You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Rameen Ariff

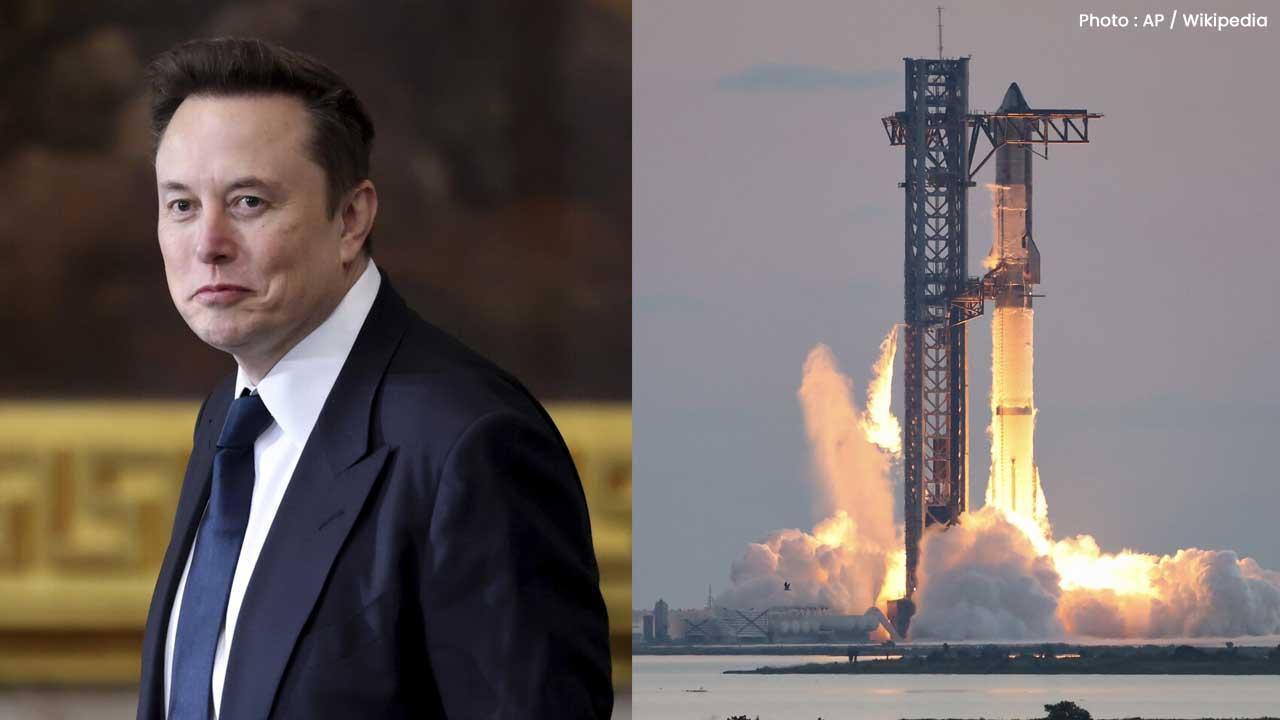

United States: SpaceX, the record-breaking space company founded by Elon Musk in 2002, is preparing for a potential initial public offering (IPO) that could make it the largest in history. The IPO is expected to raise more than $30 billion, opening the company to a broader range of investors and providing liquidity for existing shareholders.

Elon Musk, who has long treated SpaceX as his personal venture to transform space travel and ultimately colonize Mars, shares ownership of the company with several investment funds. Alphabet, the parent company of Google, is also among its shareholders. A public listing would allow individual investors to buy into SpaceX while giving early backers a chance to realize significant capital gains.

Experts highlight that the space industry is capital intensive. Matthew Kennedy of Renaissance Capital noted that while SpaceX has successfully raised private funds in the past, public markets provide larger funding opportunities and greater liquidity, enabling acquisitions and rapid expansion.

The IPO could value SpaceX at around $1.5 trillion, reflecting its dominance in the commercial space sector. SpaceX has revolutionized the space industry with its reusable rockets and the Starlink satellite network, the largest of its kind. Industry analysts consider SpaceX a “black swan” in the space economy due to its unmatched capabilities and ambitious projects.

The timing of the IPO comes as the global space industry experiences rapid growth. Valued at $630 billion in 2023, the sector is expected to triple in size by 2035, according to McKinsey and the World Economic Forum. SpaceX’s unique position in the market, combined with Musk’s visionary leadership, makes the IPO highly anticipated. Musk has already demonstrated his ability to significantly increase the market value of companies, as seen with Tesla.

Going public could provide SpaceX with the capital needed to accelerate its key projects, including the Starship rocket, which is designed for missions to the Moon and Mars, and plans for space-based data centers. Analysts say the IPO will also require the company to maintain greater transparency regarding finances, which could place some constraints on its experimental and risk-taking approach. However, experts believe Musk and SpaceX will likely maintain their innovative edge even as a public company.

The SpaceX IPO represents a historic moment in the commercial space industry, combining enormous financial potential with the ambitious goal of advancing human space exploration. Investors and industry watchers worldwide are closely following the development, as it may redefine how space ventures are funded and expand access to private space enterprise.

Sri Lanka Ex-Intel Chief Arrested Over Easter Attacks

Former SIS Chief Suresh Sallay arrested by CID in connection with the 2019 Easter Sunday bombings th

Japan Reports Spike in Measles Cases Authorities Issue Alert

Japan confirms 43 measles cases in early 2026, prompting health authorities to warn potential contac

Korea US Clash Over West Sea Drill Communication

Conflicting accounts emerge on prior notice briefing, and apology during Feb 18-19 US air exercise i

Richard Liu launches $690M eco-yacht brand Sea Expandary

JD.com founder Richard Liu invests $690M in Sea Expandary aiming to produce affordable green yachts

China imposes export curbs on 40 Japanese firms over military ties

Beijing restricts dual-use exports to Japanese companies, citing remilitarization concerns, promptin

Malaysia moves to protect Musang King durian amid China impostors

Authorities safeguard Malaysia’s Musang King brand as durians from Thailand and Vietnam are being fa