You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

For salaried workers, effective tax planning is essential—not just for lowering taxes but for managing income smartly, securing long-term wealth, and minimizing financial worries. Many end up rushing through tax-saving decisions as deadlines approach, often leading to poor investment choices or missed opportunities.

A comprehensive tax-saving strategy can help you pay only what is legally necessary, while simultaneously boosting savings, enhancing insurance coverage, and meeting future financial targets. This in-depth guide outlines the top tax strategies for salaried employees, including their workings, suitability, and best practices for effective application.

Before selecting tax-saving strategies, it is crucial for salaried employees to be familiar with the Old Tax Regime and New Tax Regime.

Offers various deductions and exemptions.

Ideal for individuals investing in tax-saving options.

Demands proactive tax planning.

Features lower tax slabs.

Very few deductions available.

Best for those with little investment or exemptions.

The tax-saving methods covered here are most beneficial for those opting for the Old Tax Regime, as the deductions substantially lower taxable income.

Section 80C allows a deduction up to ₹1.5 lakh annually and is the most commonly utilized tax-saving provision.

EPF stands out as one of the safest ways for salaried individuals to save on taxes.

Mandatory for many employees.

Contributions qualify under Section 80C.

Employer contributions enhance retirement savings.

Interest accrues tax-free under certain conditions.

EPF encourages disciplined, long-term savings effortlessly.

PPF is perfect for those seeking long-lasting security with tax efficiency.

15-year lock-in period.

Backed by the Government of India.

Maturity and interest are both tax-free.

Great for conservative investors aiming for retirement or family objectives.

ELSS is the sole tax-saving option under 80C tied to equity markets.

Lock-in period of 3 years (the shortest under 80C).

Potential for better returns.

Suitable for long-term wealth accumulation.

Involves market-linked risks.

ELSS is particularly suited for younger employees with a higher risk appetite.

NSC is designed for individuals desiring stable returns.

Fixed maturity timeline.

Guaranteed returns.

Interest is taxable but applicable under 80C.

NSC is an excellent match for conservative planners.

Premiums paid for life insurance covering self, spouse, or children qualify under Section 80C.

Must meet specific eligibility criteria.

Term insurance proves to be the most effective choice.

Insurance primarily serves as protection, not just a means for tax savings.

With rising medical expenses, health insurance has become increasingly vital.

Up to ₹25,000 for self and family.

Another ₹25,000 for parents.

Higher limits for parents above 60 years.

Health insurance safeguards both personal health and financial status.

Allowed within overall deduction limits.

Promotes early detection and health maintenance.

This vital benefit is often overlooked.

NPS serves as a potent yet underuses tax-saving option.

Part of the ₹1.5 lakh limit under 80C.

Dedicated savings for long-term retirement.

Extra deduction up to ₹50,000.

Beyond the 80C limit.

This makes NPS highly advantageous for high earners.

Offers an additional tax-exempt benefit.

Does not count toward the 80C limit.

Among the best structured tax-saving incentives.

NPS is perfect for tax-efficient retirement planning.

Employees renting homes can claim HRA exemption.

Actual HRA received.

Rent paid minus 10% of basic salary.

City of residence (whether metro or non-metro).

Proper documentation increases exemption amounts.

Owning property brings multiple tax benefits.

Up to ₹2 lakh for self-occupied homes.

Higher limits for let-out properties.

Principal repayments qualify under 80C.

Home loans facilitate both asset creation and tax savings.

LTA permits exemption on domestic travel costs.

Covers strictly travel expenses.

Claimable twice in a four-year cycle.

Proof of travel is essential.

LTA benefits employees traveling with family.

A uniform standard deduction is accessible to all salaried individuals.

Directly lowers taxable income.

No documentation necessary.

Straightforward and practical benefit.

Applicable to everyone, regardless of investment habits.

Interest on education loans is completely deductible.

No upper limit applies.

Available for a duration of 8 years.

Covers self, spouse, or children.

This provision aids in funding higher education without tax strain.

Deduction of up to ₹10,000 on savings interest (for non-seniors).

Higher limits for senior citizens.

Although modest, this benefit enhances overall savings.

Contributions to qualified organizations qualify for deductions.

Percentage-based deductions.

Valid receipts required.

Tax saving shouldn't solely motivate donations.

Intelligent salary structuring can minimize taxes without needing additional investments.

Meal allowances.

Reimbursements for phone and internet.

Fuel and commuting benefits.

Education allowances.

Optimizing salary structures can increase take-home pay.

Investing purely for tax benefits.

Ignoring long-term aspirations.

Overemphasizing fixed-return options.

Neglecting insurance considerations.

Choosing tax regimes without proper analysis.

Avoiding common pitfalls significantly improves savings and returns.

An effective tax-saving strategy should:

Address insurance requirements.

Support retirement savings.

Outpace inflation.

Ensure liquidity.

Legally lower tax obligations.

Striking a balance is crucial rather than seeking maximum deductions.

With shifting tax regulations, increasing income, and evolving life goals, reviewing your tax strategy annually is vital to ensure:

Enhanced compliance.

Greater savings potential.

Improved financial discipline.

Early strategy formulation reduces anxiety and last-minute scrambling.

Tax saving need not feel burdensome. When strategically planned, it becomes a vehicle for financial security, wealth accumulation, and peace of mind. Employees who gain clarity on available tax options can significantly outpace those who postpone or neglect their planning.

Smart tax preparation is not merely about evasion—it's about leveraging legal frameworks wisely.

This content is purely educational and should not be seen as tax, legal, or financial counsel. Tax rules and limits can shift with government interventions. Personal tax responsibility relies on income, investments, and other unique factors. Consulting a qualified tax expert or financial planner is recommended prior to taking tax actions.

Kim Jong Un Celebrates New Year in Pyongyang with Daughter Ju Ae

Kim Jong Un celebrates New Year in Pyongyang with fireworks, patriotic shows, and his daughter Ju Ae

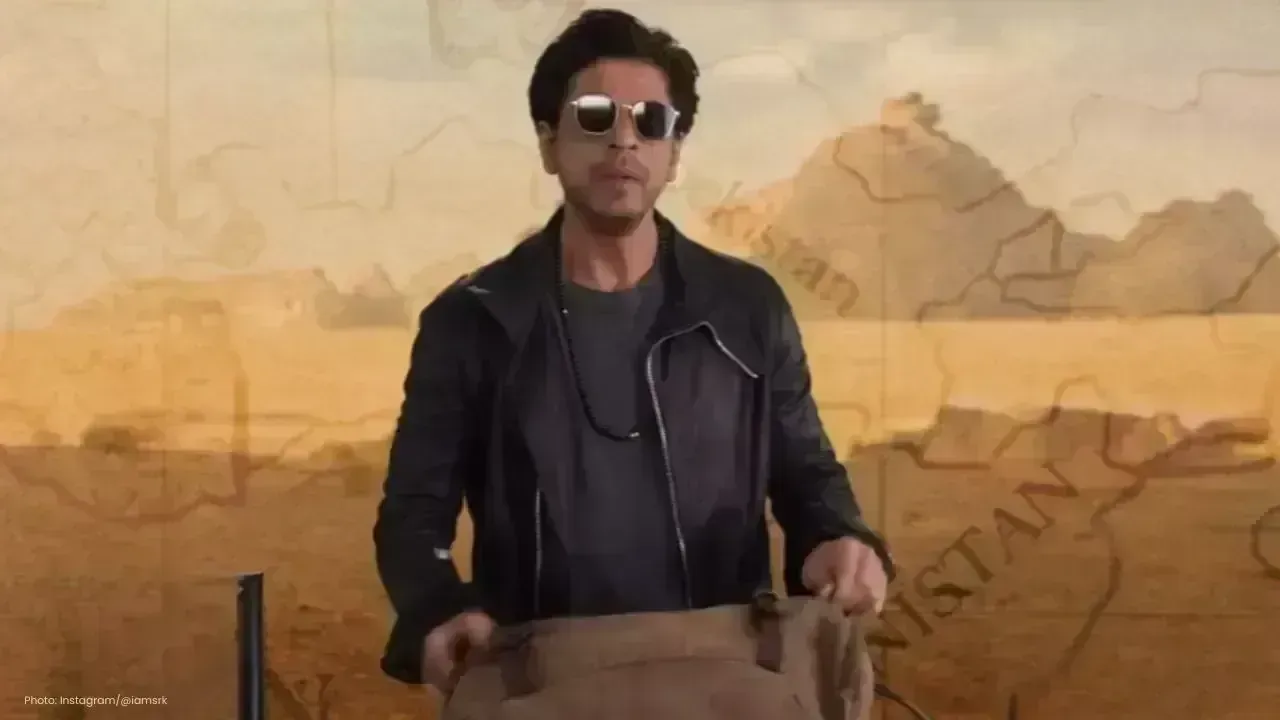

Dhurandhar Day 27 Box Office: Ranveer Singh’s Spy Thriller Soars Big

Dhurandhar earns ₹1117 crore worldwide by day 27, becoming one of 2026’s biggest hits. Ranveer Singh

Hong Kong Welcomes 2026 Without Fireworks After Deadly Fire

Hong Kong rang in 2026 without fireworks for the first time in years, choosing light shows and music

Ranveer Singh’s Dhurandhar Hits ₹1000 Cr Despite Gulf Ban Loss

Dhurandhar crosses ₹1000 crore globally but loses $10M as Gulf nations ban the film. Fans in holiday

China Claims India-Pakistan Peace Role Amid India’s Firm Denial

China claims to have mediated peace between India and Pakistan, but India rejects third-party involv

Mel Gibson and Rosalind Ross Split After Nearly a Decade Together

Mel Gibson and Rosalind Ross confirm split after nearly a year. They will continue co-parenting thei