You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

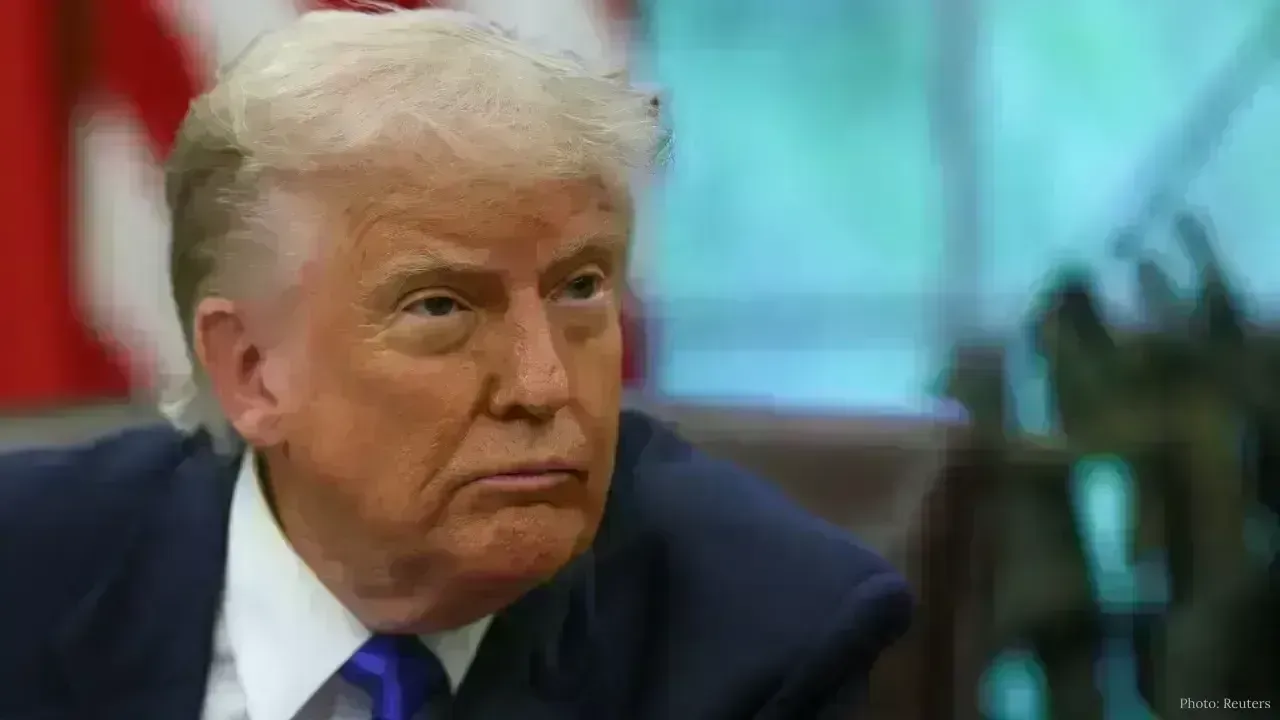

Stock markets in India and around the world are falling sharply today. Key indices such as the Nifty 50 and Sensex have dipped for several sessions in a row. Investors are worried and selling stocks. The main reason behind this slide isn’t a sudden economic collapse or company losses — it’s tied to rising fear over tariffs and trade tensions, especially related to a new tariff proposal involving former U.S. President Donald Trump.

Tariffs are taxes placed on goods imported from one country to another. When trade barriers go up suddenly or unpredictably, stock markets often react negatively because tariffs raise costs, slow down trade, and disrupt global supply chains. Today’s drop shows how powerful trader fears — even rumors or pending announcements — can influence markets in India and abroad.

This article breaks down why the markets are falling today, how global political events are linked to investor sentiment, how export-oriented sectors are affected, and what could happen next.

At the center of today’s market slump is news about a tariff proposal backed by Donald Trump. The bill under discussion could levy very high import taxes — reportedly up to 500% — on oil imports from Russia and goods from certain countries that trade with Russia.

The idea is to punish nations that continue buying Russian oil by charging them massive import tariffs. While this bill still needs legislative approval, markets tend to fall when there’s uncertainty about future trade rules. Even the possibility of such high tariffs unsettles investors because:

Companies may face higher costs for imports and exports.

Trade partners could retaliate with their own tariffs.

Global trade flow may slow down, hurting corporate profits.

These tariff fears have been enough to generate sharp selling in financial markets worldwide.

Investors remember the past impact of Trump-era tariff decisions. In 2025, markets plunged when broad tariff policies were introduced in the U.S., contributing to a major global sell-off. One historical example was the 2025 global market crash linked with sweeping U.S. trade barriers, where key benchmarks like S&P 500, Dow and Nasdaq fell dramatically in days.

That memory makes traders nervous today — even if the tariff plan is not confirmed — because they know that trade policy can trigger rapid changes in risk appetite and economic growth expectations.

In India, both the BSE Sensex and NSE Nifty 50 have slipped as tariff alarms spread. Over four days, benchmark indices have lost significant ground, erasing investor wealth.

Across global markets, stock prices in the U.S., Asia, and Europe have also shown weakness. Investors tend to sell first and ask questions later when major geopolitical-economic risks rise — a hallmark of risk-off behavior in financial markets.

Foreign portfolio investors (FPIs) have been net sellers in Indian markets recently. Record outflows and a stronger dollar often go hand-in-hand with risk aversion. When FPIs sell Indian stocks, it adds downward pressure on indices like the Nifty.

The fear that tariffs could choke global growth makes international investors more cautious about holding emerging market equities — including Indian shares.

Export driven companies are hit hardest when tariff fears escalate. Shares of textile makers, farm exporters, seafood processors, and other export-heavy firms have slid up to double-digit weakness as traders price in the risk of reduced foreign demand and higher landed costs.

This is important because export stocks make up a meaningful portion of India’s stock market. When these companies fall, it drags broader indices lower.

Tariffs raise the cost of goods crossing borders. When import duties rise, companies pay more for raw materials or finished products. They may pass these costs to consumers, squeezing profit margins and slowing economic activity.

Investors react before the impact is felt in earnings — often selling first in anticipation of slower future profits. That behavior can trigger index-wide slides.

The tariff issue is global, not just Indian. Investors in the U.S. and Asia are watching how the situation unfolds because higher trade barriers elsewhere can hurt global GDP growth forecasts.

At the same time, markets are awaiting important scheduled events, such as:

A U.S. jobs report that could influence Federal Reserve interest rate expectations.

A U.S. Supreme Court ruling on the legality of certain tariff powers that could either calm or intensify market concerns.

Many traders are now pricing in both potential outcomes, which adds volatility and uncertainty.

In financial markets, uncertainty itself is a key driver of selling pressure. Even if the tariff proposal never becomes law, markets often fall ahead of bad news. This is called the anticipation effect — where traders sell first and wait to see if bad news is confirmed.

In this case, the uncertainty is magnified because:

Tariffs may be implemented via multiple legal pathways.

They could be aimed at countries with major trade relationships.

There is no clear timeline for implementation.

All these unknowns make traders nervous.

Let’s break down how different parts of the market are reacting:

Sectors like:

Textiles

Chemicals

Agro products

Seafood

have seen heavy selling. Why? Because if tariffs on goods exported to key markets rise, international orders could drop, hurting revenue.

Even large cap companies — particularly in metals, energy, and financials — are weak. These stocks usually help stabilize markets, but today they are also sliding under broad bearish sentiment.

Risk aversion often boosts the U.S. dollar and bond yields as money flows out of stocks into safer assets. A stronger dollar makes imported goods cheaper for the U.S., but hurts global equities. That’s a key reason why commodity prices and emerging market currencies, including the Indian rupee, showed weakness.

Analysts view today’s slump as a risk-off event driven by political and trade concerns, not a sudden collapse in company earnings or demand fundamentals.

Some experts believe markets may overshoot on the downside before finding a stable range, especially if tariff news stays negative. Others argue that strong economic data or tariff clarifications could help markets recover quickly — a classic “sell the rumor, buy the fact” scenario.

However, widespread nervousness keeps traders cautious and focused on risk management.

If you are an investor trying to understand this market move, here are key takeaways:

Expect larger than normal price swings as traders react to political and trade news.

Short-term volatility can feel extreme, but long-term investment decisions should be guided by company cash flow, earnings, and economic fundamentals — not just headlines.

Holding a mix of sectors and asset classes (stocks, bonds, gold) can soften the impact of sharp swings.

The trajectory of tariff news — whether it hardens, softens, or gets delayed — will have a direct impact on market confidence.

The stock market is falling today due to heightened fear over a potential tariff proposal backed by Donald Trump. Even though the tariff bill is not law yet, its possible impact on global trade, corporate earnings, and investor risk sentiment has triggered broad selling across markets. Export-oriented stocks, foreign investor flows, and global uncertainty all contribute to the weakness we see in markets today.

Rising tariffs represent a shift toward trade protectionism, which historically has increased costs, reduced trade volume, and sparked investor discomfort. Until clarity emerges on tariff outcomes and global economic data, investors may continue to see volatility in stock markets.

Disclaimer:

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Markets are subject to rapid change and investors should consult licensed financial professionals before making investment decisions.

China Ousts Three Retired Generals from Top Political Advisory Body

CPPCC ousts retired PLA generals ahead of annual Two Sessions as broader anti‑corruption military sh

Japan Jobless Rate Rises to 2.7%

Japan sees first increase in jobless rate in five months as voluntary quits rise and job openings sl

Strong 6.1-Magnitude Earthquake Shakes Indonesia’s Sumatra Island

Tremors felt across region no immediate reports of damage or casualties as authorities monitor seism

Rizwan Sajan Reaffirms Trust in UAE’s Safety and Growth

Danube Group Chairman Rizwan Sajan assures residents and expatriates of safety in UAE, highlighting

India Witnesses Chandra Grahan Blood Moon Visible in Parts of World

Skywatchers observe partial eclipse in India as total ‘Blood Moon’ visible across North America Aust

14 Pakistan Players Shortlisted for The Hundred 2026

ECB reiterates nationality will not influence selections as Haris Rauf and Shaheen Afridi headline P