You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Rameen Ariff

CalPERS, the largest public pension fund in the United States, said it will vote against Elon Musk’s proposed $1 trillion compensation plan for Tesla, a development that could influence other institutional investors ahead of the shareholder meeting in Austin on November 6.

Holding roughly five million Tesla shares, the fund argued the package far exceeds pay levels for chief executives at comparable companies and raised concerns about further consolidating control with a single shareholder.

The proposal stretches across a decade and ties awards to a series of performance milestones. If every target is met, the arrangement would permit Musk to obtain additional shares and could boost his stake in the automaker to about 25%.

During Tesla’s recent earnings call, Musk urged shareholders to support the plan, saying it was essential to sustain his incentives and leadership. Several proxy advisory firms, however, have criticized the arrangement as excessive and misaligned with broader shareholder interests.

This is not CalPERS’ first confrontation over Musk’s pay. The fund opposed a 2018 compensation package worth $50 billion, a deal that a Delaware court later invalidated earlier this year.

CalPERS also objected last year to a separate $56 billion proposal; CEO Marcie Frost publicly questioned the transparency and accountability of Tesla’s compensation framework.

The controversy highlights wider tensions over executive pay and governance in Silicon Valley, with critics warning that record-setting awards can create problematic precedents while supporters point to Musk’s pivotal role in Tesla’s growth.

As the November 6 vote approaches, Tesla’s board faces mounting pressure to explain how the scale and structure of the rewards align with long-term shareholder value.

The outcome will shape Tesla’s ownership dynamics and contribute to the national debate over CEO remuneration and corporate responsibility in U.S. markets.

How investors respond to CalPERS’ opposition could influence both the vote’s result and the evolving norms around executive compensation.

Deadly Bushfires in Victoria Leave One Dead, 300 Structures Lost

Bushfires across Victoria have destroyed hundreds of homes, claimed one life, and forced evacuations

Himalayas Turn Rocky as Winter Snowfall Falls, Scientists Warn

Himalayas see record low winter snow, accelerating glacier melt and threatening water supply, forest

Virat Kohli Fastest to 28,000 Runs, Celebrates Career Milestone

Virat Kohli reached 28,000 international runs, reflecting on his journey with gratitude, joy, and de

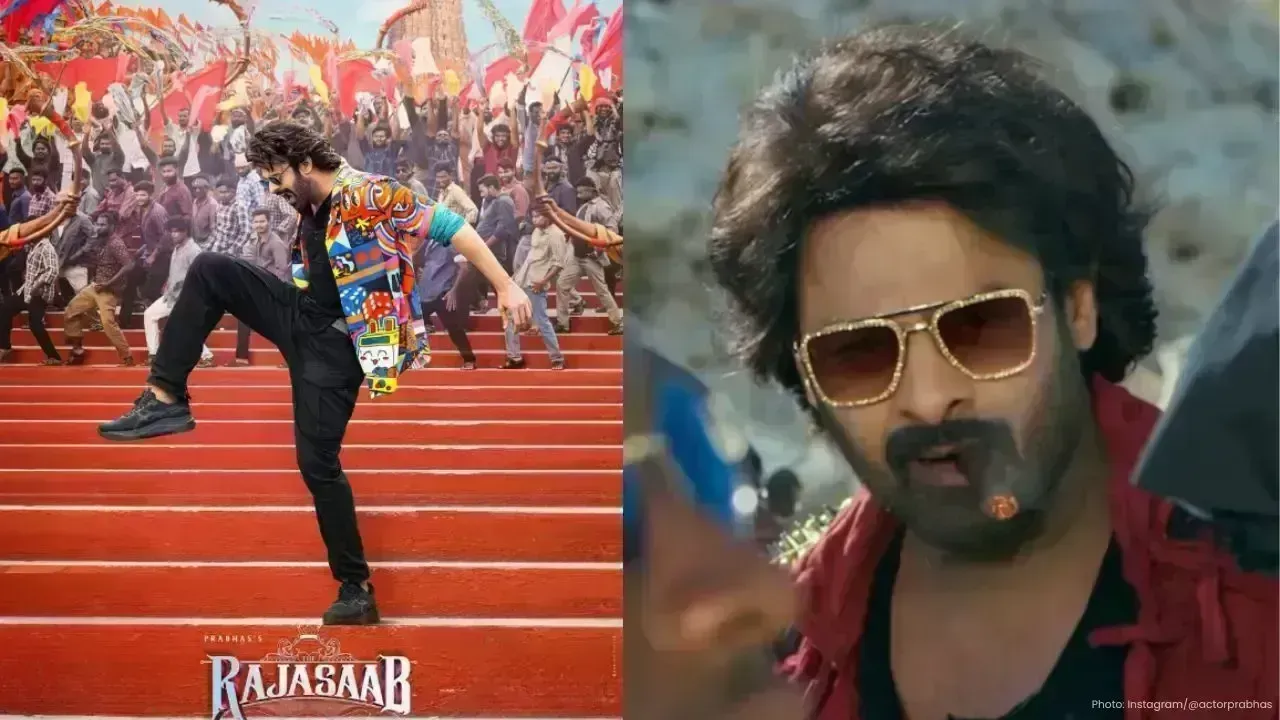

Prabhas’ The Raja Saab Tops ₹100 Crore in India on Day 3 Box Office

The Raja Saab collects Rs 108 crore in India; worldwide total nears Rs 200 crore. Sequel announced w

Malaysia Blocks Grok AI Over Sexualized Image Misuse

Malaysia restricts access to Grok AI after misuse for sexualized, non-consensual images, pending str

Thailand Exports to Grow 2–4% in 2026, Driven by Foreign Investment

Thailand’s exports are projected to grow 2–4% this year, largely due to foreign investment, raising