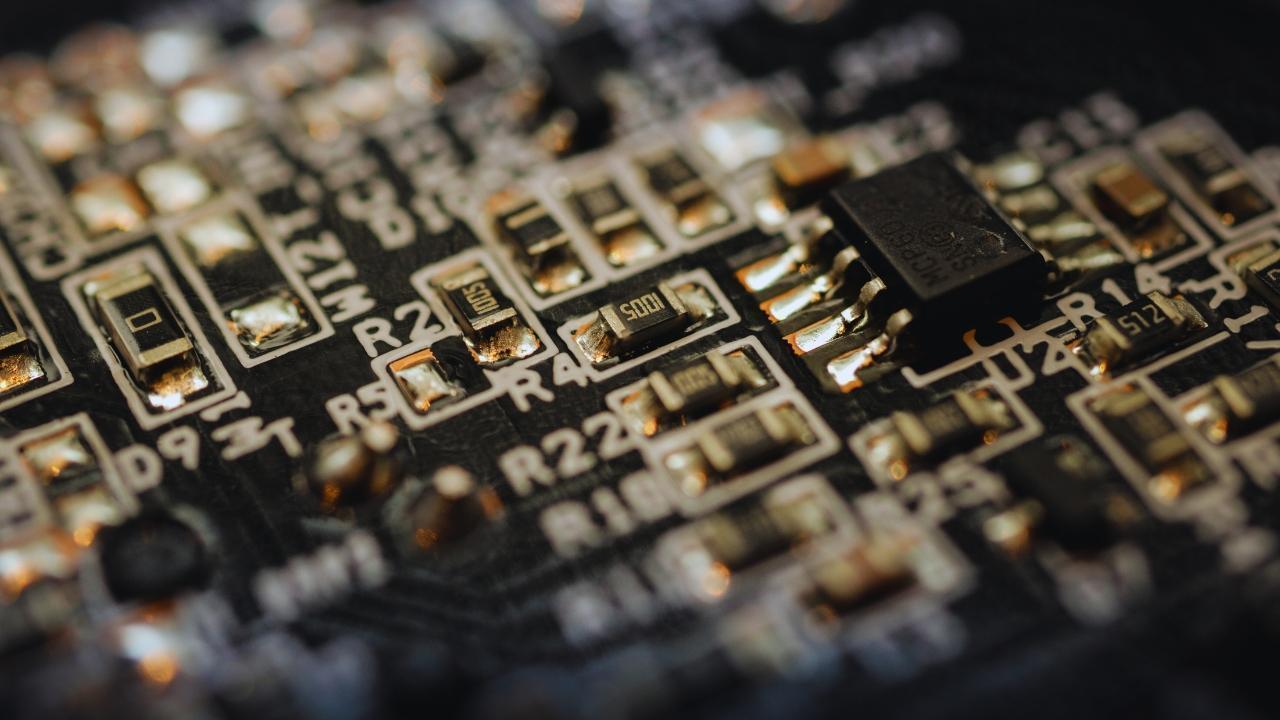

At the core of modern technology lies a microscopic powerhouse: the semiconductor. From smartphones and smart homes to satellites and fighter jets, semiconductors fuel today’s digital revolution. While once hidden behind screens and circuit boards, these tiny chips have now sparked one of the fiercest geopolitical rivalries of our time—between the United States and China.

Dubbed the "New Cold War of Semiconductors," this competition is far from symbolic. It’s a complex confrontation with real-world consequences. Control over chip manufacturing, design, and supply chains is now considered a pillar of national security and economic survival. And as both superpowers race to secure dominance, the global tech ecosystem hangs in the balance.

The semiconductor conflict didn’t ignite overnight. For decades, the United States led the global chip industry. American companies like Intel, Qualcomm, and NVIDIA built their empires on innovation and a head start in chip design and research. However, the actual fabrication of chips—the manufacturing process—gradually moved offshore, mainly to East Asia.

Today, companies like TSMC in Taiwan and Samsung in South Korea dominate advanced chip production. Meanwhile, ASML in the Netherlands holds a near-monopoly on the world’s most advanced chip-making equipment: extreme ultraviolet (EUV) lithography machines. These machines are essential for making the most cutting-edge semiconductors.

China, aiming to reduce its dependence on foreign technology, launched the “Made in China 2025” initiative. The goal was clear: become self-sufficient in critical sectors, with semiconductors at the top of the list. However, catching up in this high-stakes game is no easy feat. China has poured billions into domestic firms like SMIC (Semiconductor Manufacturing International Corp.), but major gaps in talent, tools, and know-how remain.

In response to China’s ambitions, the United States doubled down on domestic manufacturing. The CHIPS and Science Act, passed in 2022, pledged over $52 billion toward research, production, and workforce development in semiconductor technology. It signaled America’s intent to reclaim its position not just in design, but also in fabrication.

Alongside funding, Washington imposed sweeping export restrictions on China. Chinese firms were banned from purchasing high-end chips and chipmaking tools, especially those involving AI and military applications. In 2023, the U.S. extended its influence by pressuring key allies like Japan and the Netherlands to restrict Chinese access to advanced equipment and intellectual property.

Beijing responded swiftly. China began enforcing export controls on rare earth elements, including gallium and germanium, vital for chip production. It also stepped up investment in indigenous R&D and launched subsidies to accelerate breakthroughs in materials and lithography systems.

The situation has created a tense global tech environment where every innovation, trade deal, or acquisition is viewed through a national security lens.

The once-borderless semiconductor supply chain is now fragmenting. As nationalism rises and trust wanes, firms are reconfiguring operations to minimize geopolitical risk. Major players like Apple, Intel, and TSMC are moving parts of their operations to India, Vietnam, and the U.S., while exploring “friend-shoring”—producing goods in politically aligned countries.

Meanwhile, Taiwan’s pivotal role in chip fabrication has come under scrutiny. With over 90% of the world’s most advanced chips being produced in Taiwan, the threat of conflict in the Taiwan Strait carries alarming global implications. Many experts believe that any disruption there could cripple industries from consumer electronics to defense for months, if not years.

The European Union is also making moves. The EU Chips Act, with a proposed €43 billion in funding, aims to double Europe's global semiconductor market share by 2030. These moves highlight a new world order in which semiconductor self-reliance is becoming a national priority across continents.

Beyond economics, semiconductors have become the foundation of modern defense and military technology. Precision-guided weapons, satellites, communication systems, and surveillance tools all depend on high-performance chips.

Artificial intelligence, a strategic battleground in its own right, further intensifies the rivalry. Cutting-edge AI models require immense computing power, powered by specialized chips—an area where American companies like NVIDIA and AMD currently hold the lead. Recognizing this, the U.S. has blocked the sale of AI-enabling chips to Chinese buyers.

In turn, Chinese firms such as Huawei, Baidu, and Alibaba are scrambling to create domestic alternatives. The question is no longer whether AI will transform economies and societies, but who gets to lead—and regulate—that transformation.

The escalating semiconductor cold war is placing neutral nations and private corporations in a difficult position. Countries like Singapore, Malaysia, and Vietnam are trying to attract investment without alienating either superpower. Simultaneously, tech firms that once freely collaborated across borders are being forced to pick sides or restructure operations.

Companies with global supply chains now face complex compliance requirements. Licensing, export checks, and the risk of sanctions are pushing businesses to reassess partnerships and logistics. For many, the cost of doing business in semiconductors is rising—not just financially, but politically.

Meanwhile, the global consumer pays the price: costlier electronics, longer wait times, and decreased innovation from fragmented collaboration.

While this is primarily an economic and technological standoff, there are real fears that the rivalry could escalate beyond trade and policy.

Taiwan remains a flashpoint. If tensions between China and Taiwan worsen, a conflict would not only disrupt chip production—it could plunge the entire global economy into crisis. The U.S. has pledged to defend Taiwan militarily, while China sees reunification as a non-negotiable national goal.

Some analysts have compared the current semiconductor landscape to oil in the 20th century: a vital resource around which alliances are formed, wars are waged, and economies are built. But unlike oil, semiconductors are not naturally occurring—they require expertise, cooperation, and years of cumulative investment.

Despite the competition, some experts argue that total decoupling is unrealistic. The semiconductor supply chain is too interdependent, and innovation thrives on collaboration. Instead, what’s emerging is a dual-track system—one led by the U.S. and its allies, and another by China and its strategic partners.

To avoid disaster, both sides will need to establish clearer communication channels, red lines, and mechanisms for conflict resolution. Global forums for cooperation on standards, security protocols, and ethical uses of chips may serve as starting points.

Ultimately, the world must reckon with a paradox: the very chips that drive progress are now a potential source of division.

This article is intended for informational purposes only and reflects geopolitical and technological developments as of 2025. Readers are encouraged to follow official policy updates and consult independent sources for further insight.

Minimarkets May Supply Red and White Village Cooperatives

Indonesia’s trade minister says partnerships with minimarkets and distributors can strengthen villag

South Africa vs West Indies Clash Heats Up T20 World Cup 2026

Unbeaten South Africa and West Indies meet in a high-stakes Super 8 match at Ahmedabad, with semi-fi

Thai AirAsia Targets Growth Through China & Long-Haul Routes

Thai AirAsia aims 6-9% revenue growth in 2026 expanding domestic flights and new international route

India Ends Silent Observer Role Emerges Key Player in West Asia

From passive energy buyer to strategic partner India’s diplomacy in West Asia now commands trust inf

Indian Students Stuck In Iran Amid US-Iran Tensions And Exam Worries

Rising US-Iran tensions leave Indian students stranded, fearing missed exams could delay graduation

India Says J&K Budget Exceeds Pakistan’s IMF Bailout

India slammed Pakistan at UNHRC, stating J&K’s development budget exceeds Pakistan’s IMF bailout and